Daily Market Outlook, June 28, 2022

Daily Market Outlook, June 28, 2022

Overnight Headlines

- Risk Sentiment Buoyed By China Headlines on Travel And Policy Moves

- China Vows Timely Policy Measures To Cope With Economic Risks

- China To Cut Covid Quarantine For Travelers From 3 Weeks To 10 Days

- ECB’s Kazaks Says Worth Looking At 50BPS Hike In July

- US ComSec. Presses Lawmakers To Greenlight $52Bln For Chipmaking

- Biden Raises US Tariff Rate On Certain Russian Imports To 35%

- Russia In Historic Debt Default As Sanctions Hit Payments

- UK PM Johnson Wins Commons Vote On Bill To Rip Up N Ireland Protocol

- Central Banks In Asia Spend Billions To Slow Currency Declines

- Japan Premier Support Slips Ahead Of Vote On Inflation Worries

- China Extends Anti-Dumping Tariffs On EU, UK Steel Fasteners Imports

- Euro Gains Traction Ahead Of Inflation Data, Dollar Steadies

- Oil Extends Gains On Supply Disruptions Ahead Of OPEC+ Meeting

- OPEC+ Trims 2022 Market Surplus Projection To 1Mln Bpd

- Raft Of US Banks Raise Dividends After Stress Tests

The Day Ahead

- Equity markets are mixed during the Asian trading session following the negative close on Wall Street. Markets are higher in Japan, South Korea and Australia, but lower in Hong Kong. Brent crude moved up above $116 a barrel on reported supply issues. US Treasury yields edged lower after rising in the last two sessions. Germany reported a fourth fall in consumer confidence in the past five months.

- Markets will likely be focused on the ECB’s forum on ‘Challenges for monetary policy in a rapidly changing world’ in Sintra (Portugal). They will await tomorrow’s policy panel at the forum consisting of the heads of the ECB, the US Federal Reserve and the Bank of England, as policymakers navigate the trade-off between high inflation and weakening growth prospects. Today, ECB President Lagarde will give an introductory speech in Sintra at 9am which will be followed by sessions on ‘Globalisation and labour markets in the post-pandemic economy’ and ‘Energy price volatility and energy sources in Europe’, hosted by ECB Chief Economist Lane. Then there will be a panel discussion on central bank digital currencies, chaired by the ECB’s Panetta with participants including BoE Deputy Governor Cunliffe.

- On the economic data front, US releases include the goods trade balance and the Conference Board’s measure of consumer confidence. The widening trade deficit was a factor resulting in a contraction in Q1 GDP. Today’s goods deficit data for May is forecast to narrow for a second consecutive month. That will add to expectations that US GDP growth will rebound in Q2. Growth, however, is expected to moderate in the second half of the year and in 2023. For US consumer confidence, expect a fall to 100.0 in June from 106.4 which would be the lowest since early 2021, driven by the impact of high inflation.

- The British Retail Consortium’s shop price index is due early Wednesday and provides an early guide to inflation on commonly purchased goods. It has trended higher over the past twelve months.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0450-60 (600M), 1.0595-05 (883M)

- USD/JPY: 135.00 (350M). GBP/USD: 1.2185 (247M)

- USD/CHF: 0.9425 (480M), 0.9550 (471M), 0.9645 (260M)

- EUR/CHF: 1.00 (280M), 1.0125 (276M), 1.0200 (280M)

- AUD/USD: 0.7000-05 (378M), 0.7040-50 (423M)

- USD/ZAR: 16.37 (220M)

