Daily Market Outlook, January 31, 2020

Daily Market Outlook, January 31, 2020

Main Market Themes

The US market pared early losses and instead ended higher overnight amid mixed corporate earnings. This was despite the World Health Organisation (WHO)’s new declaration of the new Coronavirus outbreak as a global public health emergency which would allow coordinated global efforts in addressing and containing the virus outbreak.

The Dow Jones, S&P 500 and NASDAQ rose 0.3-0.4%, amidst mixed corporate earnings with Facebook (-6.1%) being among the top losers of the day after reporting a slower profit growth in 4Q. Microsoft stocks rose nearly 3% after its earnings beat estimates, thanks to its Azure public cloud business.

US bond yields finished barely changed across the curve. Gold prices slipped a little to $1574.28/troy ounce, crude oils lost 2.2-2.5% over coronavirus fear - Brent crude closed at $58.29/barrel.

The USD saw mixed performance across the FX board; GBP surged after the BOE left bank rate unchanged at 0.75%. The European Union formally granted approval on Brexit, allowing Britain to finally withdraw from the bloc today.

BOE refrained from cutting rate as Mark Caney held last MPC meeting: The Bank of England MPC voted 7-2 to leave its bank rate unchanged at 0.75%, refraining from cutting the benchmark rate despite recently poor economic data and dovish policy makers’ comments that had led to earlier speculations that the central bank might have made a move this time around. The decision came on the eve of Brexit when Britain is set to formally leave the EU on Friday. The central bank issued a downbeat growth forecast - 1.3% in 2019, 0.8% in 2020 and around 1.5% in 2021. 4Q19 growth was revised from 0.1% to 0% to indicate no growth. Nonetheless BOE appeared optimistic in its statement, as it said that recent indicators suggest that global growth has stabilised, noting the pickup in global business confidence and manufacturing indicators as well as receding near-term uncertainties facing domestic businesses and households. CPI inflation is projected to remain below the MPC’s 2% target throughout this year and much of 2021. BOE maintained its hawkish stance that “some modest tightening of policy may be needed to maintain inflation sustainably at the target” if the economy recovered broadly with its latest projection, consistent with its previous message that it still intends to raise rate should things turn brighter.

Thursday's meeting was Governor Mark Carney’s last before Andrew Bailey takes over the role in March this year. Carney said in the post-meeting press conference that the UK economy is “so far good enough, data needs to fill in or additional stimulus likely to be required”. He mentioned that it was still early to judge the impact of the new coronavirus outbreak.

US 4Q GDP growth held steady; full year growth at 2.3%: The US economy grew 2.1% QOQ in the fourth quarter of 2019 (3Q: +2.1%) according to an advanced estimate, beating a Bloomberg survey of 2.0% QOQ. 4Q growth reflected positive contributions from personal consumption expenditures (PCE), federal government spending, state and local government spending, residential fixed investment, and exports, that were partly offset by negative contributions from private inventory investment and nonresidential fixed investment. For the full year of 2019, real GDP growth clocked in at a slower 2.3% gain (2018: +2.9%) due to a deceleration in nonresidential fixed investment and PCE and a downturn in exports. On a separate note, initial jobless claims fell by 7k to 216k for the week ended 24 January (previous: 223k) as the job market remained tight in the US.

Signicant rise in Eurozone economic sentiment: The European Commission Economic Sentiment Index rose markedly to 102.8 in January (Dec: 101.5), driven by higher confidence level in the industry and construction sector following the signing of a trade deal between the US and China. Another sub component, the consumer confidence index was unchanged at -8.1. Meanwhile, unemployment rate in the euro area slipped to 7.4% in December (Nov: 7.5%) reflecting an increasingly tight labour market.

UK consumer confidence improved ahead of Brexit: The GfK Consumer Confidence Index rose by 2pts to -9 in January (Dec: -11), its best reading in more than a year, reflecting consumers’ better perception over their personal finance and economic outlook for the next 12 months amidst an alleviation of Brexit fears as the country is scheduled to formally leaves the EU today.

