Daily Market Outlook, December 7, 2020

Daily Market Outlook, December 7, 2020

Equity markets in Asia were mixed as investors weighed up the positive news around the deployment of a vaccine – with the UK set to begin its deployment programme from tomorrow – against renewed tensions between the US and China. In the US, reports suggest the FDA may approve the vaccine this Thursday, with a rollout programme commencing from Friday. However overall risk sentiment has been soured somewhat by reports that the US was preparing to impose sanctions on some Chinese officials. Meanwhile, with the UK and the EU yet to agree on a trade deal, discussions between the two parties continued yesterday. The decision to continue talks came about following a conversation between UK PM Johnson and European Commission President von der Leyen on Saturday evening, at which both agreed, “that further effort should be undertaken by our negotiation teams”, however, UK PM Johnson is reportedly ready to pull-out of discussions within hours, according to The Sun, adding to GBP losses.

Talks between the EU and the UK are likely to spill over into today, ahead of another scheduled phone call between PM Johnson and Ms von Der Leyen later this evening. With time running out for a deal to be agreed, particularly with number 10 setting a deadline of today, UK environmental secretary, George Eustice suggested that talks could be extended if progress was deemed to be being made. With Brexit discussions at a delicate stage, the Internal Markets Bill returns to the House of Commons today. MPs will be asked to consider amendments to the bill made by the House of Lords, which removed controversial clauses that allowed the UK government to override certain parts of the original withdrawal agreement. The clauses – which the UK government are expected to re-insert – would allow the UK to ignore parts of the agreed treaty that required Northern Ireland to follow some of the EU’s rules in the event of a no deal. Against this backdrop, today’s relatively uninspiring data calendar is unlikely to receive much attention.

The Euro area Sentix investor survey for December is expected to show a modest improvement, from -10 to -7.8, reflecting the uptick in European equities since the start of the month and the easing in lockdown restrictions across a number of member states. Overnight in the UK, the British Retail Consortium will release its November retail sales report. With much of the UK under tighter restrictions last month, the report is expected to capture the impact of non-essential store closures.

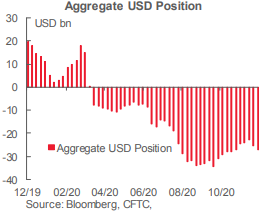

Our second dose of CFTC positioning data this week, following the delayed data released after the US Thanksgiving break, shows a little more activity in speculative positioning after a relatively subdued run into the holiday break. Again, the overall USD short position, reflected in the aggregate exposure in all the currencies we monitor in this report, showed an increase on the week, rising USD1.6bn to USD27.1bn. Overall positioning continues to be dominated by the large, and increasing, net long EUR position (up USD557mn this week to USD21.1bn). However, net currency longs in the JPY (up USD875mn) increased more significantly while net MXN and NZD longs also rose very modestly.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.2000 (583M), 1.2045-55 (800M) 1.2100-15 (621M)

- USDJPY: 103.45-50 (550M), 104.00-05(515M) 104.25-30(517M)

104.50 (700M), 105.00(605M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.20 targeting 1.23

EURUSD From a technical and trading perspective, as 1.1820 acts a support look for a retest of cycle highs at 1.20 anticipate a profit taking pullback on the initial test, while 1.1820 is defended then look for price to test the wave 5 upside objective at 1.2120 UPDATE target achieved as 1.20 now acts as support bulls target primary ascending trendline resistance to 1.23

Flow reports suggest topside offer increasing through the 1.2180 level and continuing to the 1.2220 level where weak stops are likely to appear however, having broken through the 1.2120 area the congestion only starts to appear once the market reaches for the 1.2250 level and increasing into the bottom of the early 2018 ranges, downside bids light through into the 1.2100 area with weak stops on a break of the 1.2080 area opening a deeper move to the 1.19 handle again, with weak bids on the break through the 1.2000 area.

GBPUSD Bias: Bullish above 1.3175 targeting 1.39

GBPUSD From a technical and trading perspective, as as 1.3250 supports then prices can extend higher to test wave 5 upside objectives to 1.3910/80 area,failure below 1.3175 opens the pivotal 1.30

Flow reports suggest topside light offers through to the 1.3500 level market then opening only to the 1.3550 area where light offers are likely to continue building into the 1.3580-1.3600 area with stronger stops on a move through the level and opening the market for a larger move higher, Downside bids light through the 1.3400 level with weak stops on a move through the level and opening quickly to the 1.3350 with stronger bids starting to accumulate on any move through to the 1.3300 level and stronger stops below the areas

USDJPY Bias: Bearish below 105 targeting 101.20

USDJPY From a technical and trading perspective, near term short covering to challenge offers to 105 descending trendline resistance, as this area contains upside attempts look for the next leg lower to target year to date lows at 101.20

Flow reports suggest congested through to the 104.80 level where offers are likely to be a little stronger with weak stops on a move through the 105.20 level before further offers into the 105.50 area and weakness through to the 106.00. downside Bids into the 103.50 level increasing on move through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00

AUDUSD Bias: Bullish above .7230 bullish targeting .7700

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400 from here anticipate a profit taking pullback towards .7200 again before price attempts to extend higher again to target wave 5 upside objective towards .7700

Flow reports suggest downside bids light through the 74 cents area with weak stops likely on a dip through the 0.7380 areas before congestive bids into the 0.7360-40 level, stronger bids into the 0.7320-00 with weak stops mixed with weak bids through to the 0.7250 area. Topside offers through to the 0.7460 area with increasing offers to the 0.7500 area and congestion beyond the level probably dated (old) however, likely to be in the area and negating much of the weak stops and only sentimental option levels to be concerned with, stronger offers then from the 0.7550 through to 0.7600 area and offers then likely to continue to increase.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!