Technical & Trade Views

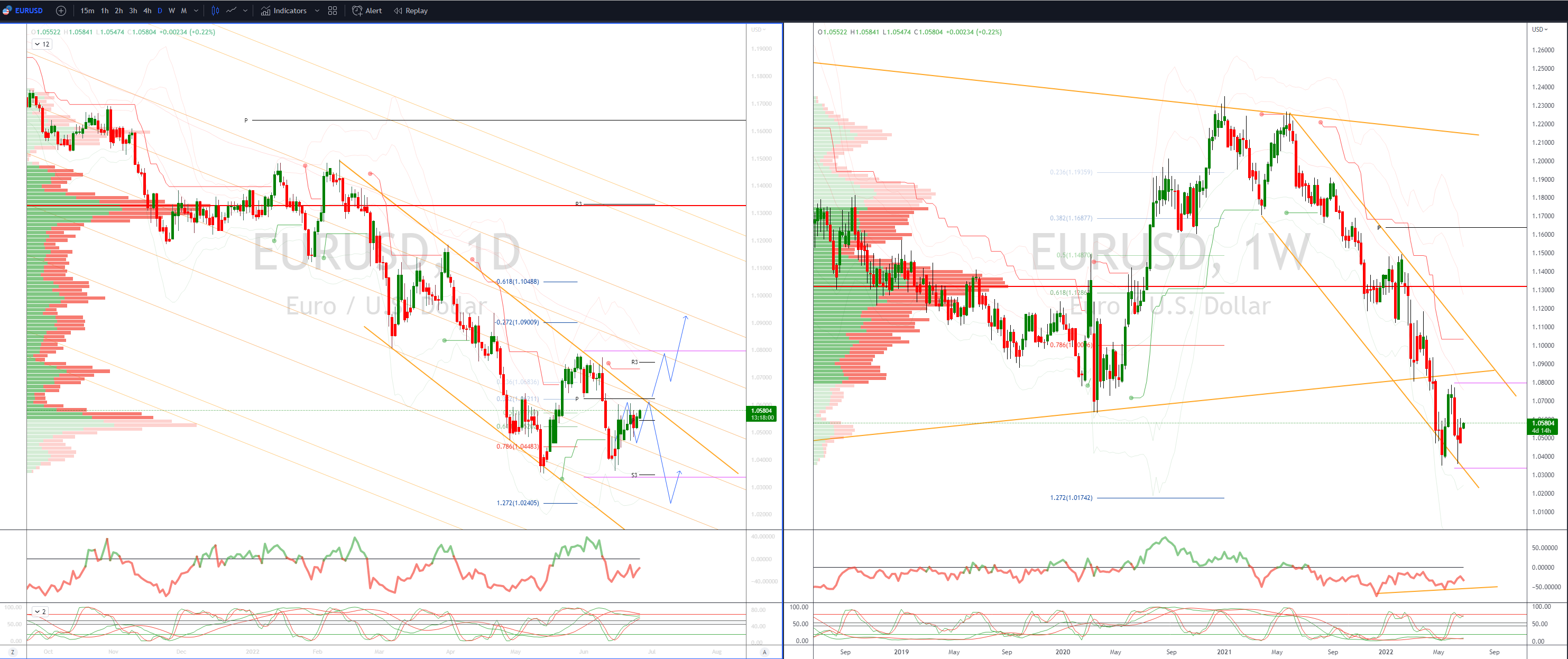

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR/USD in a holding pattern waiting for clues on ECB intentions

- Trading continued within yesterday's range as LDN starts

- Market waits for ECB President Lagarde who speaks this morning will likely provide directional catalyst

