Daily Market Outlook, July 6, 2022

Daily Market Outlook, July 6, 2022

Overnight Headlines

- UK PM Scrambles To Save Himself, Reshuffles Top Cabinet

- New Chancellor Zahawi Inherits Faltering Economy, Inflation

- Tory Rebels Plan Rule 1922 Change To Expel UK's Johnson

- Biden Prepares Action To Reshape Trump's Tariffs On China

- US Pushes ASML To Stop Selling Chipmaking Gear To China

- Blinken Plans A ‘Candid Exchange’ With China Over Ukraine

- US Call For Russia Pressure To Open Grain Delivery Lanes

- Shanghai Mass Testing Fuel Fear Another Lockdown Looms

- ECB Policymakers Unwavering In Support For Tighter Policy

- BoE's Tenreyro: Gilt Sales Unlikely To Have Economic Affect

- Goldman Say Oil Has Overshot As Global Deficit Unresolved

- Europe Gas At Near 4-Month High, Focus On Tight Supplies

The Day Ahead

- Global recession fears continued to dominate the mood in financial markets, despite reports suggesting that US-China talks may lead to lower trade tariffs. European equities closed lower yesterday after a constructive start to the week, while their US counterparts ended in the red after the return from a public holiday. Asian stock markets followed through with widespread sell-offs. Brent crude oil dropped to a low of $101.10 yesterday but is slightly higher overnight. US 10-year Treasury yields has declined to 2.80%.

- The release of the minutes of the US Federal Reserve’s June policy meeting will be closely parsed as markets assess how policymakers respond to the trade-off between a weakening economic outlook and still uncomfortably high inflation. The Fed upped the ante and hiked rates by 75bp last month, with Chair Powell indicating that a similar rise is in play later this month. Powell indicated that evidence of rising longer-term inflation expectations among consumers partly justified the bigger hike. However, that measure of inflation expectations has since been revised lower. Nevertheless, given the Fed’s imperative to meet its inflation objective, the tone of the minutes is still likely to be ‘hawkish’ with the likelihood of further aggressive tightening flagged.

- In the UK, political uncertainty has increased after the resignations of the Chancellor and the Health Secretary yesterday. PM Johnson has indicated he is determined to stay on, while reports suggest his party’s MPs may seek to amend the rules over leadership changes. PMQs take place today. Meanwhile, Bank of England Chief Economist Pill is scheduled to give a keynote address entitled ‘The role of Central Banks in a Transforming World’ at a Qatar conference. Earlier this morning, BoE Deputy Governor Cunliffe said UK growth will be ‘essentially flat’ over the coming year, but the Bank will act to bring down inflation.

- Data wise, the UK construction PMI for June will be released and is expected to show continued expansion in activity in the sector. Yesterday’s UK services PMI was revised up to 54.3. Financial markets, nevertheless, are focused on softening business expectations. This morning’s Eurozone retail sales figures are likely to attract limited attention. Broader concerns remain about the curtailment of energy supplies from Russia and the impact on the Eurozone economy. The US data focus will be the ISM services survey. Look for a fall to 54.5 in June from 55.9, which would be the weakest pace of expansion for two years.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0230 (570M), 1.0250 (471M), 1.0300-10 (374M)

- 1.0400-10 (350M)

- USD/JPY: 133.97-00 (682M), 134.50-60 (710M)

- 135.00 (615M), 135.00 (615M), 136.00 (506M)

- GBP/USD: 1.2250 (204M)

- AUD/USD: 0.6675-85 (487M). NZD/USD: 0.6200 (392M)

- 0.6410 (1.18BLN). AUD/JPY: 89.30 (1.1BLN), 93.49 (773M)

- USD/CAD: 1.2830 (566M), 1.3000 (380M), 1.3050-60 (270M)

