Daily Market Outlook, February 22. 2021

Daily Market Outlook, February 22, 2021

Market risk sentiment has started the week on a cautious note, with equities across the Asia-Pacific region seeing a mixed session while European and US equity futures point to modest declines ahead. Media reports over the weekend suggest that Chancellor Sunak is set to extend the UK furlough scheme into the summer, before phasing it out. He is also reported to be planning to raise corporation tax up to 23% ‘eventually’, with at least a 1% rise coming this autumn.

With new Covid-19 cases and hospitalisations falling across a number of countries, attention is increasingly turning towards the easing of lockdown restrictions. That includes the UK, where PM Johnson is set to unveil an easing ‘roadmap’ for England later today. He has already said he intends to be “cautious and prudent” and will be “data, rather than date” driven. That suggests the plan will be short on specific dates. Media reports say that after the reopening of schools on 8th March it will be suggested that further restrictions may be eased at four-weekly intervals with the intention of near normality by July.

Hopes of a return to more-normal times continue to build across the continent, despite the relatively slow rollout of the vaccine. Today’s German IFO survey for February is expected to show an improvement in business expectations, akin to that seen in last week’s ‘flash’ PMIs. That is expected to lead to the headline ‘business climate’ balance moving away from January’s seven-month low of 90.1, despite the ‘current assessment’ component likely remaining weak.

Meanwhile, US Treasury Secretary Janet Yellen and ECB President Christine Lagarde are due to speak at separate events. Both are expected to highlight the importance of a strong fiscal response in supporting economic recoveries from the pandemic. The Bank of England’s Vlieghe delivers a speech later this evening, the text of which was released on Friday. In it, Mr Vlieghe suggested that no additional stimulus would be needed if the Bank of England’s central forecasts came to pass. However, in the event that the recovery fell short of expectations and more stimulus was required he noted a preference for further cuts in Bank Rate over more QE.

The only official data release in the UK this week, the latest labour market report, is due to be published early tomorrow morning (07:00 GMT). Look for a further modest rise in the unemployment rate, for the 3-months to December, to 5.1% from 5.0%. However, expect employment to have slipped by a relatively small 15k over that period. A key reason of course why the rise in UK unemployment has so far been relatively small is the government’s furlough scheme. The scheme is currently due to end at the end of April, however, the Chancellor is reportedly set to announce an extension when he delivers his Budget speech on 3rd March.

CFTC Data

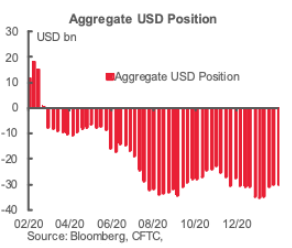

The general trend towards reducing short exposure to the USD continued this week but the pace of position adjustment slowed again in the week through February 16th, the latest CFTC report shows. The aggregate USD short position against the major currencies we cover in this report was trimmed by USD291mn, leaving the overall short standing at just over USD30bn, a two month low. The pattern of relatively limited positioning changes and weak conviction remains very much in evidence, however.

Net EUR longs remain the biggest bull bet against the USD reflected in these data but EUR net long liquidation, driven mainly by an increase in gross EUR shorts, was one of the smallest week-over-week changes reported through Tuesday, falling just USD55mn. The MXN saw the absolute smallest changes in exposure on the week (and one of the smallest I recall seeing recently at least); a tiny net long of just USD35mn dropped USD2mn on the week.

The fact that the most interesting elements of this report is how little positioning has changed is illustrative of how static speculative sentiment has become in the past few months. Speculators added modestly to net GBP longs (up USD103mn), net NZD longs (up USD 153mn) and net JPY longs (USD246mn). Net GBP longs of just under USD2bn do at least represent the biggest bull bet on the pound in a year

Elsewhere, position reduction was the order of the day; modest net CAD longs were cut USD107mn while net CHF longs were reduced USD426mn. A tiny net AUD short was more or less halved to USD219mn on the week. Speculative sentiment has been entirely unimpressed with the AUD recovery from last March’s low. It remains to be seen whether its move to three year highs this week can draw more support from the speculative community. Beyond FX, gold was also caught up in the liquidation trade; net longs were slashed more than USD4bn over the week to USD42.2bn.