Japan industrial output recovered; retail sales was lacklustre and jobless rate unchanged: Japan industrial production picked up 1.3% MOM in December (Nov: -1.0%), its first increase in three months, as factories returned to production after a devastating typhoon hit the country in early October last year. The MOM expansion also left the annual pace of contraction smaller at 3.0% (Nov: -8.2%). Retail sales barely rose in the same month, recording a mere 0.2% MOM growth (Nov: +4.5%); compared to the same period last year, sales contracted by 2.6% YOY (Nov: -2.1%) as consumers continued to adjust to the higher consumption tax imposed in October. On a separate note, Japan jobless rate remained unchanged at 2.2% in December (Nov: 2.2%) while the jobs-to-applicants ratio was also held steady at 1.57, reflecting ongoing tightness in the labour market.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.0950 (EUR648mn); 1.0990 (EUR429mn); 1.0999 (EUR455mn); 1.1000 (EUR1.2bn); 1.1040 (EUR976mn); 1.1100 (EUR486mn); 1.1125 (EUR330mn); 1.1135 (EUR467mn)

- GBPUSD: 1.3000 (GBP322mn); 1.3050 (GBP418mn); 1.3060 (GBP734MN); 1.3150 (GBP240MN); 1.3250 (GBP244MN)

- USDJPY: 108.00 (USD387mn); 108.25 (USD330mn); 108.50 (USD1.1bn); 109.00 (USD379mn); 109.10 (USD352mn); 109.20 (USD491mn); 109.40 (USD433mn); 109.50 (USD310mn); 109.55 (USD1.2bn); 110.00 (USD402mn)

- AUDUSD: 0.6875 (AUD322mn); 0.6880 (AUD362mn)

