Daily Market Outlook, February 16, 2024

Daily Market Outlook, February 16, 2024

Munnelly’s Market Minute…

“Nikkei Heading For All Time Highs WIth Japan In Recession”

The Nikkei reached a 34-year high, just shy of its all-time high of 38,957.44 points set on Dec. 29, 1989. The stock market in Asia has surged by 15% this year, following a 28% rally in 2023. Despite Japan slipping into recession and losing its position as the world's third-largest economy to Germany, the market has seen significant growth. The weakening yen has both positive and negative impacts, benefiting large Japanese companies with global operations but raising prices for food and energy imports, affecting consumers. The Bank of Japan is facing the challenge of balancing negative interest rates with accommodative monetary policy. BOJ Governor Kazuo Ueda mentioned the central bank will consider maintaining its monetary easing measures once the inflation target is consistently achieved.

The UK's retail sales figures for January, showing a much larger-than-expected monthly rise of 3.4%, indeed signal a strong rebound from the previous month's decline. This positive momentum aligns with Bank of England Governor Bailey's recent assertion regarding signs of economic recovery. The improvement in consumer fundamentals such as rising wages and increasing confidence further supports the notion of a strengthening economy and may influence the Bank of England's stance on interest rate cuts.

In the US, upcoming data releases, including producer price data and the University of Michigan consumer sentiment reading, are anticipated to provide insights into inflation trends and consumer outlook. The recent rise in consumer sentiment, driven by factors like falling inflation and expectations of lower interest rates, underscores the potential impact on economic decisions and policy considerations.

The speeches by US Fed Regional Presidents Barkin and Daly, both influential voters on interest rates, will be closely watched for their perspectives on recent economic developments. Additionally, Bank of England Chief Economist Pill's address in Washington is expected to offer insights into the broader international economic landscape.

Overnight Newswire Updates of Note

Bostic Says May Take ‘Some Time’ To Know Inflation Heading To 2%

House Won’t Pass Stopgap To Avoid Shutdown, Key Republican Says

ECB’s Villeroy: Risk Of Cutting Too Late At Least As Big As Too Early

China Set To Bide Time On Rate Cut Until Yuan, Data Stabilize

Unfazed By Recession, Reports Suggest BoJ Keeps April Shift On Table

BoJ Ueda: To Mull Policy Move When Infl. Target Conditions Met

Japan FinMin Watching FX Moves With A High Sense Of Urgency

Orr Says RBNZ Still Needs To Anchor Inflation Expectations

Japan 10-Year Yield Seen Breaking Above 1% Even Before BoJ Hike

Wall Street Await Potential Spring Approval Of Spot Ether ETF

US House Votes To Overturn Biden’s NatGas Export Approval Freeze

Japan Stocks Near 1989 Historic High After S&P 500 Hits Another Record

Applied Materials Jumps After Forecast Shows Rebound For Chips

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0615 (1.6 billion), 1.0670-75 (2 billion), 1.0700 (1.8 billion), 1.0750-55 (1.4 billion), 1.0800 (3.1 billion), 1.0820 (1 billion)

GBP/USD: 1.2650-60 (1.7 billion), 1.2720 (500 million)

USD/CHF: 0.8780 (800 million)

AUD/USD: 0.6400 (500 million), 0.6535 (700 million)

USD/JPY: 149.00 (1.1 billion), 150.00 (1.1 billion), 152.00 (800 million)

USD/CAD: 1.3500-05 (1.8 billion)

CFTC Data As Of 8/02/24

The British Pound had a net long position of 34,475 contracts.

The Euro had a net long position of 62,153 contracts.

The Japanese Yen had a net short position of -84,230 contracts.

Bitcoin had a net short position of -1,523 contracts.

The Swiss Franc had a net short position of -5,567 contracts.

Equity fund managers reduced their net long position in S&P 500 CME by 53,941 contracts to 912,862.

Equity fund speculators decreased their net short position in S&P 500 CME by 8,669 contracts to 423,955.

