Daily Market Outlook, March 27, 2024

Daily Market Outlook, March 27, 2024

Munnelly’s Macro Minute…

“Markets Muted Ahead Of Holidays”

On Wednesday, most Asian stock markets are trading lower due to negative cues from Wall Street and cautiousness among traders. They are also awaiting key U.S. and European inflation readings and comments from central bank officials for insight into the interest rate outlook. Meanwhile, concerns are also rising about the economic impact of the indefinite suspension of vessel traffic at the Port of Baltimore, following a cargo ship's collision with the Francis Scott Key Bridge, resulting in its collapse. The Japanese stock market is showing significant gains, recovering from losses in the previous two sessions, despite the negative signals from Wall Street. The Nikkei 225 is currently above the 40.7k handle, with most sectors experiencing gains, particularly in the exporter and financial sectors. Stocks dropped in China and Hong Kong, primarily due to the decline in technology companies. The decrease was influenced by the drop in Nvidia's shares and Alibaba's announcement of postponing the IPO of its logistics subsidiary, impacting the morale of AI-related firms in the region.

In the Eurozone, the European Commission's monthly economic confidence survey for March is expected to indicate an increase in the headline index, rising from 95.4 to 96.2. Consumer confidence data, already released, revealed a rise to 14.9, marking the highest level since the invasion of Ukraine by Putin two years ago. Additionally, there is anticipation for a rebound in services confidence following last month's decline.

Meanwhile, there are no significant data releases expected Stateside today. However, the Fed's Waller is set to deliver a speech on the economic outlook at the Economic Club of New York. Last week's updated Fed dot plot maintained its signal for three interest rate cuts this year, although the number of projected cuts for 2025 was reduced.

Overnight Newswire Updates of Note

BoJ’s Ueda: Accommodative Financial Conditions Are Expected To Continue

BoJ’s Hawkish Member Eyes Steady Rate Hikes For Normalization

PBoC Chief Seeks To Deepen Currency Ties With Asian Economies

ECB’s Kazaks: Inflation Is Slowing, First Rate Cut Is Nearing

China Industrial Profits Rise In Sign Of Stabilizing Economy

Australia’s Inflation Rate Comes In Lower Than Expectations In February At 3.4%

Yen Drops To Lowest In 34 Years Despite BoJ Rate Hike

NZ FinMin Willis Reveals Gloomy Outlook In Budget Scene Setter

Oil Prices Slip As Traders Assess Ukraine Drone Strikes, Red Sea Impact

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

USD/JPY: 150.00 ($1.95b), 145.00 ($1.59b), 148.00 ($908.3m)

EUR/USD: 1.0865 (EU1.78b), 1.0800 (EU1.33b), 1.0860 (EU1.14b)

USD/CAD: 1.3650 ($1.26b), 1.3070 ($1.15b), 1.3445 ($681.9m)

USD/CNY: 7.2500 ($683.3m), 7.2600 ($493.1m), 7.3200 ($479.1m)

AUD/USD: 0.6510 (AUD1.23b), 0.6500 (AUD923m), 0.6395 (AUD510m)

NZD/USD: 0.6000 (NZD722m), 0.6095 (NZD647.8m), 0.6140 (NZD300m)

USD/MXN: 16.70 ($529.7m)

EUR/GBP: 0.8700 (EU377m)

Credit Agricole Month End Model: Our FX month-end rebalancing model suggests potential mild USD selling across various currencies, with the strongest sell signal observed against the SEK. Additionally, our corporate flow model indicates EUR selling at the end of the month. Consequently, we are employing a combined strategy, utilizing the signals from the month-end rebalancing model.

