Daily Market Outlook, August 4, 2022

Daily Market Outlook, August 4, 2022

Overnight Headlines

- Bank Of England On Precipice Of Largest Rate Hike Since 1995

- Fed’s Kashkari: Very Unlikely Will Cut Interest Rates Next Year

- Taiwan Braces For Impact From China Military Post Pelosi Trip

- White House Lobbies Dems Against Aims Deepen Taiwan Ties

- China Locks Down Part Of Tropical Tourist Hub, Covid Spreads

- Sinema Seeks Private Equity Breaks Hold, Curb Corporate Tax

- Eyeing Russia, US Senate Backs Finland, Sweden Joining Nato

- Ukraine Pres Seeks Direct Talks With Xi Amid War With Russia

- Iran, US Set To Resume Talks In New Bid To Save Nuclear Deal

- Truss To Look At Changing Bank Of England Inflation Mandates

- Brazil Hikes By 50Bps To 13.75%, Signal Another Hike Possible

- Walmart Slashes 200 Corporate Jobs As Costs, Inventory Weigh

The Day Ahead

- Most Asian equity markets are up this morning seemingly lifted by optimism regarding profit reports and possibly buoyed by yesterday’s rise in US equities. The oil price has moved sharply lower overnight as reports of rising inventory levels in the US spark concerns that demand for oil is slowing. Several Federal Reserve speakers yesterday stressed that lowering inflation remained the US central bank’s number one priority and that interest rates were likely to move higher.

- Today’s policy update from the Bank of England’s Monetary Policy Committee (MPC) is likely to be the key event of the week for UK markets. A sixth successive increase in Bank Rate is widely expected, but there is some uncertainty over its size. Our base case forecast is for another 25 basis point rise, but there is a strong chance that the MPC will deliver a larger increase of 50bp and markets appear to be almost fully discounting such an outcome. There were hints of this at the time of the last update in June and since then comments from some BoE policymakers, including BoE Governor Bailey confirmed it as a possibility. Economic data since the June update have actually been mixed. Nevertheless, the possibility of at least a small majority of MPC members supporting a larger hike is high. However, if they do so they will probably describe it as front-loading tightening rather than a sign that rates need to rise by much more than previously indicated.

- In addition to the policy rate announcement, expect the BoE’s updated forecasts to again highlight that market-based measures of interest rate expectations, which currently see Bank Rate peaking around 2.75-3.00%, are excessive. Notably, while the BoE will probably again lift its forecast for the near-term peak in inflation, to around 12% (in October), expect their medium-term projection based up on the market-implied interest rate path to still show inflation moving below 2%, and potentially by more than shown in the forecasts from May. Meanwhile, the BoE’s GDP growth forecasts for 2022 and 2023 are likely to be downgraded, not least due to the more persistent hit to households’ spending power from higher inflation.

- Finally, the MPC will also provide an update on its strategy for ‘active’ gilt sales. It seems likely that a vote to commence such sales may take place at the September MPC meeting, which would pave the way for them to potentially begin in October. Today the MPC may confirm timings and give some indication of the intended pace of selling, at least for the near term.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0100 (1.22B), 1.0150 (2.40B), 1.0200-05 (1.46B), 1.0215 (622M)

- EUR/USD: 1.0225-30 (1.06B), 1.0295-1.0300 (1.31B). EUR/JPY: 134.00 (403M)

- USD/JPY: 133.00 (1.41B), 134.80-85 (1.08B), 135.00-05 (2.14B)

- EUR/GBP:0.8400-05 (370M), 0.8415 (300M), 0.8560 (350M)

- USD/CHF: 0.9780 (500M). USD/CAD: 1.2750 (745M), 1.2900 (540M)

- AUD/USD: 0.6975 (354M), 0.7000 (584M)