Technical & Trade Views

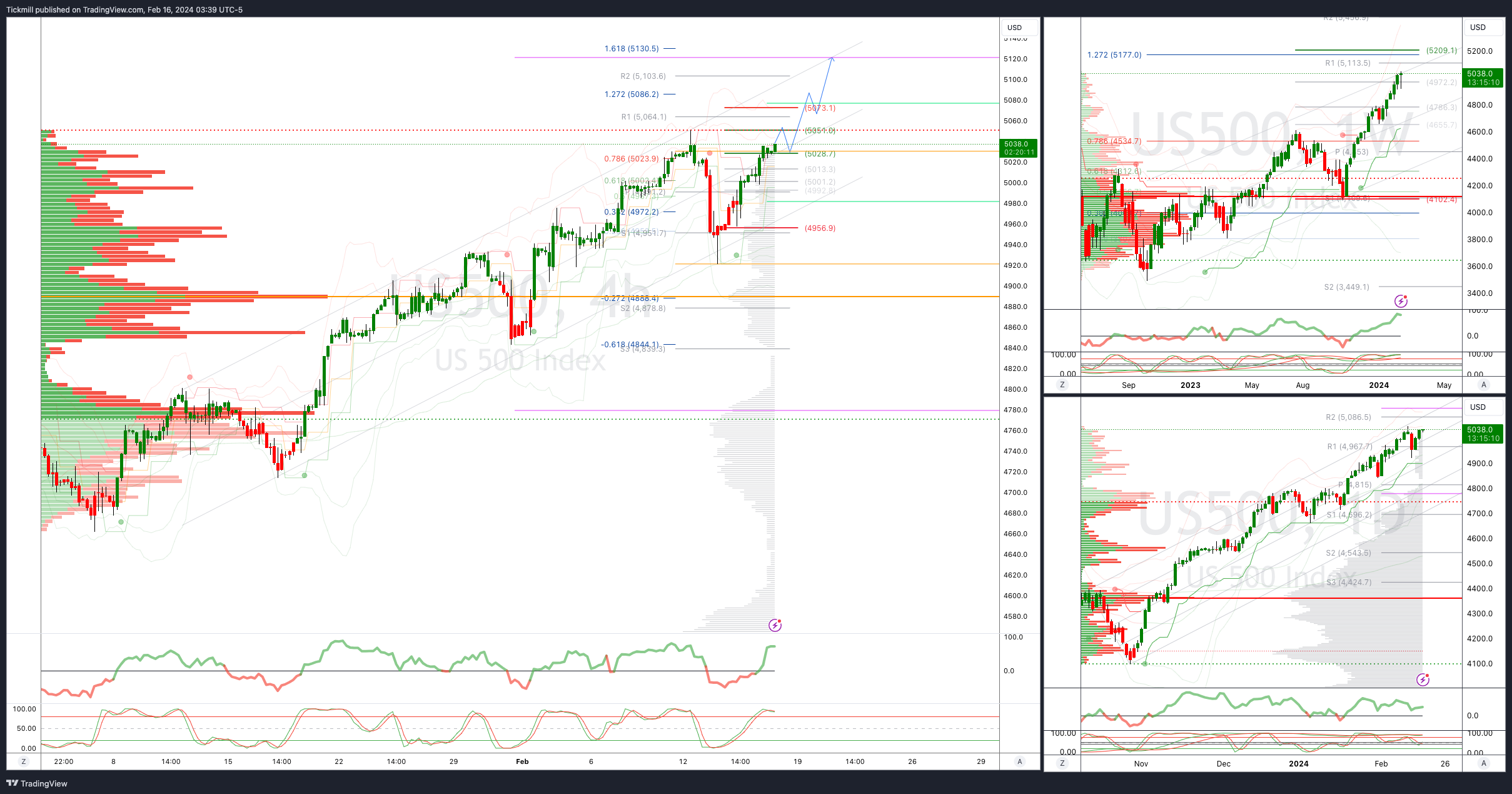

SP500 Bullish Above Bearish Below 5028

Daily VWAP bullish

Weekly VWAP bullish

Above 5040 opens 5086

Primary support 4900

Primary objective is 5120

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bearish

