Daily Market Outlook, July 26, 2021

Daily Market Outlook, July 26, 2021

Overnight Headlines

- NIH Director Fauci Warns US Going In ‘Wrong Direction,’ May Need Booster

- Senator Warner: 'Believe We Will' Have Infrastructure Bill Ready Monday

- House Speaker Pelosi: Infrastructure Won’t Get Vote Without Larger Plan

- Merkel Aide Warns Virus Surge In Germany May Mean Curbs For Unvaccinated

- UK Government To Scrap Post-Brexit Red Tape On Wine Imports, Cutting Cost

- UK Government Buoyed By Data Showing Fall In Covid Cases Again On Sunday

- Chinese Foreign Minister Blames US For Stalemate In Relations, As Talks Begin

- Japanese Factory Activity Grows At Slowest Pace In Five Months In July

- US Dollar Index Holds Near Multi-Month Highs As Fed Meeting In Focus

- Oil Prices Little Changed, Covid And Floods Threaten Demand; Gold Subdued

- Chinese Equity Markets Slump As Beijing Cracks Down On Tutoring Firms

The Day Ahead

- Ahead of next week’s Bank of England policy announcement, External MPC member Vlieghe, is scheduled to speak at 12:00 BST, in what will be one of his last speeches before he leaves the Bank of England at the end of August. Expectations for the 5th August policy update have fluctuated of late. Earlier this month, relatively hawkish comments from a couple of Monetary Policy Committee members prompted speculation about an earlier than previously expected end to the BoE’s asset purchase programme and led markets to bring forward their expectations for a first Bank rate hike to early 2022.

- However, last week, comments from two other MPC members, Haskel & Deputy Governor Broadbent appeared to indicate that neither is ready to vote for a near-term change in policy. The title of his speech, “What we have learned in the past six years about ‘3D’ (demographics, Debt, distribution of income) drivers of low r", suggests Mr Vlieghe may focus on the extent to which interest rates will rise once the Bank of England begins to normalise monetary policy.

- There are no UK data releases due today, however, the German IFO survey will provide a timely update of German business confidence. Activity across the country has benefitted from a further easing in restrictions of late, expect that to be captured by a further improvement in the current conditions of the IFO survey. However, concerns over the Delta variant and its potential impact are expected to show up via a moderation in the future expectations component. Nevertheless, the overall business climate measure is forecast to move up to 102.6 from 101.8 previously.

- Meanwhile, in the US, following two months of decline, new home sales are expected to have picked up in July. Look for a 4.5% monthly rise, which will take the seasonally adjusted annual rate back above the 800k mark.

The Week Ahead

- Week Ahead-FOMC in focus, along with earnings and COVID watch The Federal Open Market Committee meets this week, but as Fed meetings go, this one should be less exciting as the U.S. central bank will not be releasing a dot-plot or economic projections. U.S. corporate earnings and COVID-19 infection rates will also be in focus. The Fed statement will be parsed for clues on when the Fed will taper asset purchases, but there is unlikely to be any fresh information. The statement and Chair Jerome Powell's press conference will likely reiterate the Fed's view that inflation is most probably transitory and note the downside risks from the latest wave of COVID-19 infections. This will be the biggest week of the current reporting season, with over 160 of the S&P 500 companies reporting. Earnings from the tech heavyweights could impact market sentiment. The key updates will be delivered by Apple, Facebook, Amazon, Netflix, Alphabet and Tesla. Other major U.S companies reporting this week include Caterpillar, Boeing, McDonalds and Proctor & Gamble. Moves in the bond market will continue to influence other asset markets after a week of wild swings. Bond investors are being pushed and pulled by inflation and COVID-19 concerns.

- Week Ahead-Q2 GDP leads busy U.S. data calendar Advance second-quarter GDP leads a busy week for U.S. economic data, with the market expecting a whopping 8.6% year-on-year growth rate. Investors will also pay close attention to inflation components within the GDP data. Other key data out of the U.S. this week includes durable goods, new home sales, consumer confidence, Chicago PMI, core PCE price index and University of Michigan consumer sentiment. Euro zone flash Q2 GDP will also be released in the week ahead with the market expecting strong 13.2% year-on-year growth. Other key data includes the German Ifo and EZ flash inflation, unemployment, business sentiment surveys and consumer confidence. There is no major data out of the UK this week. Japanese data includes flash manufacturing PMI, IP, unemployment and retail sales, along with construction orders and housing starts. China industrial profits will be released this week, while the official PMIs will be released on Saturday. In Australia, the key event will be Q2 CPI, with the focus on the trimmed and weighted mean inflation measures. PPI and private sector credit will also be on tap. New Zealand released trade data early Monday and Canada's highlights are inflation and May GDP.

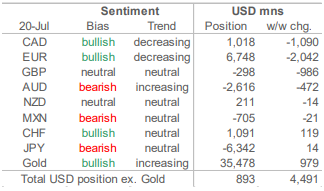

CFTC Data

- USD Positioning Flips to Long

- Data up to Tuesday July 20, released on Friday July 23.

