Daily Market Outlook, January 17, 2022

.png)

Daily Market Outlook, January 17, 2022

Overnight Headlines

- US Omicron Surge Spurs New Covid-19 Relief Push In Congress

- Democrats Make Voting Rights Push Ahead Of Senate Consideration

- ECB's Schnabel Warns That Early Rates Hike Could 'Choke' Recovery

- UK PM Boris Johnson Prepares Mass Clearout To Save Own Skin

- China Cuts Policy Interest Rate For The First Time Since April 2020

- China Tops 2021 Growth Target, But Slowdown Underlined In Q4

- Japanese Machinery Orders Rise More Than Expected In November

- North Korea May Have Fired Ballistic Missile, Fourth Launch In Jan

- Global Bonds Under Siege Monday As Treasuries Selloff Spreads

- Oil Extends Rally On Supply Tightness, Brent Tops Three Year High

The Day Ahead

- Asian markets were mixed overnight, as China reported a slowdown in the annual rate of growth to 4.0% in Q4 from 4.9% in Q3, weighed down by Covid outbreaks and the property market. Full-year growth for 2021 was 8.1%. There are concerns that China’s zero-Covid policy, especially ahead of next month’s Winter Olympics, will continue to weigh on the economy. Moreover, there may be an impact on already stretched global supply chains, which have added to inflation pressures across the world. In a bid to support the economy, China’s central bank cut interest rates for the first time in nearly two years.

- It’s a quiet start to the week for Europe and the US in terms of economic data and events. Aside from domestic political developments, there will be considerable interest in UK data this week, including tomorrow morning’s labour market report and inflation figures on Wednesday. The bulk of the labour data in the latest update will be for the three months to November and so will provide further evidence on the initial impact of the end of the furlough scheme. Look for another rise in employment of 125k and a fall in the unemployment rate to 4.1% (from 4.2%), its lowest since June 2020. Moreover, job vacancies are expected to have elevated in December.

- All of this suggests that the end of furlough has made little difference and that the labour market remains tight. Nevertheless, annual earnings growth will have moderated further in November to 4.2% from 4.9% (or to 3.9% from 4.3% on the excluding bonuses measure). Of late, the earnings data have been so distorted by the pandemic that it has been very difficult to gauge the underlying trend. However, we are now much closer to a cleaner picture, and it appears that, despite reports of big wage increases in some sectors, the whole economy acceleration has so far been more modest.

- The Bank of Japan early Tuesday is expected to keep policy unchanged, including short-term interest rates at 0.1%. There will be interest in updates to the BoJ’s growth and inflation forecasts. Overall, in contrast to their counterparts in the US and the UK, there are no indications that Japan’s policy rates will be raised this year.

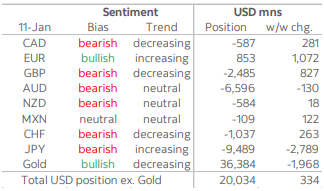

CFTC Data

- Overall positioning in the USD saw little change for a sixth straight week in CFTC data published today. The aggregate USD long rose by USD334mn to USD20b practically equivalent to the USD20.9bn average of the past fifteen weeks. However, the modest net bullish bet on the dollar was the result of a large bet against the JPY and a smaller move against the AUD while investor sentiment improved across all the other currencies covered in this report.

- Net non-commercial JPY shorts climbed by USD2.8bn to an aggregate bearish position of USD9.5bn, which represents an eight-week low in JPY sentiment as guided by positioning data. The increase in JPY shorts followed last week’s move in the cross past 116 to a fiveyear low (although it has since outperformed all G10 currencies) amid rising US yields. On that note, bearish speculative positioning in 10-yr UST notes has risen to near a two-year high as the yield on these instruments touches 1.80%.

- The small EUR short flipped into a small net long of USD853mn thanks to a USD1.1bn move in its favour; note that the data precede the EUR’s break of 1.14 on Wednesday. The weekly adjustment follows from an increase in gross longs to a five-month high, while shorts were trimmed to a two-month low. The EUR’s overall position remains non-committal, however, mirrored in a lack of direction in spot trading that lasted through most of December until just a few days ago.

