Daily Market Outlook, August 8, 2022

Daily Market Outlook, August 8, 2022

Overnight Headlines

- Daly: Fed Is ‘Far From Done Yet’ On Bringing Inflation Down

- Fed’s Bowman: Large Interest-Rate Rises Could Continue

- The Most Americans Since 2008 Say Economy Is Getting Worse

- US Senate Passes Tax, Climate Spending Deal To Revive Biden Agenda

- Italy’s Centre-Left Coalition Collapses Days After Agreement

- Japan Runs First Current Account Deficit In 5 Months

- Japan Bank Lending Picks Up On Demand To Meet Rising Material Costs

- New Zealand Posts First Dip In Inflation Expectations In 2 Years

- New Zealand Economists See Jobs Market Past Peak As Rates Rise

- China To Conduct 'Regular' Military Drills East Of Taiwan Strait Median Line

- China's Exports Gain Steam But Outlook Cloudy As Global Growth Cools

- Dollar Extends Gains Against Yen As Big Fed Hike Bets Ramp Up

- Oil Extends 10% Weekly Drop As Demand Concerns Spur Caution

- Iran, US Close In On Nuclear Deal Text But Hurdles Remain

- Asian Share Markets, US Futures Mostly Softer On Monday

The Day Ahead

- Having posted solid gains over the previous three weeks, global equities are now showing signs of cooling with Asian markets trading somewhat mixed at the start of the new week. Friday’s stronger-than-expected US payrolls report added to the case for further hikes in US interest rates, which in turn has provided a more cautious backdrop for risk assets. Sentiment across China has also been impacted by new Covid restrictions in parts of Hainan island. The province has reported a surge in Covid infections over the past week leading to a number of major cities being placed under lockdown.

- Markets have also remained on recession watch over the past week as they look for clues on how quickly and by how much economic activity is set to slow across a number of major economies. In the UK, the Bank of England’s Monetary Policy Committee delivered a downbeat message about UK economic conditions alongside its latest interest rate hike. The message from the BoE is that further hikes are likely despite their forecast that the UK economy is likely to enter a five-quarter recession later this year, alongside the prospect of the headline rate of CPI inflation exceeding 13% in October in response to the next energy price cap rise.

- This Friday’s UK GDP report may be seen as evidence that the UK economy is already in recession as we expect it to show a monthly fall in output for June of 0.9%, resulting in a quarterly decline in GDP across Q2 as a whole. However, the Bank of England is anticipating a decline and also expects a corresponding rebound in Q3, which is partly why it is not forecasting the recession to start until Q4. Until then, it is a quiet week for UK data reports, with no releases due today, although the early Tuesday release of the British Retail Consortium’s retail sales report for July will provide some first insights into Q3 trends.

- Elsewhere, it is also a very light day for key data with no major releases due in the US, while in the Eurozone the attention is limited to the latest Sentix investor confidence survey for August. A fall from -26.4 to -29.0 is expected, which would take it down to its lowest since May 2020

CFTC DATA

- USD long pared considerably amid significant yen short – cover

- USD net spec long cut in Jul 27-Aug 2 period; $IDX -0.8%

- EUR specs +2,773 contracts now -38,811 amid EUR$ 0.45% rise

- JPY net short reduced considerably, $JPY -2.73%, specs +18,728 contracts

- GBP$ +1% in period; specs -2,419 contracts now -56,409; BoE rate path lags

- AUD specs -8,565 contracts now -55,950; growth woes, commod dip weighs on A$

- BTC +9.73% in period, specs sell 460 contracts into strength, now -581

- JPY short-cover changes USD long rankings- EUR short +$4.9bn, GBP$ short +4.3bn, $JPY long +$4.0bn (Source: Reuters)

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0100-05 (692M), 1.0175 (234M)

- 1.0200-05 (353M), 1.0245-55(423M), 1.0300 (567M)

- USD/JPY: 134.00 (445M), 134.75-85 (372M)

- 135.00 (510M), 135.50 (260M), 135.90 (230M)

- 135.90-00 (639M), 137.50 (960M)

