Daily Market Outlook, July 4, 2022

Daily Market Outlook, July 4, 2022

Overnight Headlines

- Recession Fears Dominate At The Start Of A Holiday Shortened Week

- China Covid Outbreaks Widen As Mass Testing Finds More Cases

- UK Tory Rebels Preparing Another Vote To Expel PM This Month

- Biden Administration Split On Whether To Remove China Tariffs

- Senate Democrat Urge Biden To Repeal Tariffs To Fight Inflation

- Biden Weighs Push To Trim Mortgage Costs As Home Prices Rise

- Russia Claim Full Control Of Luhansk As Ukrainian Forces Retreat

- ECB Plan To Block Banks From Billion Euro Windfall As Rates Rise

- Confidence Drains From UK Companies As Economic Woes Grow

- Germany Risks A Cascade Of Utility Failures, Economy Chief Says

- IEA Urges Saudi Arabia Pump More Oil In Energy Crisis Red Alert

- Iran Slashes The Cost Of Its Oil To Compete With Russia In China

- Tesla’s Deliveries Dropped In Quarter, Snapping Two-Year Streak

The Day Ahead

- Equities across the Far East are mixed, with gains across Japan and Australia offset by declines elsewhere. Notably, stock markets in China are trading lower on the day as rising Covid infections weigh on sentiment. Flare-ups in infections in provinces near Shanghai are causing some parts of the region to be locked down, although case levels remain well below those seen during April and May. In the UK, the release of the British Chambers of Commerce’s latest Quarterly Economic Survey showed that a record number of UK firms were expected to increase prices in the next three months.

- Over the past week, fears over a sharper than desired slowdown in global economic activity have been the overarching driver of market moves. Global stock markets slipped, contributing to a torrid first half for equities, while bond yields moderated further from their recent highs as markets increased their expectations that central banks may have to cut policy rates in the second half of next year (although not before raising them significantly to combat elevated inflationary pressures), as ongoing signs of a global economic slowdown continue to be evident.

- For now, however, the message from policymakers continues to be that they remain most concerned about higher-than-expected inflation. Consequently, they feel the need to tighten policy aggressively to ensure that the present high inflation does not become embedded in longer-term inflation expectations. That means significant further interest rate rises across a range of countries before year end are still expected.

- Over the coming days, the release of the minutes to the last Fed and ECB policy meetings in June, along with a plethora of central bank policymakers – including from the Bank of England – are likely to continue signalling support for a further tightening in monetary policy. However, any indication that recent signs of slowing economic activity are weighing on their minds will likely see a further shift in interest rate expectations.

- For today, the focus will be on comments from ECB members Nagel and de Guindos, while on the data front, the Eurozone Sentix investor confidence survey for July is expected to show another decline, reflecting further drops in equity markets. Meanwhile, early tomorrow morning the Australian central bank (RBA) will give its latest update, which is expected to result in a third successive rate rise, this time by 50 basis points.

CFTC Data

- IMM: USD net spec long trimmed amid EUR, GBP bottom – fishing

- IMM net spec USD long cut in Jun 22-28 period; $IDX +0.16%...

- EUR$ -0.15% in period, specs +5,009 contracts into dip now -10,596

- $JPY -0.37% in period specs +5,884 contracts short cut to 52,570

- GBP$ -0.74%, short reduced by 10,129 contract to -53,118

- AUD specs sell into dip now short 42,980; CAD specs +4,992 as $CAD -0.3%

- BTC dipped 2.8% in period, specs add 39 contracts long grows to 1,085

(Source: Reuters)

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0440-50 (558M), 1.0470 (249M), 1.0530 (210M)

- 1.0565-70 (437M), 1.0585 (268M)

- USD/JPY: 135.00-05 (320M)

- GBP/USD: 1.2145-50 (378M)

- AUD/USD: 0.6905-15 (410M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.0650 Bullish above

