Daily Market Outlook, June 23, 2022

Daily Market Outlook, June 23, 2022

Overnight Headlines

- Fed Chair Powell: Soft Landing Very Challenging; Recession Possible

- Dollar Languishes Amid Lower US Yields As Recession Fears Mount

- Bitcoin Recovered After Prices Briefly Slipped Beneath 20,000 Level

- G7, NATO To Ratchet Up Pressure On Russia, Keeping Eye On China

- US President Biden Announces A Likely Doomed Gas Tax Holiday

- Biden Approval Falls Fourth Straight Week, Tying Record Low: IPSOS

- Fed's Evans: Another Big Rate Hike 'Reasonable' Discussion For July

- Fed's Harker: Interest Rates Should Reach Above 3%, Then Reassess

- Market Expect ECB To Hike Rates By 25bps In July & 50bps In Sep

- Zelenskiy Calls For Arms, EU Membership As Russia Pounds Cities

- Xi Vows To Meet Growth Target That Analysts Say Is Out Of Reach

- Japanese June Factory Activity Growth Eases On Chinese Curbs

- Westpac Expect RBA To Hike By Half-Point At Next Two Meetings

- Crude Oil Hit Again As Recession Angst Rips Through Commodities

- Asian Equity Markets Mostly Higher; China Tech Stocks Lead Gains

The Day Ahead

- Asian equity market performance was mixed overnight as investors digested yesterday’s comments from US Fed Chair Powell’s testimony to Congress. The Hang Seng index outperformed on reports that Hong Kong is planning to reopen its borders. Powell acknowledged that a soft landing for the US economy is ‘very challenging’ and that a recession is ‘certainly a possibility’. Another 75bp rate hike by the Fed is expected next month with further, smaller, hikes priced in by markets for the remainder of the year.

- Preliminary ‘flash’ PMI surveys for June will be released this morning, covering the Eurozone, the UK, and the US, among others. We expect the surveys to provide further evidence that activity has softened in the face of headwinds such as higher inflation and interest rates, and the war in Ukraine. For the UK, interpreting this month’s data may be complicated by the extra Bank Holiday which, unlike regular holidays, will not be covered by the seasonal adjustment process. That may lower the level of monthly activity in manufacturing but raise it for some recreational services. Overall, look for the UK headline manufacturing index to decline to 54.2 from 54.6 and the services index to fall to 53.0 from 53.4. The CBI will also release its June distributive trades (including retail) survey at 11am.

- In the Eurozone, expect the manufacturing PMI to fall for a sixth month in June to 54.2. Its output component in May was only slightly above 50, weighed down by supply chain disruptions, while total orders fell below 50 for the first time in two years. For services, expect a slight decline to 55.7 leaving it firmly in growth territory. Pent-up consumer demand and a shift in spending towards services are being offset by rising costs and uncertainty.

- The US PMI data tend to be watched less closely than their European equivalents but will provide some insight into the latest activity and price trends. Today also sees Fed Chair Powell make his second semiannual testimony to US Congress. He will appear before a House committee after yesterday’s testimony to the Senate.

- Early tomorrow sees the release of the June UK GfK consumer confidence survey. Consumer confidence has fallen sharply in recent months, most likely due to higher inflation and the impact on real spending power. Look for a modest rebound for this month to -38, reflecting a Platinum Jubilee feel-good factor and also a boost from the announcement of the government’s cost of living support package. However, the reading is still expected to be close to last month’s all-time low. Also due tomorrow will be official UK retail sales figures for May and the results of the two by-elections.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0450-55 (1.18BLN), 1.0460-65 (711M)

- 1.0500 (1.425BLN), 1.0525-30 (338M)

- 1.0595-00 (990M)

- USD/JPY: 134.00 (641M), 135.00 (998M), 137.00 (470M)

- USD/CHF: 0.9550 (260M), 0.9580 (288M)

- 0.9630 (427M), 0.9645 (332M), 0.9700 (600M)

- GBP/USD: 1.2300 (429M), 1.2380 (358M), 1.2400 (726M)

- EUR/GBP: 0.8515 (1.19BLN), 0.8590 (230M), 0.8700 (300M)

- 0.8725 (627M)

- AUD/USD: 0.7000 (322M), 0.7025 (313M), 0.7050 (300M)

- NZD/USD 0.6350 (210M). USD/ZAR: 16.10 (270M)

- USD/CAD: 1.2800 (1.36BLN), 1.2915 (1.0BLN), 1.2935 (260M)

