Daily Market Outlook, August 9, 2022

Daily Market Outlook, August 9, 2022

Overnight Headlines

- NY Fed: Inflation Expectations Decline Across All Horizons

- US Dollar Loiters Off Highs As Traders Eye Upcoming CPI

- Citi: Fed Could Approve 100 Bps Rate Hike After Jobs Shocker

- EU Puts Forward 'Final' Text To Resurrect Iran Nuclear Deal

- UK Retail Sales Growth Fails To Keep Pace With Soaring Inflation

- UK PM Rejects Calls For Emergency Measures On Cost Of Living Crisis

- China Unlikely To Cut Interest Rate And RRR – Securities Daily

- Australian Consumer Sentiment Slides As Rates Rise Further

- Australia Business Activity Booms In July, Costs Continue Surge

- Oil Prices Retreat On Potential Chance Of Iran Supply Boost

- Wall Street Strategists Say Stocks Rally At Odds With Profit Outlook

- Asia Stocks Wobble As Focus Turns To US Inflation Data, Fed Outlook

- Google Hit By Worldwide Outage As Users Report Search Engine Down

The Day Ahead

- Asian equity market performance is mixed overnight with no major moves. A US Federal Reserve survey showed that both near-term and longer-term inflation expectations have fallen. The move seems to have been primarily driven by the recent fall in oil prices. A spokesperson for UK PM Johnson said that whether further fiscal support will be given to offset the latest rise in the energy price cap will be up to the new prime minister. The latest British Retail Consortium report showed retail sales up 1.6% yr-on-yr in July, boosted by sales of hot weather clothes and other items to combat the heatwave.

- The rest of today’s economics calendar is light with nothing of note in either the UK or the Eurozone. Indeed, the schedule for the whole week is sparse until Friday when UK GDP and Eurozone industrial production will provide updates on economic activity. There are also no scheduled speeches from either Bank of England or European Central Bank policymakers as we move into the main holiday period. However, with the Conservative Party leadership contest continuing there will be interest in what the two candidates have further to say about their economic policies and in particular any plans they have to offset the likely impact on consumers of the energy price cap rise expected in October.

- In the US, the key release of the week will be tomorrow’s update for CPI inflation. Ahead of that, today’s releases are forecast to show a big fall in productivity in Q2, due to the combination of falling GDP and strong employment and a resulting large rise in unit labour costs. Those outturns are likely to reinforce US central bank policymakers’ concerns that inflationary pressures are not yet under control. Meanwhile, the NFIB small business survey for July may provide insights into trends in a key segment of the economy. Already released results to some of the questions show a small rise in hiring plans but a slight easing in the jobs vacancies ‘hard to fill’ component, while compensation plans were unchanged.

- The latest Chinese inflation data will be released early tomorrow. The July results are expected to show a rise in annual consumer price inflation to 2.9% from 2.5% but a fall in producer price inflation. The expected acceleration in consumer price inflation would take it to its highest since April 2020 and will likely be primarily driven by food prices. However, the big picture is that inflation is still well below trends in much of the rest of the world, which suggest that the government still has room to stimulate economic growth.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0000 (1.06BLN), 1.0100 (799M), 1.0145-50 (926M)

- 1.0185-90 (1.69BLN), 1.0200-10 (1.69BLN), 1.0225-30 (380M)

- 1.0260-65 (320M), 1.0300 (1.27BLN)

- USD/JPY: 133.00 (570M), 133.40 (679M), 134.50 (210M)

- 135.00-05 (975M), 135.30-40 (1.43BLN)

- EUR/GBP: 0.8350 (210M)

- USD/CAD: 1.2750 (325M), 1.2875 (470M), 1.2900 (1.17BLN)

- 1.2920 (223M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.0350

- Opens unchanged as market looks ahead to US CPI

- EUR/USD opens unchanged around 1.02 after a quiet Asian session

- USD eased against some currencies due to a move lower in US yields

- EZ bond yields also fell to offset and cap EUR/USD gains

- Resistance 1.0250/60 stronger offers seen to 1.0350/60, support 1.0100-05, 1.0070-75

