Daily Market Outlook, January 14, 2020

Daily Market Outlook, January 14, 2021

Most Asian equity markets are higher this morning, although Chinese indices are down. The US House of Representatives voted yesterday to impeach President Trump. However, the trial in the Senate seems unlikely to take place before next week’s inauguration of President-elect Biden. Impeachment requires a two-thirds majority and so would need some Republican support.

US President-elect Biden is supposed to unveil some details of his proposals for what is reputed to be a $2trn fiscal stimulus package this evening. A package of that size would be more than double the level of the measures passed at the end of last year. However, the impeachment process may slow its passage through Congress.

A first estimate of 2020 German GDP growth will be released this morning. Q4 GDP numbers are not yet available but the expected annual decline of 5.1% would seemingly imply a small fall in output in the final quarter of last year.

Minutes of the European Central Bank’s final policy meeting of last year will provide further details about the decision to ease monetary policy further in December. However, some of the comments about economic developments may now look dated given the most recent pickup in Covid-19 cases and tightening in restrictions.

In the US, weekly jobless claims will provide a timely update on the labour market. The December employment report, which showed the first monthly fall in jobs since May, confirmed the message from other recent claims reports that the labour market rebound has now stalled. Job losses appear to be rising again, primarily in parts of the service sector where social distancing issues are most strongly felt.

A number of US Federal Reserve policymakers, including Fed Chair Powell, are scheduled to speak. These will be some of the last public appearances before the Fed goes into its silent period ahead of the late January monetary policy meeting. Recent comments have suggested that, despite some weakening in near-term economic data, many Fed officials now feel more confident about a rebound later this year. Indeed some have talked about the possibility of ‘tapering’ asset purchases by the end of 2021, although others have played this down.

UK November GDP data will be released early Friday. They will show the impact of the second national lockdown in England. Look for a monthly decline of 4.0%, with weakness primarily concentrated in services, as pubs, restaurants, leisure facilities and non-essential shops closed. While the fall is predicted to be considerably less than that during the first lockdown and activity in December is likely to have picked up as restrictions were temporarily eased, negative growth is still expected for Q4 as a whole.

G10 FX Options Expiries for 10AM New York Cut

EUR/USD: 1.2150 on EUR 909-million Tuesday (Jan 19) - EUR 7-billion between 1.2190-1.2250

USD/JPY strike at 104.25 expiry on $445-million

GBP/USD: 1.3700 strike expiry on £206-million

Source: DTCC

Technical & Trade Views

EURUSD Bias: Bearish below 1.2265 targeting 1.2050

EURUSD From a technical and trading perspective, failure below 1.22 opens a retest of bids to 1.2050, only a close back through 1.2265 would suggest a false downside break

Flow reports suggest topside offers light through the 1.2200 area and continuing lightly through to the 1.2250 area where the market starts to thicken a little on the offer and the closer the market moves to the 1.2280 area the stronger the offers, a push through the 1.2300 area will likely see stronger offers building with short term sellers likely joining the queue with weak stops on a strong push through the 1.2320-30 areas opening only to the 1.2350 areas. Downside bids getting stronger the closer the market gets to the 1.2120 area with likely stronger congestion through the area and strong stops on a push through the 1.2080 area with very limited bids to support the market through to the 1.20 handle.