CFTC Data As Of 22/03/24

Bitcoin net short position is -2,096 contracts

Euro net long position is 48,342 contracts

Japanese Yen net short position is -116,012 contracts

Swiss Franc posts net short position of -20,500 contracts

British Pound net long position is 53,200 contracts

Equity fund speculators trim S&P 500 CME net short position by 57,268 contracts to 416,777

Equity fund managers raise S&P 500 CME net long position by 35.431 contracts to 949,421

Technical & Trade Views

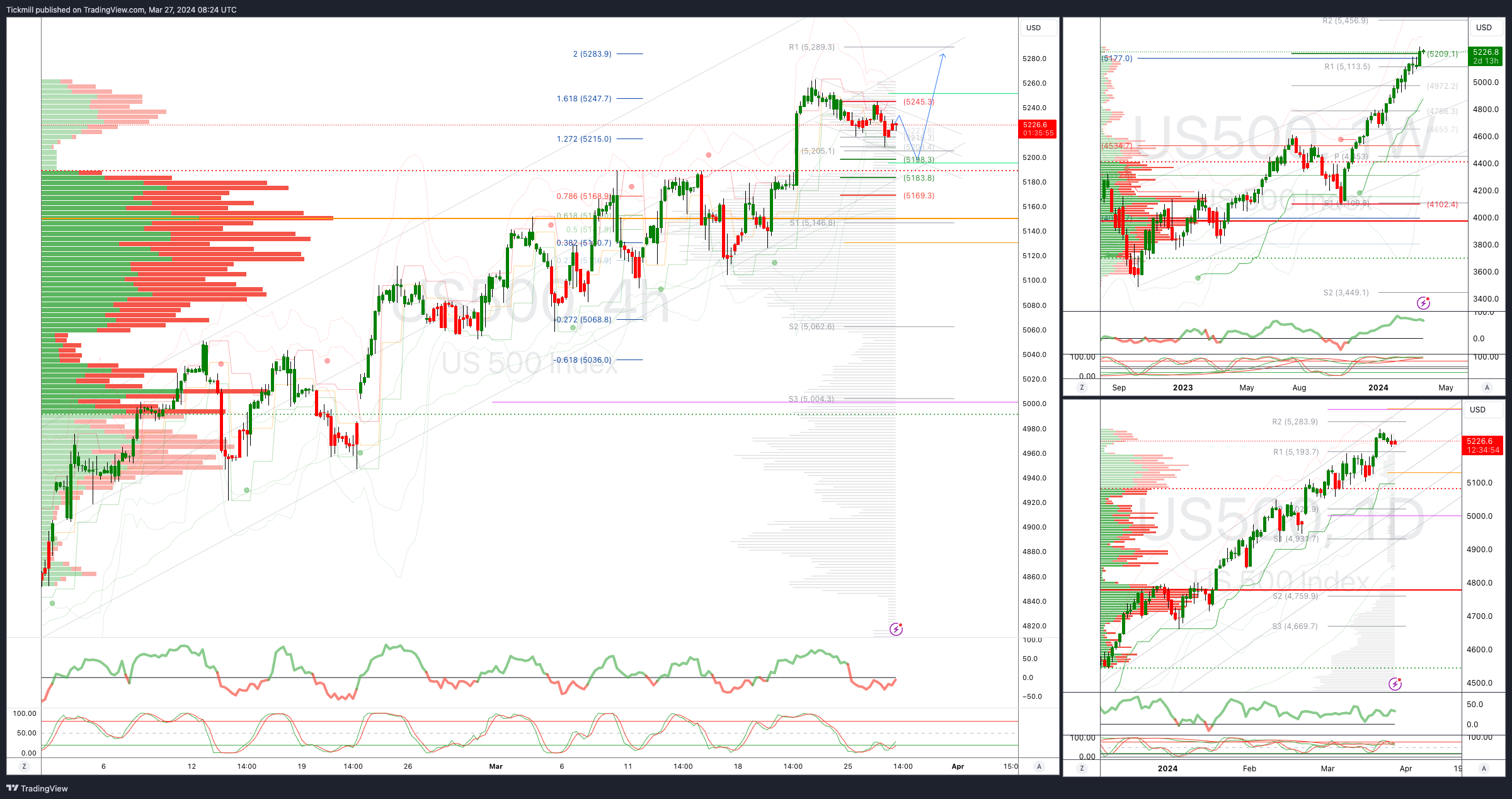

SP500 Bullish Above Bearish Below 5200