- GBP/USD: 1.1990-00 (670M), 1.2240-50 (510M)

- USD/CHF: 0.9450 (300M). AUD/USD: 0.6910 (913M)

- 0.7000 (975M). NZD/USD: 0.6400 (330M)

- USD/CAD: 1.2800-10 (340M), 1.2950 (1.07BLN)

Technical & Trade Views

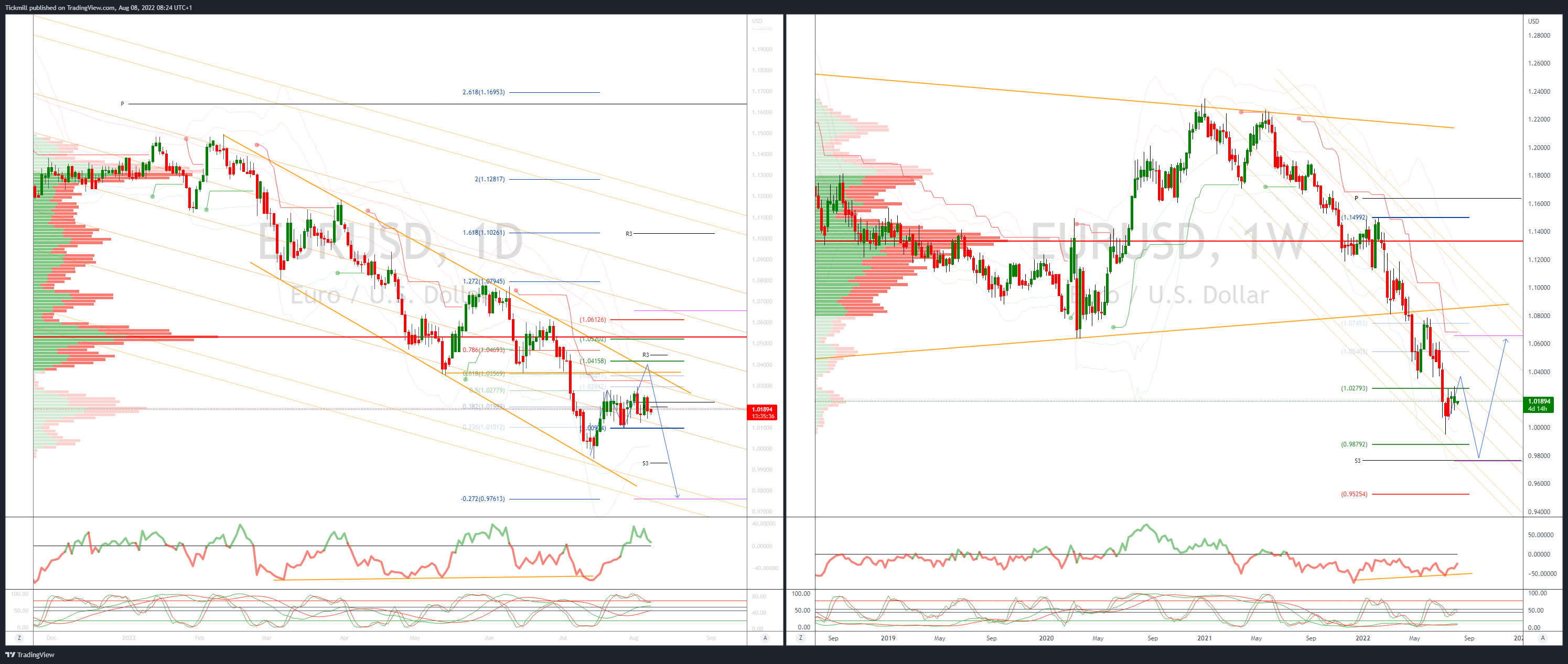

EURUSD Bias: Bearish below 1.0350

- Soft as the resilient USD and Italian issues weigh

- -0.25% amid hawkish Fed expectations after strong U.S. jobs underpin the USD

- Italian centrists in disarray - right wing Gov't chances grow

- Moody's cut Italy's outlook to 'negative' from 'stable'