Technical & Trade Views

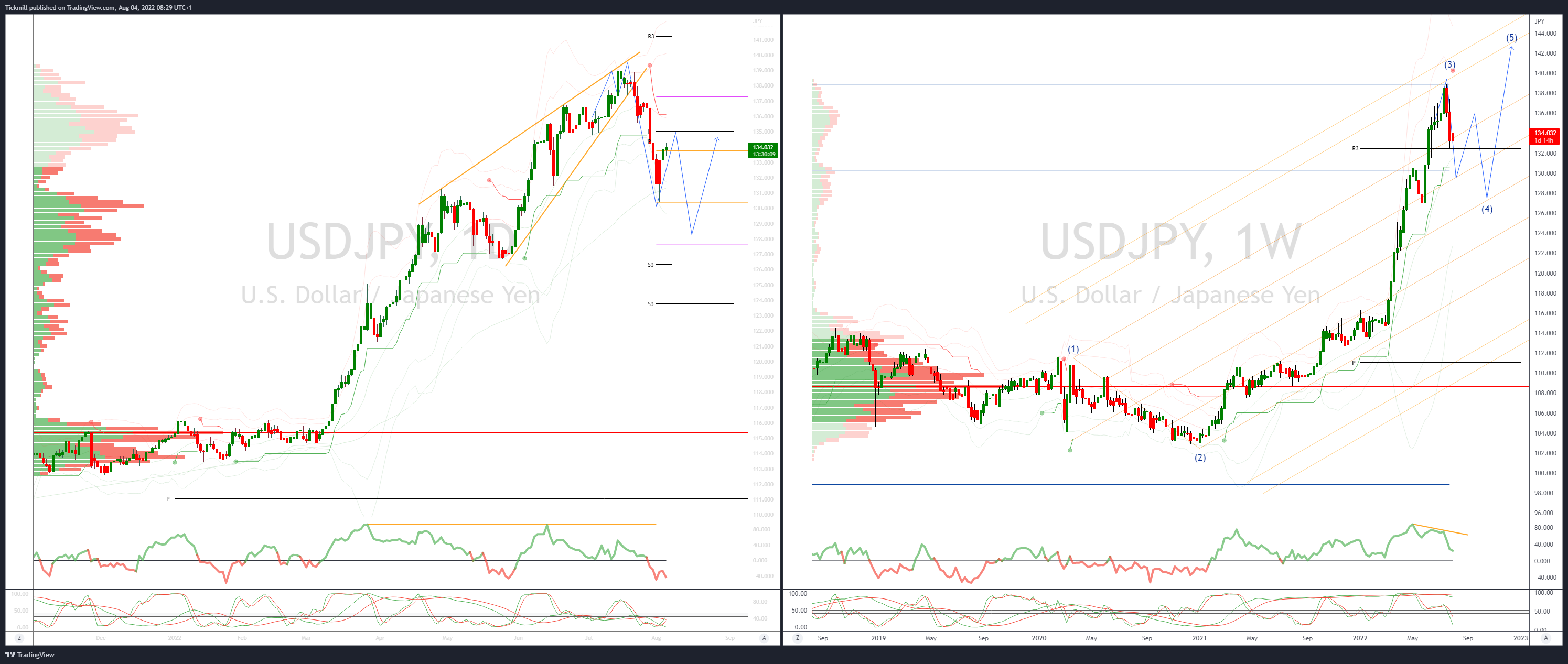

EURUSD Bias: Bearish below 1.0350

- Choppy range trading continues – large 1.0150 strikes

- 1.0150 2.396 BLN and 1.0200/15 2.218 BLN are today's close strikes

- Off 0.1% after closing a touch firmer in choppy offshore markets

- EUR/USD has been in a range since mid July, as the holiday season kicks in

- Pair needs a trigger to spark a move - upcoming NFP data a potential catalyst

- Resistance 1.0250/60 stronger offers seen to 1.0350/60, support 1.0100-05, 1.0070-75