- 1.3040-50 (441M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR/USD traded higher on Powell testimony

- Consolidates during the Asain session in a tight 1.0556/80 range

- Commodities remain pressured caping upside near term

- Initial offers are seen at 1.0560 ahead 1.0615

- Bids eyed towards 1.0450/70 ahead of cycle lows

- Daily VWAP is bearish

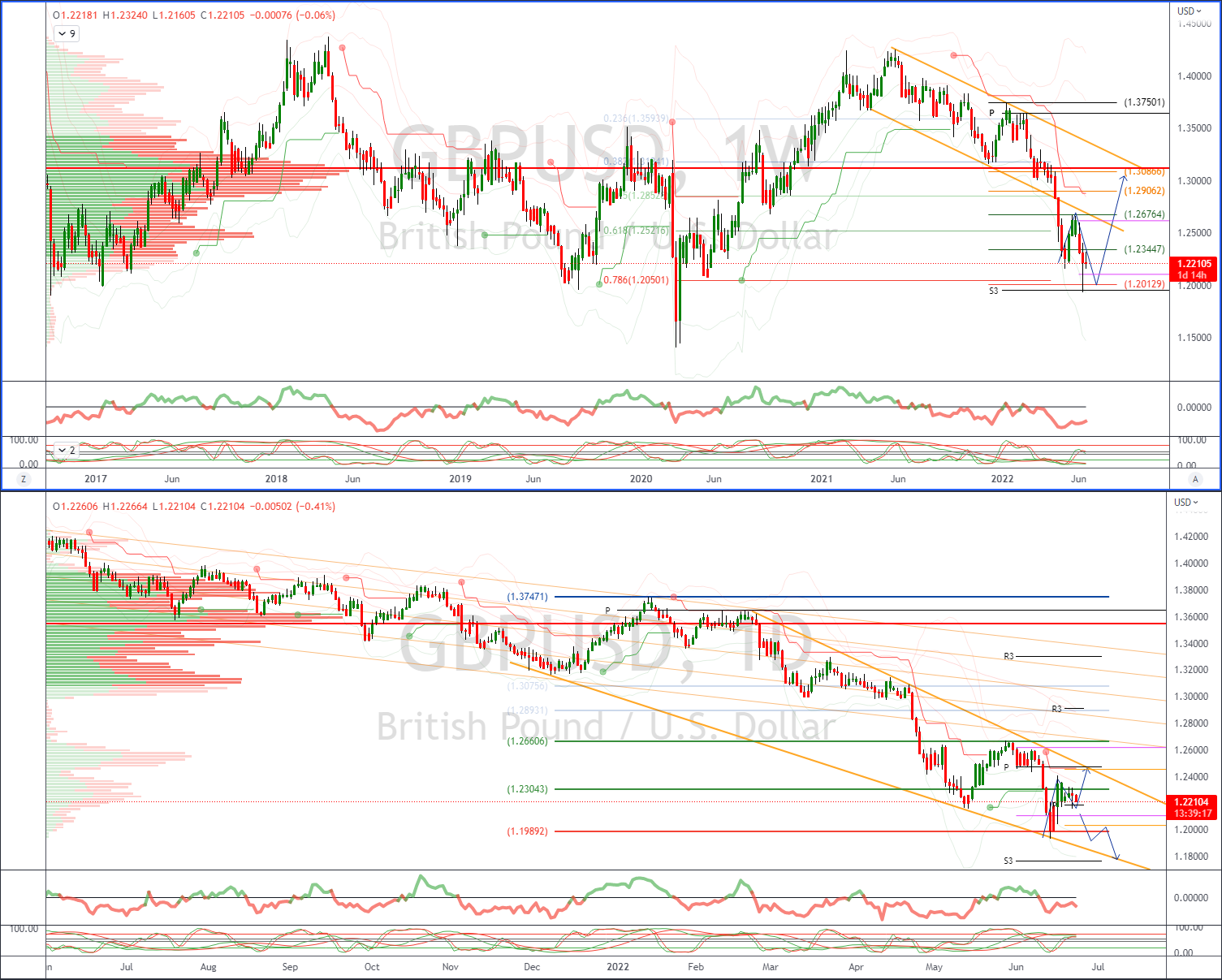

GBPUSD Bias: Bearish below 1.26 Bullish above.