- Initial offers are seen at 1.0615/20 ahead 1.0650

- Bids eyed towards 1.05/15 ahead of cycle lows

- 20 Day VWAP is bullish, 5 Day bullish

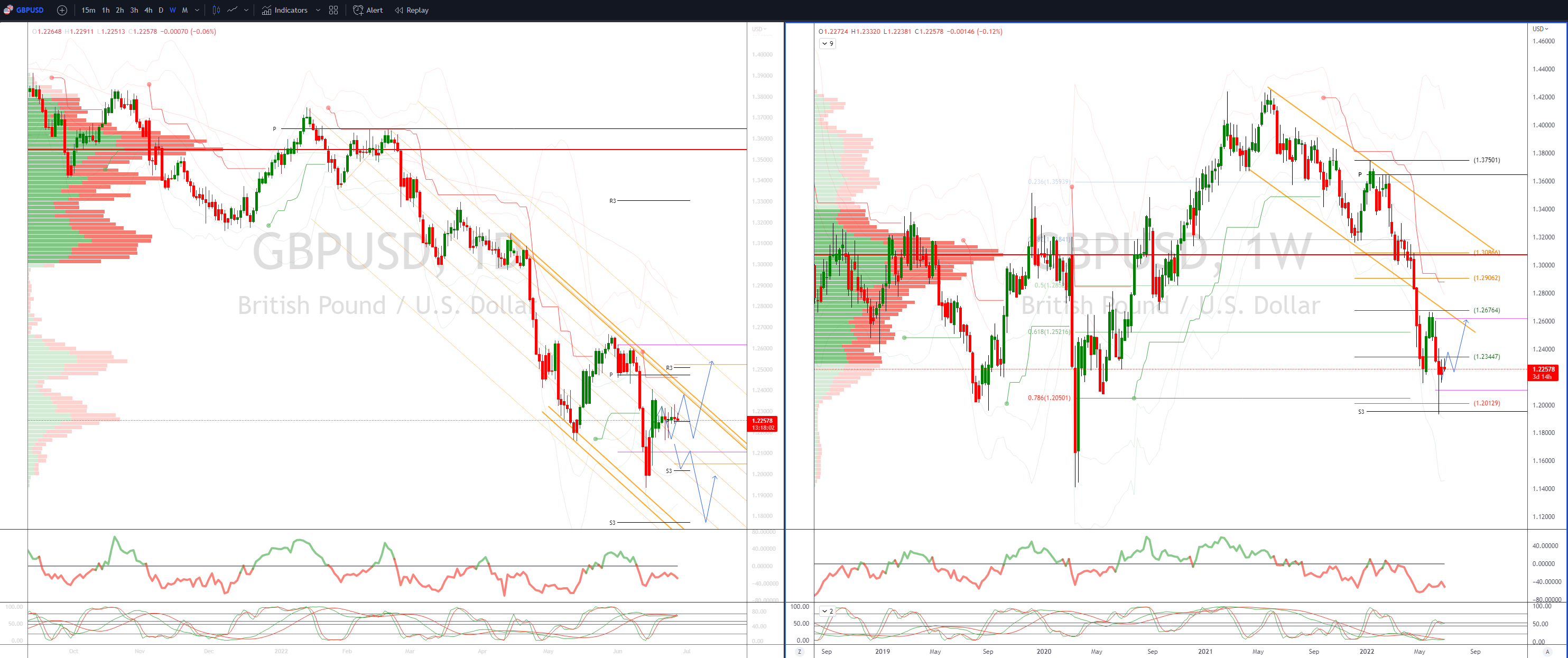

GBPUSD Bias: Bearish below 1.26 Bullish above.

- GBP/USD briefly lifts in response to risk appetite on China news

- Retreats from intraday high of 1.2288 as LDN session starts

- Offers eyed above 1.2315

- UK's Northern Ireland trade law passed in Parliment on Monday

- Tomorrow notable options Wednesday sizeable GBP1.5 bln at 1.2750

- Despite ongoing negative headlines, weak econ data, strikes & party gate GBP holds up

