Daily Market Outlook, July 21, 2021

Daily Market Outlook, July 21, 2021

Overnight Headlines

- Infrastructure Vote Looms Without Final Agreement In Place

- Democrats Weigh $4.1Tln ‘Plan B’ If Infrastructure Talks Fail

- US Admin See Chip Supply Gains, Relief Soon For Carmakers

- US, Germany To Vow Action On Russia In Nord Stream Deal

- BoJ’s Outlook Muddled By Commodity Rise, Weak Spending

- South-East Asia Virus Rise Poses Blow To Global Chip Supply

- Australia Recovery Under Threat, Slow Vaccinations Top Risk

- UK Set Collision Course With EU, Plan To Redraw Brexit Deal

- UK Recovery Cools Despite Hospitality Surge, Lloyds Suggest

- Oil Renews Decline As US Inventories Expand, Delta Spreads

- One Dose Of J&J Vaccine Ineffective Versus Delta, Study Find

- Netflix Falls After Projecting Another Quarter Of Poor Growth

The Day Ahead

- Just released June data for the UK public finances showed a slightly higher than expected public sector borrowing figure for June of £22.8bn. That is well below the number for the same time last year pointing to some improvement in the government’s finances as the economy rebounds but still almost four times the level of two years ago. .

- The UK government is expected to warn the EU today that it is prepared to override the Brexit arrangements for Northern Ireland unless the rules on trade flows from the UK are simplified. Lord Frost, the EU Minister and Northern Ireland Secretary Lewis will make statements to parliament.

- The rest of today’s economics calendar is very light with no data releases of any note and no scheduled speakers. However, Lloyds Bank has released its latest Recovery Tracker this morning.

- The Recovery Tracker shows that the upswing in global economic activity remained strong in June. However, possibly because of differing rates of vaccine rollout the recovery in advanced economies seems to be outpacing that in developing markets. Supply side pressures due to difficulties in sourcing key inputs and labour shortages appear to be growing threats to the recovery.

- The latest readings for the UK suggest growth in overall business activity was close to record highs in June but could have been even faster were it not for supply constraints. The outlook for the third quarter and beyond looks positive but growing inflationary pressures remain a key area of concern.

- Markets were again volatile yesterday. They seem unsure whether to be more wary of rising inflation and an early turnaround in monetary policy or the risk that a pickup in Covid-19 cases will abort the recovery. However, the recent sharp fall in longer-dated bond yields led by US Treasuries may suggest that the latter is currently more of a concern.

- After initially falling further yesterday both UK and US longer-dated bond yields subsequently rebounded but in both cases yields remain close to their lowest since February. Meanwhile, in currency markets sterling has come under pressure particularly against a generally stronger US dollar. Tomorrow’s speech by Deputy Governor Broadbent could provide some key insights into the BoE’s policy intentions and so may have a significant impact on UK markets.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

EUR/USD: 1.1700 (EU1.32B), 1.1900 (EU1.13B), 1.1850 (EU670.6M)

USD/JPY: 110.50 ($820M), 97.15 ($500M), 114.45 ($500M)

USD/CAD: 1.2700 ($510M), 1.2200 ($375M), 1.2300 ($350M)

AUD/USD: 0.7400 (AUD857.2M)

GBP/USD: 1.4350 (GBP459.9M), 1.4150 (GBP452.3M), 1.3950 (GBP339.8M)