Technical & Trade Views

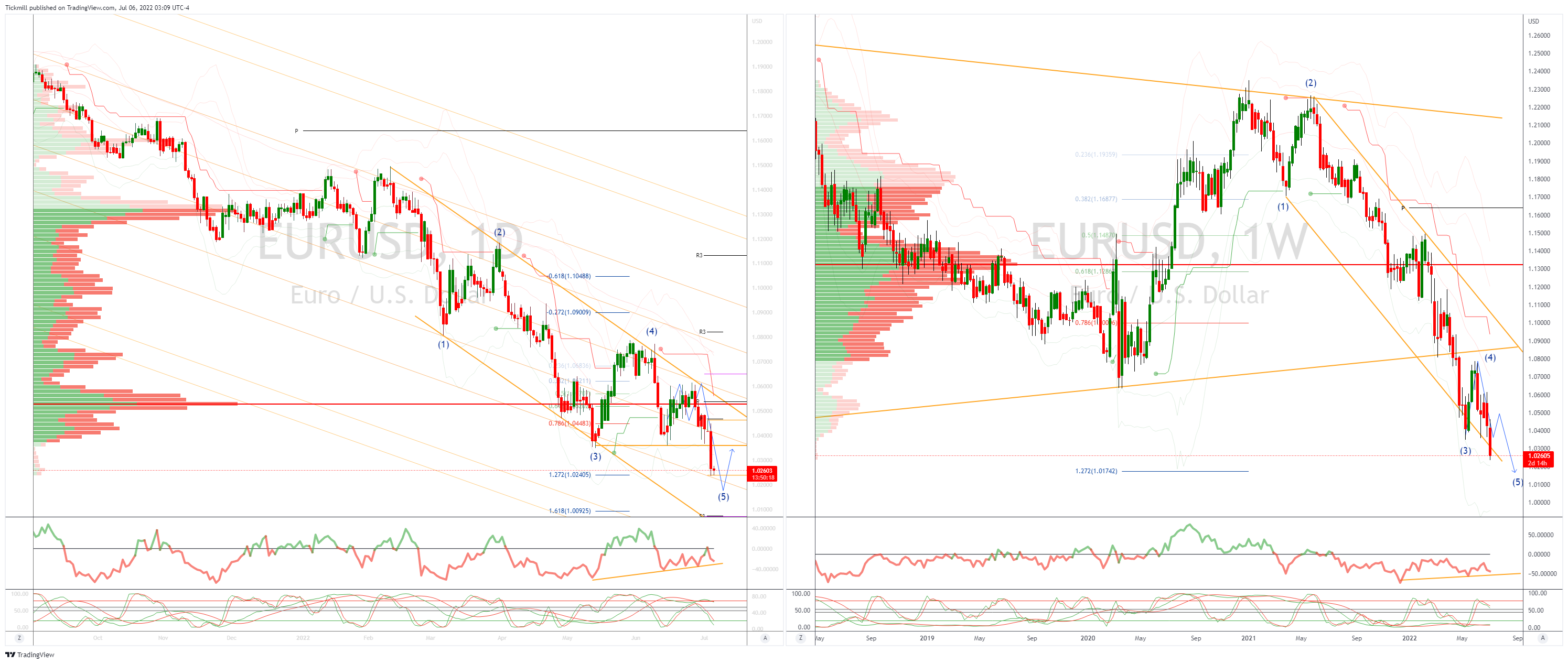

EURUSD Bias: Bearish below 1.05

- Consolidates after big losses on Tuesday’s increasing recession fears

- EUR/USD prints 20 year lows sub 1.0250

- Huge 17% increase in European natural gas prices raise recession alarms

- Lack of co-ordination on ECB support to indebted Eurozone states sours sentiment

- June Eurozone business growth adds further pressure to Euro

- Fed June meeting minutes released later as market eyes potential 75bps hike in July

