Daily Market Outlook, August 5, 2022

Daily Market Outlook, August 5, 2022

Overnight Headlines

- US July Job Growth Set To Be Robust, But Could Slow Ahead

- China Missiles Likely Fired Over Taiwan, Increasing Tensions

- Fed’s Mester Reiterates Resolve To Curb Inflation With Hikes

- Vital US Senator Sinema Agrees To $430Bln Drug, Energy Bill

- Dems Drop Carried Interest Change, Adds Stock Buyback Tax

- Iran Nuclear Talks Resume, Both Sides Play Down Prospects

- UN Sees North Korea Tests Explosive Devices At Nuclear Site

- RBA Sees Faster Inflation, Wages As Signals More Rate Hikes

- Truss Says UK Recession Avoidable Ahead Of Economic Storm

- German Cabinet Agrees To Consumer Gas Levy From October

- Tesla Holders Agree To 3-To-1 Stock Split At Shareholder Meet

- Lufthansa Ground Staff Agree Pay Deal In Third Round Of Talks

The Day Ahead

- Stocks across the Asia Pacific are trading higher on the day, with most major exchanges in the region ending, or set to end, the week up. More broadly, global equities are poised for a third weekly advance, which would take them to a near two-month high from the recent lows, supported by resilient corporate earnings figures, particularly in the US. Nevertheless, the flare up in tensions between China and Taiwan continues to induce some investor caution.

- The US labour market report is always seen as a key bellwether of economic conditions. However, against the background of recent market moves, both today’s release for July, and the August report will be particularly important. In his press conference following the US central bank’s latest decision to raise interest rates, Fed Chair Powell described the labour market as still strong and played down the significance of recent rises in jobless claims. On that basis, any sign of weakness in next Friday’s labour market report will lend support to the bond market rally, while a solid report may question the extent of the recent fall in interest rate expectations. Expect employment growth to have slowed again but still be sufficiently strong to be more consistent with the latter view. Also of keen interest will be wage growth. There have been hints in the last couple of reports that this has peaked but an alternative indicator, the employment cost index, suggested that in Q2 growth was still above a level that the Fed is likely to feel comfortable with.

- Canada’s July labour market report, which is also out today, is potentially of equal significance for monetary policy north of the border. Like the Fed the Bank of Canada raised interest rates by 75 basis points at its last meeting and pointed to the likelihood of further rises. So, today’s report, which is the only one before the BoC’s next policy update on 7th September, will be seen as an important gauge of domestic inflationary pressures.

- There are no major data releases due from the Eurozone or UK today, although the Bank of England’s Chief Economist Huw Pill is due to speak at a regional agents’ event. Following yesterday’s decision to step up the pace of monetary policy tightening, with the BoE deciding to raise Bank Rate by half a percentage point, markets will be watching today’s event for clues over whether the next meeting on September 15th could see a similar move.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0100 (871M), 1.0200 (2.06B), 1.0300-05 (1.74B)

- USD/JPY: 132.25 (822M), 132.50 (505M), 133.25-30 (822M), 134.00 (2.08B)

- USD/JPY: 135.00 (1.09B). GBP/USD: 1.1965 (664M), 1.2100 (590M)

- EUR/GBP: 0.8350 (1.48B), 0.8450 (750M)

- USD/CHF: 0.9400 (400M), 0.9600 (685M). EUR/CHF: 1.0100 (400M)

- USD/CAD: 1.2600 (1.06B), 1.2800 (1.58B), 1.2900 (1.08B), 1.3000 (538M)

- AUD/USD: 0.6800 (918M), 0.6900 (494M), 0.6950 (497M), 0.7200 (1.01B)

Technical & Trade Views

EURUSD Bias: Bearish below 1.0350

- EUR/USD steady ahead of US NFP

- Awaiting fresh catalysts, market capped pre-1.03 since July 19

- Massive nearby option expiries to help contain action

- 1.0100-95 E2.3 bln, 1.0200 E2.3 bln, 1.0270-80 E431 mln, 1.0300-05 E1.7 bln

- Resistance 1.0250/60 stronger offers seen to 1.0350/60, support 1.0100-05, 1.0070-75

