Daily Market Outlook, November 25, 2020

.png)

Daily Market Outlook, November 25, 2020

Asian equity markets were mixed, with initial gains supported by vaccine optimism, President Trump signalling a transfer of power and also hopes of a larger fiscal stimulus if former Fed Chair Yellen is appointed the next US Treasury Secretary. The rally lost momentum on ongoing concerns about Covid19 infections and the impact on the economy.

Today’s focus will be on UK Chancellor Rishi Sunak’s Spending Review, due to start at approximately 12:30pm after PMQs, and updated economic and fiscal forecasts from the Office for Budget Responsibility (OBR). The Spending Review will cover only 2021/22 rather than the usual three or four years, testament to the high levels of uncertainty about the economic outlook. It suggests that the Chancellor’s primary focus for now will remain on supporting the economy through the pandemic, with reports that £4.3bn will be allocated to schemes to ‘protect jobs and livelihoods’. Fiscal consolidation is for the future, but there could be indications of the need to start repairing the public finances, for instance, through public sector pay restraint. The OBR’s new economic growth forecasts will be revised sharply lower compared with those in March which were produced before the coronavirus took hold. It will be interesting to see how closely they resemble the economic ‘scenarios’ produced for the OBR’s July Fiscal Sustainability Report (FSR), which showed GDP returning to pre-virus levels only by the end of 2022 under its central scenario (see chart). The judgement on the degree of economic ‘scarring’ from the pandemic will underpin the OBR’s medium-term growth and fiscal projections. Any forecast is subject to unusually high levels of uncertainty, but the stakes are high and it will determine the government’s fiscal headroom (including the need for higher taxes) in future years. According to the July FSR, government borrowing is expected to be £372bn in the current financial year and still be above £100bn in 2024/25.

Away from the UK, the US calendar is very busy ahead of Thanksgiving tomorrow. The second estimate of Q3 GDP growth is expected to confirm a stellar rebound of 33.1% (annualised), but more recent indicators suggest activity is slowing. In particular, October personal spending growth may rise at the slowest pace since the start of the pandemic. Other data due include durable goods orders, new home sales and weekly jobless claims. The minutes of the FOMC meeting will also be released tonight, helping markets assess the Fed’s future policy stance

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1850 (371M), 1.1870 (739M), 1.1920 (203M), 1.1935 (271M)

- EURGBP: 0.8875 (800M), 0.8900 (327M), 0.9000 (491M)

- USDJPY: 103.50 (320M), 104.00 (1BLN), 104.60 (376M

- AUDUSD: 0.7390-0.7400 (750M)

