Daily Market Outlook, June 29, 2022

Daily Market Outlook, June 29, 2022

Overnight Headlines

- Asian Markets Retreat On Increasing Recession Fears

- Bitcoin Testing 20k On Souring Risk Sentiment

- Fed Officials Promise Rate Hikes, Push Back On Recession Fears

- US Dep ComSec Clear US Response On China Tariffs Is Coming Soon

- EU Countries Uphold Phaseout Of New Cars Emissions By 2035

- France Cuts Growth Outlook, But Sticks To Budget Target

- BRC: UK Shop Prices Jump By Most Since 2008

- China’s Economy Didn’t Bounce In Q2, Beige Book Survey Finds

- Japan Retail Sales Rise Faster Than Expected As Covid Curbs Ease

- BoJ Gov Vows Easy Policy As Japan Less Affected By Global Inflation

- Australian Consumers Spent Big In May After First Rate Hike

- Turkey Clears Way For Finland, Sweden To Join NATO

- Dollar Falters As US Yields Retreat Amid Recession Risks

- Oil Prices Take a Breather After Their Three-Day Rally

- EIA: Delayed Weekly Oil Reports To Be Released Wednesday

- OPEC+ Oil Output Is Half A Billion Barrels Behind On Supply Deal

- Asian Stocks Lose Bounce From Shorter Quarantine, Slip On Inflation Fears

- Tesla Lays Off Hundreds Of Autopilot Workers In Latest Cuts

The Day Ahead

- Asian equity markets are weaker, following on from the falls on Wall Street, as concerns about higher interest rates and economic growth resurfaced. Geopolitics remain in focus after Turkey dropped opposition to Finland and Sweden joining NATO. US 10-year Treasury yields are lower, as are German bund yields after unexpected falls in German state inflation data (see below). In the UK, the BRC’s shop price index of commonly purchased goods has risen for an eleventh consecutive month, led higher food prices.

- The first indications of June inflation for the Eurozone will comes from Spanish inflation printing double digits, later German data, followed by French figures tomorrow. Earlier this morning, figures for the German state of North Rhine-Westphalia has attracted attention for being surprisingly weak, falling to 7.5%y/y from 8.1%y/y. If replicated through the morning’s other regional CPI releases and in the pan-German figure at 1pm, it would pose downside risks to the Eurozone ‘flash’ CPI estimate (which is forecast to accelerate) due on Friday. Also in the Eurozone, the eurozone economic sentiment index is expected to fall, reflecting declines in consumer, industrial and services confidence.

- The final day of the ECB’s forum on ‘Challenges for monetary policy in a rapidly changing world’ takes place in Sintra (Portugal). A panel policy at 2pm featuring ECB President Lagarde, US Fed Chair Powell, BoE Governor Bailey and the BIS’s Carstens will be closely watched, as markets assess the scale of interest rate increases ahead needed to bring inflation levels back to target.

- In the US, the 1.5% annualised contraction in Q1 GDP is expected to be confirmed in today’s update. The weakness was led by a wider trade deficit and slower inventory growth, which are expected to reverse. Growth is therefore expected to rebound in Q2, but to moderate in the second half of the year and in 2023.

- Early Thursday sees the release of China’s PMIs which are forecast to rise above the key 50 level in June to signal expansion for the first time since February as Omicron restrictions are eased. Also, due early tomorrow is the Lloyds Bank Business Barometer for June. It will also provide a forward-looking gauge on businesses’ trading prospects, their assessment of the wider economy and their expectations for hiring, prices and wage growth.

- The update for UK Q1 GDP will be released at 7am tomorrow and is expected to confirm 0.8%q/q growth. Given cost-of-living challenges for households, there will be attention on the disposable income and savings data to gauge the extent to which households may be reducing their savings to smooth consumption.

- Citi's Quant prelim month-end FX hedge rebalancing flows suggest USD buying with the signal stronger than the historical average.Despite US equity and bond markets not being the worst performers, the prominence of US assets in global portfolios, allied with the assumption that foreigners tend to hedge FX exposures, suggests net USD buying. USD-buying signal is around 1.7 historical standard deviations with EUR/USD sell signal around 1.3. Has not seen much in the way of real money selling G10 currencies (with the exception of GBP and AUD).