Daily VWAP bearish

Weekly VWAP bullish

Below 5190 opens 5160

Primary support 5160

Primary objective is 5300

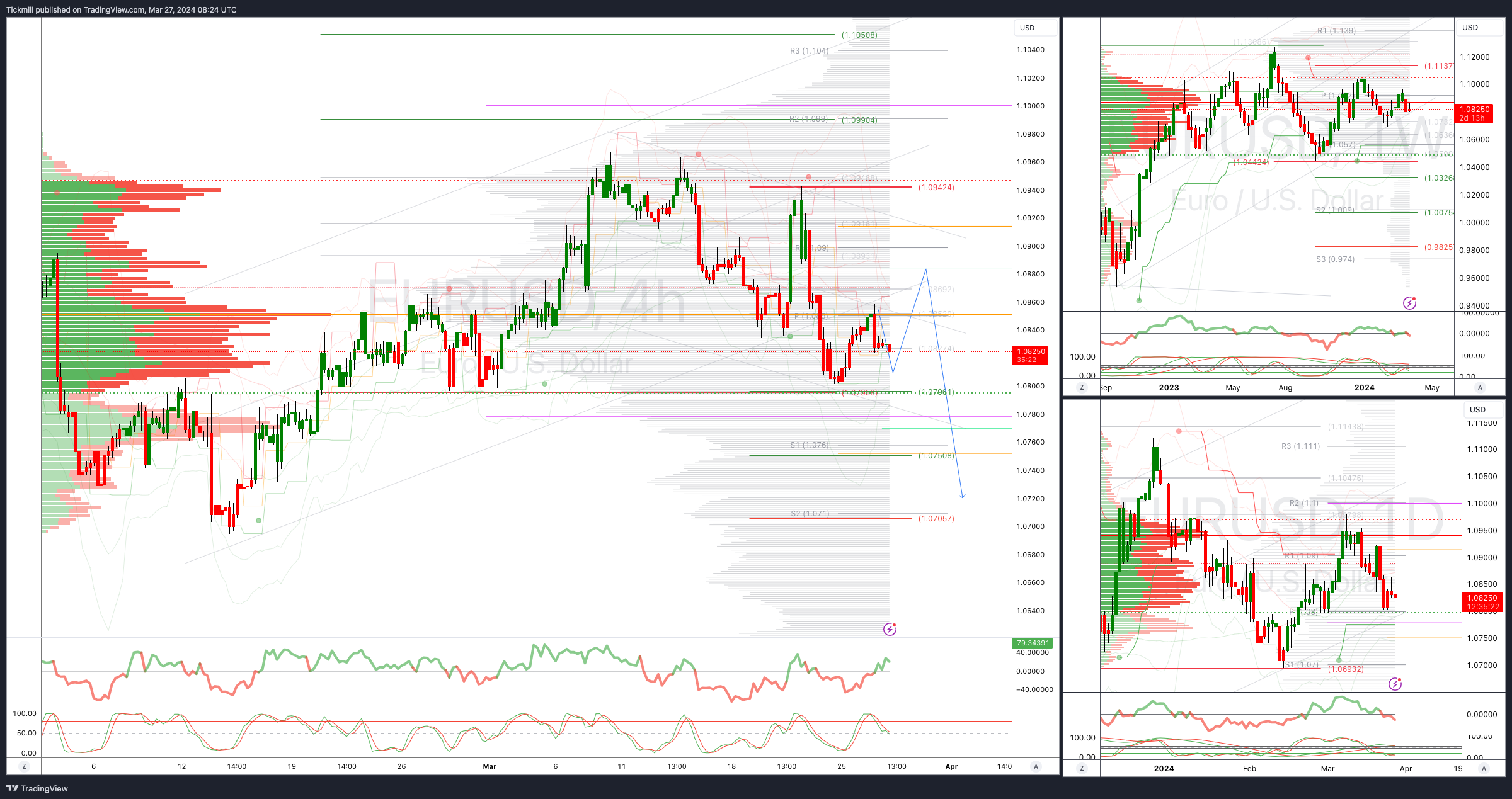

EURUSD Bullish Above Bearish Below 1.09

Daily VWAP bearish

Weekly VWAP bearish

Below 1.0840 opens 1.0795

Primary support 1.08