- Cable continues to consolidate heading into the end of the wee 1.2232-63

- Upside resistance seen by sizeable option expiries at 1.2300, 1.2370-80, 1.2400

- Negative headlines UK rail strike, Brexit concerns also weigh

- UK CPI/RPI remain elevated markets eyeing a potential 50bps move by BOE

- Resistance remains sited at 1.2410

- Support eyed at 1.2180

- Daily VWAP is bearish

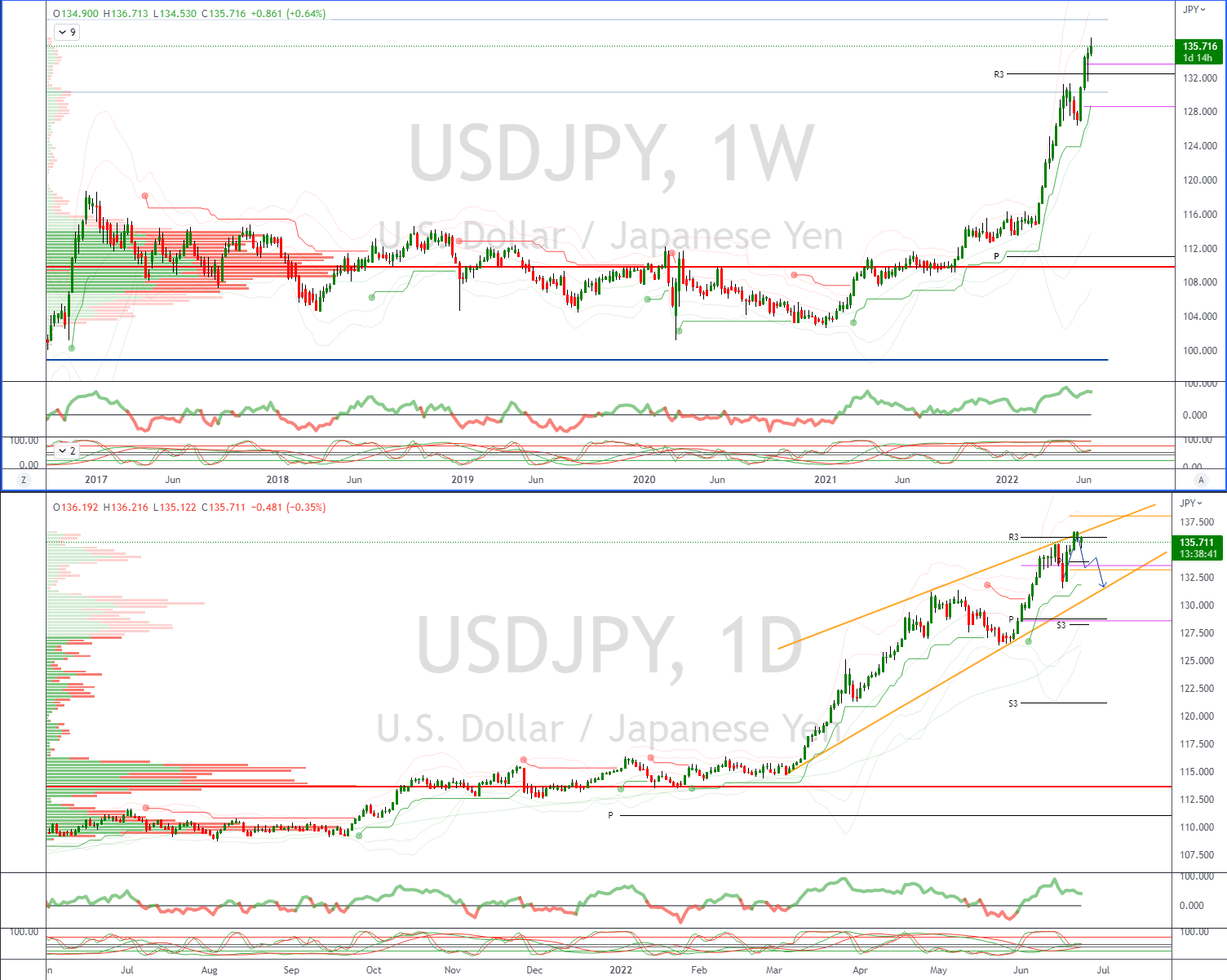

USDJPY Bias: Bullish above 132 Bearish below

- XXXJPY seen offered on broader JPY profit taking

- Flows seen driven by M&A activity and stops being triggered

- Market chatter of exMOF Nakao eyeing FX intervention and a pause in BoJ YCC

- Sizeable $999 mln in option expiries at 135.00 strike