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0550 (426M), 1.0620-25 (662M), 1.0675 (468M)

- USD/JPY: 135.00 (300M), 137.50 (500M)

- EUR/CHF: 1.0100 (574M), 1.0275 (230M), 1.0300 (300M)

- AUD/USD: 0.6950 (388M). USD/CAD: 1.2790-00 (316M)

Technical & Trade Views

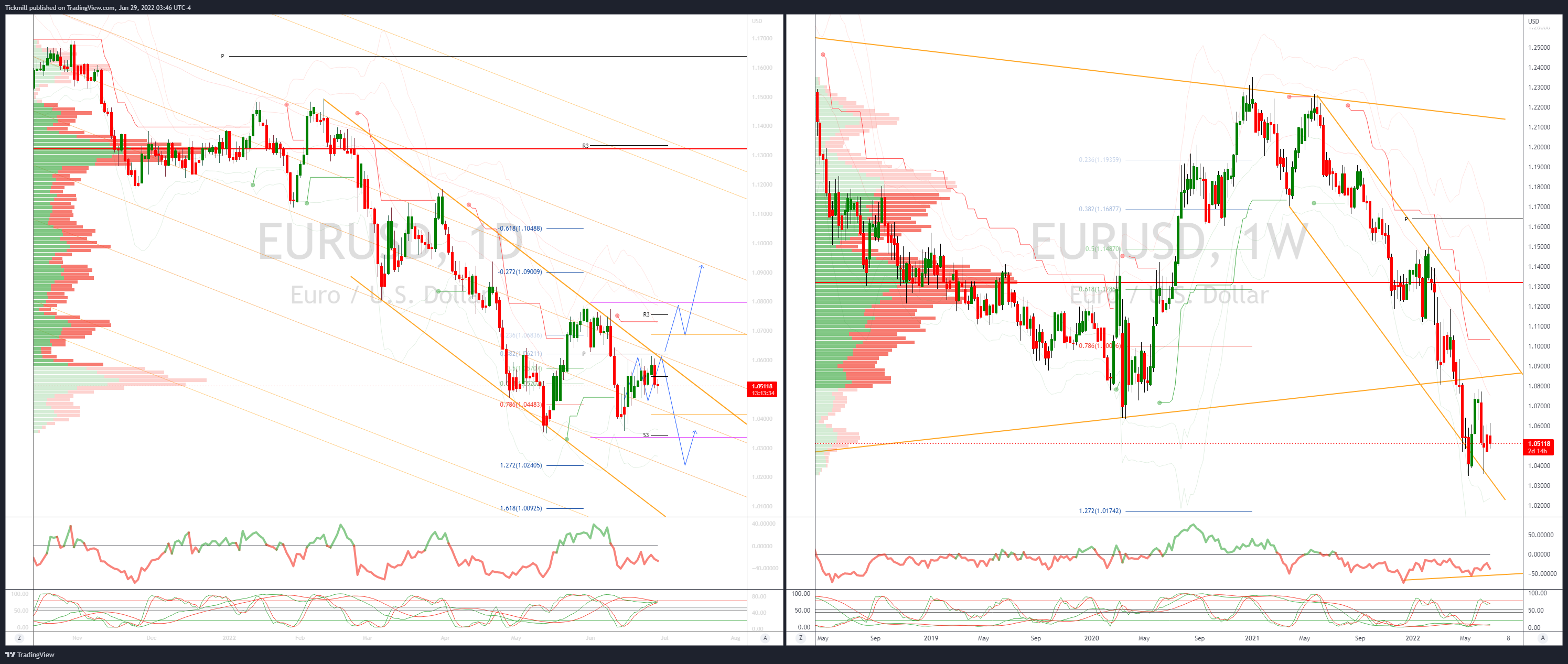

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR/USD's rally attempts are laboured ECB comments and risk aversion weigh

- Testing 1.05 as LDN session starts

- A daily close under the 1.0450 would be another bearish development

- Sintra roundtable this afternoon and month end USD buying catalysts today

- Initial offers are seen at 1.0615/20 ahead 1.0650

- Bids eyed towards 1.05 and 1.0450

- 20 Day VWAP is bearish, 5 Day bearish

GBPUSD Bias: Bearish below 1.26 Bullish above.

