Daily Market Outlook, January 18, 2021

Daily Market Outlook, January 18, 2021

Outside of China, most Asian equity indices have opened the week lower, indicating a tepid start for risk sentiment. This comes amid fresh concerns over US-China relations, following the Trump administration’s decision to revoke certain export licences for companies that export to Huawei. In China, meanwhile, equities are trading up following the release of Q4 GDP figures. Economic activity rose by 6.5% in the final quarter of 2020 relative to a year ago, helped by a quarterly rise of 2.6% in Q4. As a result, China’s economy expanded by 2.3% last year, while most of its major peers likely contracted.

Domestically, media reports over the weekend suggest that UK Chancellor Sunak is set to announce an increase in taxes in his March budget, in a bid to stem the sharp deterioration in the public finances. However, he is also reportedly set to announce an extension of the furlough and business loan support schemes, while an extension to the stamp duty cuts and an increase in benefit payments are also being considered.

There is a distinct lack of data releases and events across the major economies today, exacerbated by the closure of US financial markets in observance of Martin Luther King Jr day. Some attention is likely to be on a Bank of England flagship seminar, where Governor Bailey will be in conversation with Lord Nicholas Stern. Last week, Bailey suggested that the BoE is still assessing the impact on the financial sector of a move to negative interest rates, causing markets to conclude that such a move is probably unlikely to happen in the next few months. However, with today’s focus centred on green issues and sustainability, there are unlikely to be any comments on the near-term outlook for UK monetary policy.

As a result, the focus is likely to remain on the battle between infections and injections. On the one hand, Covid-19 cases and deaths have continued their uptrend across most of the Northern Hemisphere. That has meant that economic growth has slowed in most economies and, in some cases, it has stalled or even started to slip. On a more positive note, recent economic data are showing that the hits from the most recent lockdowns are far smaller than last spring. Moreover, the vaccine rollout is gathering pace in a number of countries. For example, the US said this week that 10 million of its citizens had already received at least one jab.

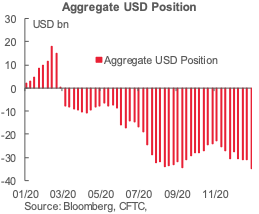

CFTC Positioning Update

Following the post-New Year lull, CFTC data reflected the largest week-to week turn against the dollar since early-Aug 2020 with the USD’s net short reaching its highest mark on record (in dollar terms) at USD35bn on the back of a USD3.7bn increase in favour of the currencies that we track.

Net EUR longs rose by USD1.8bn over the week and accounted for roughly half of the week-to-week increase in the net USD short. The EUR’s net position jumped mainly due to speculative accounts slashing their EUR gross shorts from 82k contracts to 73k contracts, after the EUR reached its highest point since April 2018 on Jan 6 at ~1.2350; it has declined by over 2% since. Gross longs climbed by 4k contracts.

Investors also warmed up to the GBP a bit more after the UK reached a trade agreement with the EU, eventually pushing Cable to (and a bit past) the 1.37 mark, building their net GBP long by an additional USD793mn (the second largest move on the week) to USD1.1bn—the biggest bullish bet on the pound since mid-March in USD and in net contract terms.

AUD sentiment turned bullish in the latest week with a USD727mn bet in its favour to take the Aussie’s net position to +USD424mn after ten consecutive weeks of negative bias. As in the case of the EUR, the move mostly reflected a clearing of short contracts against the AUD, which fell from 64k to 55k (gross longs rose by only 712 contracts).

G10 FX Options Expiries for 10AM New York Cut

EUR/USD: 1.2080 (522M), 1.2100-05 (627M)

EUR/GBP: 0.8840-50 (780M)

NZD/USD: 0.7100 (296M)

USD/JPY: 103.50-60 (551M), 104.15-25 (549M)

NB: Tues Jan 19 sees EUR/USD 7-billion between 1.2190-1.225

Source: DTCC

Technical & Trade Views

EURUSD Bias: Bearish below 1.2265 targeting 1.2050

EURUSD From a technical and trading perspective, failure below 1.22 opens a retest of bids to 1.2050, only a close back through 1.2265 would suggest a false downside break

Flow reports suggest downside bids into the 1.2050 area with increasing bids into the 1.2000 level with weak stops on any move through into the 1.1980 level with break out stops a possibility, Topside offers through the 1.2100 level light with the topside likely to remain weak through to the 1.2180 area before some stiffness appears through to the 1.2200 level with very little in stops until 1.2220 level and weak stops easily absorbed in stronger resistance.

GBPUSD Bias: Bullish above 1.35 targeting 1.39

GBPUSD From a technical and trading perspective, as as 1.35 supports then prices can extend higher to test wave 5 upside objectives to 1.3910/80 area

Flow reports suggest topside offers into the 1.3700 area and weak stops likely through the level and stronger stops possibly above the 1.3750 area for a quick test to the 1.3800 area and limited congestion running through to the next sentimental area. Downside bids into the 1.3550 area likely to again be strong with interest likely to be holding around the 1.3500 area for the same sort of support, a break below the level is likely to see weak stops opening the downside bids likely through to the 1.3450 level and a weak supportive area with congestion then running to the 1.3400 level.

USDJPY Bias: Bearish below 104 targeting 101.20

USDJPY From a technical and trading perspective, as 104.20 contains upside attempts look for the next leg lower to target 101.20

Flow reports suggest light offers through the 104.00 area and increasing a little through to the 104.20 area, weak stops on the move level and light congestion running through to the 104.50 area and increasing offers then through to the 104.80-105.00 level and stronger offers. Downside bids through 103.50 area where stronger bids appear a push through the level and stronger bids then into the 103.00 level and weak stops through the 102.80 areas.

AUDUSD Bias: Bullish above .7600 bullish targeting .8000

AUDUSD From a technical and trading perspective, as .7600 now acts as support, look for target wave 5 upside objective towards .8000. Note .7800 is an interim measured move upside objective that may prompt a profit taking pullback before the uptrend resumes from.7450 trend support

Flow reports suggest test of the 0.7680 support level with weak stops likely a little lower and stronger bids through into the 0.7540-60 areas, Topside offers through to the 0.7720 area with weak stops likely through the level with very little offers through to the 0.7780 area and increasing offers through to the 0.7820 area before weakness appears

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!