Daily Market Outlook, June 22, 2022

Daily Market Outlook, June 22, 2022

Overnight Headlines

- UK inflation hits new 40 year high of 9.1% in May

- Asian Equity Markets Slide As Recession Angst Drives Tech Selling

- Bitcoin Sinks Again As Risk-Off Mood Returns On Recession Fears

- Biden To Call On Congress Wednesday To Pass A Gas Tax Holiday

- White House Economist Remains Optimistic US Can Avoid Recession

- Fed’s Powell Faces Test Of ‘Unconditional’ Resolve To Tame Inflation

- Richmond Fed's Barkin Backs 50 Or 75 Basis Point Rate Hike In July

- Germany Prepares To Trigger Second Stage Of Emergency Gas Plan

- Draghi’s Coalition Roiled By Ukraine War As Minister Quits Party

- China Vows More Pro-Growth Policies As Banks Urged To Step Up

- BoJ Debated The Weak Yen, Warned Of Harm From Excess Moves

- Yen Bruised As Japan's Rates Gap Widens With Rest Of The World

- Crude took another leg lower as risk appetite in Asia deteriorated

The Day Ahead

- Asian equity markets are mostly lower this morning. That seems to reflect a general weakening in market risk sentiment ahead of today’s comments from US Federal Reserve Chair Powell. Ahead of that, Fed policymaker Barkin said the US central bank should raise interest rates as fast as it can without causing undue harm to financial markets or the economy. Meanwhile, US President Biden will reportedly today call for a gasoline tax holiday to combat rising inflation. In China, the authorities have made further pledges to ramp up economic support. A key China news service has reported that new pro-growth policies are being studied.

- Just released data for the UK CPI showed annual headline inflation at 9.1% in May, up from 9.0% in April. That was principally due to further rises in food and fuel prices. However, core inflation (excluding food and energy prices) fell slightly to 5.9% from 6.2% in May as an easing in goods price inflation in some areas more than offset some rises in service sector prices. Producer prices rose by more than expected in May, and April figures were revised up which points to further inflationary pressures still in the pipeline.

- Today sees the Fed’s Powell make the first of two days of semi-annual testimony to the US Congress. He will appear before a Senate committee today and a House committee tomorrow. Last week the Fed hiked US policy interest rates for the third meeting in a row but this time it did so by 75bp, its large increase in a single move since 1994. That came in response to a higher-than-expected May CPI inflation outturn and signs that inflation expectations are rising. As is the case with many central banks around the world, the Fed is facing criticism from politicians right now about underestimating inflation and being slow to react to its rise. Given that Powell may get a rough ride today, he seems set to be questioned closely about how quickly inflation will come down, what level of interest rates will be required and what the impact will be on the economy. He is likely to reiterate the Fed’s commitment to lowering inflation but may find it very hard to satisfy all sides.

- The rest of the day’s data calendar is light with just the ONS’s house price index in the UK, which so far has shown no evidence consistent of house price rises slowing in 2022. In the Eurozone, consumer confidence data for June are expected to show an ongoing impact from high inflation and ongoing uncertainties. As a result, it has slipped sharply this year and is now close to its pandemic low. It did rise modestly in May from April’s two-year low and a further small rise is expected for June. Nevertheless, its predicted June level would still suggest that Eurozone consumers are likely to behave cautiously.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0395-00 (570M), 1.0410-15 (285M), 1.0435-40 (600M)

- 1.0500 (594M), 1.0550 (284M), 1.0580 (576M), 1.0595-00 (717M)

- GBP/USD: 1.2245 (658M)

- AUD/USD: 0.6800 (200M), 0.6925 (425M), 0.7025-30 (333M)

- NZD/USD: 0.6200 (532M), 0.6300 (1.0BLN), 0.6430 (300M)

- USD/CAD: 1.3020 (520M), 1.3150 (735M)

- EUR/CHF: 1.0250 (350M), 1.0275 (270M), 1.0300 (764M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.07 Bullish above