Weekly VWAP bearish

Above 1.109 opens 1.10

Primary resistance 1.0950

Primary objective is 1.0650

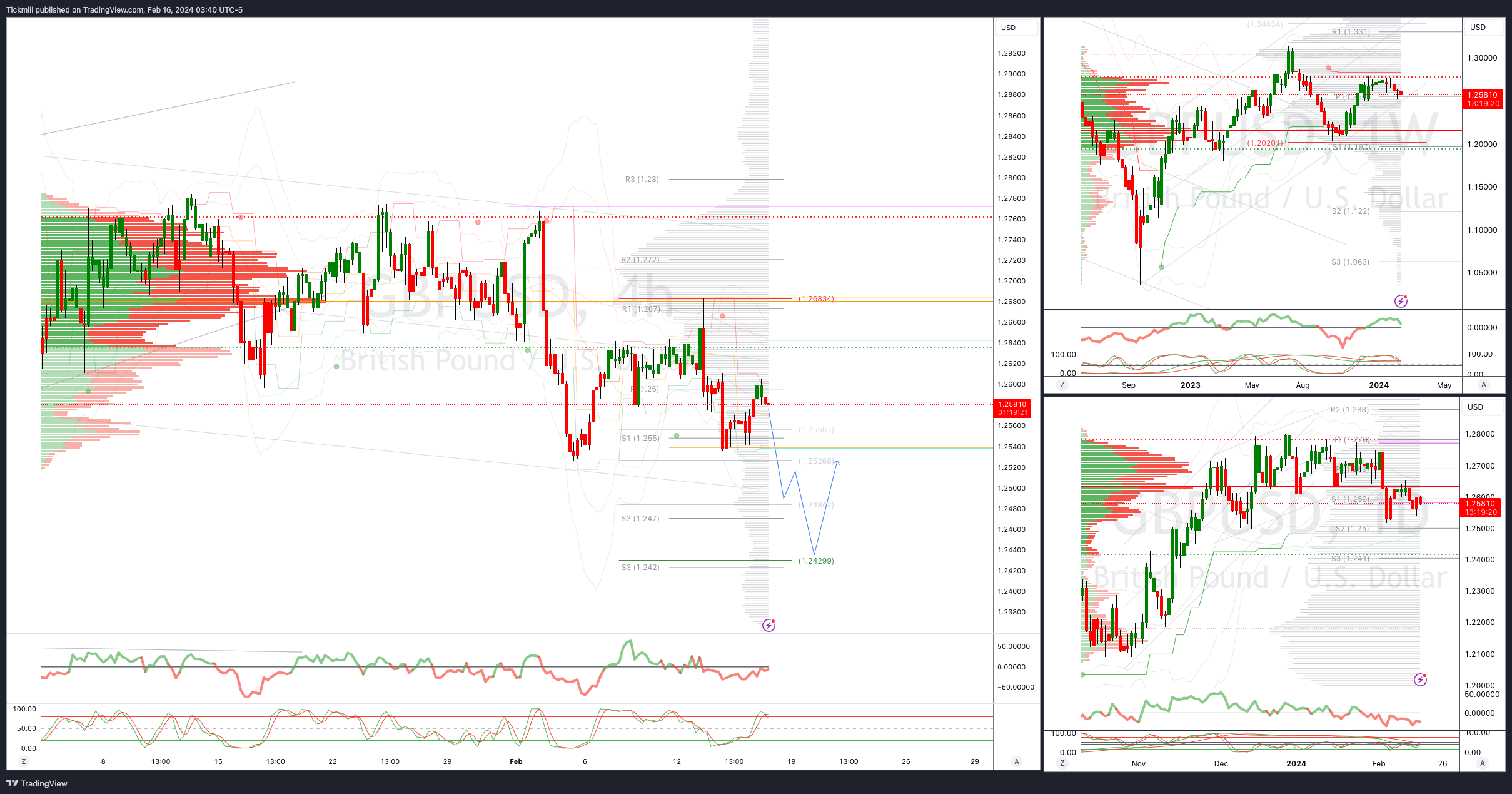

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bearish

Weekly VWAP bearish

Above 1.27 opens 1.2770

