Daily Market Outlook, February 19, 2024

Daily Market Outlook, February 19, 2024

Munnelly’s Market Minute…

“Quiet Start, With US Offline For Presidents Day”

China's markets did not show the anticipated enthusiasm after the break, with only modest gains in stocks so far. During the Lunar New Year holiday, tourism revenues surged by 47% compared to the previous year, with over 61 million rail trips taken. However, this increase was partly due to a weak season last year. The country's central bank chose not to cut rates again on Sunday, which may limit downward pressure on the Yuan. Despite this, analysts believe there is potential for further policy stimulus due to the looming threat of deflation. China's blue chip index increased by 0.5% on top of its 6% pre-Lunar New Year rally, but it is still down 1% for the year and 43% from its peak in 2021. In contrast, Japan's Nikkei has risen almost 15% so far this year, coming close to its all-time peaks reached in 1989. Despite this surge, Nikkei's market capitalization is still relatively low at 683 trillion yen ($4.55 trillion), comparable to the combined market cap of Nvidia and Apple, and well below the S&P 500's $42 trillion. The market cap of the Nikkei is also not much higher than the total cash held by Japanese companies, many of which trade at a discount to book value.

Looking at Nvidia, the upcoming results will test its high valuations and a price-to-earnings ratio of at least 96. The chipmaker's $570 billion increase in market cap this year represents over a quarter of the S&P 500's gains, so any disappointment would have a significant impact on the entire index. Options suggest that there is a risk of the shares swinging by 11%, or $200 billion, in either direction based on the results.

The primary focus in the market remains centered on when and how much central banks will cut interest rates. Last week, market optimism regarding the timing of interest rate reductions was somewhat subdued. Particularly in the US, the anticipation for early spring rate cuts has diminished, with the first cut now fully expected only by the June policy meeting. While the expectation for rate cuts throughout the year still persists, it has decreased from the initial projection of around five quarter-point cuts at the beginning of the year to at least three. Similarly, expectations for rate reductions in the UK and Eurozone have also diminished, with the UK expected to lag behind the other markets in the extent of rate cuts.

Looking ahead to the upcoming week, although data releases will be quieter compared to the previous week, there are several scheduled speeches from central bank policymakers. These speeches will be closely monitored for any indications of shifts in policy intentions in response to recent economic data. Today, however, is relatively quiet on both the data and speeches fronts in the US, largely due to Presidents' Day being observed as a public holiday.

Overnight Newswire Updates of Note

US Plans To Send Weapons To Israel Amid Push For Cease-Fire Deal

Israel To Launch Rafah Offensive Unless Hostages Home By Ramadan

China’s Premier Li Urges ‘Forceful’ Action To Boost Confidence

China Holds Key Rate Steady As Yuan Limits Room For PBoC Moves

China Stocks Struggle To Rally At Reopen Despite Upbeat Data

UK Home Asking Prices Rise As Mortgage Relief Spurs Activity

France Lowers Its 2024 Economic Growth Forecast To 1%

Dollar Steady As Sticky Inflation Dents Rate Cut Expectations

Oil Dips From Three-Week High On Lingering Concerns Over Demand

Goldman Lifts S&P 500 Target To 5,200 On Profit Expansion

Apple Set To Face Near EUR500 Million EU Fine In Spotify Row

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

USD/JPY: 144.00 ($1.16b), 150.00 ($786.3m), 143.65 ($380m)

EUR/USD: 1.0640 (EU508.9m), 1.0650 (EU430.5m), 1.0930 (EU350.4m)

USD/CNY: 7.3000 ($616.9m), 7.2000 ($611.2m), 7.1500 ($481.5m)

USD/CAD: 1.3815 ($1.94b), 1.3595 ($1.48b), 1.3700 ($1.26b)

AUD/USD: 0.6460 (AUD593.7m), 0.6525 (AUD554.4m)

EUR/GBP: 0.8540 (EU573.8m)

USD/MXN: 18.41 ($469.7m), 17.95 ($440.2m), 18.80 ($319.2m)

GBP/USD: 1.2550 (GBP390m)

USD/KRW: 1310.00 ($348.6m)

Speculators have significantly reduced their remaining euros for sale. Traders had a short position of $12 billion when EUR/USD hit 1.0781 at the beginning of February. Since then, speculators have reduced that position by $5 billion. The EUR/USD dropped to 1.0695 while traders cut their long positions. However, the pair has since rebounded, reaching 1.0788 on February 19. Volatility has decreased, indicating a lower likelihood of future movements. The 1.0750 mark has been the focal point of trading activity for the past year. The possibility of EUR/USD breaking out of the 1.05-1.10 range is diminishing.

