Daily Market Outlook, December 8, 2020

.png)

Daily Market Outlook, December 8, 2020

Asian equity markets are mostly down modestly this morning. The US confirmed sanctions on 14 Chinese officials over their alleged roles in disqualifying Hong Kong politicians. However, a White House Economic Adviser said there were no plans to impose new tariffs on China. Republican Senator McConnell, the leader of the Senate, said that further fiscal stimulus to combat Covid-19 was important. However, He refused to endorse a bi-partisan bill, but instead put forward his own package.

The first vaccinations for Covid-19 will begin in the UK today with 800,000 expected to be vaccinated before year-end. The November measure of like-for-like sales from the British Retail Consortium showed a 7.7% annual rise (up from 5.2% in October) despite the new lockdown in England. Online sales were more than 59% of the total, their highest since May.

Yesterday was a frustrating day for Brexit negotiations with both sides claiming that little progress had been made on the key sticking points. After a phone call between UK PM Johnson and EU Commission President von der Leyen failed to provide a breakthrough, it was decided that the PM would go to Brussels for face-to-face talks on Thursday. That seems to make it very unlikely now that this week's summit of EU leaders will be able to sign off on a deal. Ahead of those talks, chief negotiators from both sides have been charged with preparing a summary of the key remaining differences.

The German ZEW survey will provide one of the first indications of the performance of the Eurozone economy in December. As a survey of financial analysts’ views, it is considered a less -reliable indicator of expectations for the economy than the PMI data that will follow next week. However, it gets attention from markets for its timeliness and the expectations component has often proved to be a good leading indicator. In November, both the current conditions and expectations readings fell with the latter declining for the second month in a row to its lowest level since April. The December data will be watched in particular, for the extent to which expectations rebound on the back of hopes that a Covid-19 vaccine will allow economic conditions to return closer to normal next year. Look for a bounce to 50, which would still leave it below its October level.

The data calendar is very light with nothing of note in the UK. In the US, the NFIB small business optimism index is forecast to have fallen in November from what was its highest level since February in October. That may reflect concerns about the negative impact on the US economy of the latest rise in Covid-19 cases. Meanwhile early Wednesday, China’s CPI data is expected to show annual CPI inflation fall to a multi-year low of 0.0% despite the ongoing rebound in the economy

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.2000 (661M), 1.2115 (206M), 1.2200 (390M)

- USDJPY: 104.00 (3.4BLN), 104.45-50 (1.5BLN), 105.00-10 (1BLN)

- GBPUSD: 1.3200 (400M), 1.3450 (208M)

- AUDUSD: 0.7385 (200M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.20 targeting 1.23

EURUSD From a technical and trading perspective, as 1.1820 acts a support look for a retest of cycle highs at 1.20 anticipate a profit taking pullback on the initial test, while 1.1820 is defended then look for price to test the wave 5 upside objective at 1.2120 UPDATE target achieved as 1.20 now acts as support bulls target primary ascending trendline resistance to 1.23

Flow reports suggest topside offers light through to the 1.2180 area where offers are likely to be thick to the 1.2220 area and stops appear for possibly a strong breakout if that is possible, downside bids light through the 1.2100 level and some bids into the 1.2080 area before weak stops appear for a chance at a quick move through to the 1.2000 level and stronger stops on any attempt through the 1.1980 areas and a failed topside opening up some further weakness through to the congestion around the 1.1900 area