Technical & Trade Views

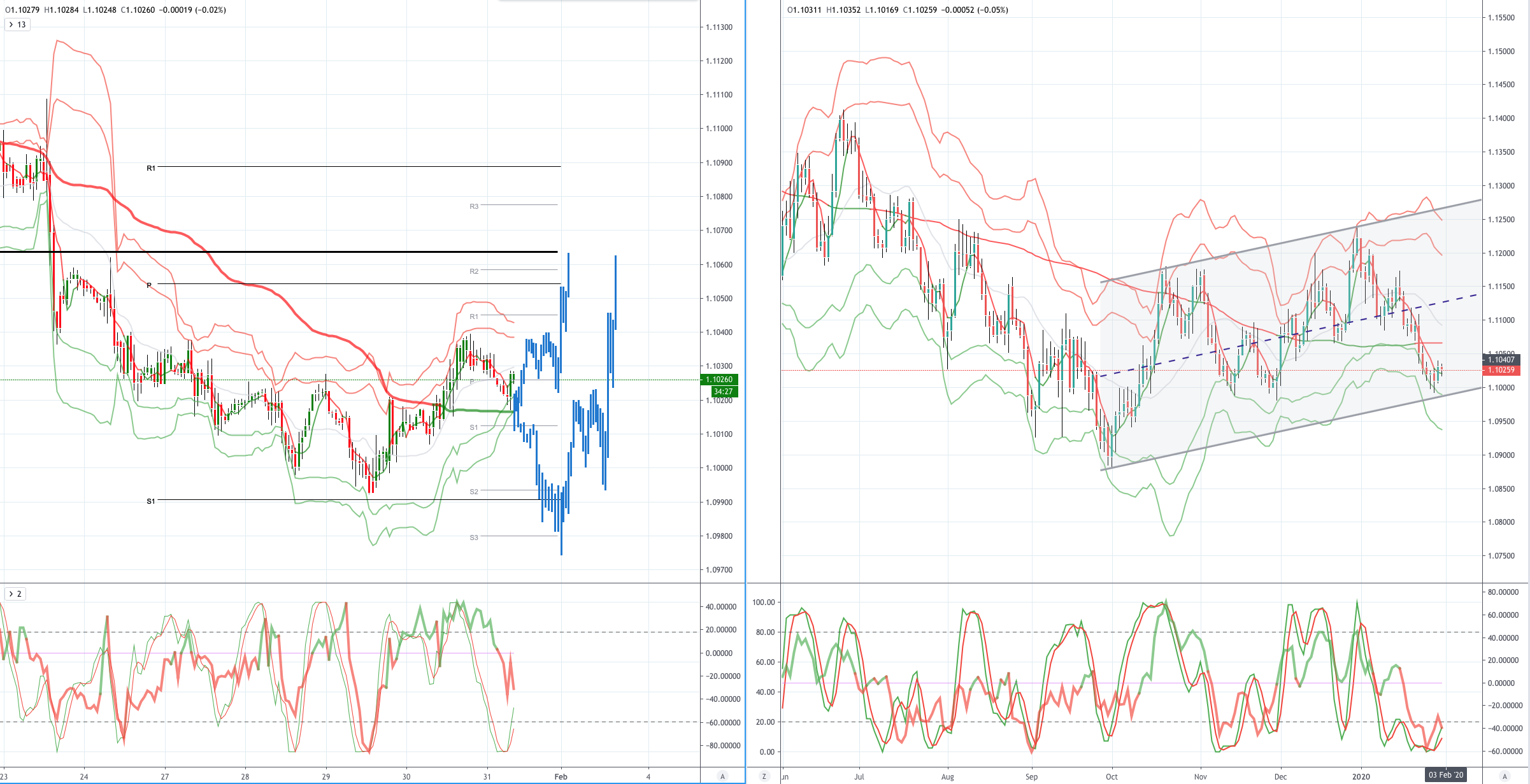

EURUSD (Intraday bias: Bearish below 1.1040)

EURUSD From a technical and trading perspective, A daily close today back through 1.1050 could prompt further short covering into the end of the month. Citi FX quants asset rebalancing signal is strong and points at USD selling against JPY and EUR at month end. Note a closing breach of 1.0980 would suggest further sustained downside risk exposing bids and stops below 1.09.