- Crude collapse weighs on XXXUSD majors

- EUR/USD trades sub 1.05 again as London sessions starts

- Bids eyed 1.0450 with support at 2022 low at 1.0349

- Focus today on market response to Fed Chair Powell's testimony

- Initial offers are seen at 1.0560 ahead 1.0615

- Bids eyed towards 1.0450 ahead of cycle lows

- Daily VWAP is bearish

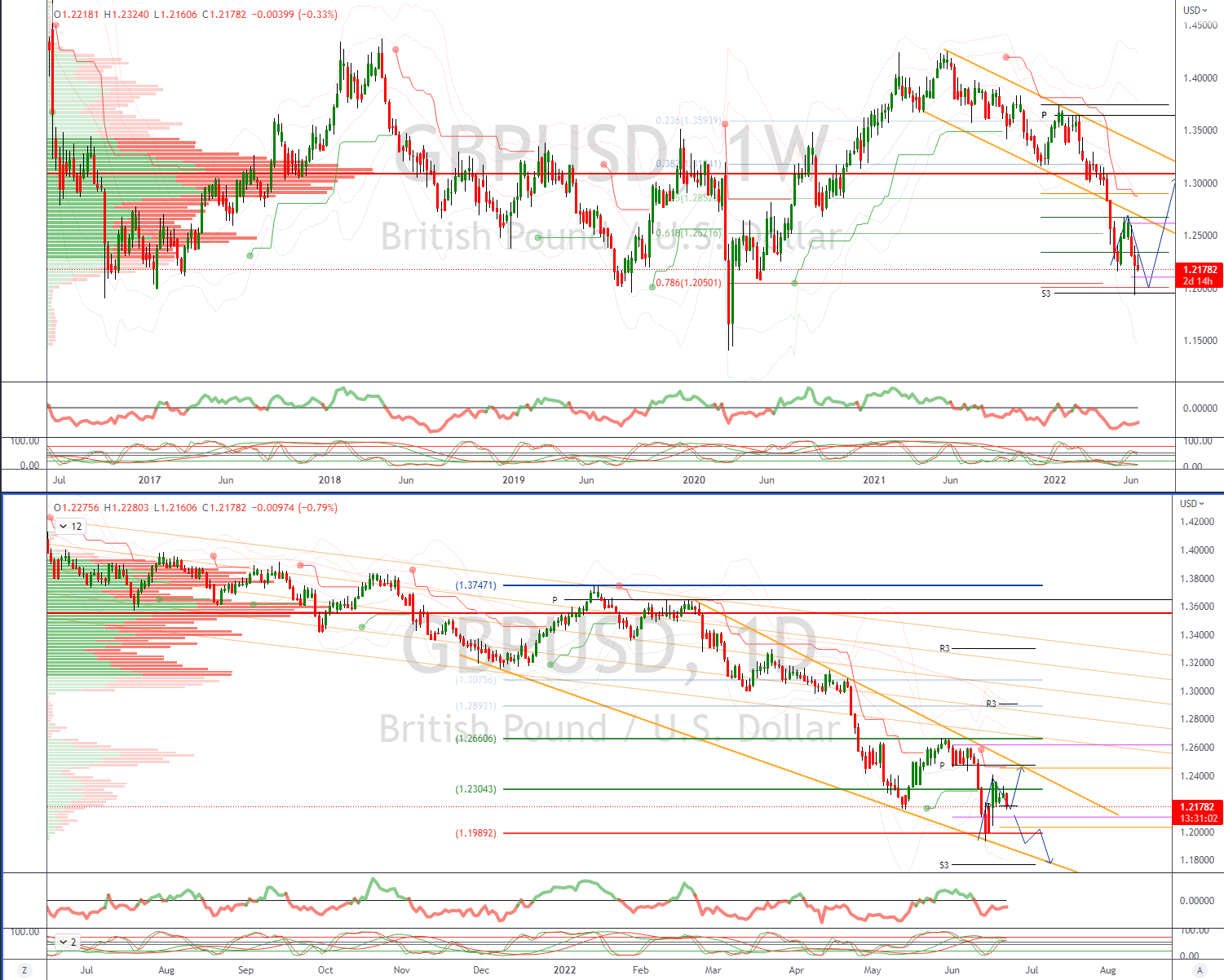

GBPUSD Bias: Bearish below 1.26 Bullish above.

