Daily Market Outlook, November 23, 2020

Daily Market Outlook, November 23, 2020

Risk sentiment remains well supported by optimistic news over a Covid-19 vaccine, leading equity markets in Asia higher this morning. In the UK, reports suggest that Pfizer’s vaccine could be given regulatory approval within the week, with the NHS reported to be on standby to administer from the start of December. Similar news has also followed from the EU and US, with the latter reportedly ready to begin vaccinations in less than three weeks. Meanwhile, speaking over the weekend, UK Chancellor said that the focus of this week’s Spending Review would be on responding to the crisis and that there would be no austerity. However, he noted that borrowing at current levels was “clearly not sustainable”, highlighting the need for increases in taxation and/or lower spending in future years.

Ahead of the UK Chancellor’s Spending Review update on Wednesday, today’s release of the November PMIs will provide a timely reminder of the Covid virus’s impact. While the latest restrictions are expected to have a much smaller negative impact than the first lockdown, look for UK services PMI to fall below the key 50 expansion/contraction level for the first time since June, dropping to 43.0. However, one key theme recently is that there has been the emergence of a two-speed economy, with manufacturing benefiting from the global recovery. Therefore expect the decline in the manufacturing PMI to be less severe, possibly holding above the 50 mark. A similar picture is expected from the Eurozone PMIs, with sentiment across the manufacturing sector likely to remain relatively upbeat. In contrast, the services sector reading is forecast to remain below 50 for a third month, declining to 44.0.

In the US, the less-closely watched Markit PMIs are expected to remain well above 50. Bank of England (BoE) Governor Bailey, along with fellow MPC members Haldane, Saunders and Tenreyro, at the Treasury Select Committee this afternoon. They will be quizzed on the assumptions that underpin the Bank’s latest forecasts in the November Monetary Policy Report (MPR). Particularly interesting is their views on how recent developments such as the extension of the furlough scheme to March 2021 and the positive vaccine news may affect the outlook for the economy. The MPR already assumes a waning impact of Covid over the forecast period, so the vaccine news may serve to alter more the balance of risks (less downside) to the central outlook. However, with UK PM Johnson expected to outline the government’s plans once the current national lockdown ends on the 2nd December, members of the Bank of England are likely to stress the highly fluid nature of the current environment. As part of the plan, which will be delivered later today to Parliament, Mr Johnson is expected to announce a harsher three-tier system along with mass testing but will include concessions for family mixing around Christmas time.

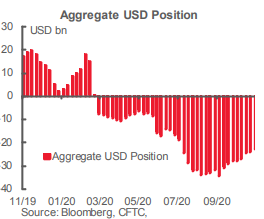

The latest data on FX sentiment and positioning, reflected in the CFTC Commitment of Traders Report through last Tuesday, continues the basic themes reflected in recent trends. Investors are keeping exposure to most currencies outside of the EUR relatively low whilst paring overall exposure from peak USD bearishness (or EUR bullishness) seen in mid-September. Aggregate positioning in the major currencies we cover in this report reflects a net USD short position of USD22.9bn this week, down USD1.4bn over the last week’s data. Net EUR longs remain the largest since currency position in these CFTC data. But positioning this week was very little changed over the prior week and showed a net paring of just USD117mn in overall EUR longs. Bearish bets on the GBP were maintained and extended, through again, only very slightly. Bullish CHF sentiment was trimmed—slightly—by USD120mn. JPY net long liquidation accounts for effectively all of the improvement in USD positioning this week, reflecting a broad reduction in exposure to the yen. Gross JPY longs fell sharply while gross yen shorts fell to the lowest level since late 2004.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1800-10 (560M), 1.1820 (342M), 1.1850 (628M), 1.1900 (287M), 1.1950 (372M)

- GBPUSD: 1.3295-1.3305 (650M)

- EURGBP: 0.8830 (484M), 0.8900 (443M), 0.8950 (226M), 0.8990 (659M), 0.9000 (190M)

- AUDUSD: 0.7200 (501M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.1750 targeting 1.20

EURUSD From a technical and trading perspective, as 1.1750 acts a support look for a retest of cycle highs at 1.20, failure below 1.1750 opens a retest of range support at 1.16

Flow reports suggest topside offers through to the 1.1920 level, even there where you’re likely to see weak stops you will find the same type of congestion continuing to the 1.1950 before weakening a little and increasing for any move to the 1.2000 level. Downside bids light through the 1.1800 area with weak stops on a dip through the 1.1780 area and opens the market for a renewed challenge of the 1.1700 area with light support from there.

GBPUSD Bias: Bullish above 1.3150 targeting 1.3480

GBPUSD From a technical and trading perspective, as 1.3150 supports look for a test of prior cycle highs at 1.3480

Flow reports suggest topside offer light through the 1.3350 area with stronger offers likely into the 1.3400 level and likely to continue through the 1.3450 area before break out stops are likely to appear through the area and into the 1.3500 level with weakness above, downside bids light through the 1.3250 level with stronger congestions on a dip to the 1.3200 areas, weak stops on a move through the level and downside weakness through to the 1.3100 level where some stronger congestion can be possibly found

USDJPY Bias: Bearish below 104 bullish above

USDJPY From a technical and trading perspective, look for another tet of 103.20 projected ascending trendline support, another hold here could prompt near term short covering to challenge offers to 105 descending trendline resistance

Flow reports suggest downside bids into the 103.50 level increasing on move through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00.

AUDUSD Bias: Bearish below .7243 bullish above targeting .7400

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400

Flow reports suggest downside bids cleared through to the 0.7260 level yesterday but reforming with stronger bids likely through to the 0.7240 area, a move through the level is likely to see limited bids into the 0.7200 area with weak stops appearing on a move through the 0.7180 area opening a deeper move over several days to the 70 cents level. Topside offers through the 0.7350 area are likely to continue to be strong with increasing offers beyond the 0.7380 area through to the 0.7410-20 level before stops appear however, offers around the 0.7450 area are likely to increase beyond the level.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!