- Opens the LDN session trading in the middle of Fridays range

- Trading in a 25pip range driven by reduced flows due to US holidays

- Asian trade in general has had a risk off tone driven by ongoing recession fears

- EUR/USD will likely remain under pressure in the short-term

- Failure below the base opens a test of 1.0270’s next

- Initial offers are seen at 1.0530/50

- Bids 1.04 stops below to fuel a retest of cycle lows

- 20 Day VWAP is bearish, 5 Day bearish

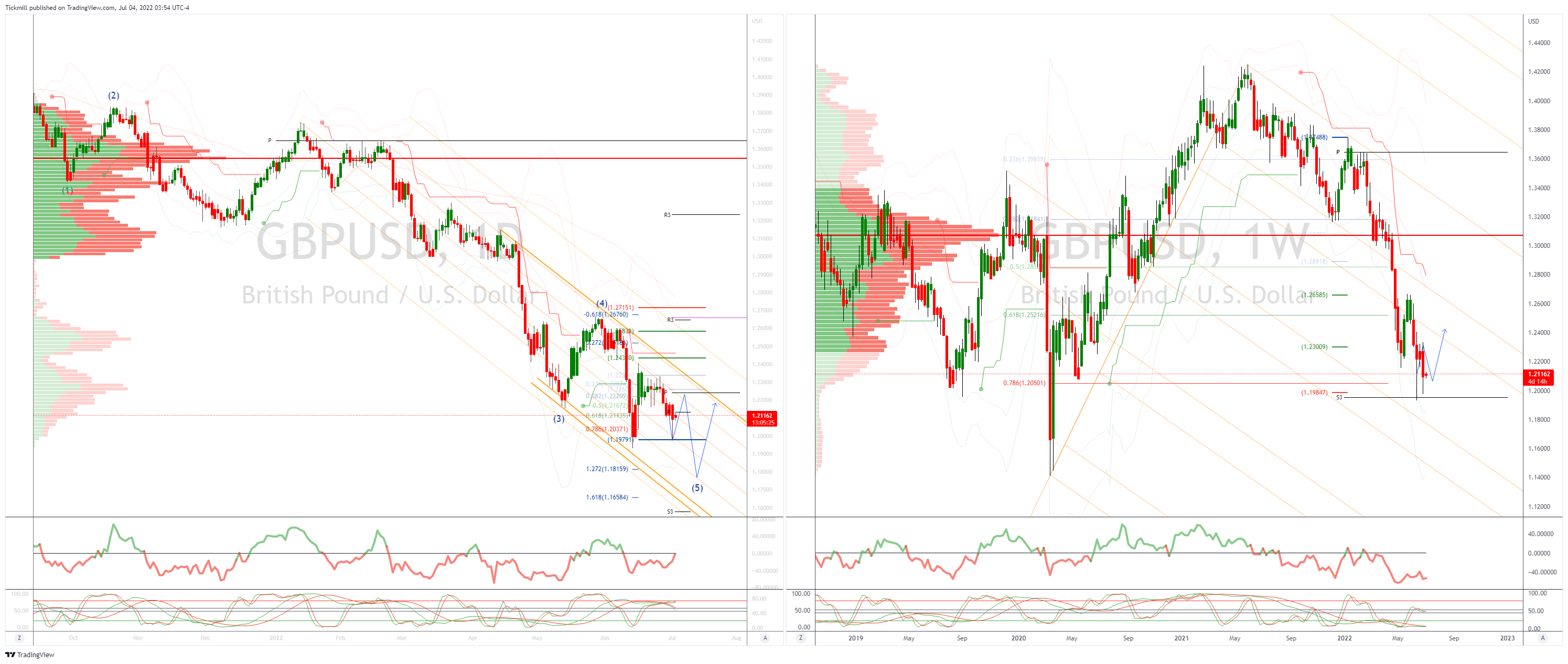

GBPUSD Bias: Bearish below 1.24 Bullish above.