- Bears eyeing a parity test; offers seen at 1.0340/60

- 20 Day VWAP is bearish, 5 Day bearish

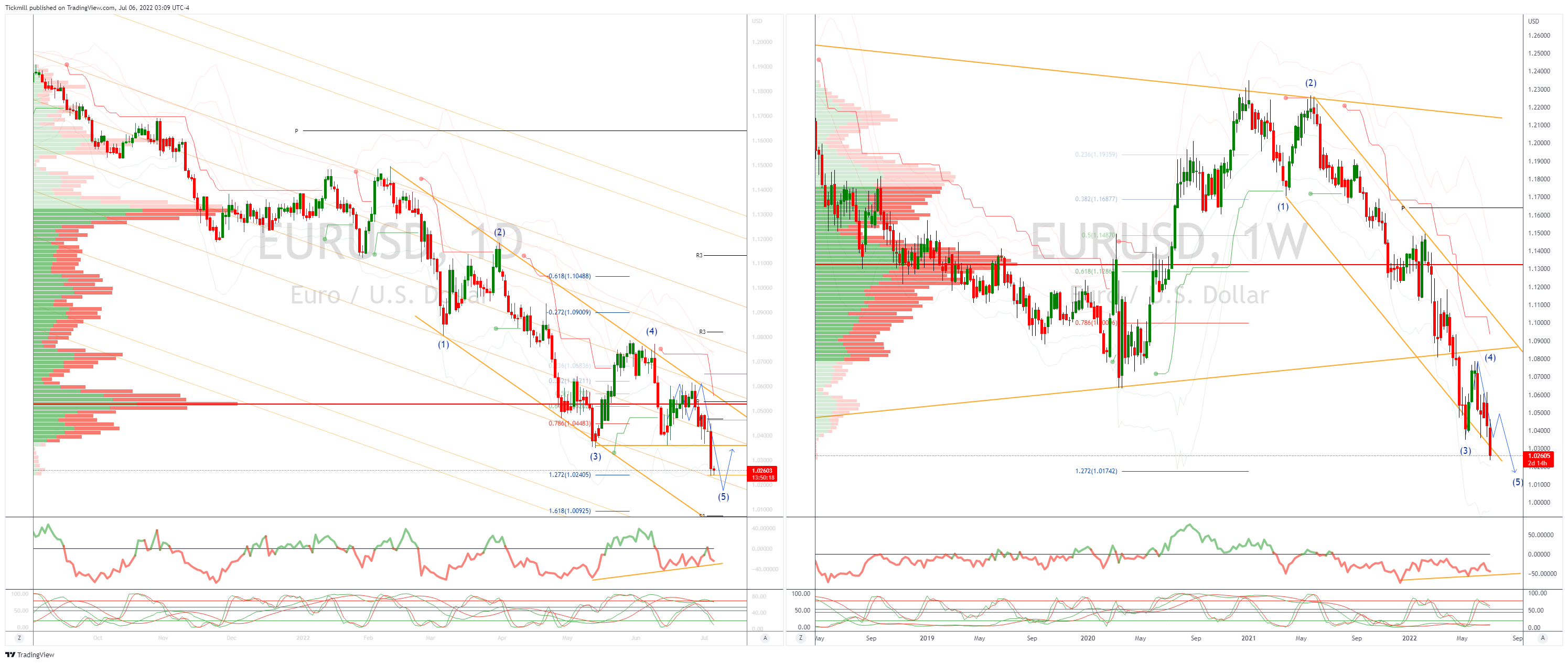

GBPUSD Bias: Bearish below 1.2150

- GBP pressured by political developments and weakening economy

- GBP/USD sitting at you year lows after losing 1.25% yesterday

- Fin Min & Health Sec quit Johnson Government decrying poor leadership

- New Fin Min Zahawi left to manage weak econ & cost of living crisis

- Energy price inflation and recession fears weigh on GBP

- Bears breach YTD lows en-route to a test of 1.18

- Offers seen at 1.2130/60 Bids 1.1770

- 20 Day VWAP is bearish, 5 Day bearish

USDJPY Bias: Bullish above 134

- JPY demand rises on recession fears

- USD/JPY off another leg, 135.90 to 135.13 EBS

- Japanese importer bids seen at 135

- Traders betting on 134/137 range trade

- US10Y 2.84 trading firmer by just under 1% seen as supportive for USD/JPY

- Initial offers seen at 136.55/65 stops above to see retest of 137

- Option barriers KO’s quoted at 137 remain intact