- Souring risk sentiment weighs on GBP trading sub 1.22 early LDN trading

- Month end USD bids add further downside pressure

- Scottish Gov seeking another Independence vote

- BOE Gov Bailey speaking in Sintra this afternoon

- Resistance remains sited at 1.2410

- Support eyed at 1.2150 failure here will open 1.2050

- 20 Day VWAP is bearish, 5 Day bearish

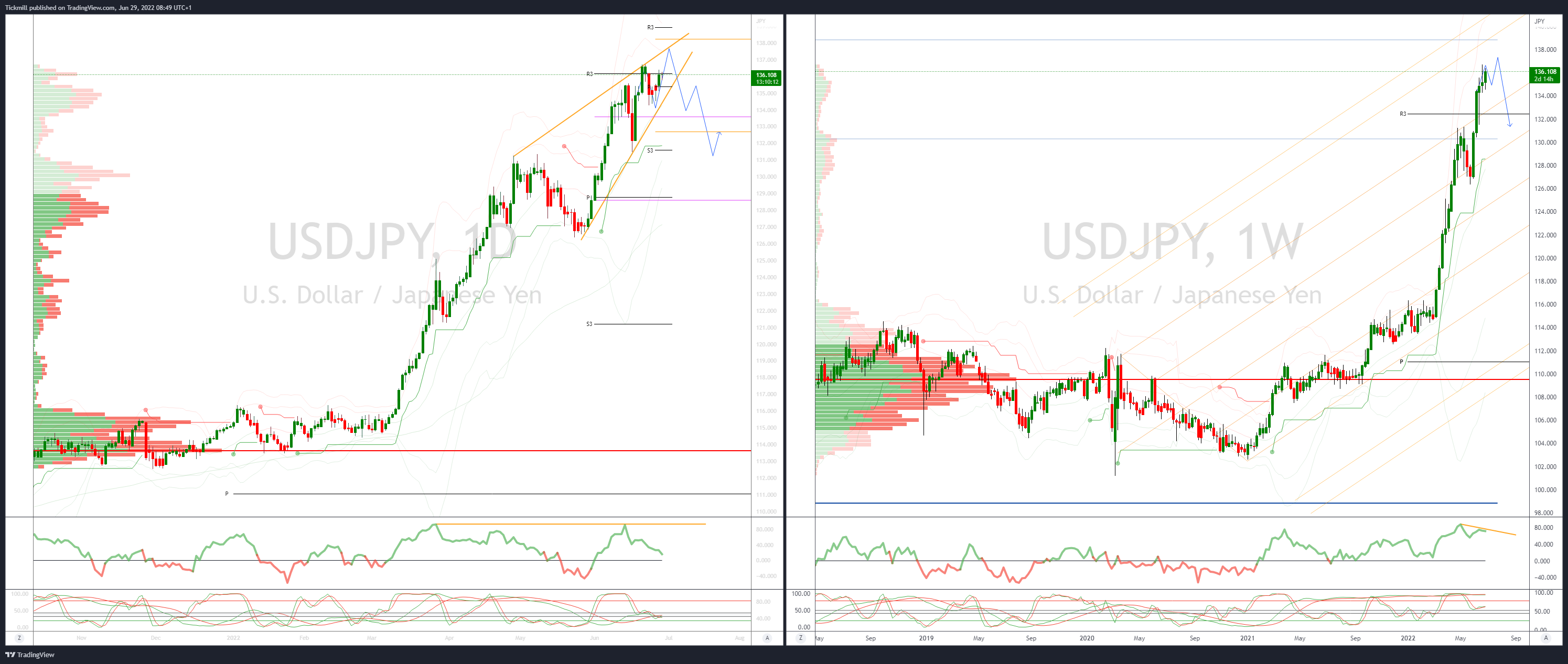

USDJPY Bias: Bullish above 132 Bearish below

- USD/JPY bid in the Asian session holding in the upper end of Tue’s range

- US yields soften on recession fears, 10 yr Treasury trading 3.14%

- Japanese importer bids sited towards 135