- GBP stages a tepid recovery from lows Friday but bias remains lower

- GBP crosses follow cables lead and recover losses from Friday

- Headwinds continue to cloud cable outlook, high inflation, PM issues, dovish BoE

- Market feels heavy below 1.2230/60 resistance

- Note Friday has GBP810 mln in option expiries at 1.2000 strike

- Bears targeting a break of YTD lows en-route to a test of 1.18

- Resistance sited at 1.2275

- 1.2150 failure opens a test of bids at 1.2050

- 20 Day VWAP is bearish, 5 Day bearish

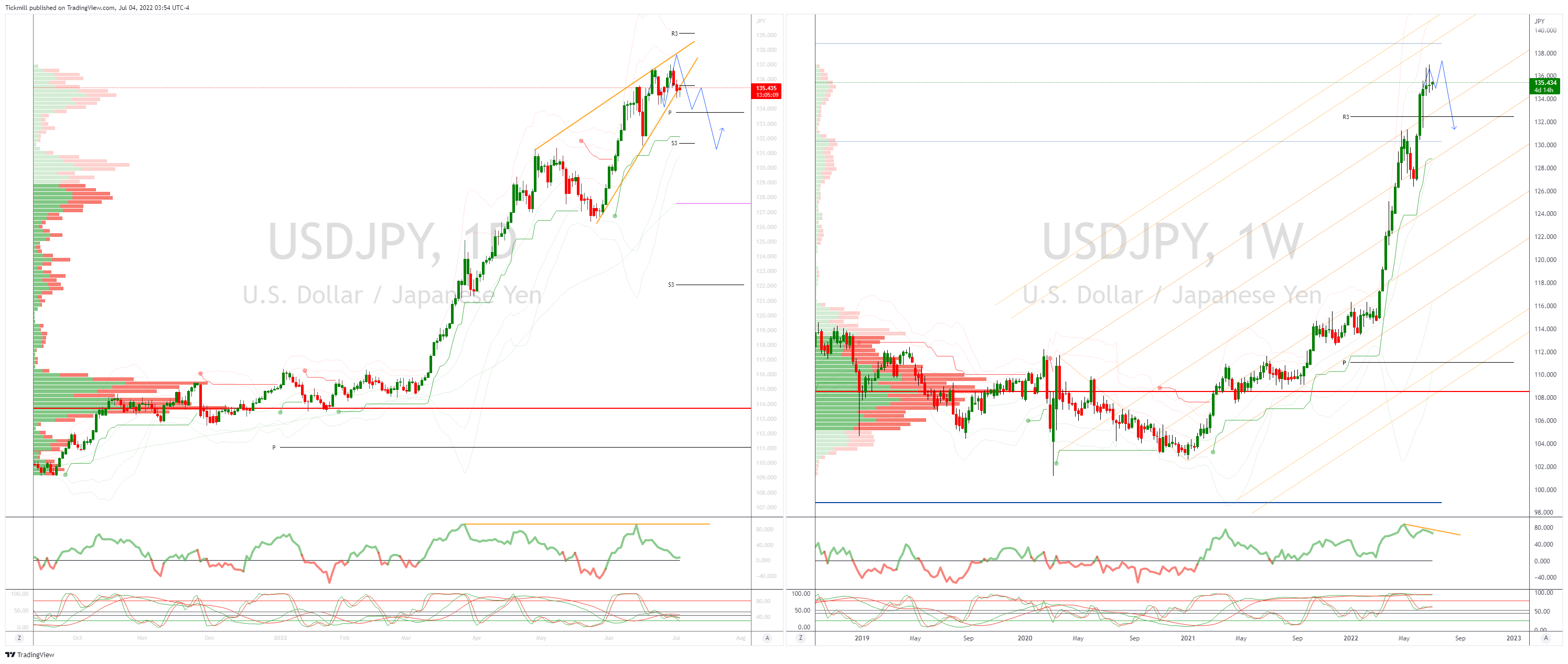

USDJPY Bias: Bullish above 132 Bearish below