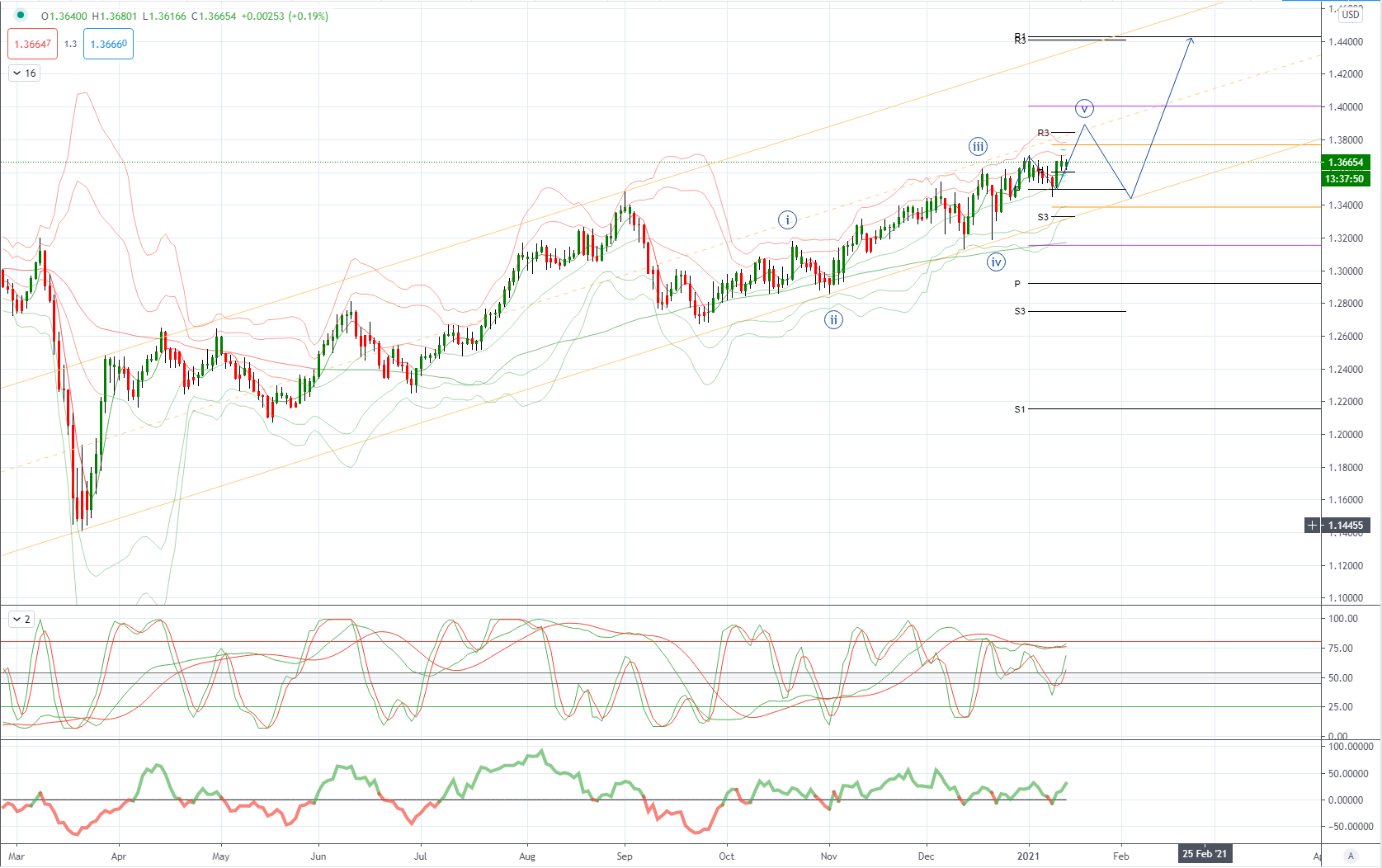

GBPUSD Bias: Bullish above 1.35 targeting 1.39

GBPUSD From a technical and trading perspective, as as 1.35 supports then prices can extend higher to test wave 5 upside objectives to 1.3910/80 area

Flow reports suggest topside offers through the 1.3700 level with weak stops likely on a move through the 1.3720 area to quickly test through to the 1.3750 area and some limited offers likely and increasing offers through to the 1.3800 area and stronger congestion likely from there on, downside bids light back through the 1.3600 level with weak stop light through the level and light bids through the sentimental levels before stronger bids appear around the 1.3450 level.

USDJPY Bias: Bearish below 104 targeting 101.20

USDJPY From a technical and trading perspective, as 104.20 contains upside attempts look for the next leg lower to target 101.20

Flow reports suggest topside congestion around the 104.40-60 area and then increasing into the 104.80 level with strong offers through the 105.00 area, Downside bids light through to the 103.00 level before stronger bids start to appear and increase through to the 102.50 area with very little in the way of stops on a dip through with likely increasing bids to the 102.00 areas and likely to see stronger bids continuing from importers.

AUDUSD Bias: Bullish above .7600 bullish targeting .8000

AUDUSD From a technical and trading perspective, as .7600 now acts as support, look for target wave 5 upside objective towards .8000. Note .7800 is an interim measured move upside objective that may prompt a profit taking pullback before the uptrend resumes from.7450 trend support

Flow reports suggest light bids into the 0.7700 area and then a little patchy through to the 0.7660-40 area with stronger bids on a move through to the 0.7620 level with weak stops likely through into the 0.7580 area and the market then congested through sentimental levels. Topside offers into the 0.7780 area likely to be quite strong through to the 0.7820 area before option barriers are likely to be cleared and break out stops join weak stops for a strong move through to the 0.7850 area however, congestion is likely to kick in from there through to the 0.7880 area and increasing into the 79 cents level before the topside opens up for a move towards the 80cents level, downside bids light through the 77 cents area with weak stops likely through the 0.7680 area and opening weakness through to the 76 cents where congestion is likely to be waiting to slow any descent, stronger bids through to the 0.7550 likely to be limiting.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!