Daily Market Outlook, November 17, 2020

Daily Market Outlook, November 17, 2020

Moderna yesterday reported its Covid-19 vaccine, which uses a similar technology to Pfizer, was nearly 95% effective in third-stage trials. Risk sentiment was boosted in Europe and the US yesterday, with the S&P 500 closing at a record high. That carried over into the Asian trading session, although markets have ended more mixed and futures suggest European stocks may open lower.

Today’s US data calendar has updates for a range of sectors, including retailing and industrial production. There has been concern since the summer that a pickup in Covid-19 would lead to a sharp slowing in the US rebound. While growth has slowed, it has nevertheless outperformed expectations. The latest data are likely to show the economy continuing to grow in October across many sectors – look for headline retail sales and industrial production rising 0.6% and 0.7%, respectively. Downside risks for the retail sales reading, however, should be noted after a significant positive surprise in September.

Central bankers have sounded cautiously optimistic about news of potential breakthrough in a vaccine to combat Covid-19. Bank of England Governor Andrew Bailey will give a keynote speech today at 2pm, while ECB President Christine Lagarde will take part in a Q&A session (4pm) at a Bloomberg event. Among other speakers worth noting is BoE MPC member Dave Ramsden’s lecture at the University of Nottingham on the future of the UK economy (5pm).

At 7am tomorrow, UK inflation figures for October will be released. Annual CPI inflation is expected to be 0.5%, unchanged from September. Modest upward pressure from other factors will probably have been offset by a negative impact from the energy price cap. Inflation is expected to remain well below the 2% target through the winter, reflecting weak demand (relative to supply) in the economy as well as temporary factors such the lower energy prices and the VAT reduction.

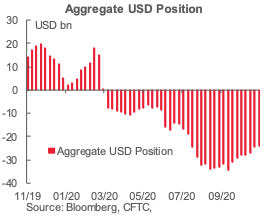

CFTC data released today showed practically no change in the net USD short in the week to Nov 10 with only a USD55mn week-to-week decrease in the USD’s net speculative short of USD24.35bn. The seven-day period saw uncertainty around the results of the US presidential race on November 3 with former VP Biden (widely) projected as president-elect on November 7. It also followed the previous week’s semi-lockdown announcements in key parts of Europe.

The weekly change in the overall USD position, however, hides a large USD1.61bn increase in the JPY’s net long to nearly USD5bn, which represents the highest yen bullish position since late 2016 as speculative accounts likely turned to the JPY for its haven appeal in light of electoral uncertainty. The weekly net long JPY increase is also its largest since the height of the panic in markets in March. Accounts also increased their CHF net long by USD126mn as another sign of haven-seeking activity.

As speculators turned to the JPY, they trimmed their EUR, GBP, and AUD positions almost equally, by USD572mn, USD551mn, and USD541mn respectively. While the EUR’s net long is still roughly USD15bn larger than that of the JPY, last week’s drop marked the seventh straight decline in net bullish bets on the shared currency with its net position falling below USD20bn for the first time since July. In the case of the GBP, its net short widened to its largest point since July with the added risk of a no-trade-deal end to the Brexit transition period on January 1, 2021.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1830 (1BLN), 1.1850 (2.1BLN), 1.1900 (1.1BLN)

- EURGBP: 0.8900 (923M), 0.8950 (256M), 0.9050 (804M), 0.9000 (245M), 0.9050 (804M)

- USDJPY: 104.00 (400M), 104.50 (226M), 105.00 (636M)

- AUDUSD: 0.7200 (362M), 0.7325 (225M)

Technical & Trade Views

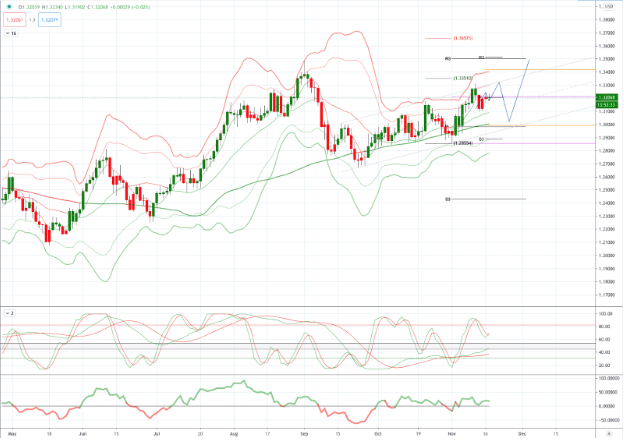

EURUSD Bias: Bullish above 1.1750 targeting 1.20

EURUSD From a technical and trading perspective, as 1.1750 acts a support look for a retest of cycle highs at 1.20, failure below 1.1750 opens a retest of range support at 1.16

Flow reports suggest topside offers through to the 1.1920 level, even there where you’re likely to see weak stops you will find the same type of congestion continuing to the 1.1950 before weakening a little and increasing for any move to the 1.2000 level. Downside bids light through the 1.1800 area with weak stops on a dip through the 1.1780 area and opens the market for a renewed challenge of the 1.1700 area with light support from there

GBPUSD Bias: Bullish above 1.3150 targeting 1.3480

GBPUSD From a technical and trading perspective, as 1.3150 supports look for a test of prior cycle highs at 1.3480

Flow reports suggest offers into the 1.3300 level are likely to be a little light with limited congestion through to the 1.3400 level before stronger offers start to appear with weak stops on a break through the level to open the 1.3500 level for a second test of the year. Downside bids light back through the 1.3200 level with congestion forming around the 1.3150 and stronger to the 1.3100 level, weak stops on a move through the area and nothing special until the 1.3000 one suspects.

USDJPY Bias: Bearish below 104.30 bullish above

USDJPY From a technical and trading perspective, as 104.30 supports look for a test of descending trendline resistance at 105.50 UPDATE as 104.30 continues to attract buyers look for a breach of 105.50 to open a test of 106 next

Flow reports suggest downside bids light through the 104.50 level before beginning to thicken on any dip below the 104.00 level increasing on move through the 103.50 level with weak stops likely on a dip through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00.

AUDUSD Bias: Bearish below .7243 bullish above targeting .7400

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400

Flow reports suggest topside offers remain strong into the 0.7340 area and likely to continue through to the 0.7360 area before some weakness appears, however, the stronger offers are likely through the 74 cents area to 0.7420 before stops appear. Downside bids light through the 73 cents area and a push through the 0.7240 area is likely to see weak stops and the market opening to a move into the 0.7150 area.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!