Daily Market Outlook, March 1, 2021

Daily Market Outlook, March 1, 2021

Equities across the Far East are trading broadly higher this morning, amid some stabilisation in global bond markets following large moves last week. Notably, the yield on US 10- year Treasuries has eased back to 1.40%, having spiked up to 1.60% last Thursday. In China, the Caixin manufacturing PMI eased to 50.9 in February from 51.5 previously, following drops in both the ‘official’ manufacturing and nonmanufacturing PMIs. However, all measures remained above the key-50 mark, and likely reflected some distortions due to seasonal variations caused by the Chinese Lunar New Year holidays.

Over the weekend, UK Chancellor Sunak announced that he would be providing for a business ‘restart’ grant scheme in his upcoming Budget, to help those firms most affected by the crisis. Reports also suggest that the Chancellor will announce a government guarantee scheme for mortgage borrowers that would allow them to borrow up to 95% of a property’s value.

The ECB has been less sanguine about recent rises in government bond yields than their US counterparts, perhaps reflecting continued downside economic risks due to the relatively slow start to the vaccine rollout. Still, it is notable that inflation across the bloc has started the year strongly, jumping by the most on record across a number of euro zone countries in January. However, this is largely explained by higher energy prices and various one-off factors. Notably, Germany saw headline inflation rise from -0.7%y/y to 1.6%y/y and while today’s reading for February is expected to see a pause in the recent uptrend, headline German inflation is likely to move higher still over the coming months with ‘core’ inflation likely to prove more subdued.

Today’s calendar sees manufacturing sector updates across a number of countries. The sector has been less affected by mandatory restrictions put in place to stop the spread of Covid-19, and has therefore seen activity trends prove more resilient. For the euro area and the UK, the manufacturing PMIs for February are final readings are expected to be unchanged from the ‘flash’ estimates, holding well above the 50-level and consistent with strong expansion.

In the US, meanwhile, expect the manufacturing ISM to nudge slightly higher to 58.8 from 58.7. In the UK, Bank of England lending data for January are due at 09:30 GMT, expect these to show that the number of mortgage approvals dipped slightly in January, to 96.0k from 103.4k in December, reflecting a reduction in in those buyers expecting to complete before the temporary stamp duty reduction expires at the end of March. Media reports suggesting the Chancellor may extend the stamp duty holiday in Wednesday’s Budget, however, point to mortgage activity likely picking up again in the coming months.

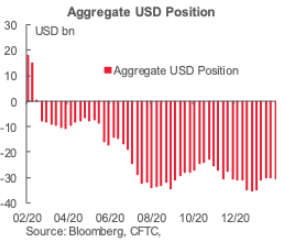

CFTC DATA

The week to Tuesday saw the first increase in the aggregate USD short in five weeks, with the week’s USD366mn rise roughly offsetting the previous period’s decline of USD291mn to hold flat around USD30bn through all of February.

Week-on-week positioning adjustments were relatively minor across the currencies that we track with the bulk of moves on the week focused on three currencies: the JPY, the GBP, and the CHF. Regarding the JPY, speculative accounts continue to reduce the currency’s net long from its recent peak in January with a weekly cut in the position of USD984mn to USD3.4bn—its lowest level since early-November 2020.

The JPY nevertheless rose by 0.8% over the period albeit losing ground against the GBP, AUD, NZD, and CAD which is somewhat mirrored by an increase in the net long exposure to these currencies, particularly the pound. The latter three saw less than USD100mn added to their respective positions, taking the AUD position a bit closer to neutral and the net NZD long past the USD1bn mark. The CAD long has remained fairly steady since mid-Dec.

Investors added USD806mn to the net GBP long to take the net bullish bet on sterling to its highest mark since March 2020 at USD2.7bn with markets banking on a prompter economic rebound in the UK thanks to a fast rollout of vaccines—also eliminating the chance of further BoE easing. The weekly change originated from a sizeable increase in long contracts (8k) while shorts declined only slightly (800 contracts).

Speculative accounts also added to the net CHF long by USD419mn to practically unwind the move in the opposite direction (USD426mn) in the previous week. The CHF position has only narrowly fluctuated since last-Aug. In contract terms, there were 21.6k longs and 10k shorts outstanding as of last week compared to 21.8k longs and 10k shorts in early-Aug.