- 20 Day VWAP is neutral/bearish, 5 Day bullish

GBPUSD Bias: Bearish below 1.2280

- Liz Truss, likely next UK PM to outline economic plans today

- Sterling entering a volatile period with a new PM and economic uncertainty

- BOE will be data and event driven, fuelling intraday volatility

- Offers sited at 1.2280/1.23 bids 1.2090

- 20 Day VWAP is bullish, 5 Day bearish

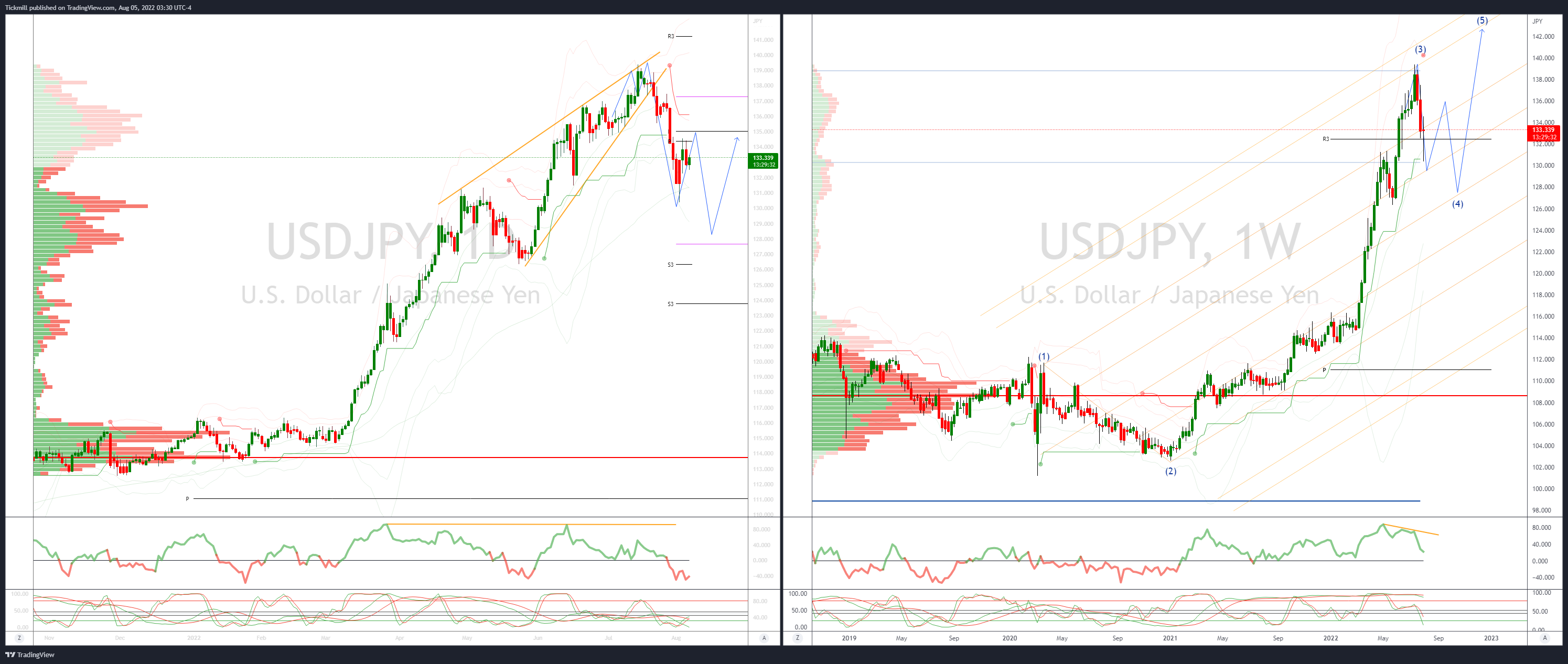

USDJPY Bias: Bearish below 135

- USD/JPY heavy but downside likely limited, Gotobi demand, US NFP later

- Bid to 133.30’s on Gotobi Tokyo fix demand

- Yield on US Treasuries steady into US NFP/jobs report

- Non-farm payrolls seen rising 250k, prev +372k

- Massive option expiries in area today, to help contain action into NFP

- 132.25-50 total $1.7 bln+, 133.15-30 $1 bln, 134.00 $2.1 bln

- Bears target a test of 130

- Offers seen at 135.10

- 20 Day VWAP is bearish, 5 Day bullish

AUDUSD Bias: Bearish below .7050

- Muted response to the realistic RBA's SOMP

