Daily Market Outlook, November 20, 2020

Daily Market Outlook, November 20, 2020

Asian equity markets are mixed this morning although there are no major movers in either direction. The US Treasury decided not to extend the majority of the Federal Reserve’s emergency lending programmes past the end of the year, although the one to support money market funds will continue. EU leaders called for ‘no deal’ Brexit preparations to be intensified, while trade negotiations are set to continue remotely for now as one of the EU team has Covid-19.

This morning’s UK retail sales update for October showed an unexpected 1.2% increase in spending just ahead of the new lockdown in England. That continues the strong rebound seen in sales since the spring lockdown. As a result, the retail sector is one of the few parts of the economy where activity is back above its February level. Despite the resilience of retail sales so far, there are concerns that they may slow more sharply over the winter. However, the recent extension of the government’s furlough scheme, and news that a vaccine may soon be available, have increased the odds that spending will hold up. Information on consumer confidence will be an important first indicator of that. However, today’s November GfK consumer confidence reading, which will have been collected in the first two weeks of November seems to have been too early to see a vaccine lift. Instead, the measure slipped to -33 from -31 as new restrictions started to bite. UK October public finances posted a monthly budget deficit of £21.6bn. That was lower than expected but still more than double the borrowing figure at the same point last year. Next Wednesday, the Chancellor of the Exchequer will report the results of his government spending review and the Office for Budget Responsibility will publish a new set of economic forecasts. The latter will provide more detail on the scale of the deterioration in the UK’s fiscal position and possibly on what may need to be done to correct this in future.

The rest of today’s economic calendar is light. In the Eurozone, the November reading for consumer confidence will give some idea of the initial impact of the recent tightening in restrictions. However, as was the case in the UK, the data will probably have been collected too early to have been given a lift by the recent news on vaccines.

A number of policymakers from some of the biggest central banks are set to speak today, including ECB President Lagarde. However, as she has already made several speeches this week, it seems unlikely that we will learn anything new from today’s comments or indeed from the remarks of the other speakers. The key recent message from central bankers has been that while the vaccine news is welcome, significant risks continue to exist and so monetary policy will remain supportive.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1850 (1.1BLN), 1.1885 (290M), 1.1900 (1.3BLN)

- GBPUSD: 1.3100 (531M), 1.3155 (180M), 1.3300 (205M)

- EURGBP: 0.8900 (230M), 0.8950 (205M)

- USDJPY: 103.25 (500M), 103.75 (626M), 104.00 (1BLN)

- AUDUSD: 0.7250 (288M), 0.7320-25 (300M)

Technical & Trade Views

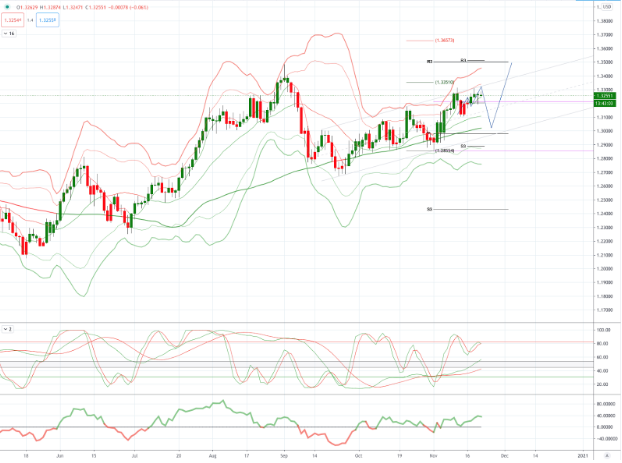

EURUSD Bias: Bullish above 1.1750 targeting 1.20

EURUSD From a technical and trading perspective, as 1.1750 acts a support look for a retest of cycle highs at 1.20, failure below 1.1750 opens a retest of range support at 1.16

Flow reports suggest topside offers through to the 1.1920 level, even there where you’re likely to see weak stops you will find the same type of congestion continuing to the 1.1950 before weakening a little and increasing for any move to the 1.2000 level. Downside bids light through the 1.1800 area with weak stops on a dip through the 1.1780 area and opens the market for a renewed challenge of the 1.1700 area with light support from there.

GBPUSD Bias: Bullish above 1.3150 targeting 1.3480

GBPUSD From a technical and trading perspective, as 1.3150 supports look for a test of prior cycle highs at 1.3480

Flow reports suggest offers into the 1.3300 level are likely to be a little light with limited congestion through to the 1.3400 level before stronger offers start to appear with weak stops on a break through the level to open the 1.3500 level for a second test of the year. Downside bids light back through the 1.3200 level with congestion forming around the 1.3150 and stronger to the 1.3100 level, weak stops on a move through the area and nothing special until the 1.3000 one suspects.

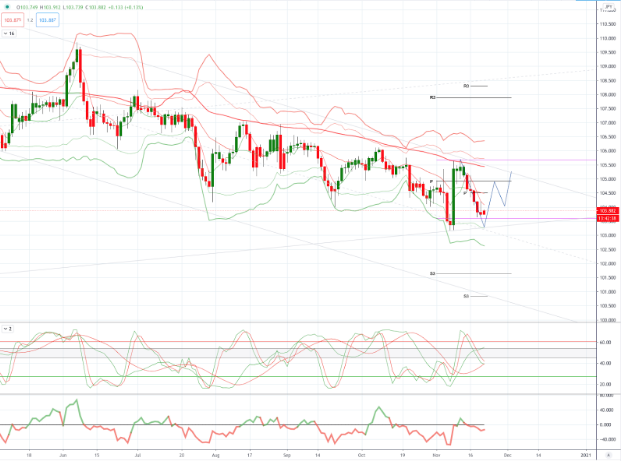

USDJPY Bias: Bearish below 104 bullish above

USDJPY From a technical and trading perspective, look for another tet of 103.20 projected ascending trendline support, another hold here could prompt near term short covering to challenge offers to 105 descending trendline resistance

Flow reports suggest downside bids into the 104.00 level increasing on move through the 103.50 level with weak stops likely on a dip through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00.

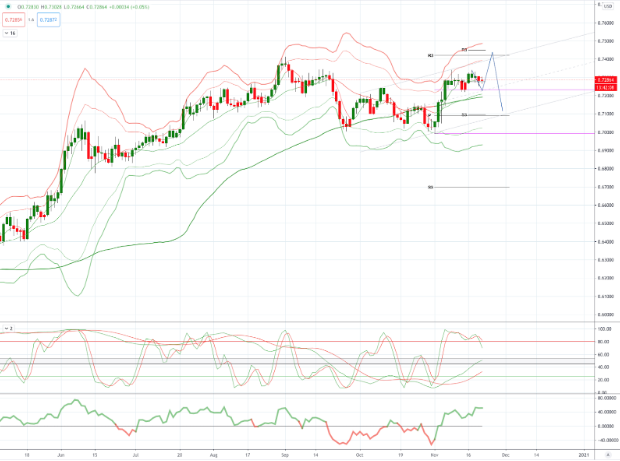

AUDUSD Bias: Bearish below .7243 bullish above targeting .7400

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400

Flow reports suggest downside bids cleared through to the 0.7260 level yesterday but reforming with stronger bids likely through to the 0.7240 area, a move through the level is likely to see limited bids into the 0.7200 area with weak stops appearing on a move through the 0.7180 area opening a deeper move over several days to the 70 cents level. Topside offers through the 0.7350 area are likely to continue to be strong with increasing offers beyond the 0.7380 area through to the 0.7410-20 level before stops appear however, offers around the 0.7450 area are likely to increase beyond the level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!