- Negative positioning in the GBP declined by USD827mn, but the overall USD2.5bn position remains significantly bearish despite the pound’s recent stretch of gains that has taken it past 1.37. This week, investors increased their GBP longs by roughly as much as they reduced their GBP shorts (4.5k vs 5.5k contracts). Speculators also trimmed the small CAD short by USD281mn to USD587mn in a week where the CAD led the G10 currencies with a 1.1% gain to a seven-week high (at the cutoff date of the data). The AUD was the only other currency aside from the JPY that saw a bearish bet this week, with a minor USD130mn to its sizable USD6.6bn short; the NZD position was practically unchanged. Finally, the MXN position remains neutral at USD109mn with a USD122mn move in its favour while the CHF short neared USD1bn after a reduction of USD263mn this week.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

EUR/USD: 1.1200 (623M), 1.1325-30 (290M), 1.1340-45 (363M)

1.1400-10 (340M), 1.1505-15 (657M)

USD/JPY: 114.05-10 (520M), 114.20 (1.0BLN), 115.00-10 (1.577BLN)

116.00 (310M), 116.50 (680M)

GBP/USD: 1.3395 (244M), 1.4100-05 (300M). EUR/GBP 0.8405-10 (685M)

AUD/USD: 0.7285 (577M). EUR/NOK 10.31 (352M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- Steady after early dip finds buying support

- EUR/USD opened 1.1425 after closing down 0.33% on Friday when USD bounced

- The opening price was the high and EUR/USD eased to 1.1400

- USD moved higher across the board early, but EUR/USD bids around 1.1400 held

- Heading into the afternoon it is unchanged at 1.1416

- EUR/USD trending higher with the 5, 10 and 21-day MAs in a bullish alignment

- Support is at the 10-day MA at 1.1368 and break would suggest top is forming

- Strong resistance around 1.1500 where 61.8 fibo and 100-day MA converge

- Key will moves in US yields ahead of Jan 26 FOMC

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Soft, as U.S. dollar firms – UK wages pressure builds

- -0.1%, busy early at the top of a 1.3665-1.3675 range with a firmer USD

- London financial vacancies jump 40% from pre-pandemic level

- UK manufacturers feel the pay pressure from rising inflation

- Pay rises key for BoE - BOE WATCH priced a Feb hike to 0.50% at 78.31% Friday

- Charts; 5, 10 & 21 day moving averages, plus 21 day Bollinger bands climb

- Momentum studies conflict, which is still a strong positive trending setup

- Initial target comes in at the 1.3829/34 range top in October - likely caps

- Sustained 1.3620 10 DMA break, a recent base would undermine topside bias

USDJPY Bias: Bullish above 114.50 Bearish below

- JPY crosses bid in Asia with US, other yields up

- USD/JPY adds to gains Friday in Asia, 114.16 to 114.51 EBS

- NY saw it up to 114.27 Friday from a low of 113.48 as US yields spiked

- USD/JPY moving up through 114.09-62 hourly Ichi cloud

- Tracks away from daily Ichi cloud between 113.17-64, 114.23 55-DMA

- Good support now from bids ahead of 114.00 now - importers, investors

- Option expiries today-tom too, today 114.10-20 $1.5 bln, tom 114.00 $1.5 bln

- Also massive $1.5 bln at 115.00 today, to help cap, tom not till 116+

- Tokyo risk mood better, Nikkei +0.8% @28,344, AXJ mixed, E-Minis -0.2% @4646

AUDUSD Bias: Bearish below 0.7250 Bullish above

- Recovers from early dip after China GDP better than expected

- AUD/USD opened 0.7215 after falling 0.87% Friday when US yields and USD rose

- AUD/USD came under pressure early Asia and fell to 0.7196 at one stage

- USD was broadly bid in Asia first up and moved higher across the board

- China Q4 GDP came in better than expected while retail sales and IP were mixed

- AUD/USD steadied and is trading around 0.7205/10 into the afternoon

- Resistance is at 0.7215/20 where the 10 & 21-day MAs converge

- A break above 0.7220 would ease the downward pressure

- Bids are tipped ahead of 0.7190 with support at Jan 7 low at 0.7130

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!