Finally, investor sentiment on Gold continues to turn less bullish with a USD3.2bn reduction in the metal’s net long to USD38bn, its lowest since Jun 2020 and quickly heading for a new low since early-2019, as rising US yields damage its appeal.

G10 FX Options Expiries for 10AM New York Cut

EUR/USD: $1.2000-05(E871mln), $1.2070-75(E667mln-EUR puts), $1.2200(E1.3bln), $1.2245-55(E1.6bln)

USD/JPY: Y104.95-00($517mln), Y105.40-45($785mln), Y105.55-57($2.0bln), Y106.20-25($1.8bln), Y106.45($1.65bln), Y106.50-55($720mln), Y106.75-85($766mln)

AUD/USD: $0.7750(A$683mln-AUD puts), $0.7770(A$2.2bln), $0.7865-70(A$746mln)

AUD/NZD: $1.0730-35(A$567mln), N$1.0790-108.00(A$645mln)

NZD/USD: $0.6950(N$734mln), $0.7170-75(N$588mln), $0.7350(N$1.9bln-NZD puts)

USD/CAD: C$1.2500($1.25bln), C$1.2665-75($520mln)

USD/CNY: Cny6.40($520mln)

USD/TRY: Try7.00($571mln)

----------------

Larger Option Pipeline

EUR/USD: Mar02 $1.2045-65(E1.1bln); Mar03 $1.1900(E1.0bln), $1.2000(E1.4bln), $1.2300(E1.0bln)

USD/JPY: Mar02 Y105.75-80($1.0bln), Y105.90-10($1.7bln); Mar03 Y105.40-60($2.1bln); Mar04 Y105.60-75($1.5bln); Mar05 Y105.45-50($1.2bln); Mar08 Y104.35-40($1.9bln), Y105.50-55($1.7bln)

EUR/GBP: Mar03 Gbp0.8600(E1.9bln-EUR puts)

USD/CAD: Mar05 C$1.2620($1.0bln)

USD/CNY: Mar08 Cny6.45($1.5bln)

Technical & Trade Views

EURUSD Bias: Bullish above 1.20 bearish below

EURUSD From a technical and trading perspective, the closing breach of 1.21 and the descending trendline is a bullish development opening a retest of prior highs at 1.2350, only a move back through 1.20 would suggest further downside opening a potential test of 1.17 yearly pivot

Flow reports suggest topside offers 1.2180-1.2220 level with weak stops above the level and increasing on any push above the 1.2250 level with possible strong offers into the 1.2300 level Downside bids light through to the 1.2080 area and possible weak stops appearing through the level and opening the chance of a test to the 1.2000 level in the short term with stronger bids into the 1.1950.

GBPUSD Bias: Bullish above 1.3750 targeting 1.44

GBPUSD From a technical and trading perspective, as 1.40 now acts as support bulls will target a test of 1.44 as the next upside objective. Below 1.40 opens a retest of 1.3750 pivotal trend support.

Flow reports suggest downside bids light through the 1.3950 level and increasing bids into the 1.3900 level with congestion through to the 1.3850 area and a similar pattern through the 1.3800 area and increasing bids through the 1.3750 area. Topside offers light through to the 1.4100 area and then limited offers increasing into the 1.4200 areas to limit a Friday market

USDJPY Bias: Bullish above 104.50 targeting 107

USDJPY From a technical and trading perspective, as 104.50 supports there is potential for a further squeeze higher to test offers towards 107. A loss of 103.50 would negate further upside and suggest a resumption of trend

Flow reports suggest topside offers through the 106.70 area increasing through the 107.00 level with weak stops likely on any break of the 107.20 areas with more offers into the 107.50 level. downside bids light through the 106.00 level and weak stops on a breakthrough the 105.80 area and limited congestion through to the 105.00 areas where stronger bids appear

AUDUSD Bias: Bullish above .7560 bullish targeting .8000

AUDUSD From a technical and trading perspective, as the major trendline support at .7560 now acts as support, look for target wave 5 upside objective towards .8000. A closing breach of .7730 of the internal descending trendline will encourage the bullish thesis.

Flow reports suggest downside bids into the 0.7700 area and likely to be strong however, weak stops through the 0.7680 area with the market likely only to open a short distance before stronger bids again appear and the market struggles for any further downside movement, Topside offers light through the 78 cents level with weak stops likely above the level and the 79 cents level then likely to open quickly and very little to curb the push.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!