Technical & Trade Views

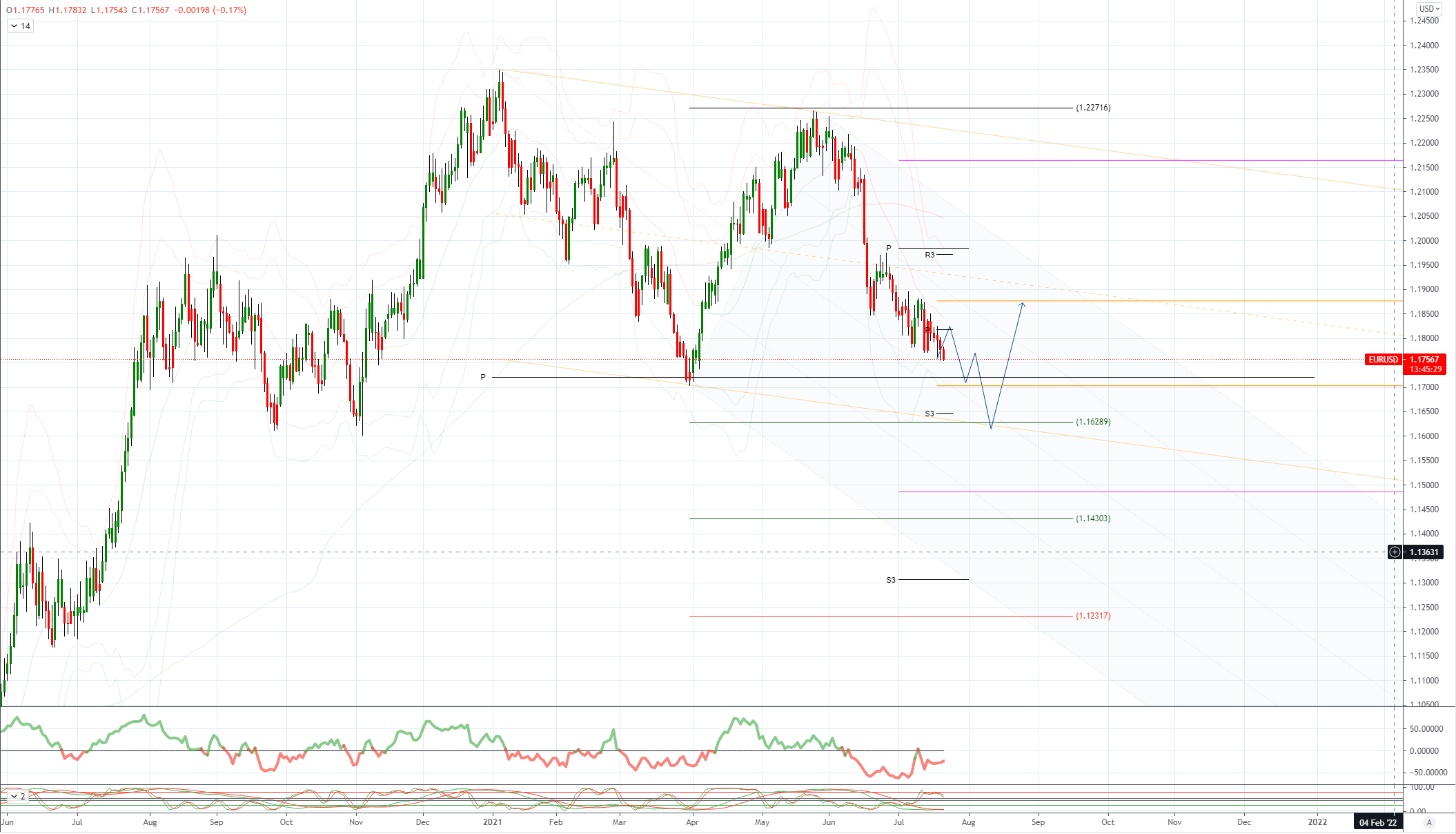

EURUSD Bias: Bearish below 1.1950 Bullish above

Consolidates in quiet Asian session • EUR/USD opened -0.16% at 1.1780 after recovering from 4-month low at 1.1755 • In a quiet Asian session it traded in a 1.1770/83 range • EUR/USD is trending lower, but the descent is gentle and glacial • The 5, 10 and 21-day MAs are in a bearish formation and point lower • Bids are eyed ahead of 1.1750 with support at 2021 low at 1.1704 • Resistance is at the 10-day MA at 1.1817 and break would ease the pressure • EUR/USD may continue to consolidate ahead of ECB meeting on Thursday

GBPUSD Bias: Bearish below 1.40 Bullish above.

Shade softer, ahead of potential EU Brexit conflict • -0.05% in a low key session – 1.3609-1.3642 range with the USD firmer • UK recovery cools in June despite hospitality surge – Lloyds • Charts; momentum studies, 5, 10 & 21 daily moving averages track lower • 21 day Bollinger bands expand – signals add up to a strong bearish setup • Sustained break of 1.3697 200 DMA, a base since Sep 2020, strong negative • Close above 1.3815 21 daily moving average needed to downside bias • Next significant support comes in at 1.3451/63, 2021 low & 50% Sep/Jun rise • Firm USD, potential EU conflict suggest sterling slide extends Firm USD, EU conflict suggest sterling slide extends Sterling has fallen for four consecutive days, partly with the rising USD, but it has also weakened against the euro. Prime Minister Boris Johnson's "freedom day" gamble and looming political conflict with the European Union over areas of UK sovereignty are weighing on the pound. Monday's removal of all coronavirus restrictions in the belief that the fast vaccination rollout will overcome the expanding Delta variant is a major gamble by the UK government. Many scientists think it is too fast and early, while COVID-19 cases rose 41% in the last week. Should this strategy fail, the IFS think-tank notes Finance Minister Rishi Sunak has little scope for longer-term spending, if he maintains current budget targets. The UK and EU are heading for major conflict on the Northern Ireland trade issue, and over Gibraltar. The UK has not fully implemented the measures outlined in the Brexit deal and wants to renegotiate. The EU believes that the signed deal should first be implemented. As the EU is Britain's biggest market, a breakdown in relations would be significantly negative for the UK economy recovering from the coronavirus. Technically GBP/USD trends lower, with 5, 10 and 21-day moving averages heading south. The 1.3644 lower 21-day Bollinger band suggests the pound is oversold short term, but a test of the year's 1.3451 low beckons.

USDJPY Bias: Bullish above 109 Bearish below

Buoyant but capped ahead of 110, risk mood mixed • USD/JPY buoyant after rally o/n but capped ahead of 110.00 • Asia 109.83-98 EBS ahead of long Japanese weekend, Olympics start Friday • USD/JPY back above 109.49 100-DMA, daily Ichi cloud between 109.10-79 • Pair now on hold around more flat 55-DMA at 109.87 • Bids eyed on dips towards/in Ichi cloud, good offers from ahead of 110.00 • Bounce in US yields supportive too, Treasury 10s @1.211% • Asia risk mood mixed, Nikkei +0.5% @27,523 but E-minis -0.1% @4312.25 • Massive option expiries today 110.00-15, total $1.1 bln, 110.50 $820 mln • JPY crosses buoyant too after recent falls but risks still down • EUR/JPY 129.40-55 EBS, GBP/JPY 145.49-96, AUD/JPY 80.21-68

AUDUSD Bias: Bearish below .76 Bullish above

Under pressure but 0.7300 holding for now • AUD/USD opened 0.26% lower at 0.7329 after USD broadly firmed • It moved up to 0.7340 early Asia when Asian equity markets opened higher • E-minis slipped into the red and Asian markets gave back some early gains • AUD/USD started to slip and wasn't helped by weak prelim Aus retail sales • AUD/USD traded at 0.7303 before steadying on talk of bids at 0.7300 • Heading into the afternoon it is trading around 0.7305 • The trend lower continues with the 5, 10 & 21-day MAs in a bearish alignment • Resistance is at the 10-day MA at 0.7413 and break would ease pressure • Support at 0.73330/35 where 76.4 of 0.6990/0.8007 and 200-week MA converge

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!