Daily Market Outlook, July 19, 2021

.png)

Daily Market Outlook, July 19, 2021

Overnight Headlines

- US Treasury Sec: China Trade Deal Has ‘Hurt US Consumers’

- Democrats Mull Backing Powell As Fed Chair Choice Looms

- Infrastructure Drops IRS Funding, Raising Revenue Pressure

- Surgeon-General Warns Of Mask Mandates As Covid Surges

- US Accuses Iran Of Deflecting Blame For Nuclear Stalemate

- China Dismisses Warning on Hong Kong As ‘Pure Nonsense’

- China Signals End To $2Tln US Tech Stock Listing Juggernaut

- Australia Extends Lockdown In Victoria Amid Delta Outbreak

- UK Set For Big Reopening As Cases Soar The Most In World

- UK Faces Disruptions As Coronavirus Third Wave Intensifies

- UK House Prices Hit All-Time Highs In Busiest Ever First Half

- OPEC+ Boost Oil Output After Saudi-UAE Compromise Dea

The Week Ahead

- Eurozone flash PMIs and US housing data on tap With little tier-one economic data to be released this week, flash PMIs from Europe and the U.S. will hold the most interest. Japan's nationwide inflation figures are due Tuesday, followed by trade data Wednesday. Australia's preliminary retail sales could generate some buzz without any key data from China this week.

- Eurozone PMIs fill out a relatively quiet week on the data front as the European Central Bank policy meeting on Thursday takes the spotlight. EU current account figures and consumer confidence survey findings are also expected, while UK retail sales will be released together with flash PMI.

- A clutch of U.S. housing data is on the cards with existing home sales and building permits in focus. U.S. flash manufacturing and services PMI and weekly jobless claims should also get some attention. Canada's retail sales data might draw some eyeballs.

The Day Ahead

- Despite the rising number of Covid cases, all remaining mandatory restrictions will be lifted across England today, in a day dubbed as “Freedom Day”. The move means that the few remaining areas of the economy that have remained closed since March 2020 will now be allowed to reopen, including nightclubs. While this is intended to help boost the UK economy’s recovery, concerns continue to rise over the country’s ability to meet increases in demand. In particular, the number of people that have been ‘pinged’ by the NHS and asked to self-isolate has reportedly risen 500,000 in the past week, resulting in more companies reporting staff shortages.

- This near-term imbalance between supply and demand exemplifies a broader theme that continues to capture financial markets’ attention. The ongoing reopening of the economy, combined with global supply chain issues, have seen inflation move decisively higher in recent months, prompting a shift in tone from Bank of England MPC members. Last week, Deputy Governor Dave Ramsden said that UK inflation could reach 4% this year and that he can envisage conditions for policy tightening “being met somewhat sooner than I had previously expected”. Michael Saunders added that, “it may be appropriate fairly soon to withdraw some of the current monetary policy stimulus”.

- Ahead of the 5 August MPC meeting – where the BoE will present its updated views on the outlook and risks for inflation – markets will continue to focus on speeches by BoE officials and today’s focus will be on external member Haskel who is due to speak at 11:00 BST. Markets are already alert to the possibility that the planned £150bn of asset purchases will be curtailed and have brought forward expectations for the timing of a 15bps increase in Bank Rate to 0.25% to May 2022.

- The rest of the day is void of any major data releases across the UK and the Eurozone. For the US, the focus is limited to the NAHB housebuilders' survey for July, where a modest improvement to 82 from 81 is expected.

CFTC Data

- USD Shorts Reduced to the Lowest Since March

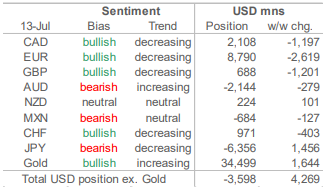

- Data up to Tuesday July 13 and were released on Friday July 16. • CFTC data for the week through July 13th reflect a further, sharp fall in overall USD short positions held by speculative traders and investors. The aggregate USD short, measured against the major currencies we monitor in this report, more than halved last week, falling USD4.3bn to total just USD3.6bn, in effect the smallest USD short since USD sentiment turned bearish in March.

- USD short-covering was concentrated in the EUR, where net EUR longs were slashed USD2.6bn, the GBP, where longs were cut USD1.2bn, and the CAD, as net longs were reduced by a third to USD2.1bn, in the main. Net CHF longs were reduced by USD403mn to USD971mn. For both the CAD and the GBP, gross longs were reduced over the past week while gross shorts rose. The change in net EUR positioning was driven mainly by increasing gross EUR shorts.