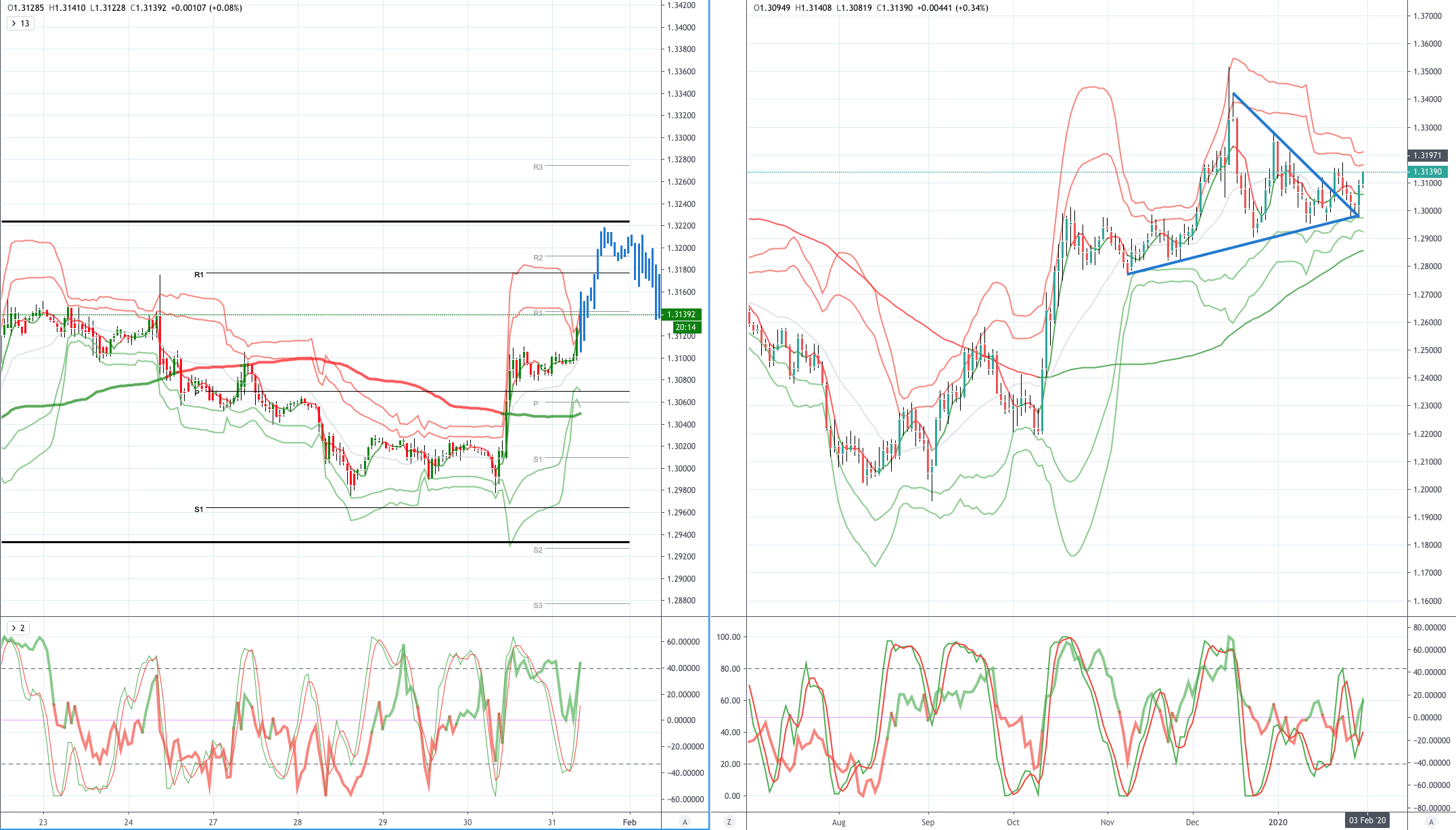

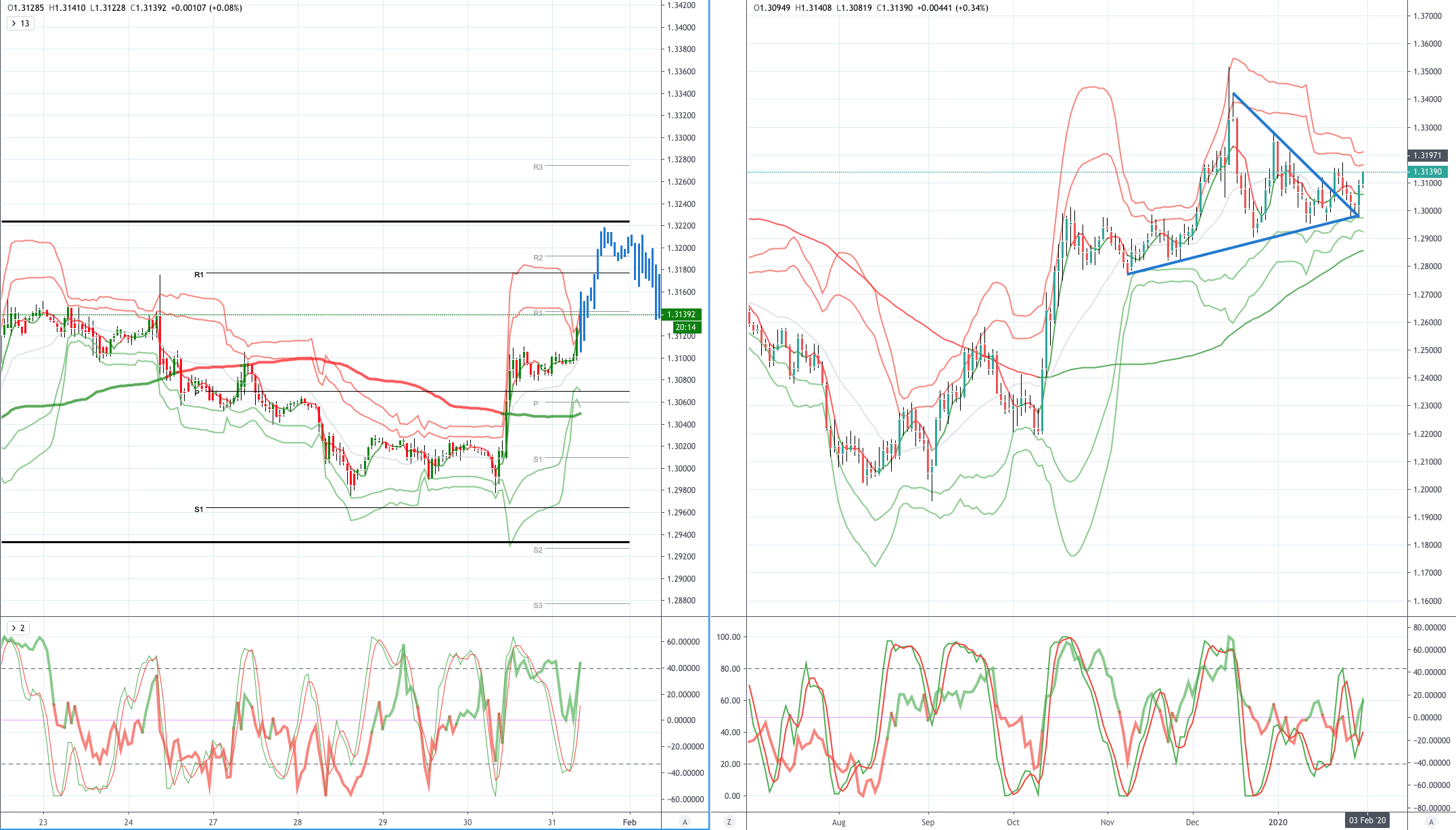

GBPUSD (Intraday bias: Bullish above 1.3100)

GBPUSD From a technical and trading perspective, as anticipated BOE followed the FED’s lead, holding rates steady, prompting rapid short covering post the release. The daily close above 1.3075 flipped the daily charts bullish and is the catalyst for further short covering/profit taking into month end. Expect an initial test of offers and stops above 1.32 to act as intraday resistance.

