Daily Market Outlook, March 09, 2020

Daily Market Outlook, March 09, 2020

The Asian stock market is down sharply again as concerns about the impact of the coronavirus on the global economy remain in sharp focus. February international trade data for China revealed a plunge in both exports and imports that took the trade balance into deficit.

The oil price fell to its lowest level since early 2016 (Brent crude below $35bbl) after OPEC failed to agree on production cutbacks and Saudi Arabia threatened to flood the market. In the US, aides to President Trump are reported to be working on a package of measures.

The flight to safety pressured global yields lower to fresh lows - 10Y US Treasury yield plunged 15bps DOD to 0.762%, marking its third consecutive week of decline since late Feb that saw a total change of -82bps. Similarly 10Y German bund yields slipped lower to -0.714%, lowest since Aug-19. Gold price was little changed (+0.1%) but notched a weekly gain of 5.6%. CHF and JPY are top gainers on their safe havens appeals.

US Treasury yields, on both front and back end, are not finding a floor, and continue to compromise the USD’s rate differential advantage. Taking CFTC data as a gauge, non-commercial and leveraged accounts still hold elevated net EUR and JPY shorts, suggesting that the position liquidation has yet to run its course. The options market also points to a further extension of the USD washout, with risk reversals in EURUSD and USDJPY suggesting further USD pain, and implied vols still elevated and extending.

Internationally the key question is whether the ECB will follow other central banks and loosen monetary policy on Thursday. Markets are expecting some policy changes but economists are less certain because of the ECB’s limited residual firepower with interest rates already in negative territory.

Robust pre-Covid job numbers: The US economy added 273k jobs in February (Jan: +273k revised), more than analysts’ expectation of 175k. Strong Feb print was also accompanied by a total of +85k net revision to Dec and Jan data. As expected, gains came mostly from the services sector (+167k) followed by construction (+42k); manufacturing added a mere 15k jobs after two straight months of job losses, adding signs to weakness. Unemployment rate slipped back to 3.5% (Jan: 3.6%) with the labour force participation rate being unchanged at 63.4%, indicating that some of previous months’ job-applicants were being absorbed by firms. Average hourly earnings rose 3.0% YOY, moderating from Jan’s 3.1% growth, extending the current trend of subdued wage growth that underpins adamantly low inflation. Feb job report was more robust than expected, again highlighting the strength of the US economy in its ongoing expansion prior to the Covid-19 outbreak. As the number of cases rose rapidly in the States within the past week (the states of Maryland, California and Washington had declared emergency), the impact would most likely be felt in March; expect much lower NFP reading by then.

Smaller US trade deficit: Trade deficit narrowed by 6.7% MOM to $45.3b in January (Feb: $48.6b revised) mainly because of the larger decrease in imports (-1.6%) versus exports (-0.4%). Exports of civilian aircrafts dropped $1.7b or nearly 41% as Boeing suspended production of its ill-fated 737 Max model in Jan. Looking at imports, firms reduced the purchase of industrial supplies, capital goods and automotive vehicles from overseas, offering signs of softer business investments. Consumer goods imports continued to increase (+1.1%) indicating solid demand. The goods trade deficit with China also narrowed to $23.7b (Dec: -$25.7b) due to the sharp drop in imports from China (-5.5%) mainly reflecting seasonal impact of the Lunar New Year celebration prior to the escalation of Covid-19 outbreak.

China posted a trade gap in Jan-Feb: China exports fell 17.2% YOY in the period of Jan-Feb 2020, versus the 7.9% growth recorded in Dec. In the same period last year, exports had increased 9.3% YOY. Imports also posted a 4.0% YOY decline in the same period (Dec: +16.5%) down from the pre-Lunar New Year surge recorded in Dec. Note that the Customs office had removed Jan figure and instead reported the Jan and Feb data collectively, the latest print this reflects the combined impacts of Lunar New Year (extended) break and the measures imposed to contain Covid-19. Notably, it posted its first trade deficit of $7.09b since Mar-18. Japan 4Q GDP revised down; contracted 1.8%: The final reading of Japan 4Q GDP was revised down from an initial contraction of 1.6% QOQ to 1.8% QOQ (3Q: +0.1%), . The contraction reflects decline in private consumption and business spending as an October typhoon disrupted economic activity while the higher sales tax imposed in the same month temporarily dragged down consumer consumption. YOY, GDP slipped by 0.4% (3Q: +1.7%), leaving the full-year GDP growth at 0.8% (2018: 0.3%). Meanwhile, leading index came in at 90.3 in January (Dec: 91.0), the lowest level since Nov 2009 driven by lower readings of new job offers, new housing construction, commodity index and stock prices, not a good start for 2020.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1250 (EUR224mn); 1.1300 (EUR231mn); 1.1375 (EUR371mn)

- USDJPY: 105.75 (USD230mn); 106.15 (USD550mn)

- AUDUSD: 0.6600 (AUD653mn); 0.6665 (AUD201mn); 0.6720 (AUD304mn)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.13 neutral below)