- Downside seen as corrective, importer bids seen 135.00

- Daily VWAP is bullish with strong support back at 132

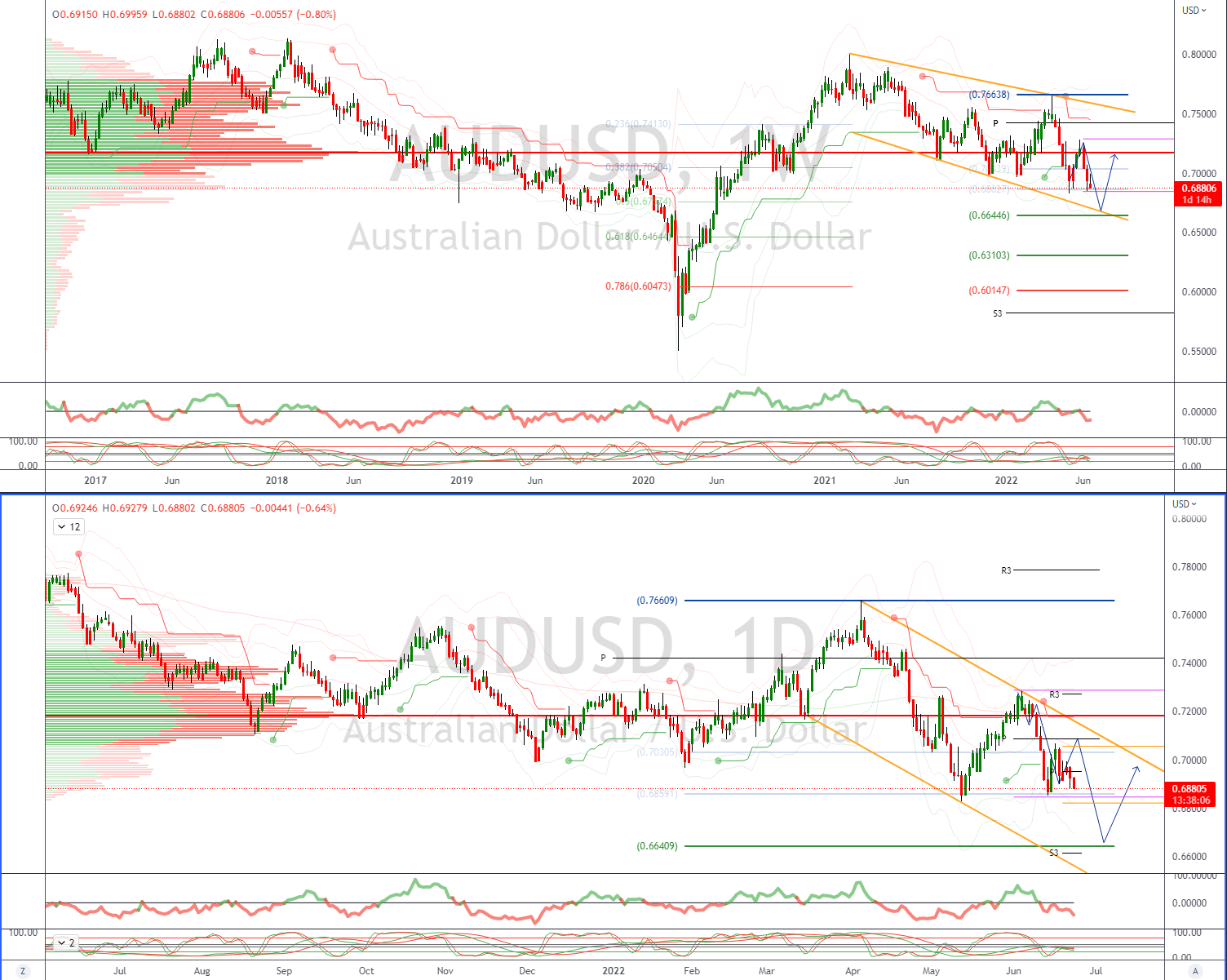

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD/USD weak as commodities continue to weigh

- Iron ore & crude remain under pressure trading sub 2% in the Asian session

- AUD/USD trending lower and the initial target is the 2022 low at 0.6829

- Daily VWAP remains untested confirming downside

- Bears now targeting a test of the basse towards 0.6840’s

- Continued concerns regarding global growth cap upside

- Offers seen towards .70, bids eyed back at .6850

- Daily VWAP is bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!