Daily Market Outlook, August 9th, 2021

.png)

Daily Market Outlook, August 9th, 2021

Overnight Headlines

- US Senate Trudges Toward Passing $1Tln Infrastructure Bill

- China Wuhan Completes Mass Virus Testing As Cases Return

- Australia East Coast Continues Struggle With Delta Outbreak

- ECB Weidmann: Inflation May Pick Up Faster Than Estimated

- EU Expected To Discuss Reimposing Travel US Covid-19 Curbs

- Top Tories Warn Johnson Against Demoting Chancellor Sunak

- Merkel’s Bloc Retreats In Poll As Would-Be Successor Struggles

- Oil Extends Losses After Weekly Slump As Delta Clouds Outlook

- Gold Tumbles With Silver On Bets Fed May Soon Start To Taper

- Dollar Hits Four-Month High On Euro On Earlier Fed Taper Bets

- Berkshire Buoy As US Rebound Fires Up Manufacturers, Retail

The Day Ahead

- Last Friday’s US jobs report for July showed that the economy added 943k jobs in July, more than markets were expecting, while the unemployment rate dropped to 5.4% from 5.9%. That means that the latter is still around two percentage points above its pre-pandemic rate, while the level of employment is close to 6mn below where it was early last year. Nevertheless, job openings likely hit a new high in June, pointing to the prospect of further big gains in employment in the coming months.

- Meanwhile, as the debate over when the Federal Reserve should begin tapering its asset purchases continues, Fed members Bostic (15:00 BST) and Barkin (17:00 BST) are scheduled to speak today, giving them opportunities to provide their latest thoughts on the matter. In comments released after Friday’s solid US labour market report, the Fed’s Kaplan suggested that the rate of purchases should be scaled back soon from its current $120bn/month pace.

The Week Ahead

- Inflation in focus after U.S. jobs data Friday's strong U.S. labor report has reignited inflation concerns as worries over slower growth recede for the time-being. The jobs data sent U.S. Treasury yields higher as the market brings forward expectations of when the Federal Reserve will start to taper its bond buying program. The market will pay close attention to speeches by Fed voters Lael Brainard and Charles Evans early in the week, as any hawkish tweak to their message will have more of an impact since both are perceived to be doves. The minutes of the July 27-28 Federal Open Market Committee meeting will also be released this week. Equity markets have been resilient through the rise of the highly contagious Delta strain of the coronavirus, as most developed world economies have avoided lockdowns due to rising vaccination rates. If the number of infections keeps rising, the threat of lockdowns could start to significantly weigh on risk assets. The market will pay more attention than usual to CPI and PPI releases out of the U.S. this week, as hotter-than-expected outcomes will spur a hawkish turn in Fed expectations. The progress of the U.S. infrastructure bill in the Senate will also be watched.

- Inflation data to shape central bank expectations CPI and PPI will be the key data events out of the U.S. this week. Friday's hot U.S. non-farm payrolls has fuelled inflation concerns, while global growth concerns move towards the back-burner. Other data out of the U.S. includes import and export prices and University of Michigan preliminary August consumer sentiment. Euro zone data in the week ahead includes the Sentix Index, industrial production, German ZEW and final July inflation. UK data includes IP, trade and preliminary Q2 GDP. Japan is on holiday Monday and the only data this week will be the current account and trade balance. China's calendar includes July CPI, PPI and lending data, following weaker-than-expected exports and imports on Saturday. Australia will be quiet this week with only the NAB business survey and consumer confidence on tap. No top-tier data is due in New Zealand and Canada.

CFTC Data

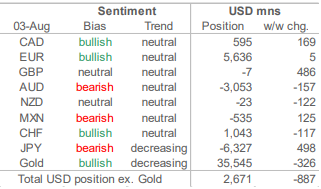

- Bullish USD Turn Stalls

- Data cover up to Tuesday August 3 and released on Friday August 6

- Speculators reporting to the CFTC trimmed the small bullish USD position with a USD887mn decrease in the aggregate net USD long, to total USD2.67bn in the major currencies that we cover in this report in the week through August 3rd. This represents the first week-to-week move against the dollar in eight weeks after positioning swung by USD21.5bn between early-June and late-July. In the week to Tuesday, the USD lost ground against all major currencies with the exception of the Brazilian real (but is up against almost all since).