Primary resistance is 1.2785

Primary objective 1.2429

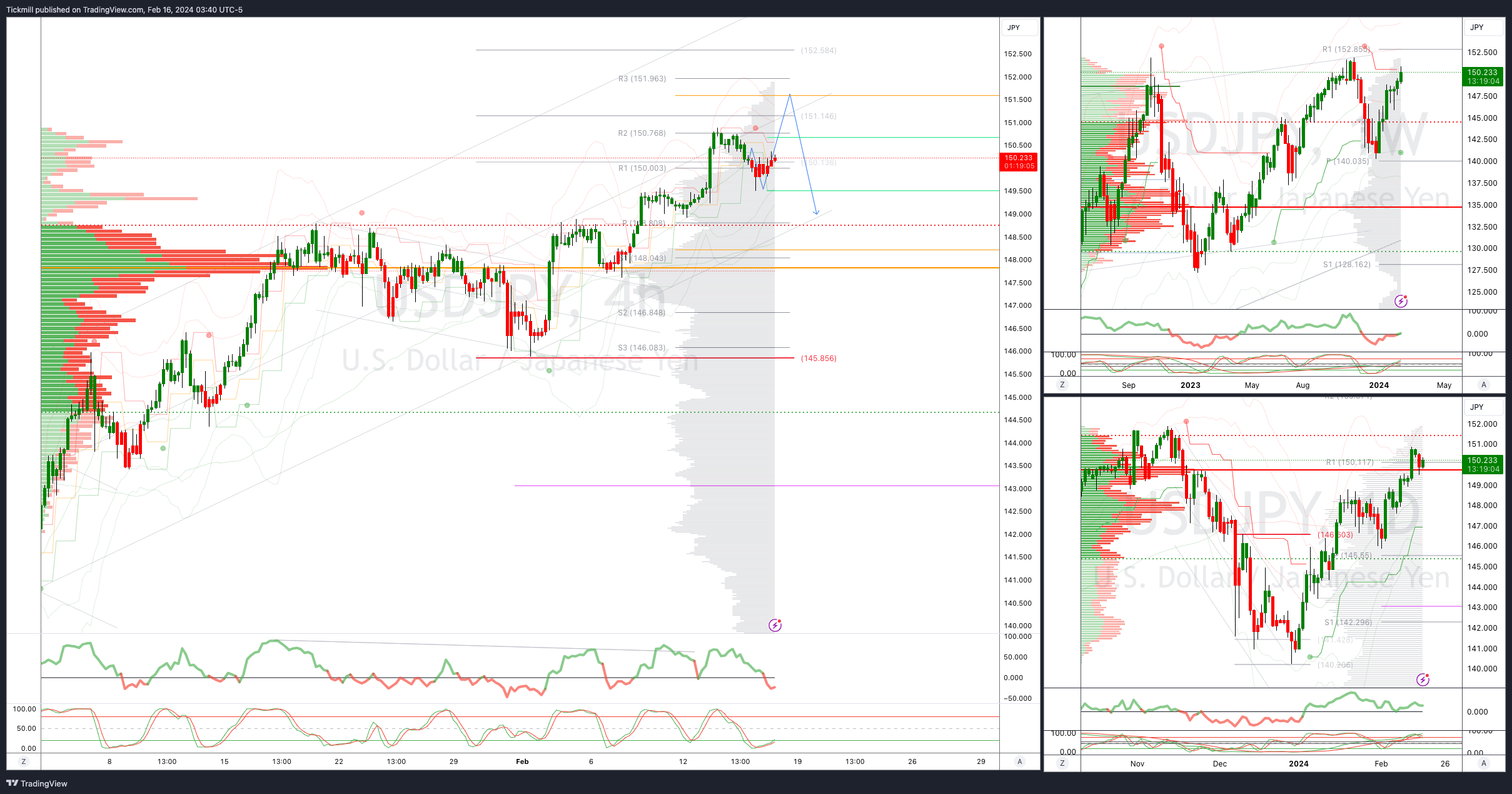

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bullish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 149.50 - Target Hit - New Pattern Emerging