- USD/JPY opens the week with a bid tone in thin holiday trade

- 60pips of range seen into the Tokyo fixing

- Desk note short covering in the Asian session

- Upside traction tricky with US yields continuing to decline US10Y 2.889%

- Initial offers at 135.55/65 stops above to see retest of cycle highs

- Option barriers KO’s quoted at 137 remain intact

- 20 Day VWAP is bullish, 5 Day bullish

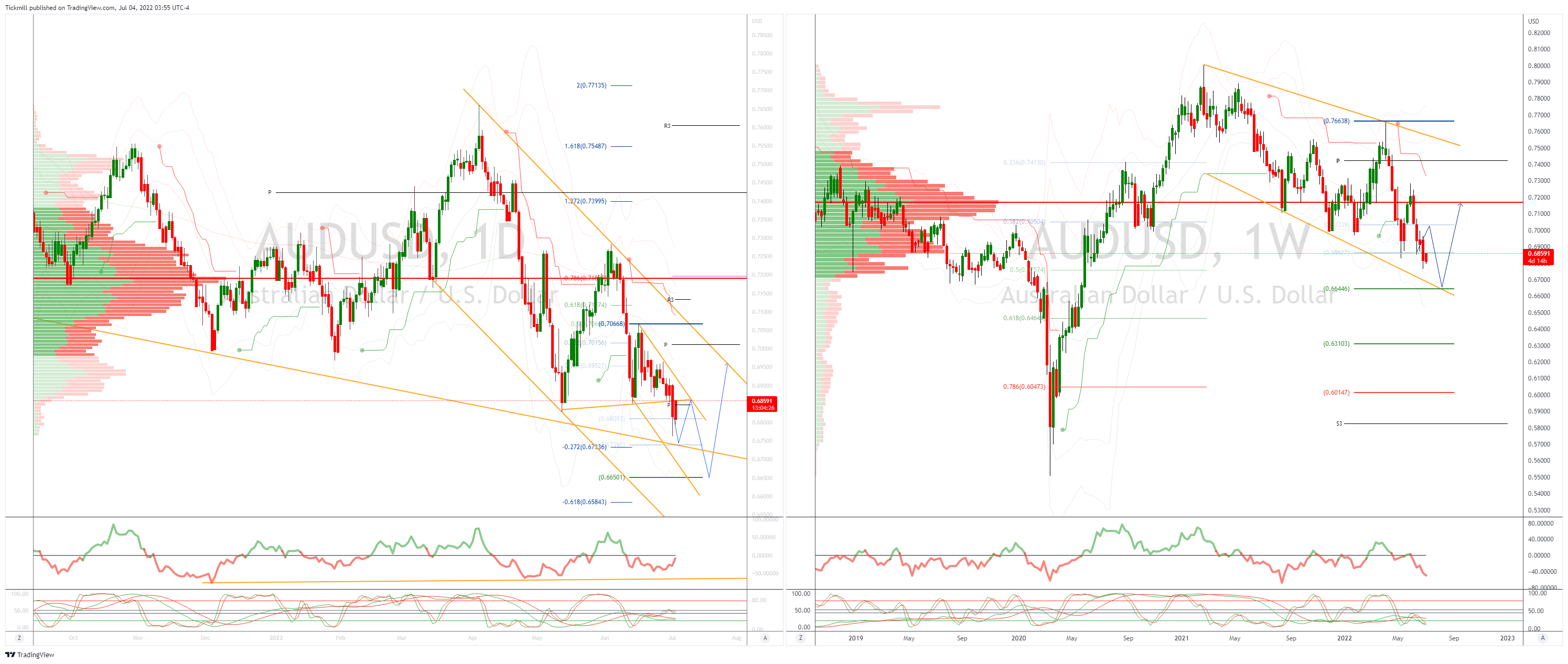

AUDUSD Bias: Bullish above .7200 Bearish below

- Aussie lifts from early Asain lows trading middle of Friday’s range break candle