Primary objective is 1.10

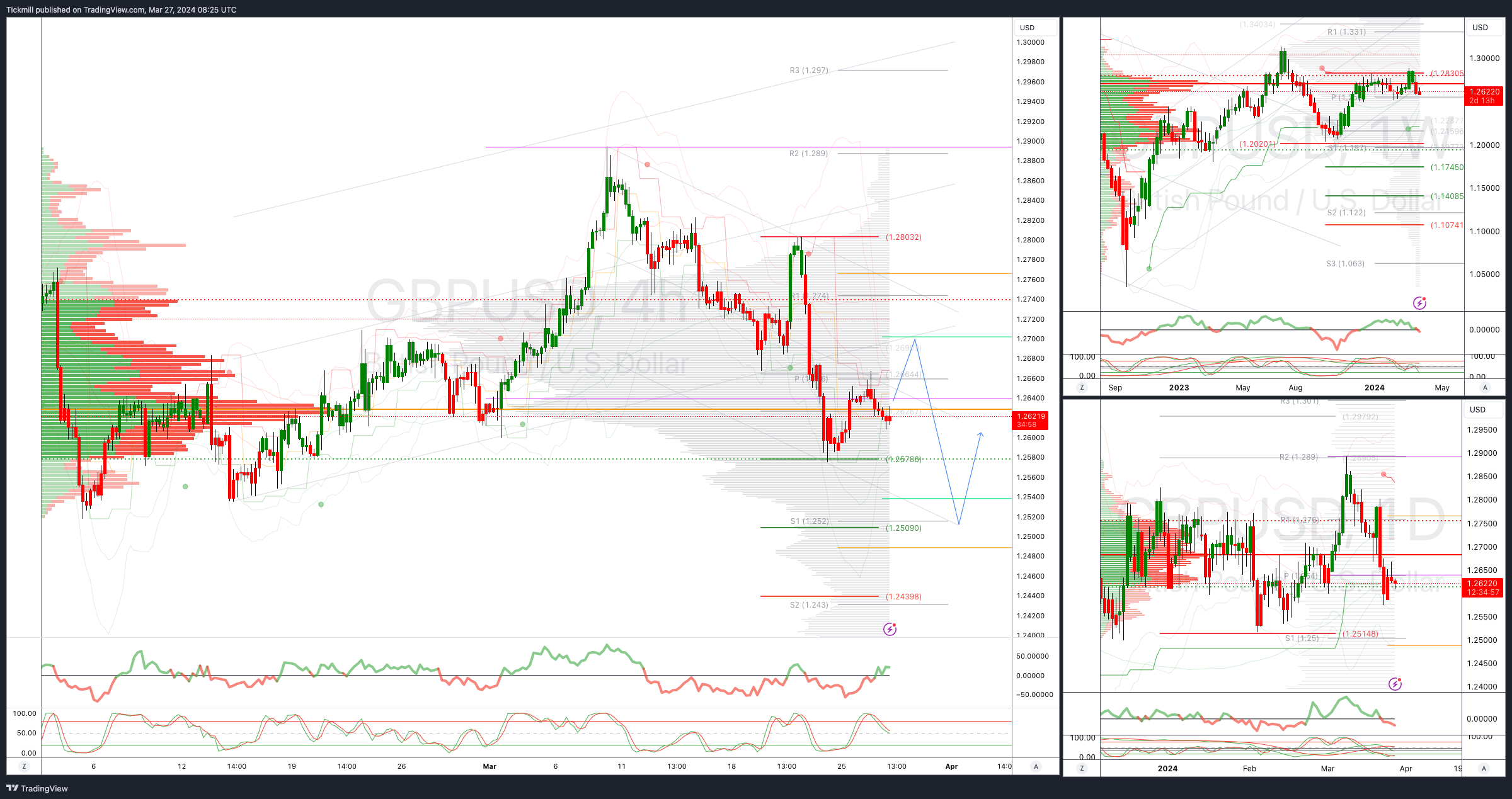

GBPUSD Bullish Above Bearish Below 1.27

Daily VWAP bearish

Weekly VWAP bearish

Below 1.2570 opens 1.2510

Primary support is 1.2514

Primary objective 1.29

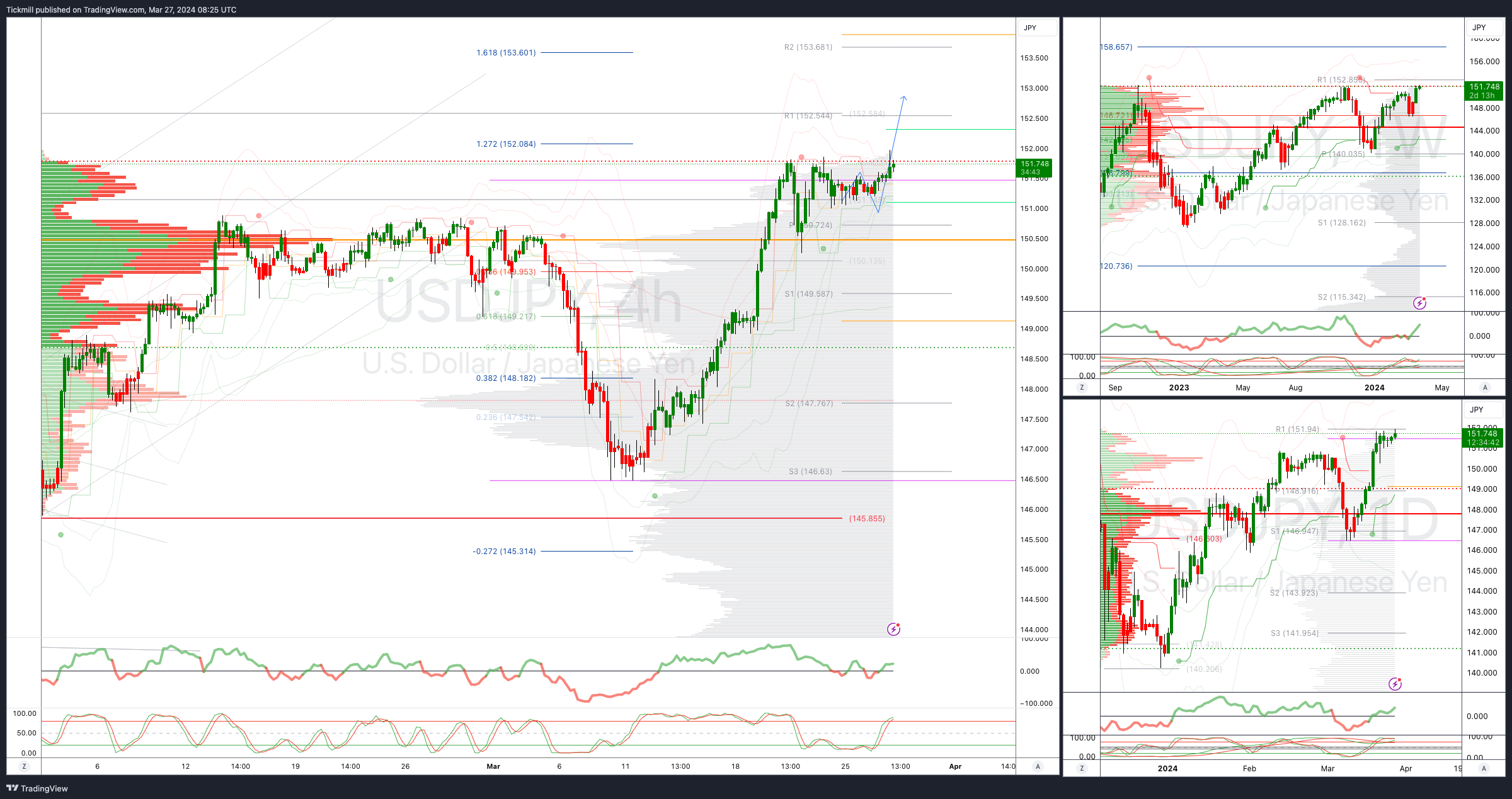

USDJPY Bullish Above Bearish Below 150.25