- 20 Day VWAP is bearish, 5 Day bearish

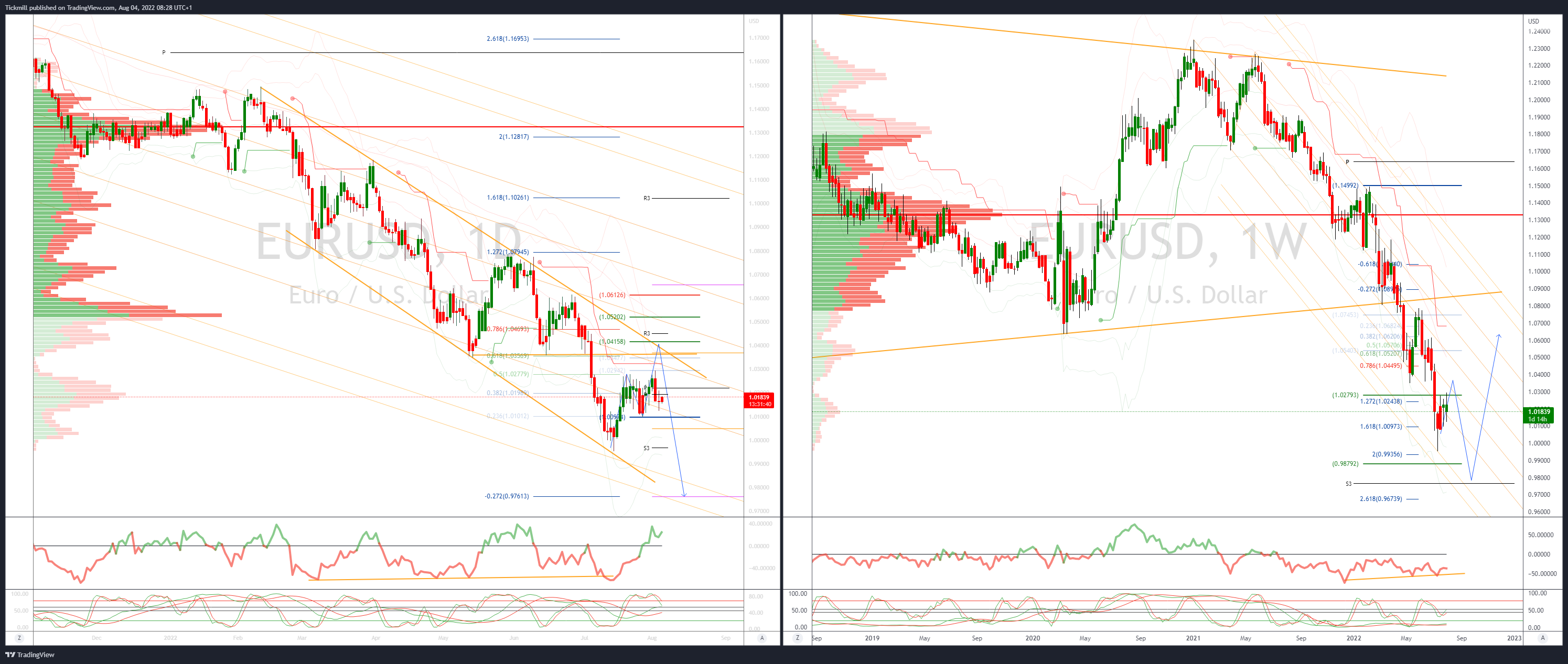

GBPUSD Bias: Bearish below 1.2280

- Softer as market awaits 50pt BoE hike

- -0.1% early with the USD a touch firmer after closing off 0.1%

- Bank of England widely expected to deliver a 50pt hike

- Raging inflation, vulnerable sterling, aggressive Fed, ECB suggest 50pt

- Stalling economy could add a note of caution in BoE statement and speech

- Offers sited at 1.2280/1.23 bids 1.2090

- 20 Day VWAP is bullish, 5 Day bearish