- Resistance 1.0250/60 stronger offers seen to 1.0350/60, support 1.0100-05, 1.0070-75

- 20 Day VWAP is neutral/bearish, 5 Day bearish

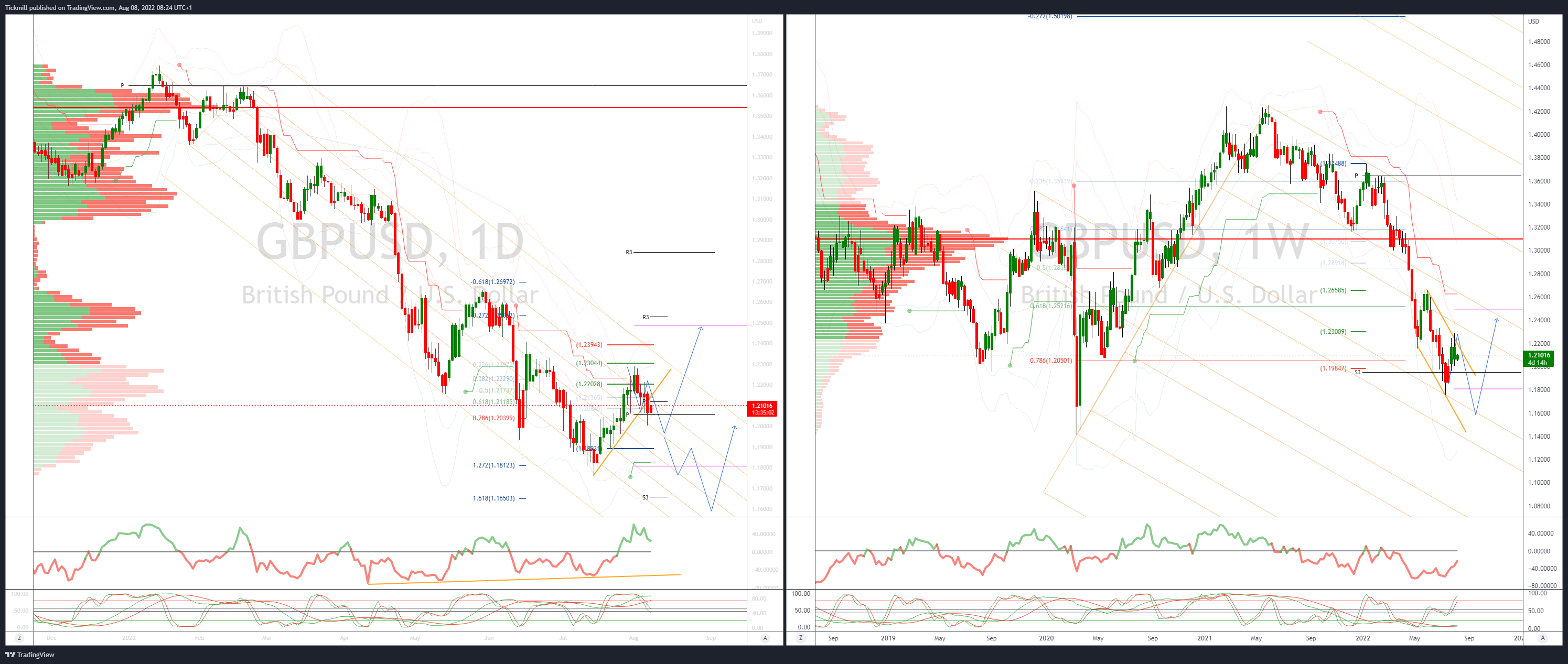

GBPUSD Bias: Bearish below 1.2280

- Surging U.S. jobs and hawkish weekend Fed comments to sustain USD strength

- Liz Truss ready to speed up tax cut plan if elected, Telegraph

- Lizz Truss is hot favourite to be next PM - oddschecker - bet 11 to win 12

- Offers sited at 1.2280/1.23 bids 1.2090

- 20 Day VWAP is bullish, 5 Day bearish

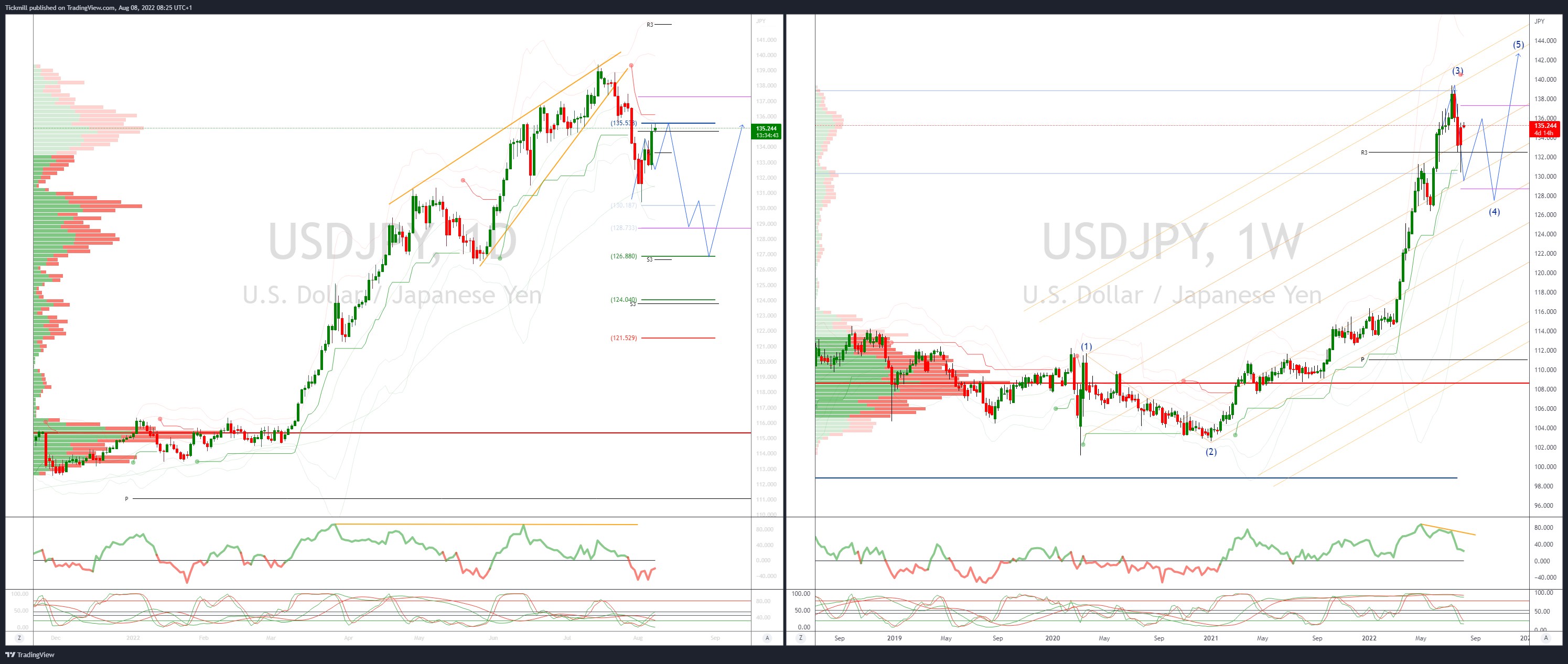

USDJPY Bias: Bearish below 135

- 0.25% after jumping 1.54% Friday as Treasury yields surged