- 20 Day VWAP is neutral/bearish, 5 Day bullish

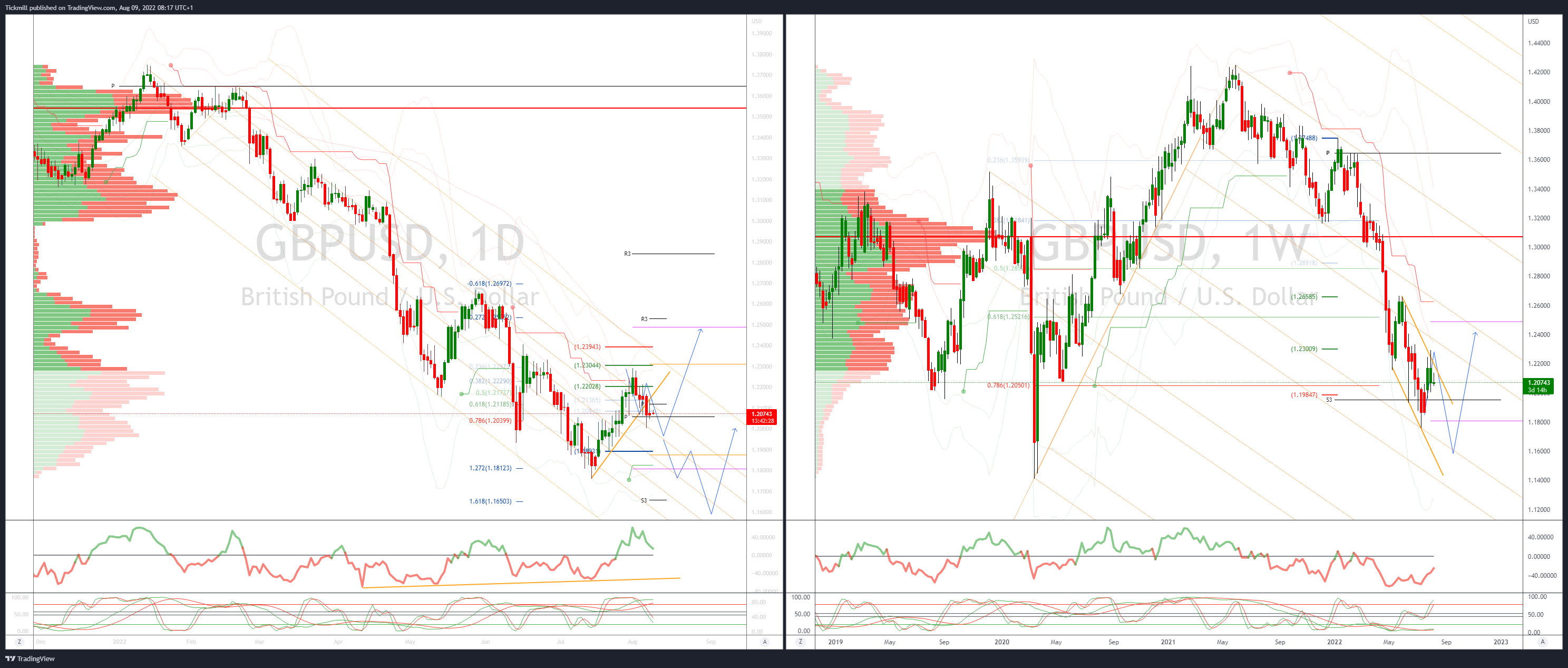

GBPUSD Bias: Bearish below 1.2280

- Heatwave fuels spending, but likely transitory

- Opens steady after closing up just 0.05% after a choppy inside day

- UK shoppers spend as heat-wave hits - likely transitory BRC

- Cost of living crisis likely to be the main focus as rates rise and colder weather comes

