Daily Market Outlook, July 16, 2021

Daily Market Outlook, July 16, 2021

Overnight Headlines

- Senate Nears Pivotal Vote On Bipartisan Infrastructure Deal

- Ocasio-Cortez Warns Progressives Can Tank Infrastructure Bill

- Yellen Concerned About Housing Prices But Inflation To Calm

- China Snubs Senior US Official In Worsening Of Stand Off

- UK Government Estimate For Brexit Divorce Bill Lower Than EU

- BOE Asset-Buying Risks Stoking Inflation, Inequality, Lords Say

- BoJ Keeps Ultra Easy Monetary Policy, Trims GDP Outlook

- BOJ To Offer Interest-Free Loans Under New Climate Facility

- New Zealand Inflation Surges, Reinforcing Bets On Rate Hike

- US Yields Fall To 1-Week Low As Powell Maintains Dovish Tone

- Nikkei Breaks Below 28,000 As Tech Stocks Track Nasdaq Slide

The Day Ahead

- Today’s European data calendar is light. There are no releases in the UK, and in the Eurozone the June CPI is a final release that is not expected to be revised from the initial reading. That showed annual inflation at 1.9%, down from 2.0% in May. That still left inflation close to the European Central Bank’s old target of close to but below 2%, although the fact that ‘core’ inflation is only 0.9% means that the ECB is still someway from hitting that target on a sustainable basis. Moreover, the ECB announced last week that, after a review, the target has now been adjusted to 2% with some scope for deviation in either direction. Consequently, the ECB seems likely to conclude at next week’s policy update that they are still some way from achieving their inflation goal.

- In the US, June retail sales are expected to post a second consecutive monthly decline. Overall, since a very big rise in March, sales have slipped. That might be seen as a sign that the economy’s rebound is faltering. However, the decline seems to be primarily concentrated in new car sales and so may reflect supply issues due to well-known disruptions rather than a lack of demand. Moreover, as consumer spending appears to be switching to services as restrictions ease, retail sales may have suffered as a result.

- Also of interest will be the University of Michigan consumer sentiment measure for July. Overall sentiment seems to be maintaining a relatively high level, and a modest rise is forecast for this month. Possibly just as interesting, however, will be what the survey says about inflation expectations, given the ongoing rise in inflation including a further upside surprise in this week’s latest CPI data for June. Last month’s survey saw a modest fall in 1-year inflation expectations to a still-elevated 4.2% from 4.6% in May. Moreover, average 5- to 10-year expectations also slipped slightly to 2.8% from 3%. Federal Reserve Chair Powell has suggested that he and other US central bank policymakers will be looking at things like this to gauge whether there is a risk of the current inflation surge becoming more permanent.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

USD/CAD 1.2350 (835M), 1.2500 (3.825BLN)

EUR/USD 1.1750-65 (545M), 1.1775-80 (350M), 1.1800 (950M)

1.1825-40 (680M), 1.1950 (507M), 1.2000 (980M)

USD/JPY 110.00 (368M). GBP/USD 1.3835 (245M)

AUD/JPY 82.10 (350M), 0.8255 (357M)

EUR/GBP 0.8510-15 (365M). AUD/USD 0.7580 (265M)

NZD/USD 0.6990-00 (478M)