CFTC Data As Of 13/02/24

British Pound net long position is 50,472 contracts.

Japanese Yen net short position is -111,536 contracts.

Bitcoin net short position is -1,921 contracts.

Swiss Franc posts net short position of -6,014 contracts.

Japanese Yen net short position is -111,536 contracts.

Equity Fund managers raise S&P 500 CME net long position by 17.391 contracts to 930,253.

Equity fund speculators trim S&P 500 CME net short position by 39.481 contracts to 384.474.

Technical & Trade Views

SP500 Bullish Above Bearish Below 4975

Daily VWAP bullish

Weekly VWAP bullish

Above 5040 opens 5086

Primary support 4900

Primary objective is 5120

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bearish

Above 1.109 opens 1.10

Primary resistance 1.0950

Primary objective is 1.0650

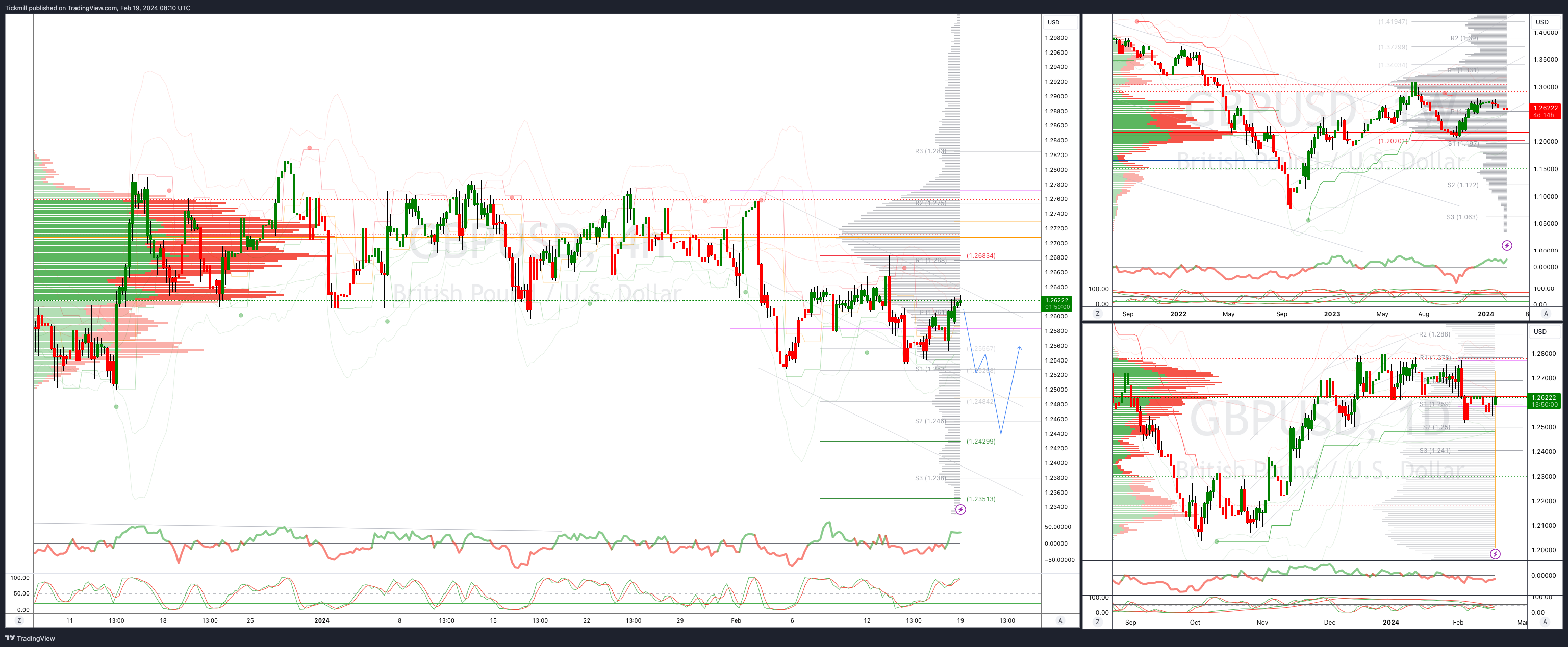

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bearish

Weekly VWAP bearish

Above 1.27 opens 1.2770

Primary resistance is 1.2785

Primary objective 1.2429

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bullish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 152