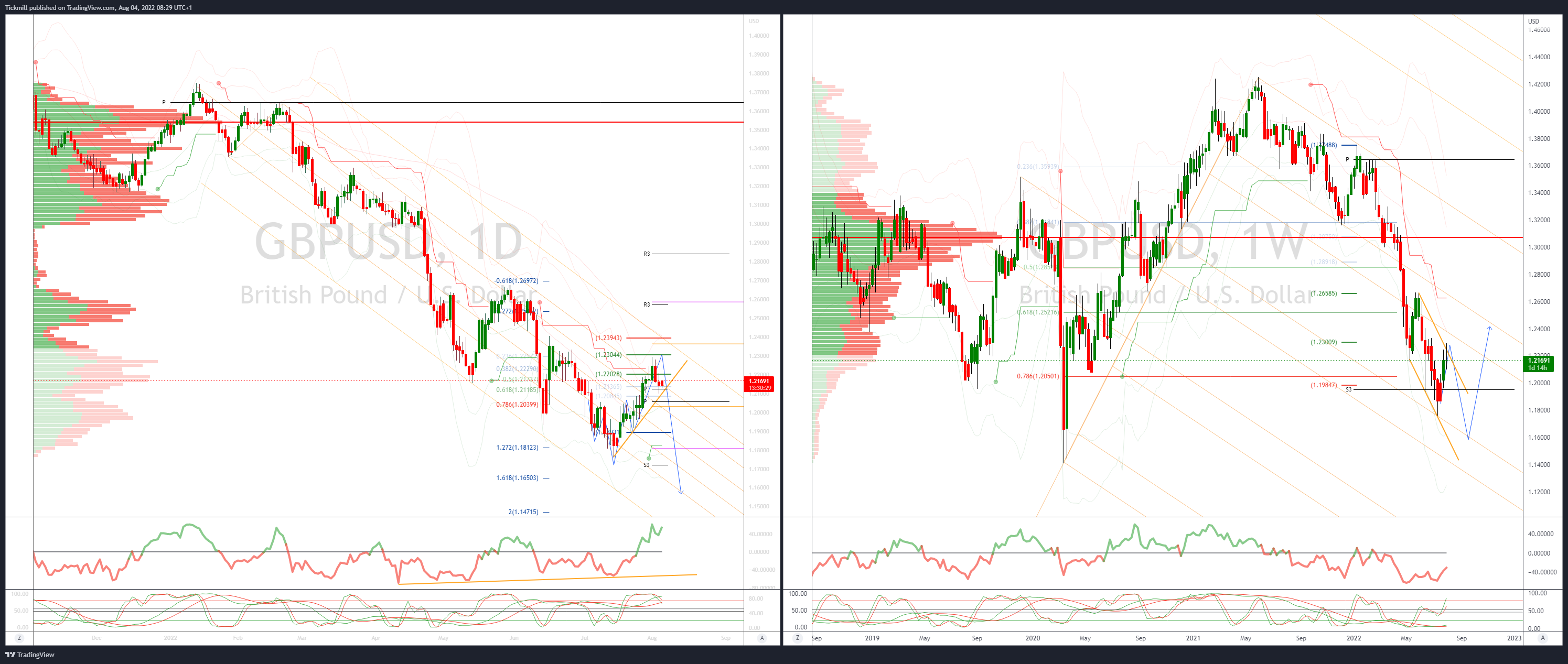

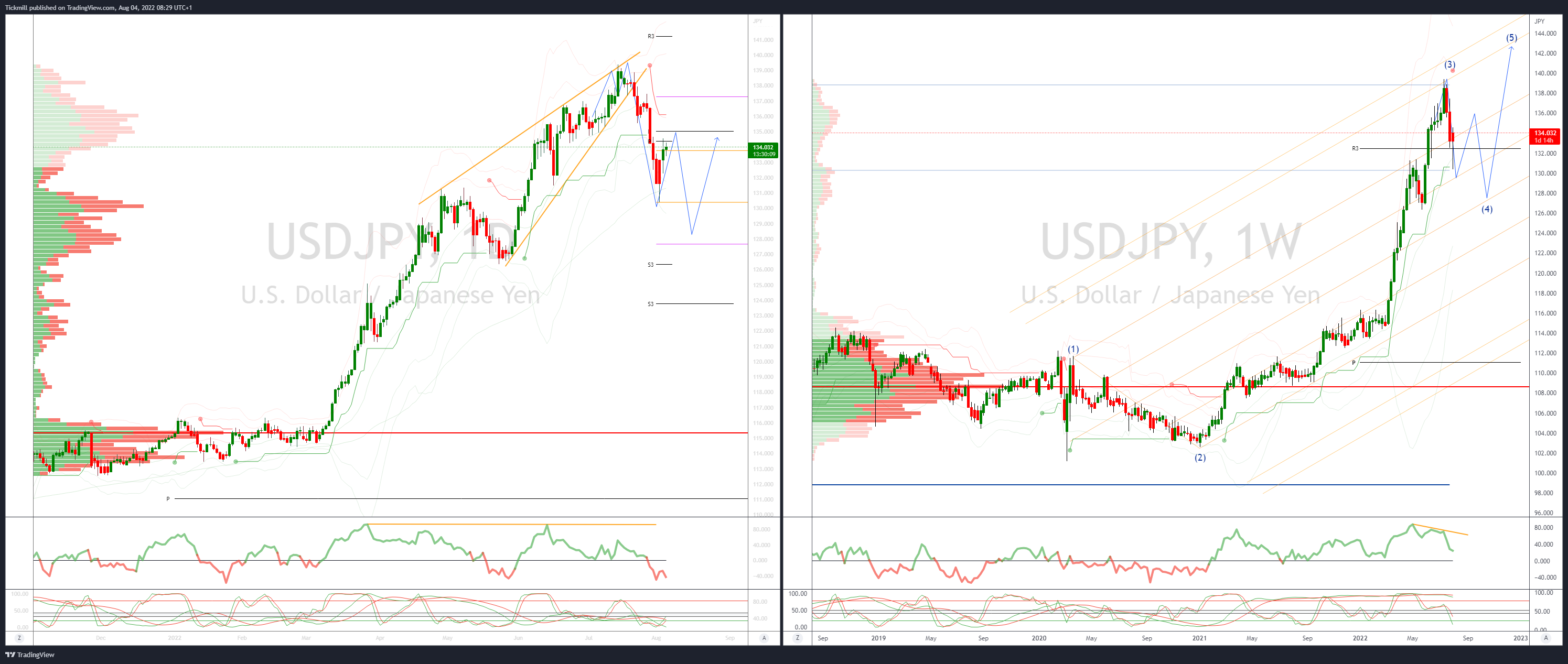

USDJPY Bias: Bearish below 134

- Looks to be about options today, below and above

- USD/JPY off from 134.14 earlier this morning to 133.43 before bouncing

- Massive option expiries today from 134.25 look to have played a part

- Some bounce from the EBS low, well ahead of massive expiries at 133.00

- Total $960 mln in expiries between 134.25-45, $1.1 bln 134.80-85, more above

- 133.00 sees $1.4 bln in expiries today, also 134.00-05 total $481 mln