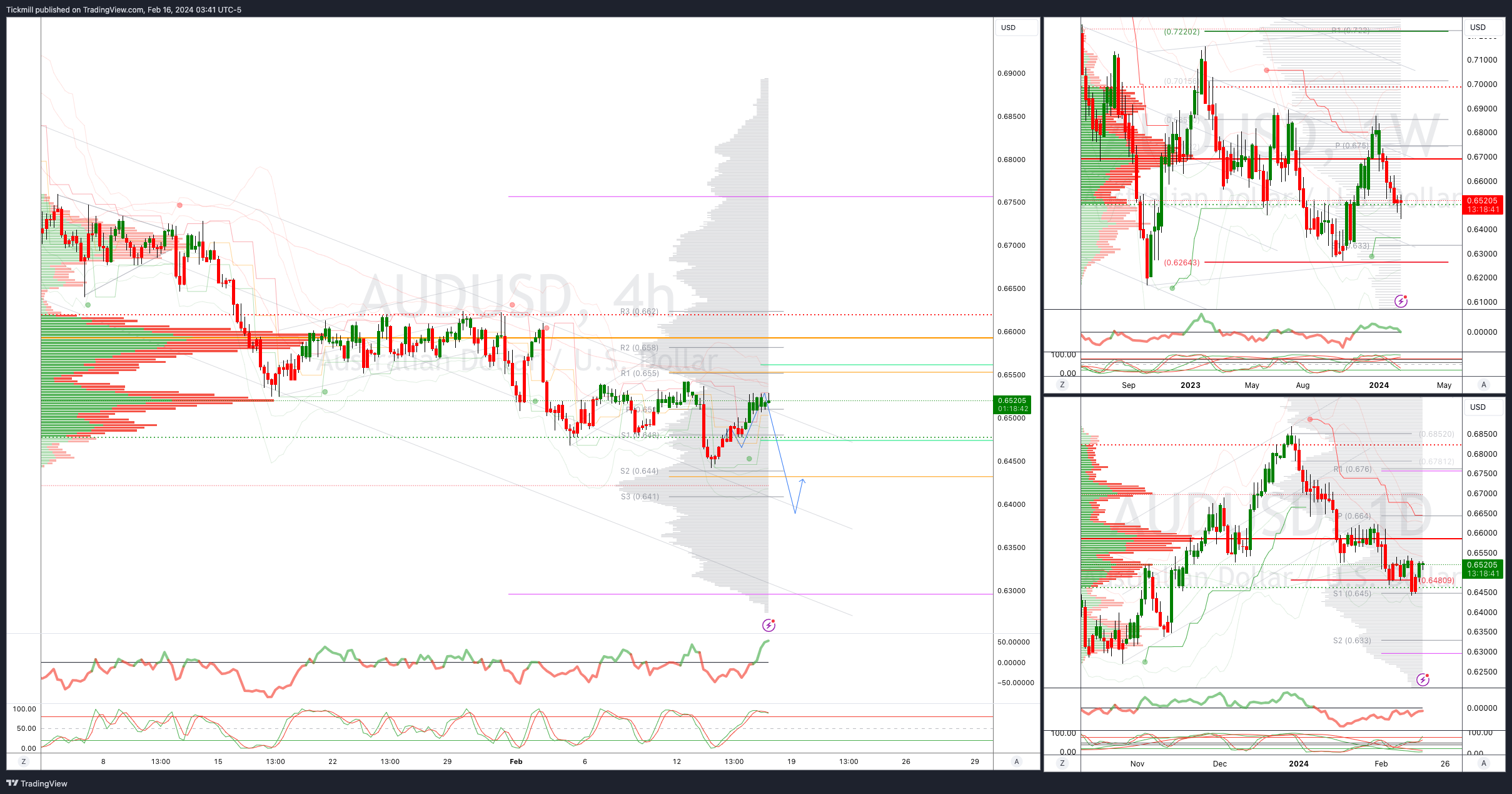

AUDUSD Bullish Above Bearish Below .6650

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6420

Primary support .6525

Primary objective is .6260

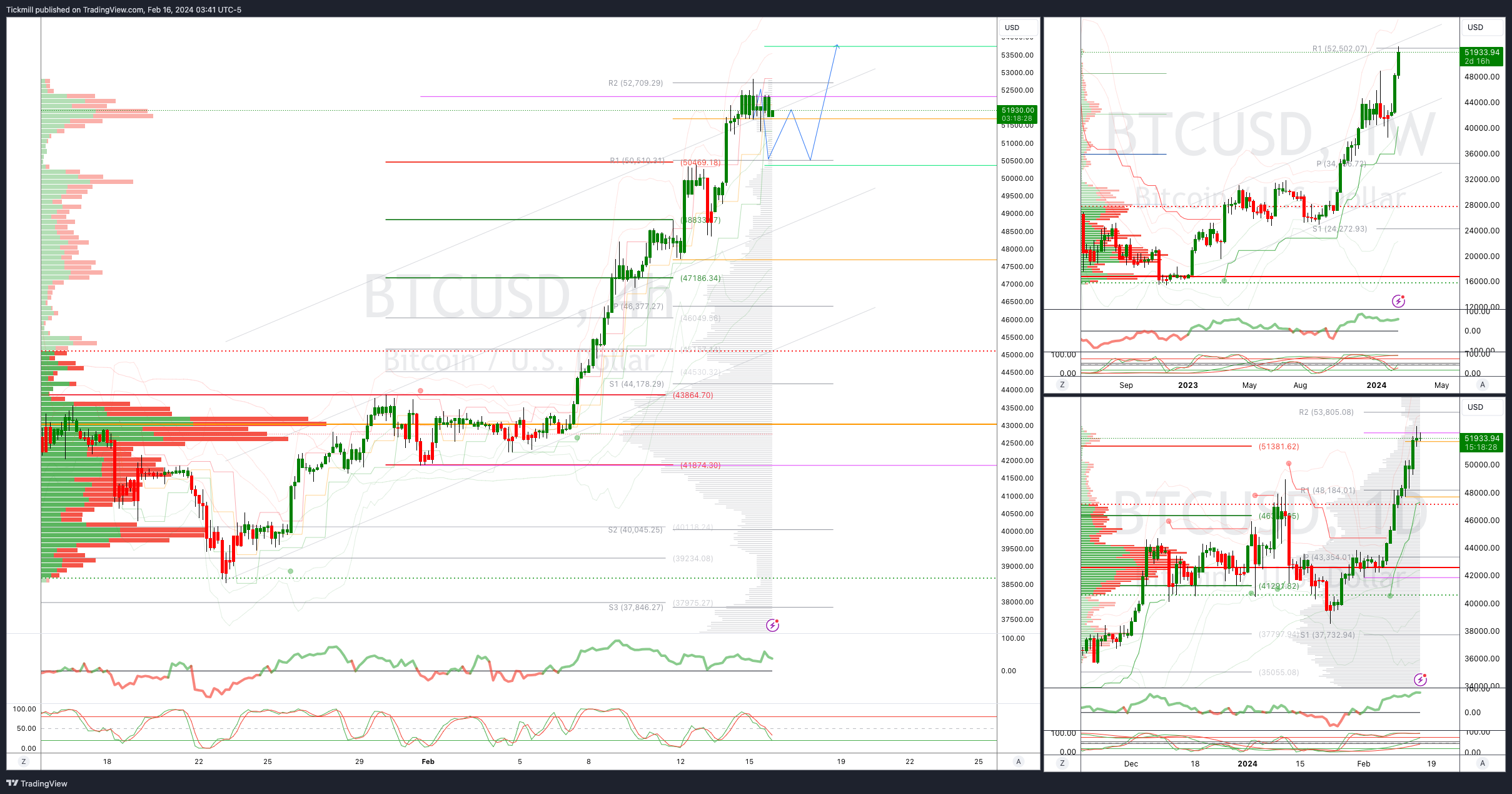

BTCUSD Bullish Above Bearish below 50500

Daily VWAP bullish

Weekly VWAP bullish

Below 48500 opens 46500

Primary support is 44390

Primary objective is 52000 - Target Hit New Pattern Emerging

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!