- Exporter offers above 136.75 stops above could fuel further upside

- Notable options expiries at 133.50 and 134.00 strikes go off Friday

- Option barriers quoted at 136.75 & 137

- Global equity sentiment continues to strengthen

- 20 Day VWAP is bullish, 5 Day bullish

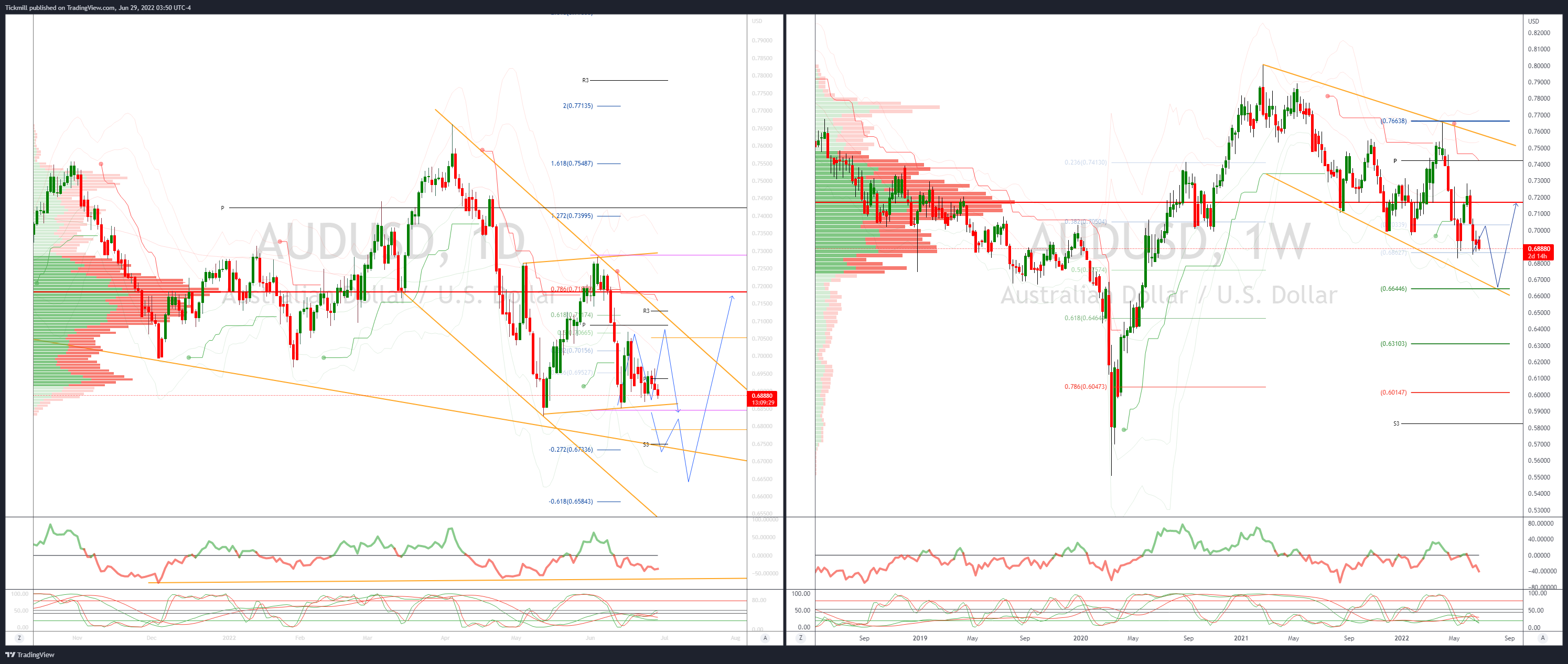

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD heavy in risk off Asain trade

- China’s June PMI’s due Thursday may provide some near term support

- Bids are tipped toward support at June 14 lows 0.6850

- Powell speaks this afternoon and will likely drive dollar action into LDN close