- Tomorrow to see $1.7 bln in expiries at 134.00 strike, 133.25-30 $532 mln

- Bears target a test of 130

- Offers seen at 135.10

- 20 Day VWAP is bearish, 5 Day bullish

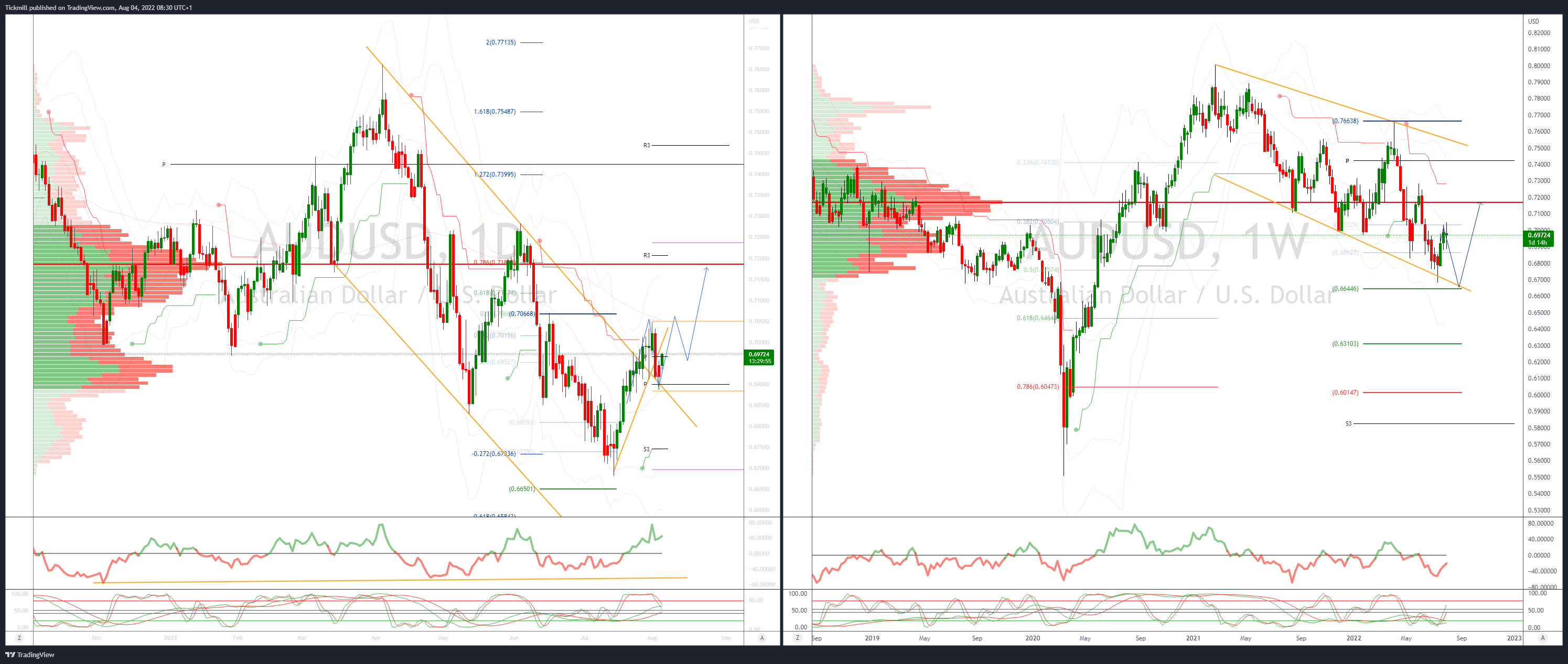

AUDUSD Bias: Bearish below .7050

- Higher as Wall Street rallies US yields ease

- AUD/USD opens +0.46% and was best performing major currency Wednesday

- Strong Wall Street gains and fall in US 10-year yield helped to underpin

- AUD up on all crosses despite fall in key commodities

- Offer at .70 being eroded as price is accepted above .70 bulls target .71 test