- E-mini S&P -0.5% - Hawkish Fed comments

- CME FedWatch Tool prices a 75bp September hike at 68% from 28% on July 29

- Japan PM Fumio Kishida to reshuffle the cabinet on Wednesday

- Bears target a test of 130

- Offers seen at 136.20

- 20 Day VWAP is bearish, 5 Day bullish

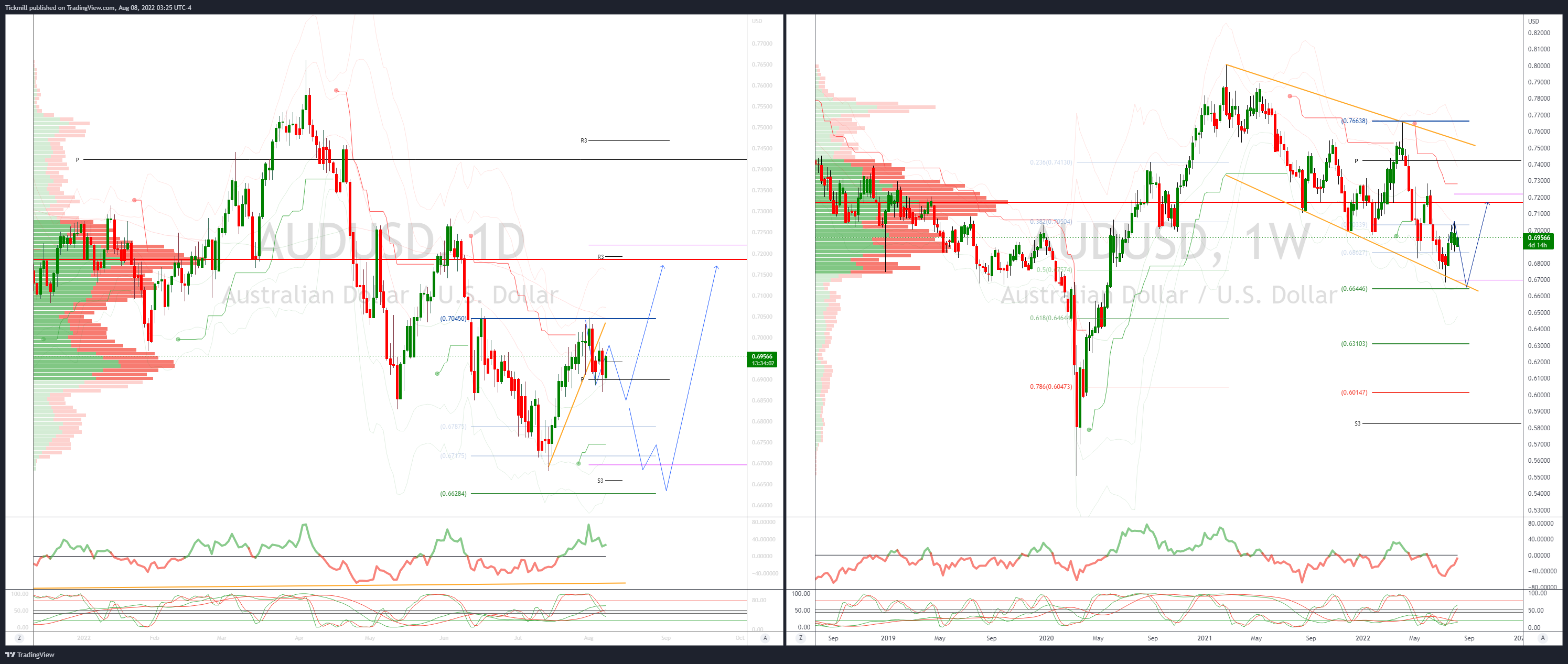

AUDUSD Bias: Bearish below .7050

- Dramatic hawkish shift in Fed expectations underpinning USD in early Asia

- Fed speakers on weekend indicate another 75 BP hike in Sept on the table

- Market pricing in a 70% chance of a 75 BP hike following the strong US payroll report

- Offer at .70 being eroded as price is accepted above .70 bulls target .71 test

- AUD/USD support now sited at .6890

- 20 Day VWAP is bullish, 5 Day bullish

BTCUSD Bias: Bearish below 25.3K

- BTC responds positively to NFP Data

- Set to make another attempt at 24k

- Foundry Makes BTC Donation to Open Source Stratum V2 Protocol Developer to Improve Bitcoin's Proof-of-Work Mining Layer

- InvestDEFY Launches STACC, a Weekly Yield Enhancement Program for Bitcoin (BTC) and Ethereum (ETH)

- Bulls need a close above 25k to gain significant upside momentum

- Closing below 21k would be a noteworthy downside development

- 20 Day VWAP is bullish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!