Daily Market Outlook, February 21, 2022

.png)

Daily Market Outlook, February 21, 2022

Overnight Headlines

- President’s Putin, Biden Agree To Summit After Macron Calls

- US Plans To Cut Ties With Targeted Russian Banks If Ukraine Is Invaded

- China PBoC Keeps Benchmark Lending Rates Unchanged

- China Home Prices Barely Fall In Glimmer Of Hope For Developers

- Japan's February Factory Activity Growth Falls To 5-Month Low

- Australia Service PMI Jumps To Eight-Month High As Omicron Eases

- RBNZ Shadow Board Calls For Substantial Tightening Over ‘22

- JPMorgan Expects String Of Nine Straight Fed Rate Hikes

- Great Britain's Property Prices Rise At Record Pace In February

- Blinken: All Signs Suggest Russia On The Brink Of Invading Ukraine

- Belarus: Russian Troops Will Stay Indefinitely As West Seeks Ukraine Talks

- FX Markets Eye Ukraine Headlines, Take Heart From Possible Summit

- Oil Slips On Ukraine Summit Plan, Prospect Of Iran Nuclear Deal

- Vitol CEO: Sees Oil Above $100 For A ‘Prolonged Period’ This Year

- Arab Oil Producers: OPEC+ Should Stick To Current Agreement

- Asia Stocks Slip, US Stock Futures Rally On Ukraine Hopes

The Day Ahead

- Asian stock markets are mostly down this morning reflecting ongoing concerns about the Ukrainian situation. However, many markets have pared some of their initial losses on reports of agreements on further talks, while US and EU equity futures are higher. US Secretary of State Blinken will meet for talks with Russian Foreign Minister Lavrov this week. Among other things, they seem set to discuss the details of a potential summit between US President Biden and Russian President Putin. However, the White House says that such a summit can only go ahead if Russia does not invade Ukraine. The US has also said that potential sanctions in the event of an invasion include cutting ties with some Russian banks.

- In a welcome sign of a gradual return to more normal conditions, both Australia and the UK will or have already taken steps towards a further loosening of Covid restrictions today. In Australia, borders have been reopened for fully vaccinated international travellers. Meanwhile, UK PM Johnson is expected to announce the ending of all restrictions for England including the legal requirement to self-isolate in the case of a positive test later this month.

- February PMI data for the UK and the Eurozone are forecast to show a positive impact from receding numbers of Omicron cases. The services readings, particularly consumer-facing services, are forecast to have led the rebounds. There were already signs of that in later returns for January. For February expect to see rises in the services index for both economies with the UK measure back to a three-month high.

- In contrast, the manufacturing headline readings for the UK may have fallen modestly, while Eurozone is expected to be unchanged. That may be partly because new orders seem to be weakening. In addition, suppliers’ delivery times are likely to have improved, which would be a welcome sign that supply chain bottlenecks are beginning to ease. The input price component of the survey may also provide indications of some slackening in these pressures.

- Early Tuesday, January public spending data, which includes self-assessment income tax payments, will provide an important indication of the extent to which the public sector deficit has fallen this year. Borrowing for the first nine months of the fiscal year was down by 46.8% compared to the same period last year and was about £13.0bn (or 8.1%) lower than the Office for Budget Responsibility’s last forecast. However, the January return is normally very important in determining the outcome for the year as a whole.

- Many government bond markets, including those in the UK and the US, continued to move up on Friday as investors looked for ‘safe havens’ amid current geopolitical uncertainties. However, currency markets are relatively unchanged with no real signs of an abrupt shift into so-called safe-haven currencies

CFTC Data

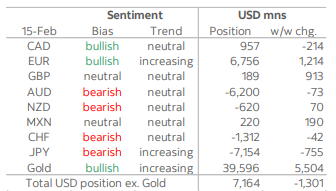

- This week’s CFTC data reflect a further paring in broader USD bullish sentiment, with the aggregate net dollar long, expressed as the overall positioning in the major currencies we monitor in this report, falling USD1.3bn to USD7.2bn, the lowest since August.