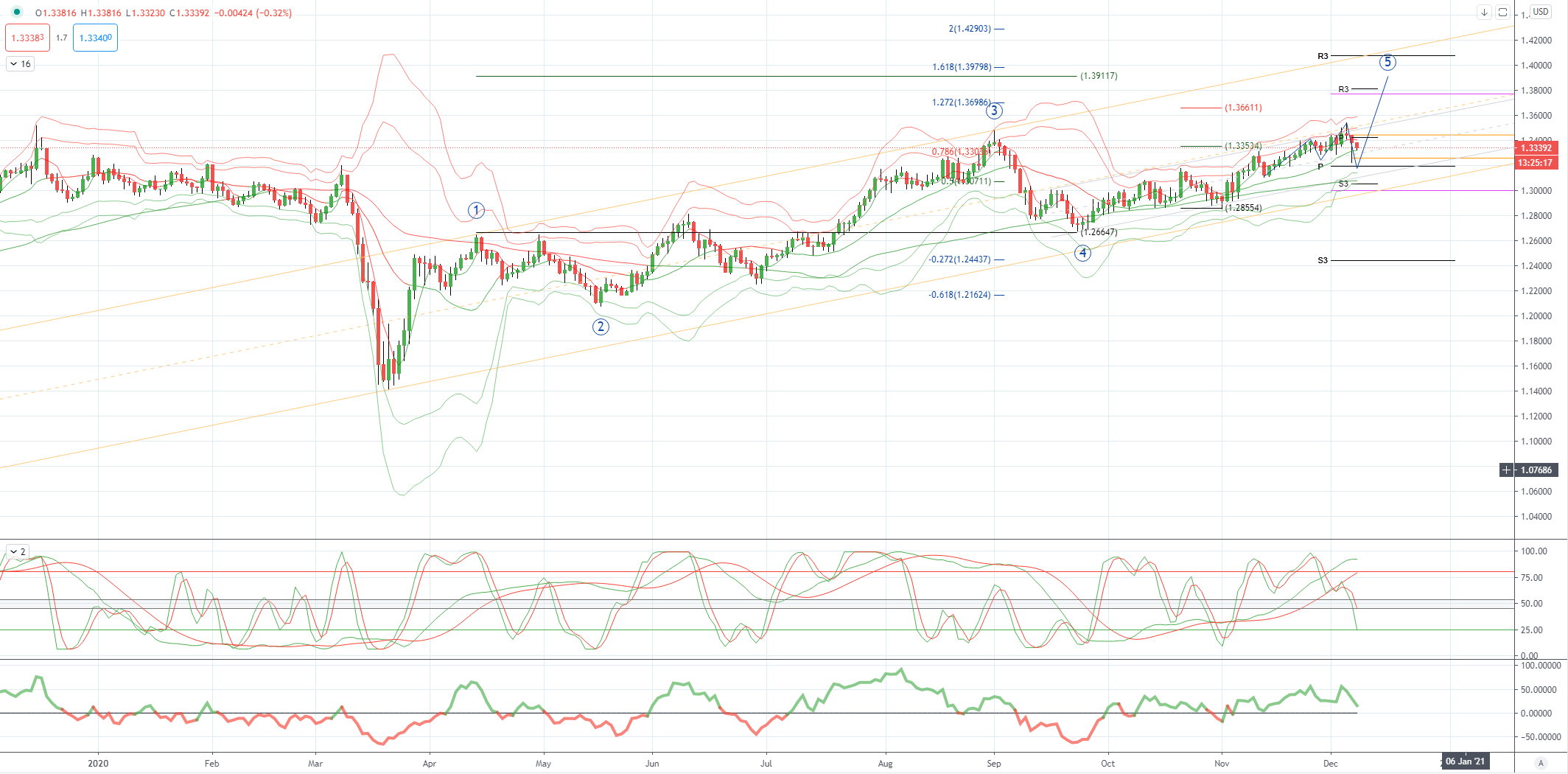

GBPUSD Bias: Bullish above 1.3175 targeting 1.39

GBPUSD From a technical and trading perspective, as as 1.3250 supports then prices can extend higher to test wave 5 upside objectives to 1.3910/80 area, failure below 1.3175 opens the pivotal 1.30

Flow reports suggest downside bids light through to the 1.3320-00 area with bids light through the level and weak stops likely on a dip through the level, light congestion through to the 1.3250 area with stronger bids likely on a move to the 1.3200-1.3150 areas. Topside offers light through to the 1.3450 area with some offers starting to form with stronger offers likely through to the 1.3500-20 area and weak stops on a move through.

USDJPY Bias: Bearish below 105 targeting 101.20

USDJPY From a technical and trading perspective, near term short covering to challenge offers to 105 descending trendline resistance, as this area contains upside attempts look for the next leg lower to target year to date lows at 101.20

Flow reports suggest congested through to the 104.80 level where offers are likely to be a little stronger with weak stops on a move through the 105.20 level before further offers into the 105.50 area and weakness through to the 106.00. downside Bids into the 103.50 level increasing on move through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00.

AUDUSD Bias: Bullish above .7230 bullish targeting .7700

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400 from here anticipate a profit taking pullback towards .7200 again before price attempts to extend higher again to target wave 5 upside objective towards .7700

Flow reports suggest downside bids light through the 74 cents area with weak stops likely on a dip through the 0.7380 areas before congestive bids into the 0.7360-40 level, stronger bids into the 0.7320-00 with weak stops mixed with weak bids through to the 0.7250 area. Topside offers through to the 0.7460 area with increasing offers to the 0.7500 area and congestion beyond the level probably dated (old) however, likely to be in the area and negating much of the weak stops and only sentimental option levels to be concerned with, stronger offers then from the 0.7550 through to 0.7600 area and offers then likely to continue to increase.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!