- Offers sited at 1.2280/1.23 bids 1.20

- 20 Day VWAP is bullish, 5 Day bearish

USDJPY Bias: Bearish below 135

- USDJPY supported by expectations of larger Fed interest rate hikes

- Fed funds futures price in 69% chance of another 75 bps rate hike in Sept

- NY Fed survey shows US consumers' inflation outlooks drop sharply, caps rise

- Inflation expectations are a key dynamic for Fed policymakers

- Bears target a test of 130

- Offers seen at 136.20

- 20 Day VWAP is bearish, 5 Day bullish

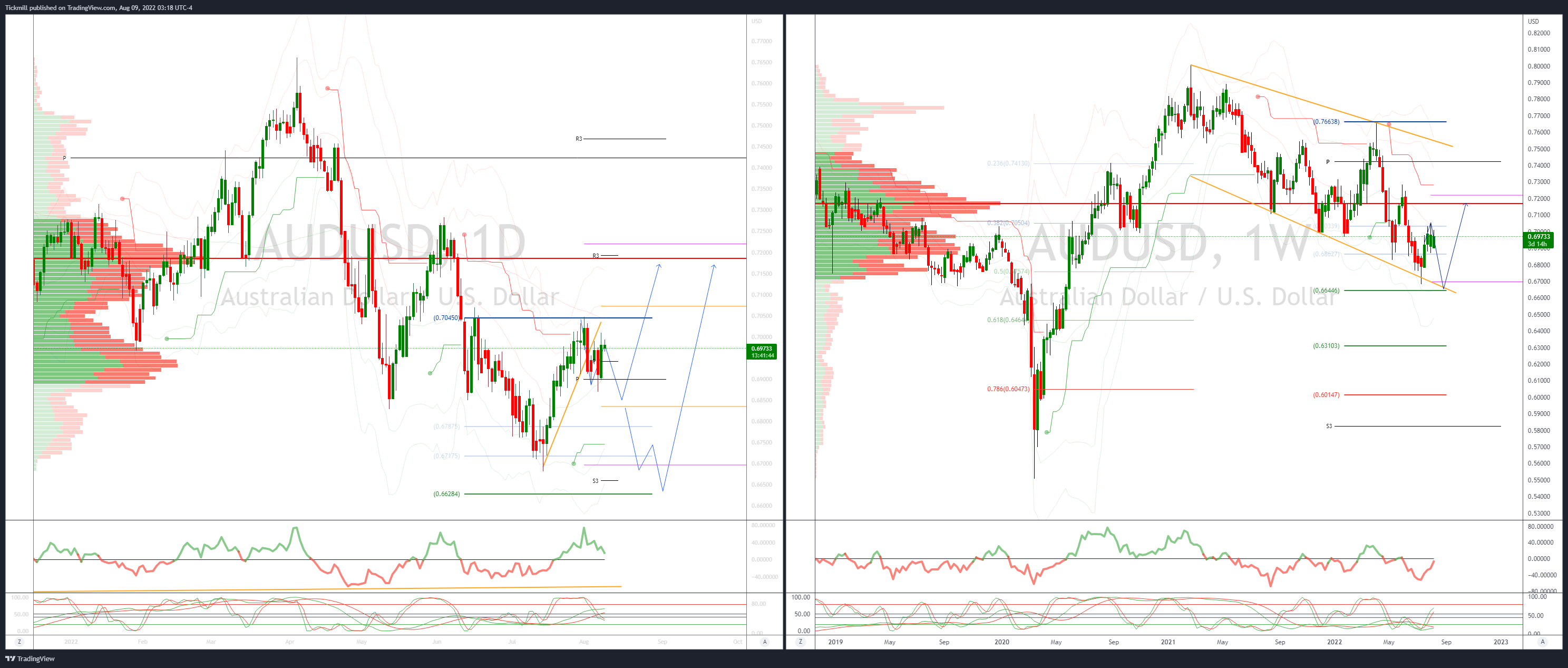

AUDUSD Bias: Bearish below .7050

- Bulls have the ball, ignore inflation data risks

- AUD/USD rallied overnight, NY opened near 0.6965, rally extended

- Equity , copper gains & softer US yields aid lift

- US July CPI risk looms, downside surprise may squeeze shorts

- Offer at .70 being eroded as price is accepted above .70 bulls target .71 test

- AUD/USD support now sited at .6890

- 20 Day VWAP is bullish, 5 Day bullish

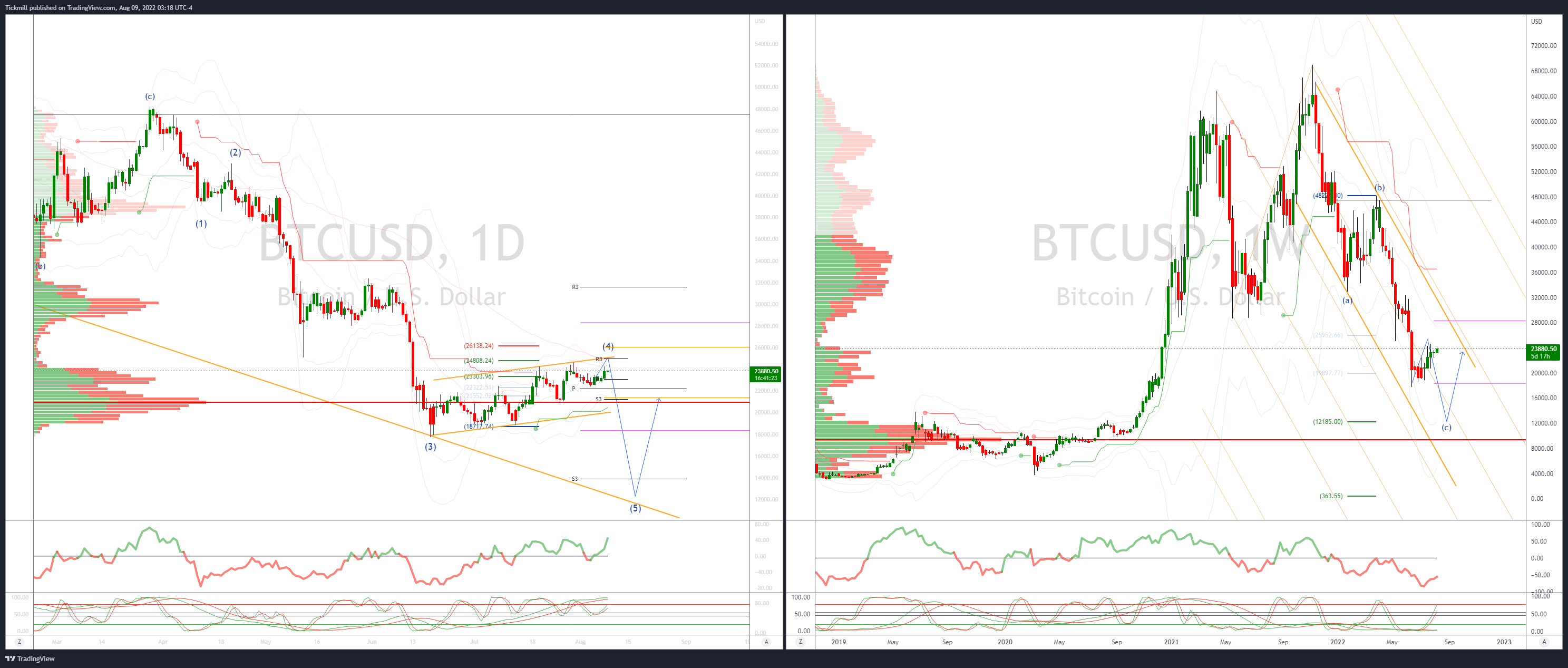