- 20 Day VWAP is bullish, 5 Day bullish

AUDUSD Bias: Bearish below .7050

- Recovers .68 handle as LDN opens up

- Commodity crush continues to weigh on AUD

- Oil and Index futures in the US recover lost ground supporting nascent AUD bid

- Offers seen towards .6900

- AUD likely to take its lead from commodity trade ahead of FOMC minutes later

- Support seen at the 50% retracement of the 0.5510/0.8007 move at 0.6758

- 20 Day VWAP remains untested confirming downside

- 20 Day VWAP is bearish, 5 Day bearish

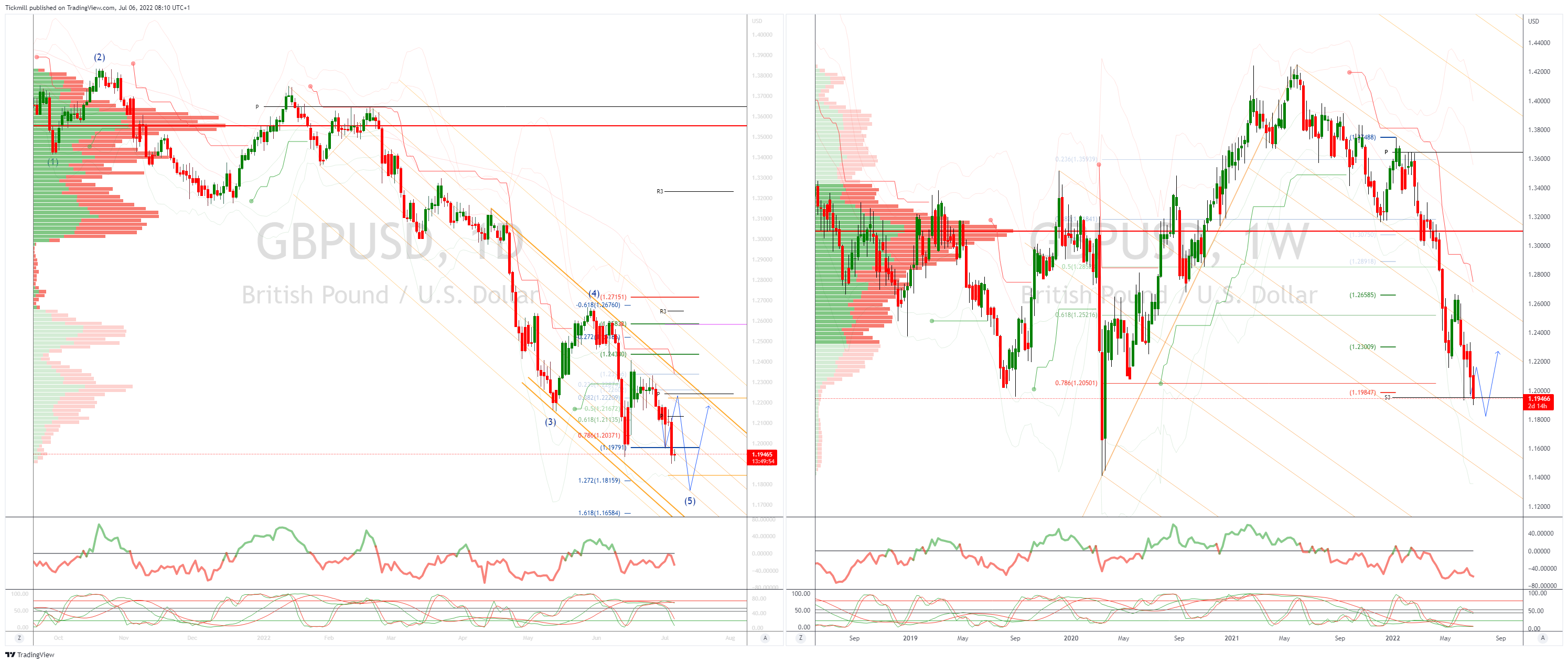

BTCUSD Bias: Bearish below 22k

- BTC continues to rotate around 20K weighing by recession fears

- Testing the 20 day VWAP which remains bearish

- 20 VWAP band contracting ready for next directional drive

- Trend remains down as within broader bearish channel beckons

- Support seen at 19k then 18300 the base of the daily VWAP bands failure here opens a retest of lows

- 20 Day VWAP remains bearishly oriented and untested

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!