- AUD/USD support now sited at .6890

- 20 Day VWAP is bullish, 5 Day bearish

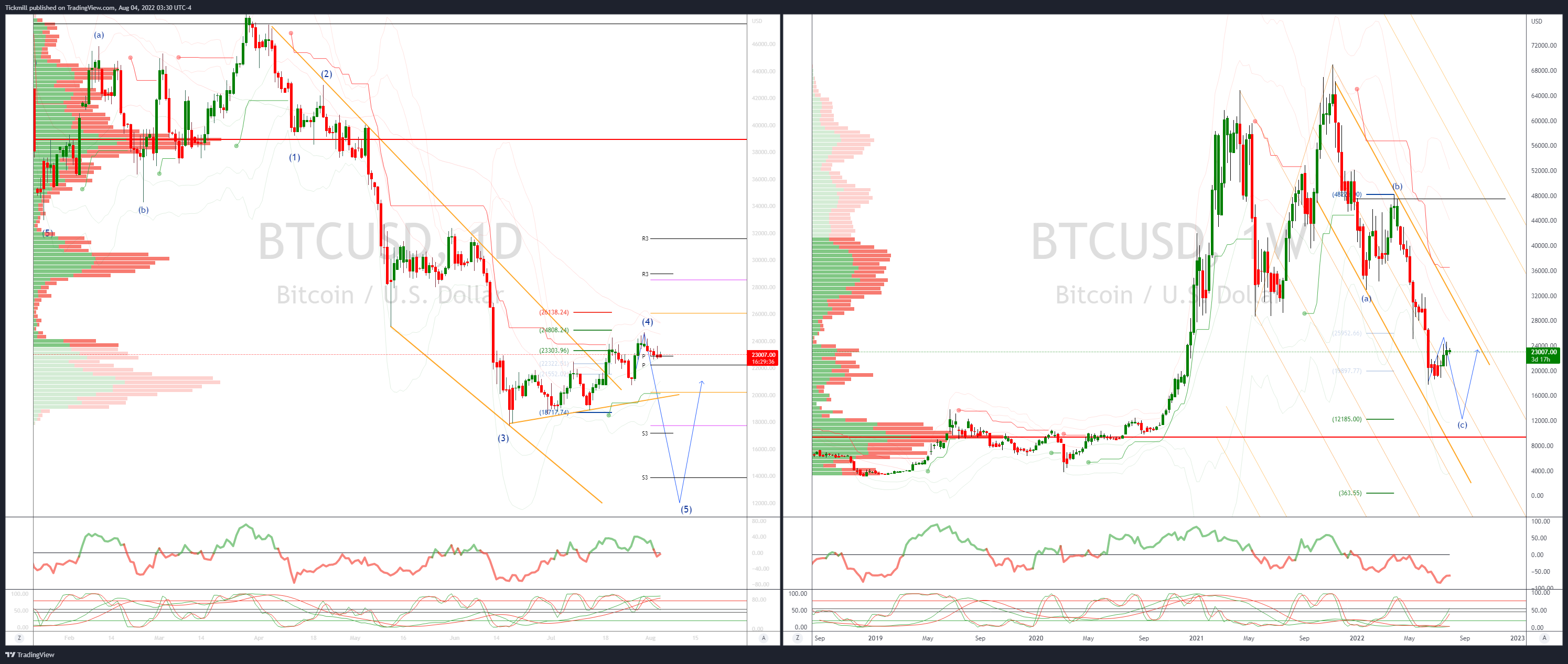

BTCUSD Bias: Bearish below 25.3K

- BTC chopping around 23k

- Risk-on mood in Asia buoys crypto, but Nasdaq futures -0.2%

- Increased regulation may accelerate crypto maturity

- Bulls need a close above 25k to gain significant upside momentum

- Closing below 21k would be a noteworthy downside development

- 20 Day VWAP is bullish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!