Technical & Trade Views

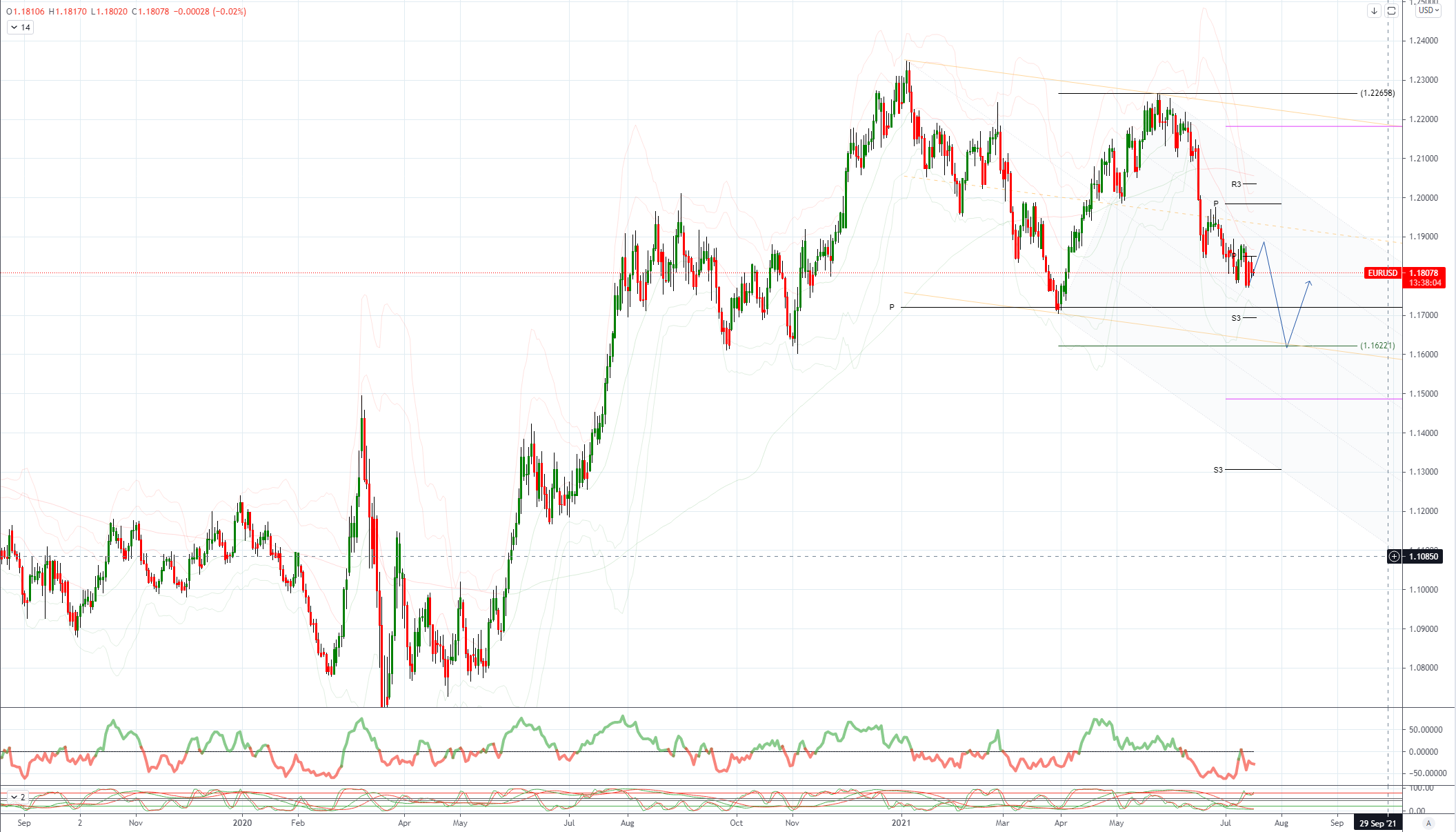

EURUSD Bias: Bearish below 1.1950 Bullish above

Steadies above 1.1800 in quiet Asian session • EUR/USD opened 0.22% lower at 1.1810 after USD and JPY rose on risk aversion • It was a quiet session for the EUR/USD as it traded in a 1.1802/17 range • Heading into the afternoon it is unchanged around 1.1810 • Support is at the double-bottom at 1.1772 with break targeting 1.1704 • Resistance is at the 21-day MA at 1.1867 and break ends down-trend • US retail sales later today could set general direction for the USD

GBPUSD Bias: Bearish below 1.40 Bullish above.

COVID-19 uncertainty caps – technicals weigh • -0.1% in Asia in a tight 1.3825-1.3835 range with modest interest • Poll UK economic recovery to continue but new COVID-19 strains a threat • Ending lockdown restrictions on July 19th increases threat • Sterling soft as inflation fears and 'freedom day' brew • 1.3733 June low, and 1.3930 38.2% of the June-July fall a viable range • Charts; momentum studies, 5, 10 & 21 daily moving averages crest or fall • 21 day Bollinger bands slip – suggests a test of the 1.3733 range base • NY 1.3805 low and London 1.3898 high initial support, resistance

USDJPY Bias: Bullish above 109 Bearish below

Still at mercy of to-fros in US yields, down then up • USD/JPY started Asia trade heavy, to 109.74 EBS before bounce to 110.07 • On low volume, in tandem with moves in US yields, Tsy 10s 1.292% to 1.317% • Treasuries in play with US hedge funds again exiting previous positions • Funds sold curve front-end o/n, bought back-end as Fed doves trump BoE hawks • USD/JPY again finds support just below ascending 55-DMA at 109.84 • Underlying support at also ascending daily Ichi cloud between 109.16-54 • Good standing bids noted in Tokyo from 109.70, offers from 110.10 • Smaller nearby option expiries today – 110.00 $498 mln only notable strike • Tokyo risk-off from get-go, Nikkei currently -1.1% @27,974

AUDUSD Bias: Bearish below .76 Bullish above

Moves higher as NZD/USD strength underpins • AUD/USD opened -0.83% @ 0.7419 after risk currencies fell against USD & JPY • After trading at 0.7415 it moved up when NZ CPI came in hotter than expected • AUD/NZD selling limited AUD/USD gain to 0.7438 as AUD/NZD fell below 1.0600 • AUD/USD is trading around 0.7435 heading into the afternoon session • AUD/USD trending lower, but the price action has been very choppy • Support is at double bottom at 0.7410 and 61.8 of 0.6990/0.8007 at 0.7378 • Key resistance is at the 21-day MA at 0.7503 and break would end down-trend

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!