- Resistance remains sited at 1.2410

- Support eyed at 1.2180

- 20 Day VWAP is bearish, 5 Day bullish

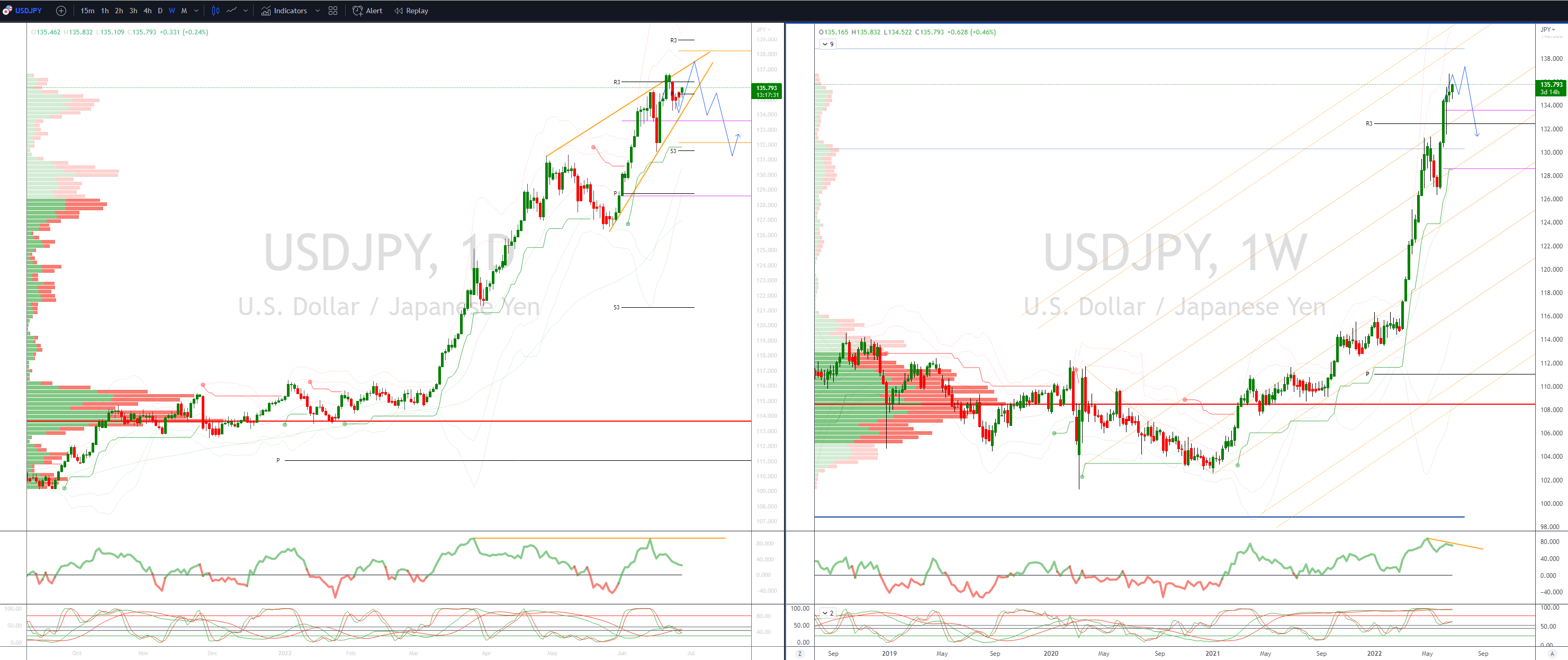

USDJPY Bias: Bullish above 132 Bearish below

- USD/JPY bid in the Asian session, firmer US yields supportive

- US yields bid in Asian trade, remain firm, 10 yr Treasury trading 3.22%

- Japanese importer bids sited towards 135

- Exporter offers above 136

- Notable options expiries at 133.50 and 134.00 strikes go off Friday

- Global equity sentiment continues to strengthen

- 20 Day VWAP is bullish, 5 Day bullish

AUDUSD Bias: Bullish above .7200 Bearish below

- In a quiet Asian session the AUD/USD briefly traded above yesterdays highs

- AUD pops on risk sentiment and China headlines

- Bids are tipped ahead of 0.6900 with support at Jube 14 low at 0.6850