- EUR bullish bets jumped over the week through February 15th, even as the EUR struggled to gain altitude against the USD and tensions in the Ukraine simmered. Net EUR longs jumped USD1.2bn in the biggest positioning change among the individual currencies over the week, mainly the result of gross EUR shorts covering their exposure. Net EUR longs have been rising steadily since late November and are now back to the levels prevailing in August. Investors also backed out of moderately sized net short to establish a minor net GBP long this week while net MXN longs edged up from near zero to a minor net long of just USD220mn.

- Net bullish bets in the CAD were cut modestly (USD214mn) to just under USD1bn in total while bearish bets in the NZD were cut slightly to total USD670mn. The significant bearish bet in the AUD remains more or less intact at USD6.7bn and is still the second-largest single currency bearish bet against the USD.

- Net JPY shorts loaded up a little more over the past week as gross longs were cut further (to just over 10k contracts) while gross shorts rose. Net positioning of USD7.2bn remains within recent ranges but it is still the largest single currency bet against the USD and relatively large, but not excessive, by historic standards. While rising US yields do suggest downward pressure on the JPY moving forward, the large net JPY short may be exposed to a squeeze should the JPY push higher on the back of rising risk aversion (falling equities or geo-political tensions). Bearish bets on the CHF amounting to USD1.3bn were little changed on the week.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- EUR/USD: 1.1315-20 (675M), 1.1340-50 (1.2B)

- USD/JPY: 114.00-10 (405M), 115.45-60 (475M)

- EUR/JPY: 130.00 (625M), 132.80 (590M)

- GBP/USD: 1.3500-10 (200M). AUD/USD: 0.6975 (275M), 0.7000 (200M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- EUR/USD opened 1.;1320 after falling 0.37% Friday when USD firmed on Ukraine concerns

- After trading at 1.1310 it moved higher on reports of possible Putin-Biden summit

- Risk assets moved higher while USD weakened after the report hit the wires

- EUR/USD tracked higher and is 1.1355/60 heading into the afternoon

- Resistance is at the 10-day MA at 1.1369 and Friday's 1.1377 high

- A close above 1.1377 would complete a bullish outside day

- Support is at the Feb 14 low at 1.1280 and break would ease upward pressure

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Bid on the softer USD with key resistance in view

- +0.1%, at the top of a 1.3588- 1.3612 range with occasional strong interest

- Soft USD supports as risk rebounded on Biden-Putin summit hopes.

- UK Foreign Secretary Liz Truss to discuss N.Ireland protocol in Brussels

- No sign of a protocol compromise - UK stressing foreign policy

- Charts; momentum studies, 5, 10 & 21 day moving averages base-climb

- 21 day Bollinger bands expand - neutral setup now positive at range top

- 1.3643/57 Feb high, upper 21 day Bolli and 76.4% 2022 fall tough resistance

- 1.3467, 61.8% Jan-Feb bounce and 1.3643/57 a viable range this week

USDJPY Bias: Bullish above 114.50 Bearish below

- JPY still bid on Ukraine tensions, despite summit talk

- Summit between US-Russia in focus, agreement but Ukraine tensions still

- Despite feel good effects of news, Nikkei still off, now -0.7% @26,926

- USD/JPY off 114.87 low but upside limited to 115.11 EBS, heavy

- USD/JPY tracking top of Ichi cloud lower, daily cloud today 114.44-80

- Ascending 55-DMA in cloud at 114.70, also ascending 100-DMA 114.24 below

- Option expiries today not a factor - 114.00-25 $735 mln, 115.40-60 $506 mln

- Soggy US yields Friday also working to cap USD/JPY upside, US holiday today

- Some EUR/JPY bounce on summit reports but still heavy, 129.99-130.64 EBS

- GBP/JPY 156.06-64, AUD/JPY 82.27-87, both holding in recent ranges

- Japan Feb mfg PMI off but still positive at 52.9, Jan 55.4

AUDUSD Bias: Bearish below 0.7250 Bullish above

- AUD/USD swings back up; bulls should wait for 100 DMA test

- AUD/USD swings back up amid choppy Ukraine newsflow

- Creeps above 38.2% Fibo, resistance 0.7213

- But 100 DMA at 0.7244 may be the key breakout level

- Optimism that diplomacy might prevent Russia invasion

- But US has prepared Russia banking sanctions

- Some skepticism over potential Biden-Putin summit

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!