EURUSD From a technical and trading perspective, prices spiked higher overnight to test 1.15 some initial profit taking and supply have capped the overnight advance for now. As 1.13 now acts as support look for a test of the yearly first resistance pivot point sighted at 1.1560. From these levels we witness some consolidation,corrective action before the next leg higher. Only a close back through 1.12 would concern the bullish bias

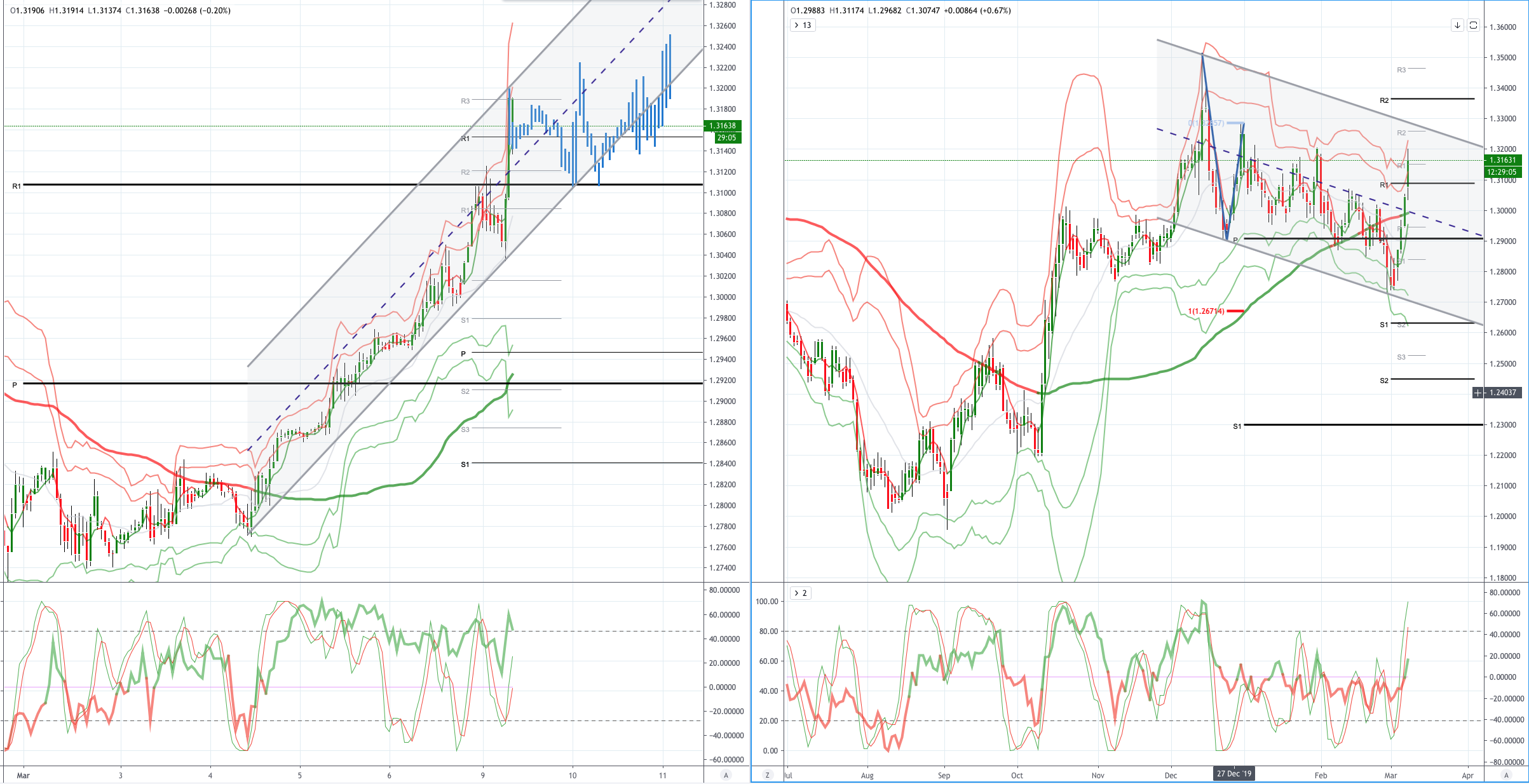

GBPUSD (Intraday bias: Bullish above 1.3130 neutral below)

GBPUSD From a technical and trading perspective, prices have extended to test resistance at 1.32 in a price pattern discussed in the Weekly Market Outlook, intraday look for support at 1.3110 to set up the next leg higher to test descending trendline resistance sighted around 1.3260 this area should cap the current advance

USDJPY (intraday bias: Bearish below 104 neutral above)

USDJPY From a technical and trading perspective, major gap lower in asian trade takes out the 104.50 support, as this level now acts as resistance bears will look to target the psychological 100 level. Only a close back through 105 would suggest a false downside break

AUDUSD (Intraday bias: Bearish below .6650 Bullish above)

AUDUSD From a technical and trading perspective the overnight gap lower found demand on the test of .6350 a close today back through .6650 would suggest a false downside break and set a base for a more meaningful corrective phase to develop. However, a close below .6450 would suggest trend continuation, with the psychological .6000 level coming into view for bears

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!