Daily VWAP bullish

Weekly VWAP bullish

Above 151 opens 152

Primary support 145.85

Primary objective is 153

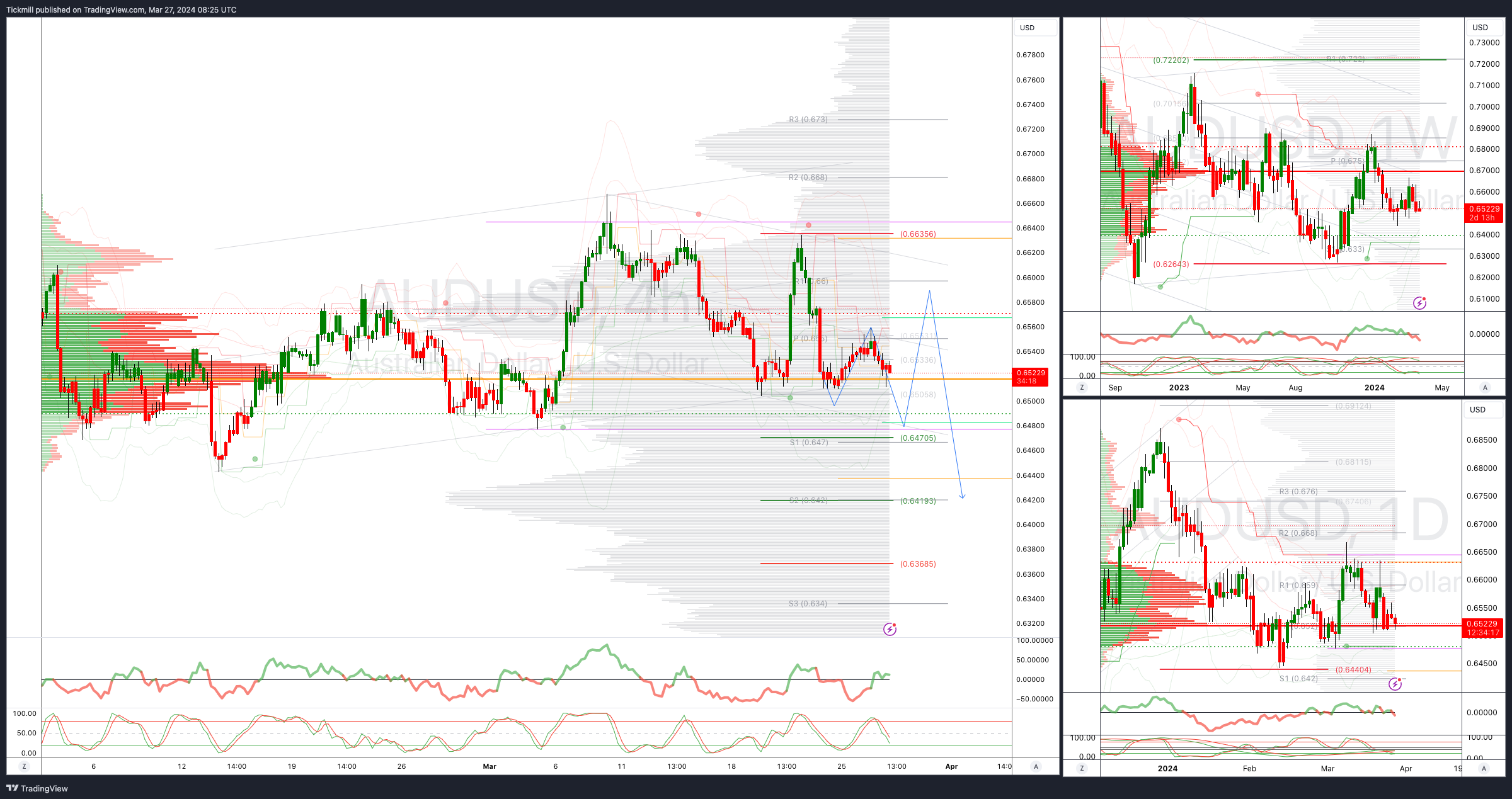

AUDUSD Bullish Above Bearish Below .6570

Daily VWAP bearish

Weekly VWAP bearish

Below .6550 opens .6470

Primary support .6477