- The overall USD mood was helped by intensifying bearish sentiment in the AUD as net shorts rose USD279mn and the MXN where the limited—neutral— positioning tilted slightly more bearishly (USD127mn) against the peso.

- Bearish JPY sentiment moderated, however, providing a modest offset to the overall swing in favour of the USD. Net JPY shorts were cut USD 1.5bn in the week; gross JPY shorts feel while gross JPY longs rose more sharply as the JPY showed signs of stabilizing from its early July low against the USD. The NZD also saw a slight improvement in what remains relatively weak bullish sentiment as investors looked ahead to the past week’s RBNZ policy meeting and CPI data. Net Kiwi longs rose slightly (USD101mn).

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.1750 (348M), 1.1800-05 (783M), 1.1820-25 (347M), 1.1850 (505M)

USD/CHF: 0.9000 (300M), 0.9250 (300M). EUR/CHF: 1.0975 (247M), 1.1000 (200M)

GBP/USD: 1.3750-65 (231M), 1.3800 (173M). EUR/GBP: 0.8550 (220M)

AUD/USD: 0.7425-30 (381M), 0.7485 (236M), 0.7510 (856M)

NZD/USD: 0.7005 (466M), 0.7045-55 (427M)

USD/JPY: 110.00-15 (263M), 110.40-50 (403M)

EUR/JPY: 130.40 (230M), 131.35 (200M)133.25 (292M)

USD/CAD: 1.2505 (200M), 1.2525 (270M

Technical & Trade Views

EURUSD Bias: Bearish below 1.1950 Bullish above

Pivots around 1.1800 in quiet Asian session • EUR/USD opened at 1.1805 and traded in a 1.1798/1.1813 range • Heading into the afternoon it is trading 1.1800/05 • Mood in Asia was gloomy, as COVID-19 concerns hang over the market • E-mini futures are down 0.35% while the AXJ index is down 1.20% • EUR/USD holding up relatively well, as buyers tipped ahead of 1.1790 • Support is at the double-bottom at 1.1772 and break targets 1.1704 • Resistance is at the 10-day MA at 1.1823 and 21-day MA at 1.1864 • EUR/USD may consolidate ahead of Thursday's ECB meeting

GBPUSD Bias: Bearish below 1.40 Bullish above.

Sterling soft, as the 'Freedom Day' gamble • -0.1% at the lower end of a 1.3747-1.3770 range with solid interest early • USD trades firmer as Asian stocks fall, with e-mini S&P futures off 0.35% • The big gamble of 'Freedom Day' begins with mixed messages • Charts; momentum studies, 5, 10 & 21 daily moving averages crest or fall • 21 day Bollinger bands expand – suggests 1.3733 range base is vulnerable • 1.3733 break would open the door to 1.3697 200 DMA, a base since Sep 2020 • Sustained break of 1.3850 21 daily moving average would end downside bias • June 1.3733 low and Asian 1.3770 high are initial support and resistance

USDJPY Bias: Bullish above 109 Bearish below

JPY crosses on back foot, risk, reflation off • USD/JPY and the JPY crosses heavy in Asia, USD/JPY 110.07 to 109.85 EBS • Pair has since steadied, $1.2 bln 110.15-65 option expiries to cap today • Tomorrow sees 1 bln 109.90-110.00 expiries too, to help anchor market • Support from area of ascending 55-DMA at 109.86 though, Ichi cloud 109.11-54 • US yields soggy, Treasury 10s @1.281%, risk off, Nikkei -1.5% @27,584 • Most of Asia risk off too, re-flaring of COVID cited, reflation trade off • JPY crosses off, AUD/JPY and CAD/JPY lead, 81.53 to 80.97, 87.29 to 86.91 • EUR/JPY, GBP/JPY off too but above supports, 129.66-89, 151.64 to 151.00 • Cross longs again reassessing positions, specs likely to remain on offer

AUDUSD Bias: Bearish below .76 Bullish above

Maintains heavy tone is risk off session • AUD/USD opened at 0.7402 and gradually drifted lower • Rise of COVID-19 concerns locally and worldwide weighing on AUD • AUD/USD broke fibo support @ 0.7378 to trade @ 0.7372, but no follow-through • Heading into the afternoon it was trading around 0.7380/85 • Risk assets wobbled in Asia with E-minis down 0.35% and AXJ index down 1.2% • Growth concerns related to spread of COVID may spark risk asset correction • AUD/USD would be vulnerable if correction plays out over coming weeks • A clear break below 0.7370 eventually targets support at 0.7230/35

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!