Technical & Trade Views

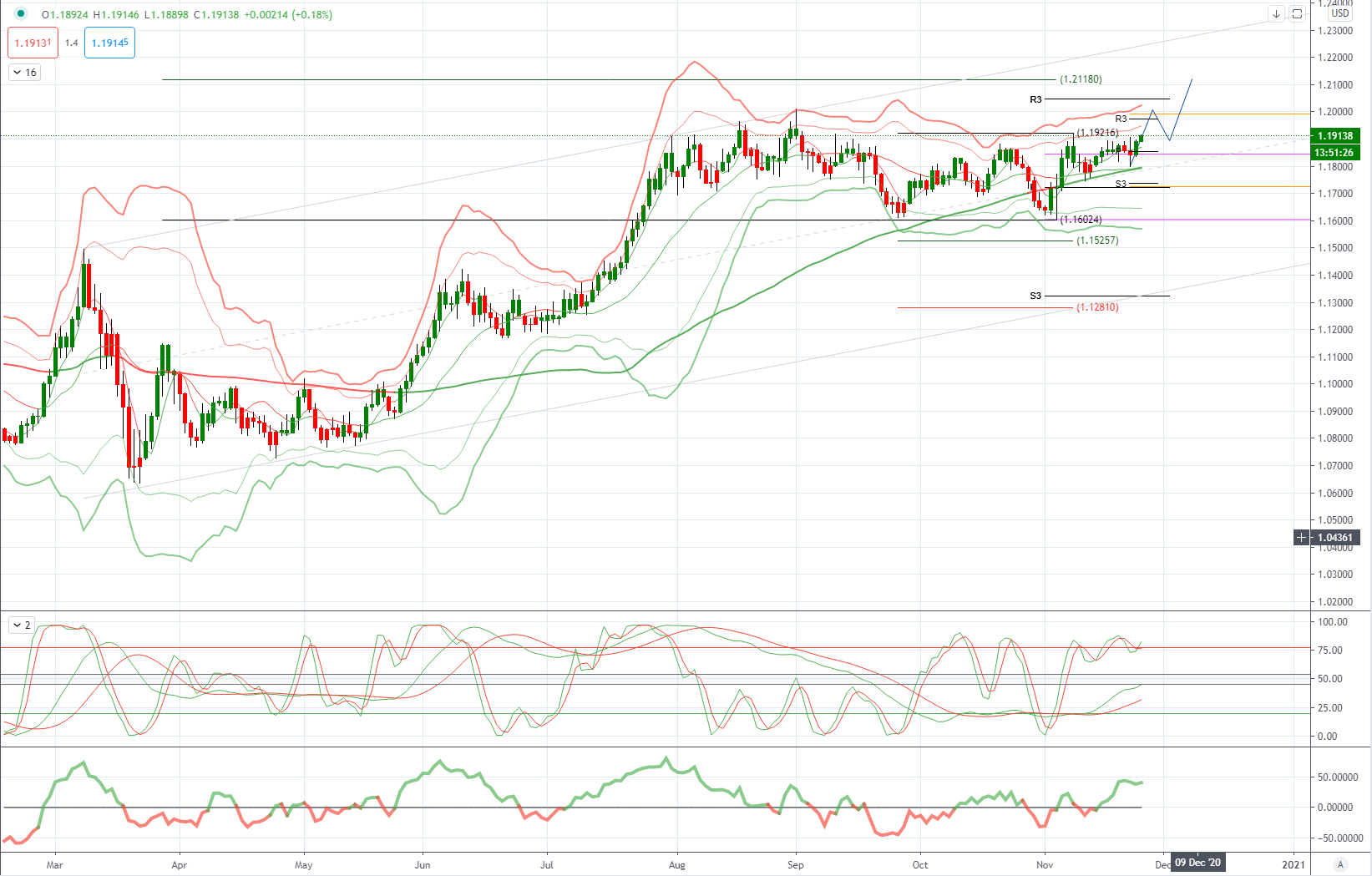

EURUSD Bias: Bullish above 1.1750 targeting 1.20

EURUSD From a technical and trading perspective, as 1.1750 acts a support look for a retest of cycle highs at 1.20, failure below 1.1750 opens a retest of range support at 1.16

Flow reports suggest topside offers through to the 1.1920 level, even there where you’re likely to see weak stops you will find the same type of congestion continuing to the 1.1950 before weakening a little and increasing for any move to the 1.2000 level. Downside bids light through the 1.1800 area with weak stops on a dip through the 1.1780 area and opens the market for a renewed challenge of the 1.1700 area with light support from there

GBPUSD Bias: Bullish above 1.3150 targeting 1.3480

GBPUSD From a technical and trading perspective, as 1.3150 supports look for a test of prior cycle highs at 1.3480

Flow reports suggest strong offers into the 1.3400 level with weak stops likely through the level before running into stronger offers from the 1.3440-50 area, a break here is likely to see stronger stops appearing and the market testing to the 1.3500 with stronger offers again reappearing however, a strong push through the level will allow the market over time to test to the 1.40-43 area, downside bids light through the 1.3300 area and weak stops likely to appear with limited congestion through to the 1.3200 level with again limited bids and stronger congestion on the move starting to appear to match off with any weak stops on a run to the 1.3150 and stronger bids

USDJPY Bias: Bearish below 104 bullish above

USDJPY From a technical and trading perspective, look for another tet of 103.20 projected ascending trendline support, another hold here could prompt near term short covering to challenge offers to 105 descending trendline resistance

Flow reports suggest congested through to the 104.80 level where offers are likely to be a little stronger with weak stops on a move through the 105.20 level before further offers into the 105.50 area and weakness through to the 106.00. downside Bids into the 103.50 level increasing on move through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00.

AUDUSD Bias: Bearish below .7243 bullish above targeting .7400

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400

Flow reports suggest downside bids cleared through to the 0.7260 level yesterday but reforming with stronger bids likely through to the 0.7240 area, a move through the level is likely to see limited bids into the 0.7200 area with weak stops appearing on a move through the 0.7180 area opening a deeper move over several days to the 70 cents level. Topside offers through the 0.7350 area are likely to continue to be strong with increasing offers beyond the 0.7380 area through to the 0.7410-20 level before stops appear however, offers around the 0.7450 area are likely to increase beyond the level.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!