Daily Market Outlook, March 8, 2021

Daily Market Outlook, March 8, 2021

Asian equity markets are mostly lower this morning despite a big rise on Wall Street on Friday. The US Congress passed a revised version of President Biden’s $1.9trn stimulus package on Saturday. The lower chamber of Congress will vote on the revisions on Tuesday. The EU and the US have agreed to suspend tariffs imposed on aircraft subsidies. In England, the NHS has started to give appointments to 56 to 59 year olds to have the Covid-19 vaccine.

Today sees the implementation of the first of the UK government’s four-step roadmap out of lockdown for England. Different rules apply in other parts of the UK. The first step consists of two parts: from today schools reopen, while two people from different households can meet outside and care home residents can have one regular visitor. The second part of step one from 29 March would see the easing of outdoor social contact limits further with the rule of six or two households mixing, and outdoor sports resuming. Further moves will hopefully culminate in the removal of all legal social contact limits by no earlier than 21 June, although some residual restrictions may remain.

Today’s data calendar is light with nothing of note in the UK or the US. In the Eurozone, already released German industrial production data for January posted a 2.5% decline and Spanish data due shortly are also expected to show a fall. That may reflect the impact of the latest lockdown, although some reports are suggesting that manufacturing activity is also being constrained by supply chain issues. The Eurozone aggregate numbers are scheduled for Friday, Also of interest will be the latest Sentix investor confidence index. It is expected to be up for March suggesting that hopes for an economic rebound has more than offset concerns about the recent rise in bond yields.

Late tonight, the second reading of Q4 Japanese GDP is expected to be revised down marginally but still show double-digit quarterly growth. Also overnight, the British Retail Consortium’s sales report for February will be watched for signs of an improvement after a big fall in the official retail spending measure for January. BoE Governor Bailey’s speech today will be his first public comments since last week's budget. That is unlikely to have substantially changed his economic outlook, although the continuation of sizable fiscal support for some months may reinforce expectations that a move to negative interest rates will be unnecessary. Of most interest will be whether he has something to say about the recent rise in government bond yields. He is likely to say that UK monetary policy will remain very stimulatory but may be reluctant to go further.

CFTC Data

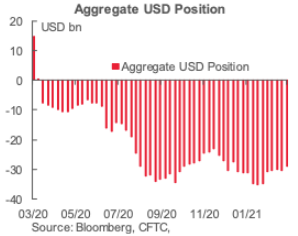

Bearish USD sentiment was pared back again this week, reversing the minor increase in the prior week. The aggregated short USD position reflected in the currencies we monitor in this report was reduced by USD1.3bn to a little over USD29.1bn, still significant but the lowest bear bet on the USD since the start of December.

There were essentially two primary drivers of position adjustment in this week’s data. Firstly, net EUR longs were slashed by USD1.9bn to USD19bn (126k contracts) , the smallest EUR net long since last July, just before the big ramp up in net EUR long positions. Also, net JPY longs were slashed even more aggressively (driven mainly by a rise in gross shorts), falling by a third in the week (USD1.1bn) to USD2.2bn (19.3k contracts), the lowest since early November. The JPY was the weakest G10 currency over the reporting week.

The second impetus, which offset sentiment shifts in the EUR and JPY contracts to some extent, was a general lengthening in the commodity currency exposure. Net CAD longs rose USD488mn in the week to USD1.2bn. Net NZD longs gained a slight USD121mn to USD1.2bn. Flat and neutral positioning in the AUD (very) turned mildly bullish (gaining USD602mn), with very neutral positioning in the MXN also tilting slightly more positive. Those changes, plus modest gains in net CHF (+USD84mn) and, more significantly, in the GBP (+USD415mn on gross short covering) reflect a marginal rotation from what had been the IMM’s high conviction trades in the past few months. The GBP net long has replaced the JPY as the second largest currency bull bet in this data.