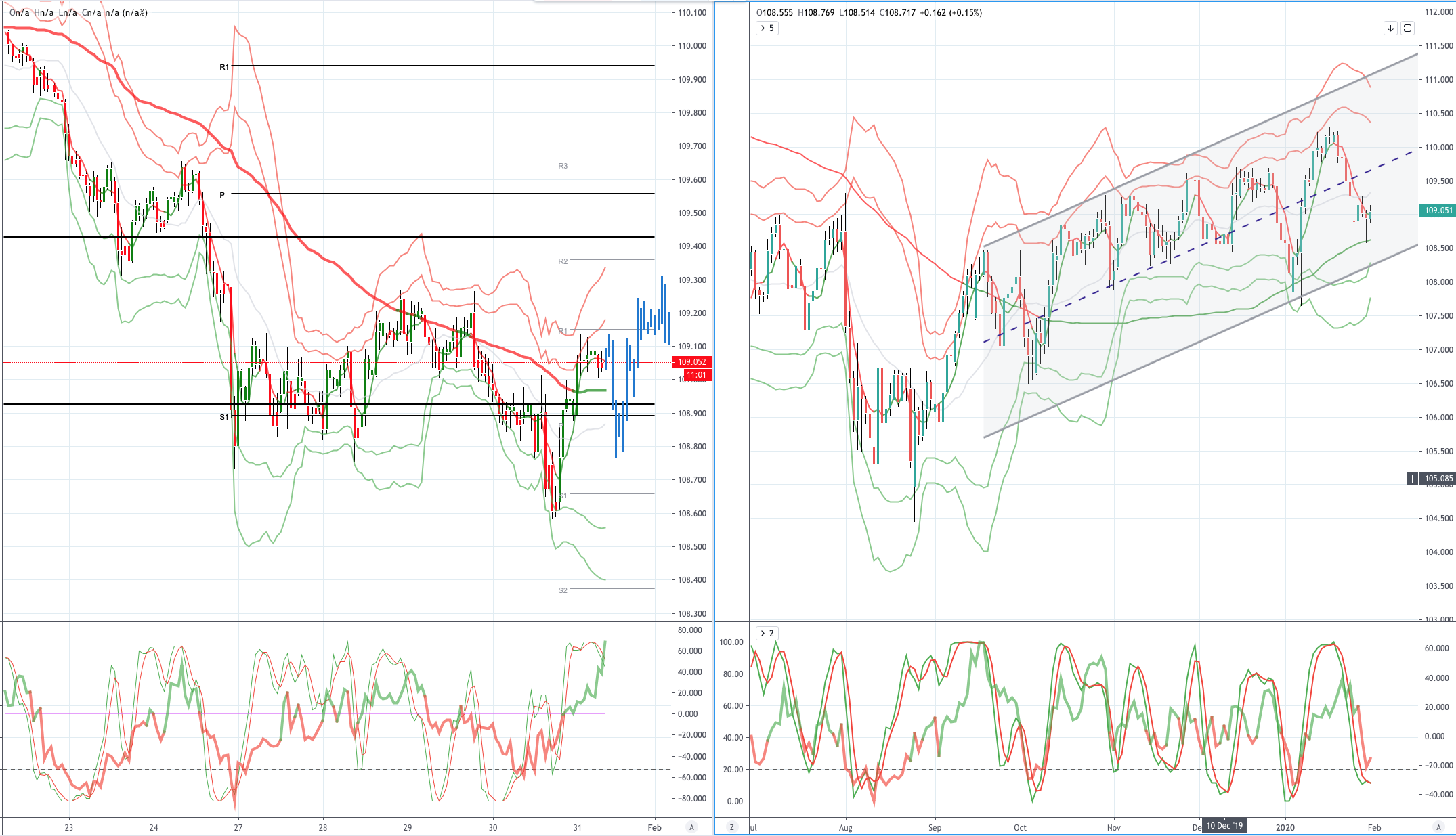

USDJPY (intraday bias: Bearish below 109.60)

USDJPY From a technical and trading perspective, as anticipated sentiment and momentum divergence has been addressed with the breach of 109.80/60 as this levels caps upside attempts now look for a move to test bids at 108.60 and stops below. On the day only a close back above 109.60 would delay downside objectives.