- AUD remains flat on the day despite a sombre outlook in the RBA's SOMP

- Further RBA rate hikes are required, which will slow economic growth

- Peak inflation expected at 7.75%, but long term 2-3% expectations remain

- 2022 growth forecasts cut from 4.25% to 3.25%, 2023/4 at 1.75%

- Inflation fight a global issue, Australia in better shape than many places

- Offer at .70 being eroded as price is accepted above .70 bulls target .71 test

- AUD/USD support now sited at .6890

- 20 Day VWAP is bullish, 5 Day bearish

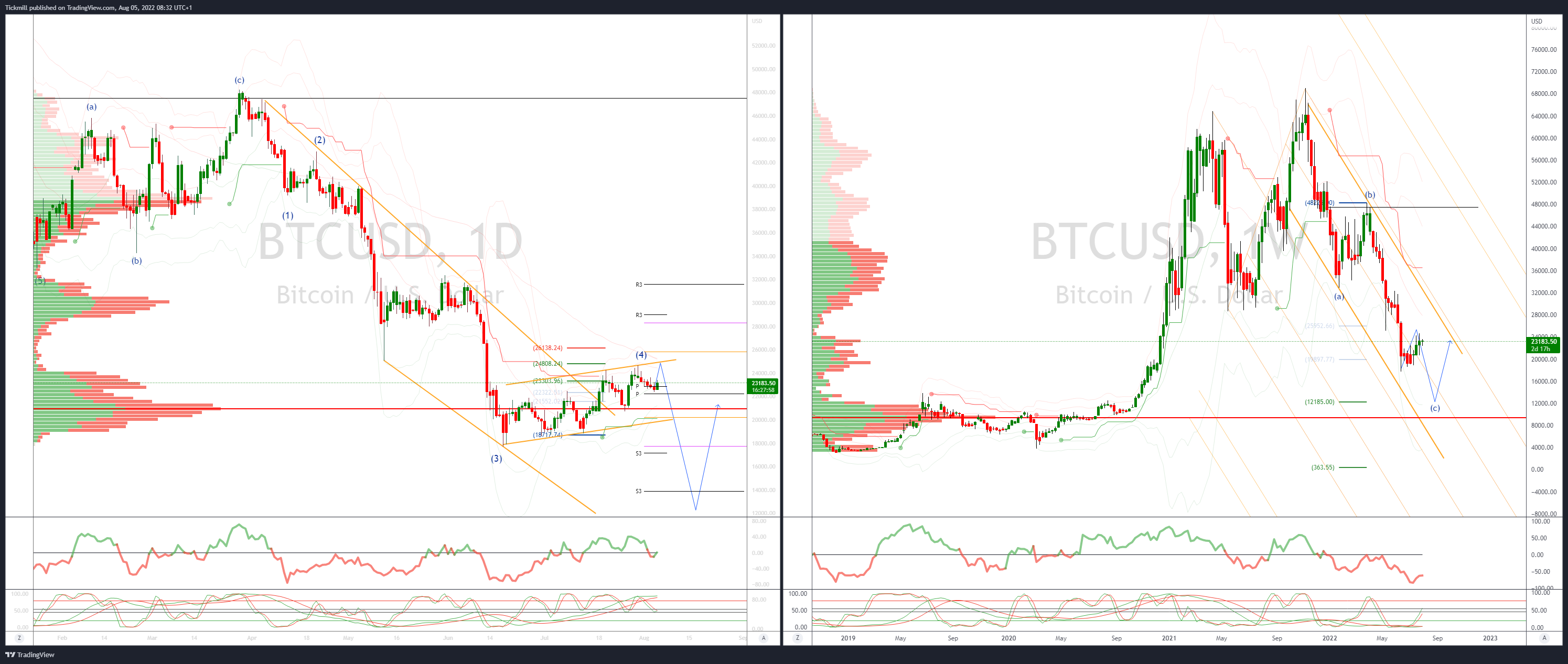

BTCUSD Bias: Bearish below 25.3K

- BTC continues chopping around 23k

- Range resolution likely on US NFP read due later today; exp 250k

- Positive reading will boost risk-taking mood again

- Coinbase soars on crypto deal with BlackRock

- Bulls need a close above 25k to gain significant upside momentum

- Closing below 21k would be a noteworthy downside development

- 20 Day VWAP is bullish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!