- Investors trimmed the JPY short by USD498mn to USD6.3bn following two consecutive increases in bearish JPY sentiment as the net bearish position seemed on track to reach the recent high of USD7.9bn in late-May, itself the most negative position on the yen since mid-2019. Net JPY shorts represent roughly double the next most bearish position against the dollar, that of the AUD. The Aussie aggregate short rose by USD157mn to USD3.1bn. Note that earlier that day, the RBA decided to (somewhat unexpectedly) leave its tapering plans unchanged.

- Accounts left net EUR longs practically unchanged, although the USD5mn increase represents the first (albeit minute) move in favour of the EUR in eight weeks, but the net balance of long versus short contracts remains around its lowest mark since March 2021; totaling USD5.6bn. The GBP and the EUR were the worst performing currencies over the week among those covered in this report, though sterling positioning did not reflect this as its net short was almost fully trimmed (to USD7mn) with a large USD486mn adjustment in its favour, ahead of the moderately ‘hawkish’ BoE announcement on Thursday.

- Positioning in the CAD also improved with a USD169mn increase in its net long taking the aggregate position to +USD595mn, after it had been slashed by USD3.3bn over the previous four weeks. Adjustments in the other currencies that we cover were mixed and of similar magnitudes, with the MXN short trimmed by USD125mn, the small NZD long flipping to a small short with a USD122mn move against it, and the CHF long (at USD1bn, the largest bullish position after the EUR) falling by USD 117mn

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- EUR/USD: 1.1750 (1BLN), 1.1800 (1.6BLN), 1.1810-20 (1BLN)

- USD/CHF: 0.9125 (235M). USD/CAD: 1.2485 (440M), 1.2600 (230M)

- USD/JPY: 109.00 (632M), 110.50 (562M).

- GBP/JPY: 152.30 (288M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1920 Bullish above

- EUR/USD opened 1.1760 and traded up to 1.1769 very early Asia

- It reversed lower when stops in gold were triggered below 1,750 to 1,686

- EUR/USD eased below support ahead of 1.1750 to 1.1742 at one stage

- Gold recovered to 1,740 and EUR/USD settled back around 1.1760

- Broad USD strength after US jobs data likely to keep EUR/USD pressured.

- EUR/USD support is found at the 2021 low at 1.1704

- Resistance is at the 21-day MA at 1.1816 and 10-day MA at 1.1833

GBPUSD Bias: Bearish below 1.40 Bullish above.

- Touch softer in a very busy but tight 1.3856-1.3870 range

- Solid flows especially early, despite Tokyo and Singapore holidays

- Fed tapering fears on U.S. jobs..., supported USD, volatile gold

- Charts; 5, 10 & 21 daily moving averages plus momentum studies conflict

- Neutral setup but topside bias survives while 1.3834 21 DMA holds

- 1.3991 61.8% June-July fall and 1.4005 upper 21 day Bolli pivotal resistance

- 1.3834 21 DMA initial support and 1.3882 late NY hourly high resistance

USDJPY Bias: Bullish above 109 Bearish below

- Steady in a 110.19-110.37 range, with an Asian sell off in commodities

- Gold fell 4.4% early, now off 1.3%, Brent oil -2%, and U.S. copper -0.4%

- Holidays in Japan and Singapore impacted liquidity and local interest

- Olympics over after providing a fantastic global distraction...

- Treasury yields will likely be the driver of USD/JPY in New York on Monday

- Charts; trades within the daily cloud with parameters at 109.57 and 110.73

- 109.95 Kijun line supports - 110.53, 61.8% of July-August fall resistance

AUDUSD Bias: Bearish below 0.75 Bullish above

- AUD/USD opened 0.7355 after falling 0.65% Friday following strong US jobs

- After trading 0.7362 it fell to 0.7328 when gold collapsed 4.5% to 1,686

- Once the gold stops were triggered, gold filled in the gaps back to 1,740

- AUD/USD followed gold back up and was 0.7355 into the afternoon session

- AUD/USD support at July 28 low at 0.7317 and trend low at 0.7289

- Resistance is at 10-day MA at 0.7372 and 21-day MA at 0.7386

- Sagging commodities on China demand fears to limit AUD/USD upside

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!