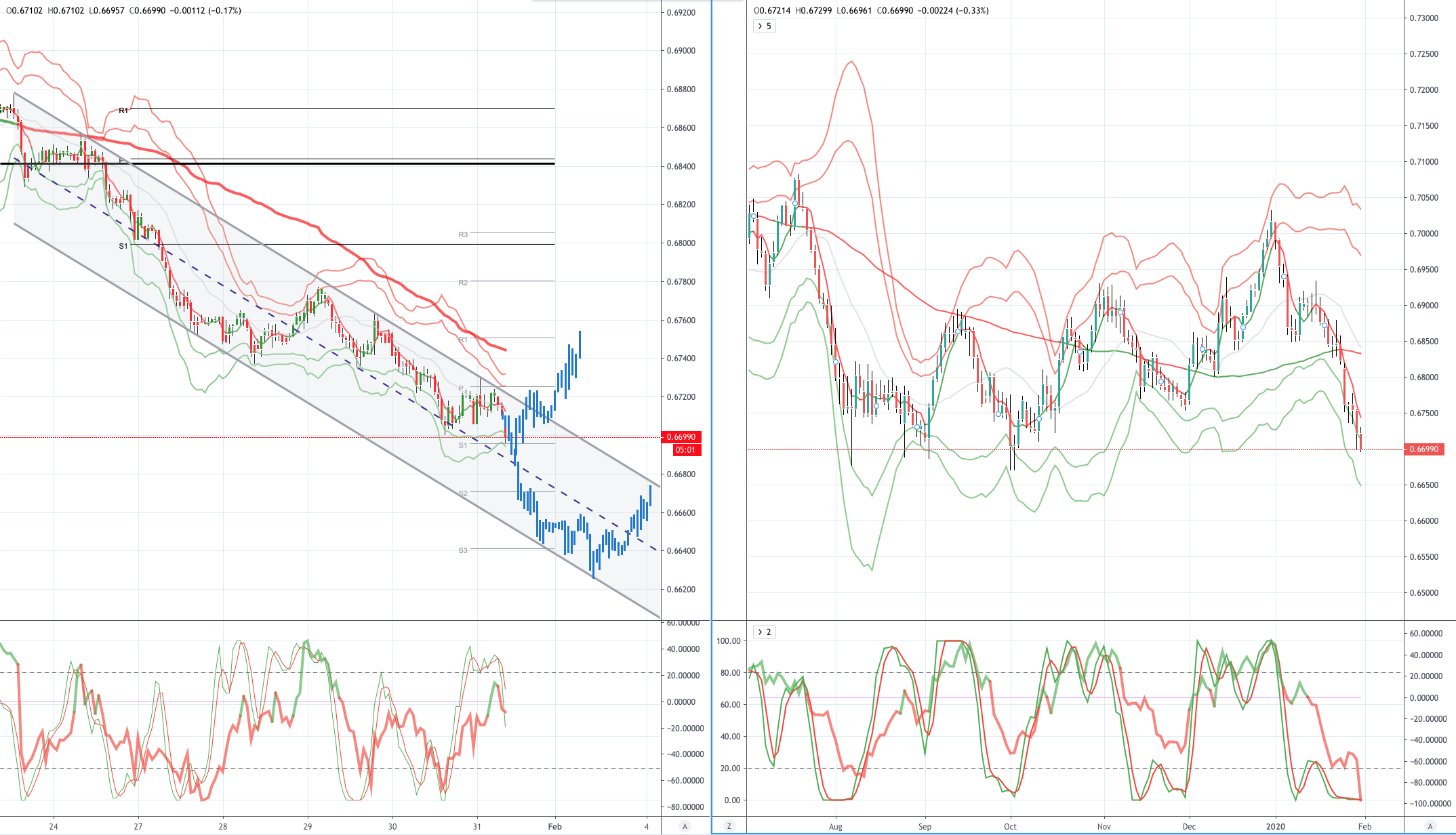

AUDUSD (Intraday bias: Bearish below .6720)

AUDUSD From a technical and trading perspective, the failure below.6730 has opened the a test of bids to .6700 and stops below. As .6720 now acts as resistance, a test of 2019 lows to .6770 is in the cards.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!