G10 FX Options Expiries for 10AM New York Cut

EUR/USD: $1.2135-45(E408mln-EUR puts), $1.2295-1.2300(E506mln-EUR puts)

USD/JPY: Y103.25($750mln), Y104.00($600mln)

AUD/USD: $0.7715(A$640mln)

NZD/USD: $0.7175-85(N$515mln)

USD/CAD: C$1.2600($420mln)

----------------

Larger Option Pipeline

EUR/USD: Feb23 $1.2135-55(E2.2bln-EUR puts); Feb24 $1.2090-1.2100(E1.1bln), $1.2130-35(E1.0bln), $1.2150-60(E1.1bln), $1.2170-85(E1.2bln-EUR puts); Mar01 $1.2200(E1.1bln), $1.2245-55(E1.0bln)

USD/JPY: Feb24 Y103.70-80($1.6bln), Y105.00(E1.25bln), Y105.65-80($2.7bln), Y107.00-05($1.0bln); Mar01 Y105.55-57($1.7bln), Y106.20-25($1.4bln), Y106.45($1.65bln)

GBP/USD: Feb26 $1.3900(Gbp1.3bln), $1.4030(Gbp1.5bln-GBP puts), $1.4060(Gbp889mln)

EUR/GBP: Feb26 Gbp0.8600(E1.0bln), Gbp0.8665-75(E1.26bln-EUR puts), Gbp0.8750-65(E1.1bln-EUR puts)

AUD/USD: Feb24 $0.7700-15(A$1.2bln), $0.7800(A$1.3bln), $0.7865-75(A$1.6bln); Feb26 $0.7590-0.7600(A$1.2bln), $0.7770-80(A$1.6bln-AUD puts), $0.7850(A$1.1bln-AUD puts), $0.7900(A$3.2bln-AUD puts)

NZD/USD: Mar01 $0.7350(N$1.2bln)

USD/CAD: Feb24 C$1.2690-1.2700($1.3bln); Feb25 C$1.2750-60($1.0bln); Feb26 C$1.2630($1.0bln); Mar01 C$1.2500($1.3bln)

USD/CNY: Feb25 Cny6.7295($1.25bln)

USD/MXN: Feb26 Mxn19.70($1.2bln)

USD/TRY: Feb25 Try7.00($955mln-USD puts), 7.10($1.5bln-USD puts), Try7.25($1.0bln-USD puts)

Technical & Trade Views

EURUSD Bias: Bullish above 1.2050 targeting 1.2350

EURUSD From a technical and trading perspective, the closing breach of 1.21 and the descending trendline is a bullish development opening a retest of prior highs at 1.2350, only a move back through 1.2040 would suggest further consolidation

Flow reports suggest topside offers into the 1.2150 area and then after a brief weak period increasing into the 1.2180-1.2220 level with weak stops above the level and increasing on any push above the 1.2250 level with possible strong offers into the 1.2300 level Downside bids light through to the 1.2080 area and possible weak stops appearing through the level and opening the chance of a test to the 1.2000 level in the short term with stronger bids into the 1.1950.

GBPUSD Bias: Bullish above 1.3750 targeting 1.40

GBPUSD From a technical and trading perspective,look for profit taking pullback to test 1.3750 as support as this level attracts fresh demand bulls will target 1.40 next. Target achieved, as 1.3750 continues to underpin the upside 1.4120 becomes the next upside objective.

Flow reports suggest topside light offers through to the 1.4100 level with weak offers likely to continue through the level with stops likely on a push beyond the 1.4110 area with any congestion limited to the sentimental levels, with 1.4150 area and stronger into 1.4200, downside bids light through the 1.4000 level and then weak stops light opening to the 1.3950 area for stronger bids from there to the 1.3900 level.

USDJPY Bias: Bullish above 104.50 targeting 107

USDJPY From a technical and trading perspective, as 104.50 supports there is potential for a further squeeze higher to test offers towards 107. A loss of 103.50 would negate further upside and suggest a resumption of trend

Flow reports suggest topside offers around the 106.50 area and stronger offers through to the 107.00 areas with stronger stops through the level. Downside bids light through to the 105.00 level and weak stops light through the 104.80 area and then stronger bids likely to appear below the 104.50 areas and continuing into the 104.00 level.

AUDUSD Bias: Bullish above .7560 bullish targeting .8000

AUDUSD From a technical and trading perspective, as the major trendline support at .7560 now acts as support, look for target wave 5 upside objective towards .8000. A closing breach of .7730 of the internal descending trendline will encourage the bullish thesis.

Flow reports suggest light weak stops on a push through the 0.7920 level with limited offers through to the 0.7950 level before stronger offers kick in with possible option barriers into the strong sentimental 80 cents level and strong stops on a move through to likely challenge the 0.8050 level quickly, downside bids light through the 79 cents level with weak stops opening a chance of a deeper run as people are squeezed with better bids likely on any move into the 0.7800 areas.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!