Outside of the major currencies, traders slashed exposure to gold, reducing the net long by nearly USD6bn to just under USD33bn

G10 FX Options Expiries for 10AM New York Cut

EUR/USD: $1.1900-05(E360mln-EUR puts), $1.2000-05(E853mln), $1.2050-65(E545mln), $1.2090-00(E676mln)

USD/JPY: Y104.25-40($2.8bln), Y105.50-55($1.7bln), Y106.00-20($614mln), Y107.00($570mln)

EUR/GBP: Gbp0.8690-00(E508mln)

AUD/USD: $0.7675-85(A$623mln), $0.7820-25(A$736mln)

USD/CAD: C$1.2490-00($730mln), C$1.2780-90($638mln)

USD/CNY: Cny6.40($650mln), Cny6.45($1.5bln), Cny6.51($562mln), Cny6.60($800mln)

----------------

Larger Option Pipeline

EUR/USD: Mar10 $1.2000-10(E1.3bln); Mar11 $1.1900-15(E1.5bln); Mar12 $1.1995-1.2000(E1.9bln),

$1.2100-10(E1.2mln)

USD/JPY: Mar10 Y105.80($1.4bln); Mar11 Y107.75($1.1bln); Mar12 Y105.95-106.00($2.7bln), Y108.30-35($1.6bln)

AUD/USD: Mar10 $0.7500(A$1.3bln); Mar11 $0.7600(A$1.7bln), $0.8000(A$1.8bln)

AUD/NZD: Mar11 N$1.0730(A$1.8bln-NZD puts)

USD/MXN: Mar12 Mxn20.30($1.1bln)

Technical & Trade Views

EURUSD Bias: Bullish above 1.20 bearish below

EURUSD From a technical and trading perspective, the closing breach of 1.21 and the descending trendline is a bullish development opening a retest of prior highs at 1.2350, only a move back through 1.20 would suggest further downside opening a potential test of 1.17 yearly pivot

Flow reports suggest downside bids through the 1.1900 level into the 1.1880 before weak stops appear and opens the to the 1.1850 stronger congestive area continuing through to the 1.1800 level and congestion onwards, Topside offers light through to the 1.1950 area before offers start appear in earnest however, there is a limit to the selling and once the buyers appear then pushing through the 1.2000 level is likely to see a short squeeze moving through the market into the congested 1.2100 onward area.

GBPUSD Bias: Bullish above 1.3750 targeting 1.44

GBPUSD From a technical and trading perspective, as 1.40 now acts as support bulls will target a test of 1.44 as the next upside objective. Below 1.40 opens a retest of 1.3750 pivotal trend support.

Flow reports suggest topside offers weak back through the 1.3900 level and light stops limited at best before running into light offers around the 1.3950 area and then increasing resistance through to the 1.4000 before slightly stronger stops appear and the market opens to the 1.4050-1.4100 with patchy resistance until closer to the topside of that range and stronger offers thereafter, downside bids into the 1.3800 level with weak stops likely on a dip through the 1.3780-40 levels with congestion likely to soak up much of the selling through to the 1.3700 level with possibly strong congestion then around the 1.3700 level increasing into the 1.3650 level before being able to make a move to the 1.3600 area and strong bids again.

USDJPY Bias: Bullish above 107.30 targeting 109.85

USDJPY From a technical and trading perspective, as 104.50 supports there is potential for a further squeeze higher to test offers towards 107. A loss of 103.50 would negate further upside and suggest a resumption of trend. Target achieved, look for a profit taking pause to develop above 108.60, as 107.30 support bulls will target a test of 109.85 next

Flow reports suggest topside offers increasing into the 108.50 area with congestion likely to increase on any move through the 108.80 and then through to the 109.20 level even through that level market is likely to remain strongly offered to the 110.00 area before strong stops start to appear, Downside bids light through the 107.50 area and limited into the 107.20-106.80 with weak stops likely on a break through the level and opening the downside to a quick move through to the 106.00 area before stronger bids start to appear.

AUDUSD Bias: Bullish above .7560 bullish targeting .8000

AUDUSD From a technical and trading perspective, as the major trendline support at .7560 now acts as support, look for target wave 5 upside objective towards .8000. A closing breach of .7730 of the internal descending trendline will encourage the bullish thesis.

Flow reports suggest downside bids into the 0.7680 area with increasing bids into the 0.7660 -0.7640 area before some weakness is seen through to the 0.7620-0.7580 and likely stronger stops appearing through the level, topside offers likely light through to the 0.7780 level with strong offers likely building through to the 0.7820 area, weak stops beyond are likely to be soaked up by continuing congestion into the 0.7850 level and increasing on any push through to the 79 cents area where stronger weak stops and break out stops may be waiting.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!