- 20 Day VWAP remains untested confirming downside

- Bears now targeting a test of the base towards 0.6840’s

- Offers seen towards .6960, bids eyed back at .6900 and stronger to .6850

- 20 Day VWAP is bearish, 5 Day bearish

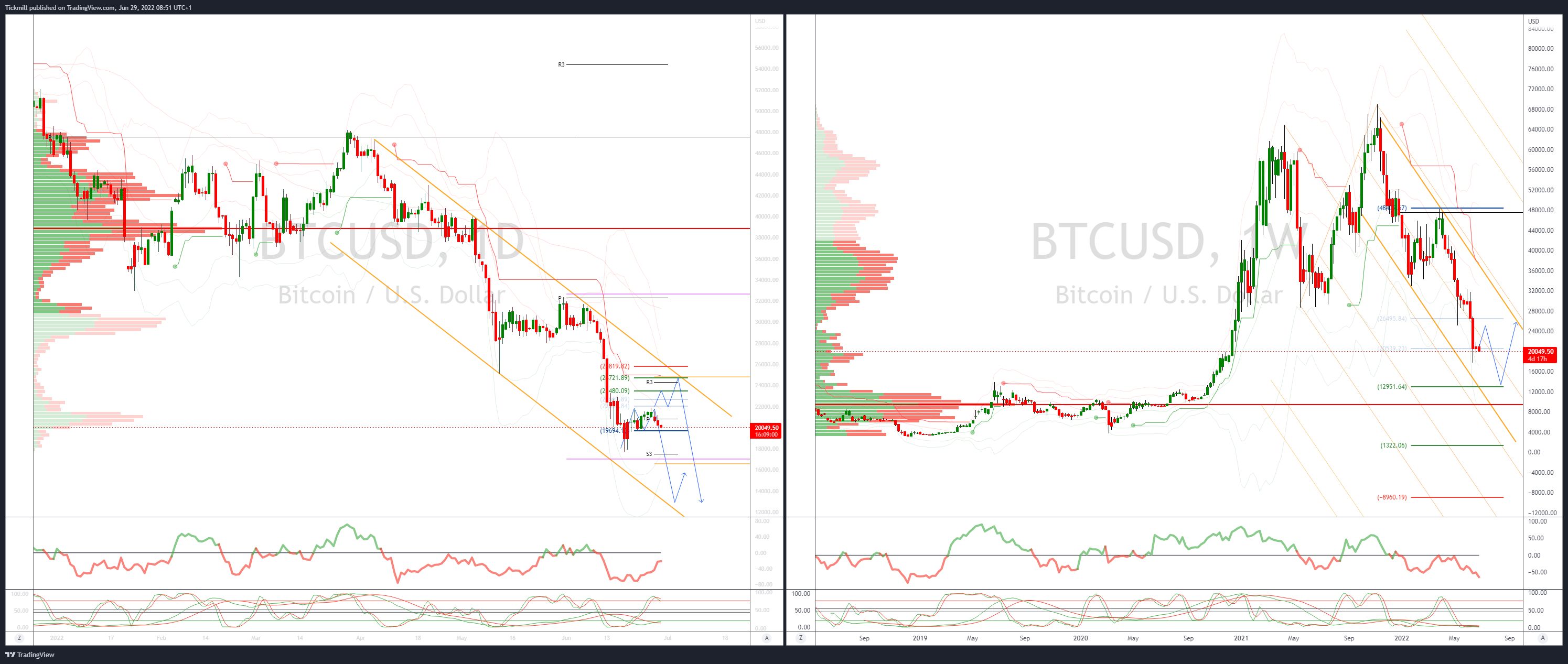

BTCUSD Bias: Bullish above .22000 Bearish below

- BTC weighed ProShares Short BTC ETF sees strong inflows in opening week of trading

- BITI holds a short exposure equivalent to 939 Bitcoins

- Trend remains down as within broader bearish channel beckons

- BTC struggling to gain traction above 21k

- Yesterdays bearish reversal flips 5 Day VWAP bearish

- Support sited at 19,690’s

- 20 Day VWAP remains bearishly oriented and untested

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!