AUDUSD Bullish Above Bearish Below .6590

Daily VWAP bullish

Weekly VWAP bearish

Below .6500 opens .6420

Primary support .6525

Primary objective is .6260

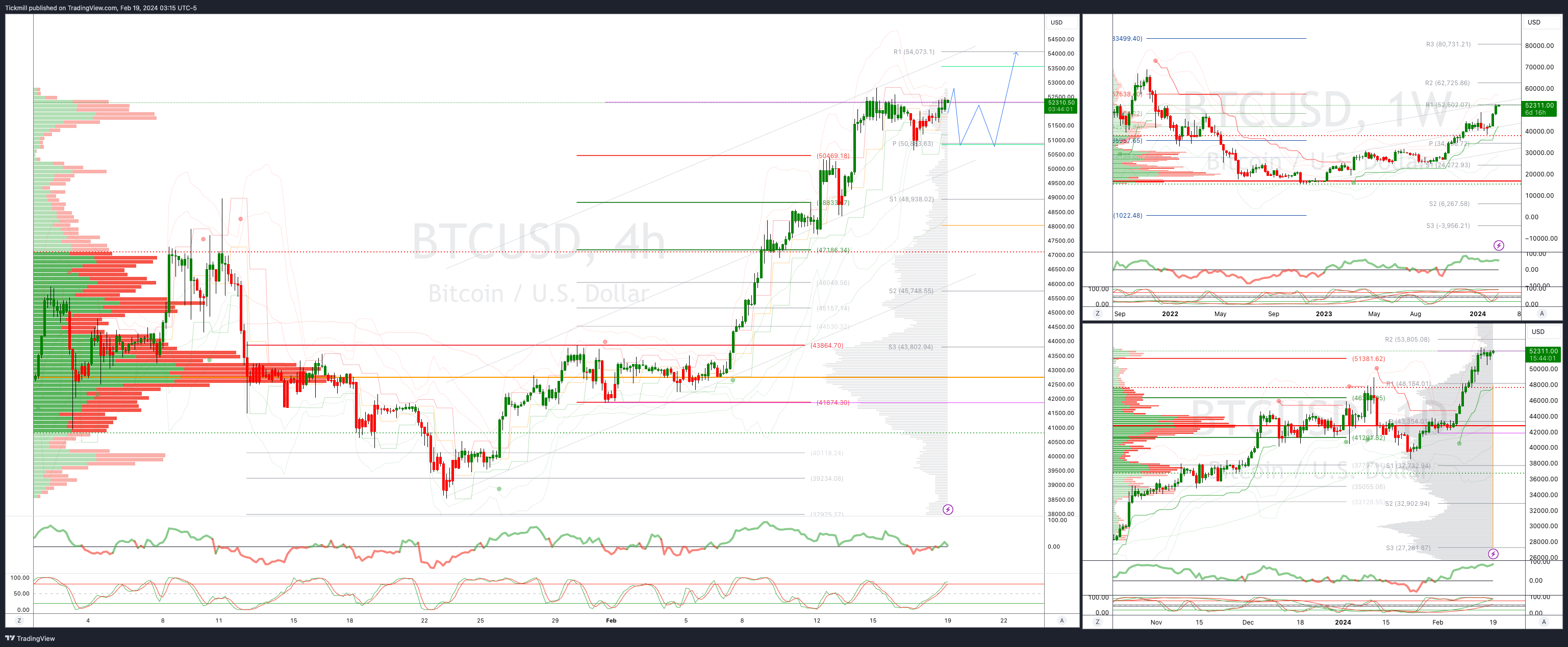

BTCUSD Bullish Above Bearish below 51000

Daily VWAP bullish

Weekly VWAP bullish

Below 48500 opens 46500

Primary support is 44390

Primary objective is 54000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!