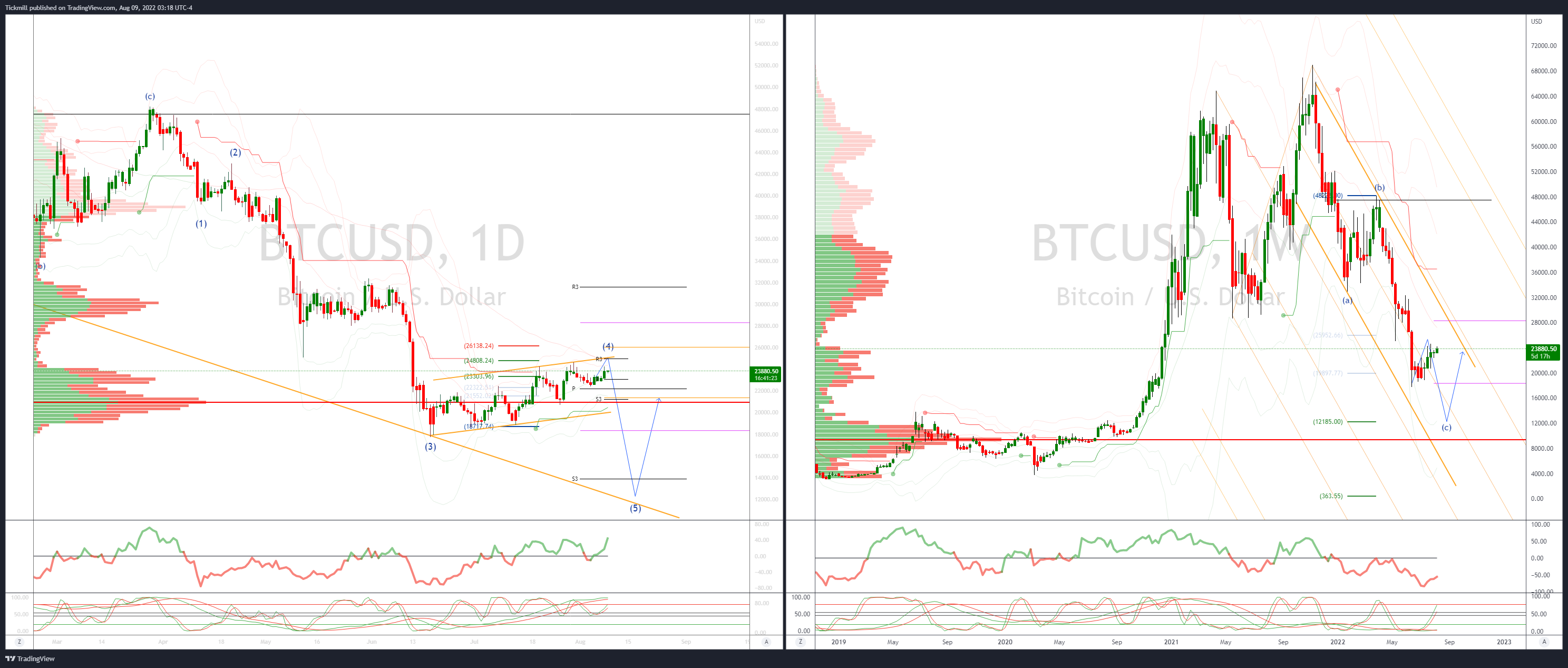

BTCUSD Bias: Bearish below 25.3K

- BTC capped at 24k for now

- Thieves stole an estimated $190 million from U.S. crypto firm Nomad last week

- Seventh hack of 2022 to target an increasingly important cog in the crypto machine: Blockchain "bridges"

- Bulls need a close above 25k to gain significant upside momentum

- Closing below 21k would be a noteworthy downside development

- 20 Day VWAP is bullish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!