- Market waiting further inflation inputs with US PCE price index eyed Thursday

- 20 Day VWAP remains untested confirming downside

- Bears now targeting a test of the base towards 0.6840’s

- Offers seen towards .6960, bids eyed back at .6900 and stronger to .6850

- 20 Day VWAP is bearish, 5 Day bearish

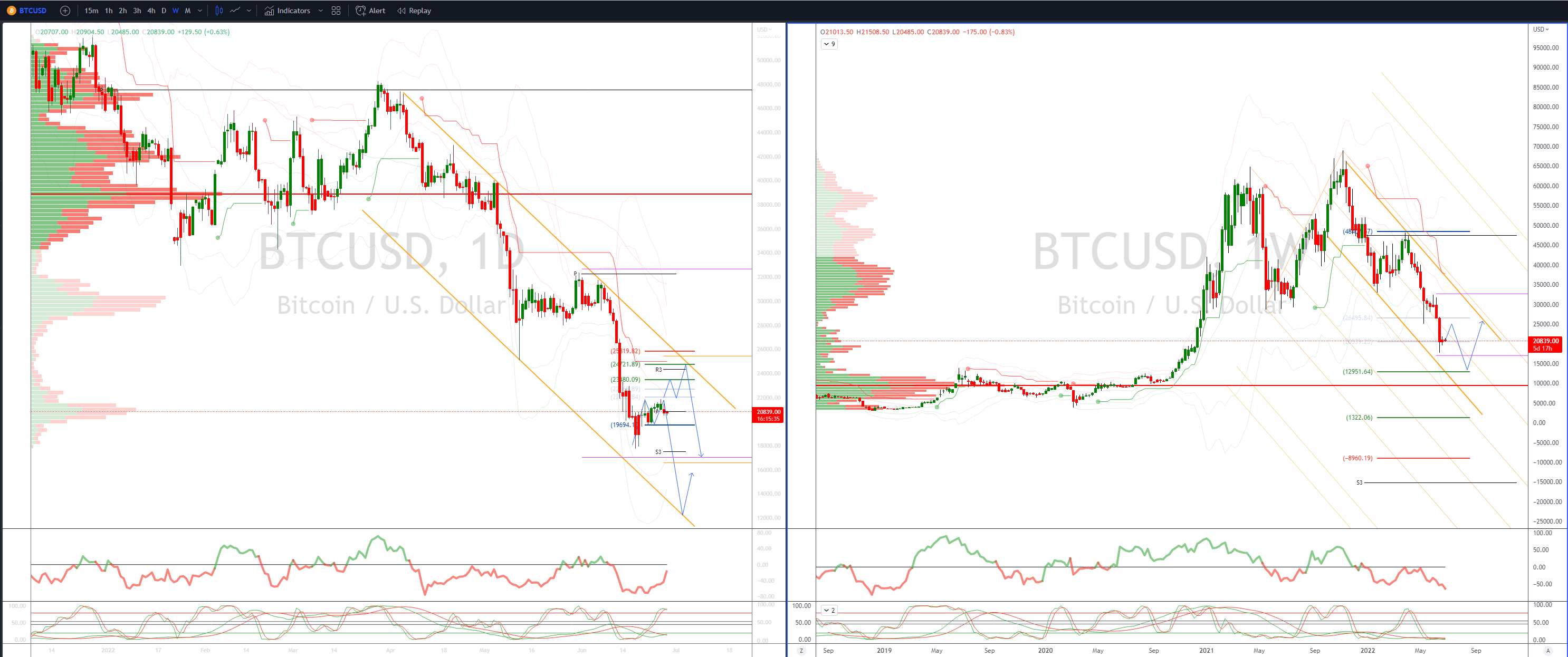

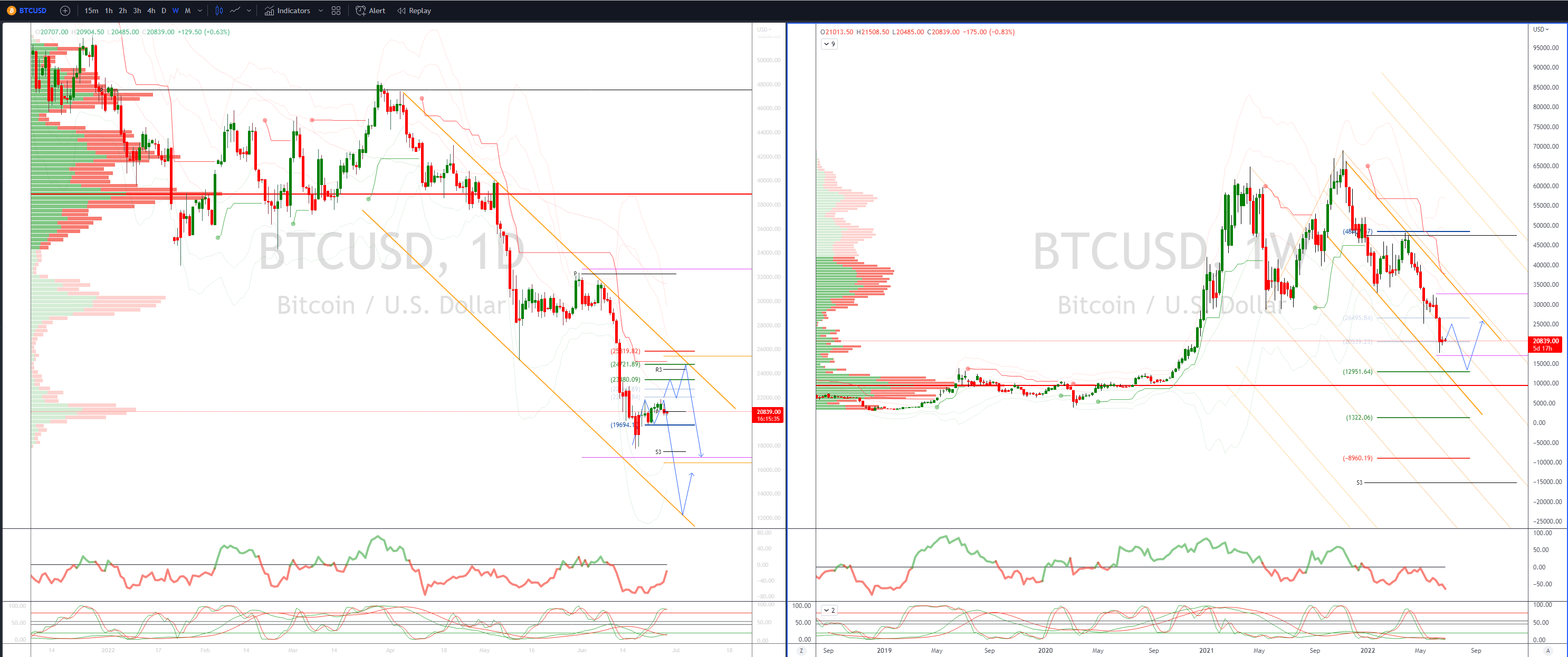

BTCUSD Bias: Bullish above .22000 Bearish below

- BTC weighed as JPMorgan note miners' selling likely seen into Q3

- Trend remains down as within broader bearish channel beckons

- BTC struggling to gain traction above 21k

- Yesterdays bearish reversal flips 5 Day VWAP bearish

- Support sited at 19,690’s

- 20 Day VWAP remains bearishly oriented and untested

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!