- Remains under pressure from reduced risk sentiment at the start of the week

- Iron ore on the back foot losing 5.5% as global growth concerns weigh

- Resistance is sited at .6900/10

- Support seen at the 50% retracement of the 0.5510/0.8007 move at 0.6758

- 20 Day VWAP remains untested confirming downside

- 20 Day VWAP is bearish, 5 Day bearish

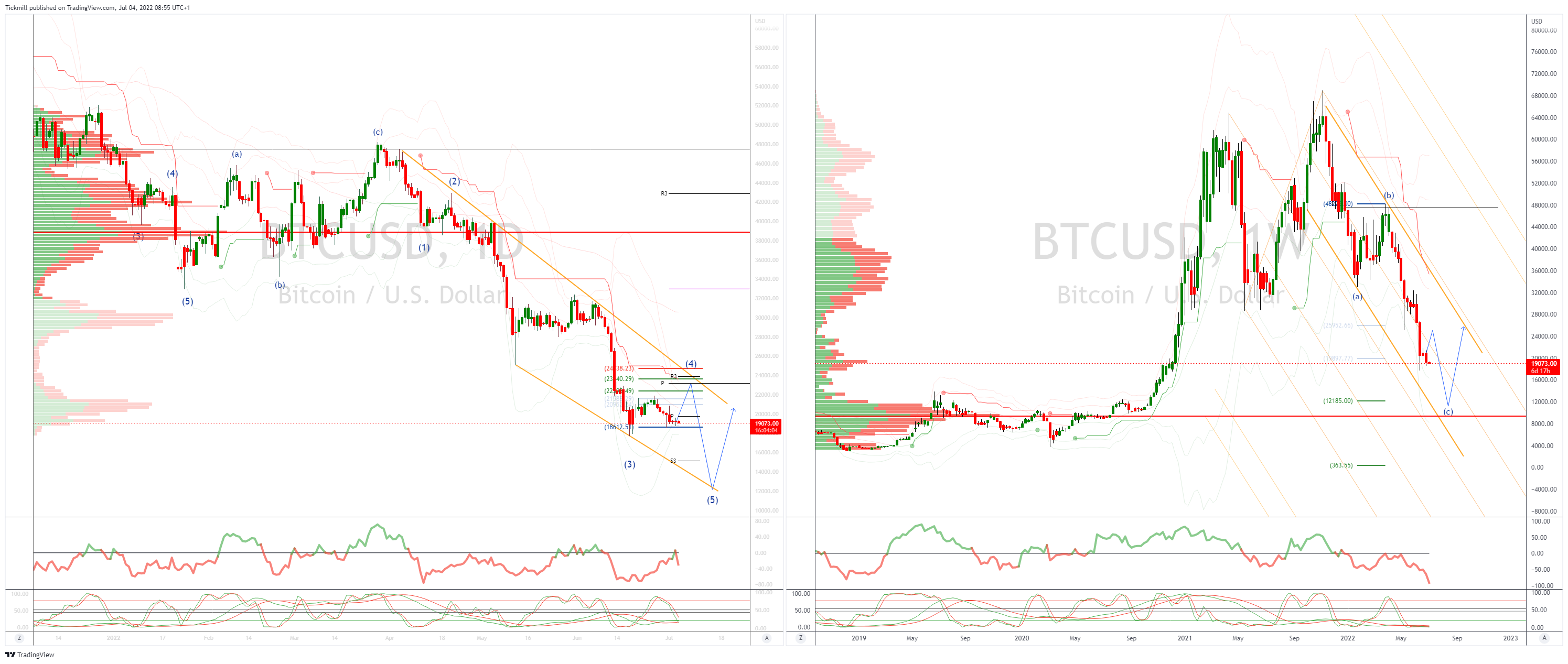

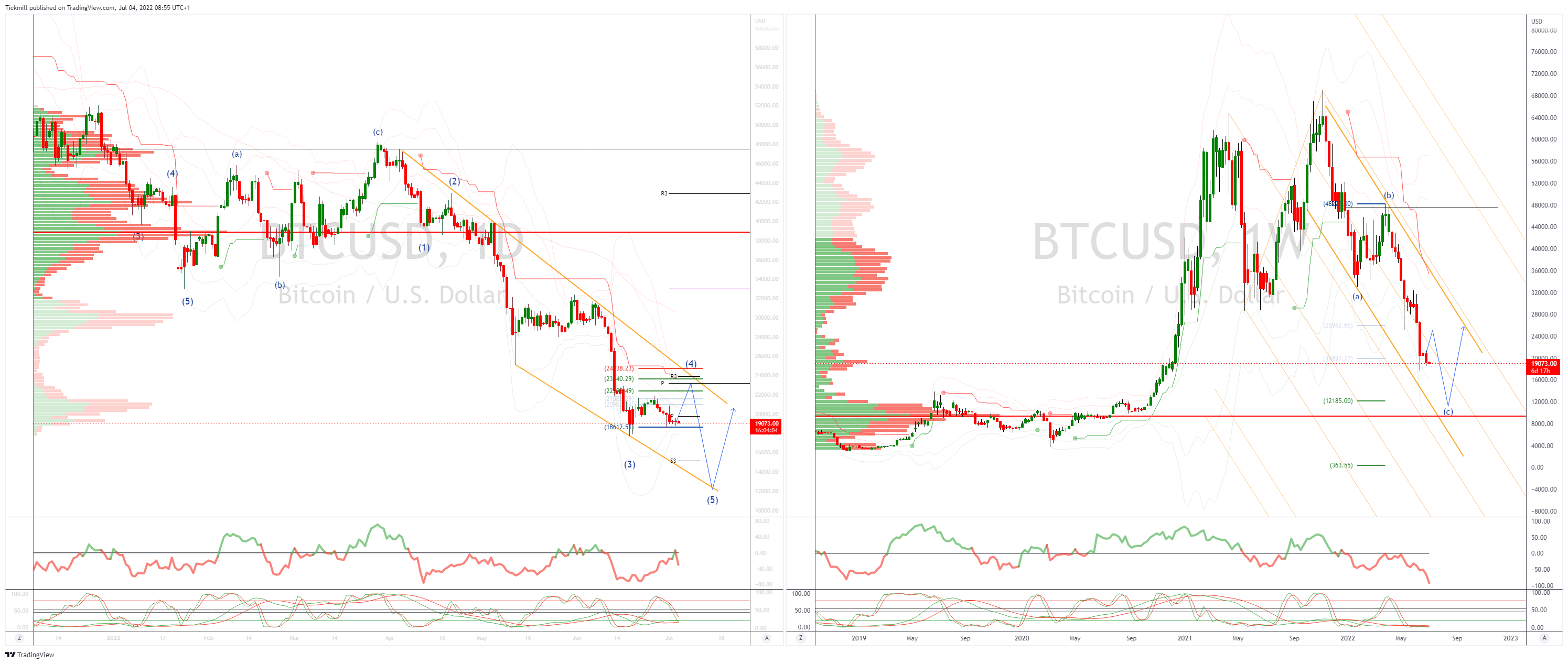

BTCUSD Bias: Bullish above .22000 Bearish below

- BTC opens the week down 1.32% weighed by souring risk sentiment

- Three Arrows Capital bankruptcy pressures amid concerns about further liquidations

- Trend remains down as within broader bearish channel beckons

- Support seen at 19k then 18300 the base of the daily VWAP bands failure here opens a retest of lows

- 20 Day VWAP remains bearishly oriented and untested

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!