Primary objective is .6700

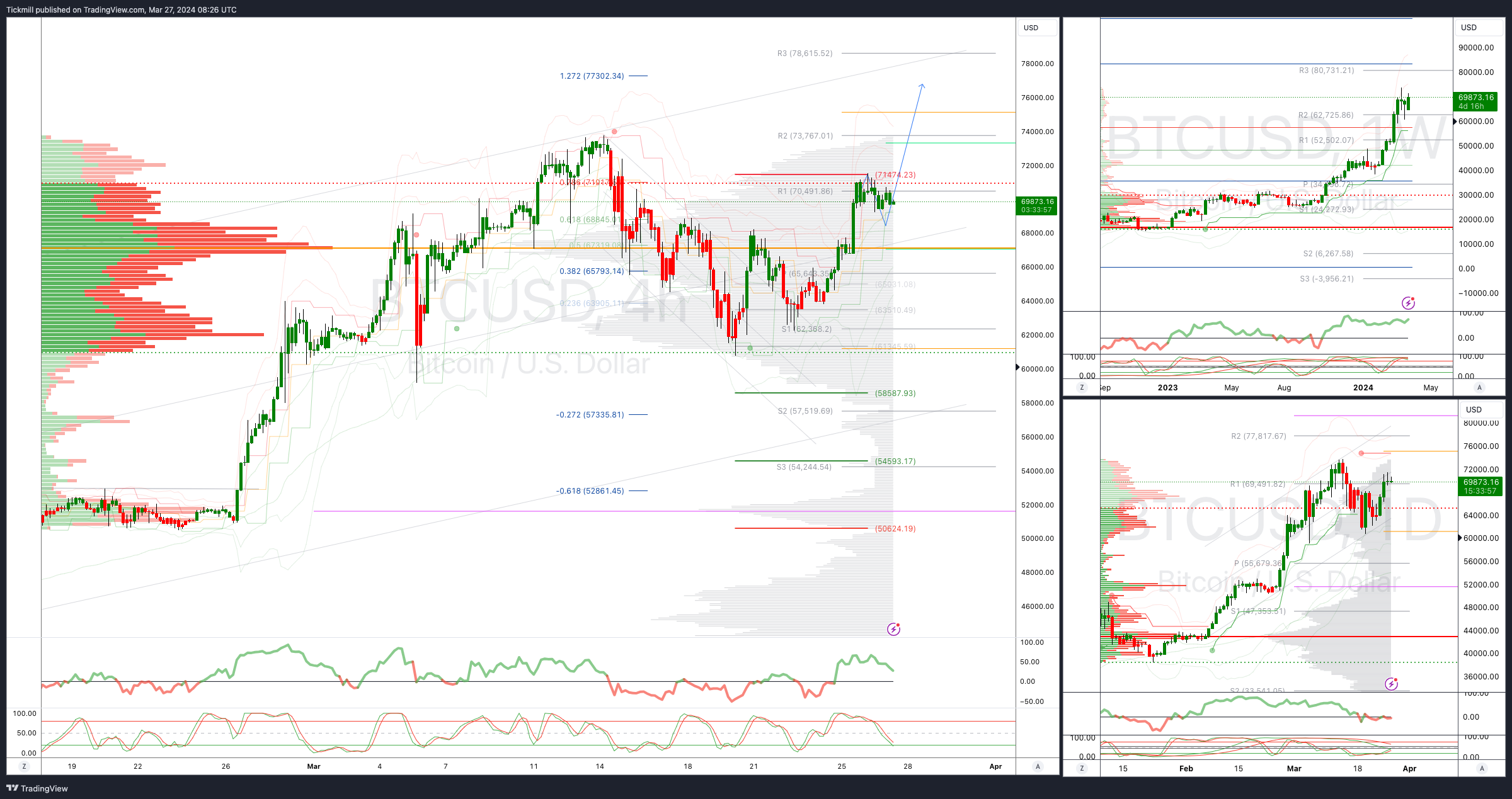

BTCUSD Bullish Above Bearish below 68300

Daily VWAP bullish

Weekly VWAP bullish

Below 64000 opens 59588

Primary support is 52800

Primary objective is 78000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!