- Fed's Powell awaited, likely maintains hawkish stance

- The base of 20 day VWAP slips below 1.20 again

- GBP/USD has declined from 1.4250-1.1934 since BOE turned hawkish

- Targets for bears move to a test of 1.18

- May CPI weighing on GBP as London session starts

- Resistance remains sited at 1.2410

- Support eyed at 1.2180

- Daily VWAP is bearish

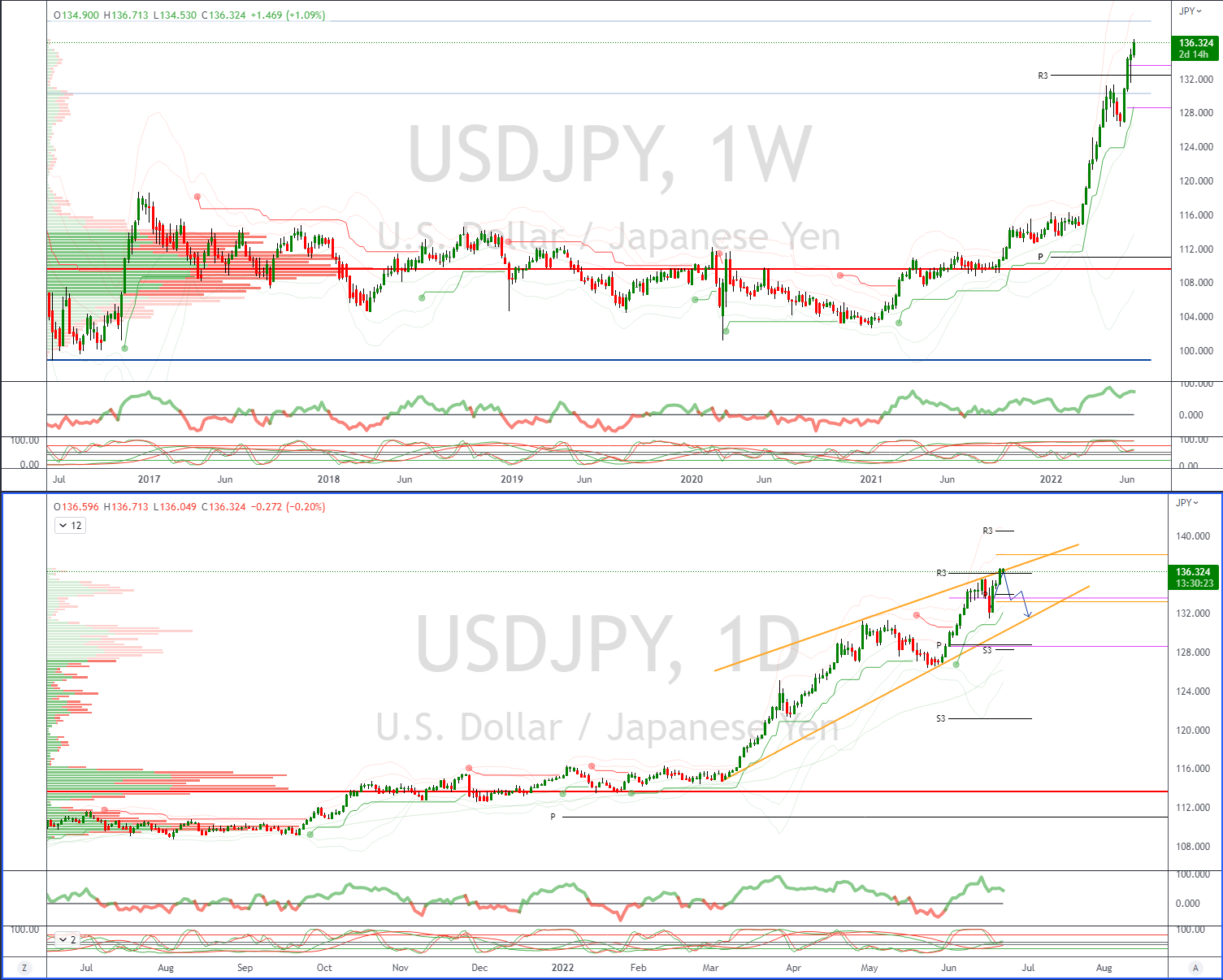

USDJPY Bias: Bullish above 132 Bearish below

- USD/JPY recovers after from Asian pull back to test offers and stops to 136.71 highs

- 136.90 is a notable level as it represents a high dating back to October 1998

- 137.00 seen as an options knock out level

- Exporters remain on the offer in Asia trade

- US yields soften and not supportive 2s trade 3.168%, 10s trade 3.232%

- Downside seen as corrective, importer bids raised to 136.00

- Daily VWAP is bullish with strong support back at 132

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD/USD under pressure as srisk sentiment sours

- Daily VWAP remains untested confirming downside

- Bears now targeting a test of the basse towards 0.6840’s

- Fed chair Powell to testify to Congress Wednesday

- Hawkish comments from Powell will add fuel to the fire

- Continued concerns regarding global growth continue to cap

- Offers seen towards .70, bids eyed back at .6850

- Daily VWAP is bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!