Daily Market Outlook, May 03, 2021

Daily Market Outlook, May 03, 2021

Fed’s Kaplan (non-voter) opined that it is appropriate to start talking about tapering the asset purchases, weighed on risk sentiments on Friday. The S&P 500 declined 0.72%, dragged down by tech shares, but still capped the third straight month of gains, while VIX was also higher at 18.61. UST bond closed on a strong note due to month-end rebalancing flows with the 10-year yield at 1.63%. Meanwhile, China’s Caixin manufacturing PMI rose from 50.6 in March to 51.9 in April.

Kaplan had noted that “we’re now at a point where I’m observing excesses and imbalances in financial markets”. Separately, Treasury Secretary Yellen had defended President Biden’s economic spending plan, citing that it is spread out quite evenly over 8-10 years and inflation should not be an issue. Meanwhile, US personal incomes surged by 21.1% in March, the most in records dating back to 1946 and powered by the third round of pandemic-relief checks which lifted spending of goods and services by 4.2%. The core PCE deflator also jumped by 1.8% yoy (0.4% mom), the most since 2018.

Asian markets trade with a muted tone today as markets in Japan and China are closed for holidays and as investors await the manufacturing PMIs due from US, Europe and Asia (including S’pore). Today’s economic calendar also comprises Indonesia’s April CPI and Hong Kong’s 1Q21 GDP growth. Fed Chair Powell is speaking today. For the week ahead, watch RBA policy decision (both the cash rate target and 3-year yield target are likely to be untouched at 0.10%) tomorrow.

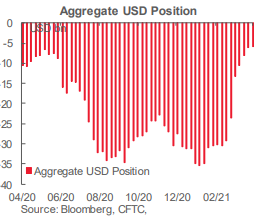

CFTC Data

USD Sentiment Weakens Again Data covers up to Tuesday Apr 27 and were released on Friday Apr 30. Speculative sentiment in the USD continues to deteriorate, CFTC data for the week through last Tuesday show. The aggregate USD short rose USD2.5bn, looking at the various exposures in the major currencies we monitor in this report, taking the net short USD bet to USD10.8bn, the highest in six weeks.

While shifts in EUR positioning and sentiment are typically the primary driver of swings in broader positioning, it is short-covering in the JPY contract that is driving the bulk of USD selling pressure this week, even though the JPY was the worst performing currency among the majors in the reporting period, speculative accounts cut JPY shorts as USDJPY broke back under the 108 zone. Net JPY shorts were reduced USD1.3bn.

Elsewhere, investors handled currency exposures with a fairly light touch. Net GBP longs were lifted USD348mn to take the net long to USD2.5bn, or 29.2k contracts. Net GBP longs have peaked in the past year or so nearer 35k contracts so there may still be some room for bullish sentiment to develop.

Speculators lifted net CAD longs modestly (USD217mn) but both gross longs and gross shorts continue to trend higher and there is clearly a reluctance among speculators—still—to buy into the CAD bull trend. Net positioning this week (USD1.27bn) is barely higher now (the equivalent of 15.7k contracts) than at the end of the year (15.3k contracts) when USDCAD was trading near 1.29. • Changes elsewhere were unremarkable; net EUR longs were little changed on the week (at USD12.3bn). Net AUD, MXN and CHF positioning is essentially flat. Net NZD longs rose slightly (USD193mn) but the overall exposure is limited. Outside of FX, net gold longs were cut just under USD2bn in the week to USD30.3bn

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

Larger FX Option Pipeline

GBP/USD: May03 $1.3700(Gbp1.3bln)

AUD/USD: May04 $0.8000(A$1.1bln)

AUD/NZD: May04 N$1.0855-65(A$2.0bln-AUD puts)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1990 bullish above

EURUSD From a technical and trading perspective, the close sub 1.2080 would warn of deeper corrective cycle to test support at 1.1990/60 failure here opens 1.1850

Flow reports suggest topside congestion through to the 1.2160 level from the highs and then while there maybe some weak stops just beyond stronger offers are likely through the level to the 1.2200 area with weak stops again appearing but very limited and the 1.2250 again seeing the stronger offers through to the 1.2300 level with the market then having the ability to test this year’s highs, downside bids light through to the 1.2000 area and then weak stops on a move through the 1.1920 level opening the market to the 1.1850 area where stronger congestion appears.

GBPUSD Bias: Bullish above 1.39 bearish below

GBPUSD From a technical and trading perspective, as 1.3960 contains upside attempts look for a test of range support towards 1.37.

Flow reports suggest topside offers through the 1.3900 level light through to the 1.3940 area where offers are likely to be a little stronger with further offers likely to be into the 1.4000 area with stops likely through the 1.4020 area and opening a stronger move higher, downside bids strong into the 1.3800 with congestion likely to continue through the level and while there may be some stops that congestion is likely to continue through to the 1.3750 level, light bids through the level but increasing again into the 1.3700 level with congestion then continuing through the level.

USDJPY Bias: Bullish above 108 targeting 112

USDJPY From a technical and trading perspective, as 107.50 acts as support there is potential for a test of the pivotal 108.50, through here will open another look at 110.

Flow reports suggest downside bids into the 107.80 however, a break through the level is likely to see weak stops and breakout stops appearing and the market free to quickly test 107.50 and an old trendline then nothing until closer to the 107.00 area where stronger bids start to appear but the downside opening to Feb levels, topside offers through to the 110.00 level with light congestion through the figure level and weak stops possibly limited and stronger offers likely increasing on a move higher towards the 111.00

AUDUSD Bias: Bearish below .7700 bullish above

AUDUSD From a technical and trading perspective, the closing breach of .7730 has relieved downside pressure opening a move to test offers towards .7820

Flow reports suggest topside offers continue through the 0.7800 area with a break through the 0.7820 area likely to see weak stops and a test towards the sentimental 0.7850 area however, while there maybe some offers in the area the market looks to be fairly open through to the 79 cents level and ultimately ranges from the end of Feb, downside bids light through the 0.7700 level with weak stops likely on a move through the 0.7680 before stronger bids around the 0.7650 area and continuing through to the 0.7600 likely increasing in size, any further moves are likely to see strong support into the 0.7550 to calm the situation.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!