- The aggregate USD short is no more as investors accumulated a USD4.5bn move in favour of the dollar that has flipped sentiment in the greenback from short USD3.6bn to long USD893mn as of Tuesday July 20. The seventeen-month-long short position in the dollar had risen to as high as USD35bn in January 2021, after essentially flipping its sign from the USD’s net long of USD36bn in April 2019.

- The moves in USD positioning over the week were centred on four currencies—the EUR, CAD, GBP, and AUD with fairly narrow moves in the other currencies that we track in this report, the CHF, MXN, JPY, and NZD.

- The EUR long was reduced by just over USD2.0bn to USD6.75bn as short contracts in the shared currency climbed to their highest point since March while longs held relatively steady (though declining slightly). Since mid-July, bullish positioning in the EUR has dropped by USD11.2bn. Despite positioning turning less positive on the EUR, the currency held unchanged over the period while most of its major peers recorded significant losses against the dollar.

- The CAD long was roughly halved to USD1.0bn on the back of a weekly reduction of USD1.1bn due to a large increase in short contracts as well as a decline in longs to their lowest point since late-April. The CAD lost about 1.3% against the dollar during the week and on Monday reached a five-month-plus low close to 0.78 (USDCAD just above 1.28).

- The AUD and the GBP, the second and third worst performing majors against the USD in the week to Tuesday (NOK being the worst, CAD being fourth from the bottom), saw respective bets against them of USD472mn and USD986mn. Investors added to the AUD short to USD2.6bn—its highest since June 2020, on increased short bets and steady longs. The GBP net long turned net short at USD298mn as accounts left long contracts relatively intact while increasing shorts by 10k contracts.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- EUR/USD: 1.1725 (488M), 1.1750 (661M), 1.1800 (289M)

- 1.1830 (622M), 1.1860 (793M)

- GBP/USD: 1.3900 (425M) . AUD/JPY: 82.65 (278M)

- AUD/USD: 0.7335-50 (764M), 0.7490 (294M)

- USD/CAD: 1.2570-75 (652M), 1.2700 (485M)

- USD/JPY: 109.80 (350M), 110.05-20 (508M), 110.80 (240M), 1.1150 (500M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1950 Bullish above

- EUR/USD opened 1.1772 and traded in a 1.1763/77 range

- Heading into the afternoon it is steady around 1.1775

- Equity markets in Asia fell with AXJ index -1.5% and Eminis -0.28%

- Risk currencies were pressured while EUR/USD remained firm

- It has bottomed between 1.1750/60 for four straight trading days

- A break below 1.1750 targets the 2021 low at 1.1704

- Key resistance is at the 21-day MA at 1.1827 and break eases pressure

- EUR/USD trending lower while the 21-day MA caps rallies

GBPUSD Bias: Bearish below 1.40 Bullish above.

- -0.05%, at the base of a 1.3741-1.3760 range - busy mid morning, then quiet

- British new COVID-19 cases have moved lower for 5 days

- Early days but perhaps the UK is turning the corner on the Delta variant

- Charts; 10 & 21 daily moving averages fall despite the recent bounce

- 21 day Bollinger bands slide, neutral momentum studies - negative setup

- Targets a test of initial significant support at the 1.3572 July low

- Close above 1.3797 21 daily moving average needed to end downside bias

- London 1.3720 low and Asian 1.3760 high initial support and resistance

USDJPY Bias: Bullish above 109 Bearish below

- USD/JPY up to 110.58 EBS into the Tokyo fix before fading to 110.32

- Most eyes on Olympics, Tokyo volume on low side, flows off post-fix

- Market seen heavy 110.50+, Japanese exporter, other offers tipped

- Support, bids towards 110.31 55-HMA though, 110.00-20 option expiries too

- Move down in USD/JPY in line with easing US Tsy yields, 10s @1.259%

- Risk on in Tokyo, Nikkei +1.4% @27,931, Asia bourses weaker, E-minis -0.3%

- EUR/JPY 129.87-130.15 EBS, GBP/JPY 151.58-152.15, AUD/JPY 81.02-46

- Crosses buoyant for now but upsides likely limited

- Japan July mfg PMI 52.2, off from June 52.4 but still above 50

- Those trading looking to FOMC tomorrow, Wednesday for direction

AUDUSD Bias: Bearish below .76 Bullish above

- AUD/USD moved up to 0.7272 from the NY close at 0.7263 in early Asia

- It has been drifting lower since, as Asian equity markets moved lower

- The Shanghai Composite is down 2.45 while AXJ index is down over 1.5%

- AUD/USD is trading at the session low at 0.7347 into the afternoon

- Minor support at Thursday's 0.7343 low with last week's low at 0.7287

- AUD failed to move higher Friday when Wall Street and copper moved up

- AUD/USD resistance is at the 10-day MA at 0.7387 and 21-day MA at 0.7445

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!