Daily Market Outlook, November 26, 2021

Daily Market Outlook, November 26, 2021

Overnight Headlines

- Nervy Week For Markets End With Wild Swing On New Strain

- South Africa Detects Covid Variant, Implications Not Yet Clear

- Chinese Traders Ramp Leverage, Bets PBoC To Stay Sidelines

- China Property-Led Economy Slowdown Show No Ending Sign

- Reports China To Ask Didi To Delist From US On Security Fear

- Shanghai Cut Tourism, Eastern City Limits Transport On Covid

- Tokyo’s Consumer Prices Rise At Fastest Pace More Than Year

- Australia October Retail Sales Surge, Economy Recovery Build

- BoE Bailey Signal Abandoned Hard Guidance For Rates Policy

- UK Stop Some Flights From Africa Over Covid Variant Worries

- French Fishermen To Blockade Ports, Protest Over UK Permits

- Brent Oil Slides, Covid Worries Ahead Of Key OPEC+ Meeting

The Day Ahead

- Equity markets fell significantly in Asia after a recently identified new Covid variant called B.1.1529 led to the UK banning flights from South Africa and five other neighbouring countries. The move is described as precautionary while scientists determine whether the new variant is more transmissible or lethal than previous ones.

- The focus today may be on the potential fallout from the new virus variant. Several central banks speakers, meanwhile, are scheduled to speak. In the UK, the Bank of England’s Chief Economist Huw Pill will talk about the economic outlook at a CBI event. Pill said last week that the December policy decision is likely to be ‘finely balanced’, with ‘no quick fix’ and a need for patience to bring inflation back to target. Policymakers have sought to emphasise the likelihood that only ‘modest’ tightening is likely to be needed over the forecast period.

- There are also a number of ECB speakers today, including a keynote speech by President Christine Lagarde at a legal conference. Other ECB members will also participate at the legal event, including Schnabel, Panetta and Lane, but it’s not clear how much reference there will be specifically to monetary policy.

- The main event in next week’s calendar is the US labour market report. Recent strong US data have raised prospects of a strong pickup in growth in Q4 and speculation that the Fed tapering pace will be increased. In contrast, Eurozone Q4 growth is set to slow, potentially more quickly than previously thought, as measures are taken in a number of countries to tackle sharply rising Covid cases. Eurozone flash CPI inflation for November is the main release next week, which is forecast to increase further. It’s a quieter UK calendar next week, with releases including Bank of England money data and the Lloyds Business Barometer, as well as a ‘fireside chat’ with the BoE MPC’s Catherine Mann.

- US Treasury yields and oil prices have declined in tandem with equities in reaction to headlines on the virus variant discovered in southern Africa. The 10-year Treasury yield fell 9bps to 1.55% and Brent crude oil dropped below $80 a barrel.

Credit Agricole Month End Model

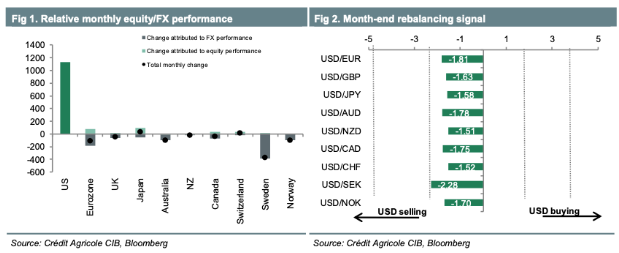

Global equity markets were somewhat mixed during November. In FX, the USD has outperformed across the board on the month. Overall, the moves in equity markets, when adjusted for market capitalisation and FX performance this month, suggest month-end portfolio-rebalancing flows are likely to be mild USD selling across the board with the strongest sell signal in the case of the USD vs SEK.

Our corporate FX flows model is further pointing to EUR buying at the end of the month. In our combined strategy, we therefore use the signals of our corporate flows model and buy the EUR vs an equally-weighted basket of USD and GBP.

As detailed in our report Month-end rebalancing model upgrade, the month-end rebalancing model generates FX trades on the basis of two signals. The first is based on the performance of US stock markets relative to the rest of G10 adjusted for changes in exchange rates and market capitalisation (Figure 1). In particular, we allocate weights to create a portfolio of the nine G10 USD-crosses. In that, we use the signals’ relative strength to determine the portfolio weights (Figure 2).

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

EUR/USD: 1.1150-60 (500M), 1.1250 (245M), 1.1275-80 (622M)

1.12695-00 (345M)

USD/CHF: 0.9100-15 (315M). EUR/CHF: 1.0440 (342M)

GBP/USD: 1.3400-10 (1.3BLN)

EUR/GBP: 0.8400 (430M), 0.8425 (210M)

AUD/USD: 0.7080 (311M), 0.7190-00 (623M), 0.7240-50 (595M)

USD/CAD: 1.2520-25 (1.85BLN), 1.2545-55 (2.9BLN)

USD/JPY: 113.00 (244M), 113.45-50 (560M), 113.65-70 (1.05BLN)

113.75-80 (490M), 114.25 (256M), 115.50 (582M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- EUR/USD does little in holiday-thinned Asia trade, 1.1206-27 EBS

- On hold just above 1.1186 low Wednesday, lowest since 1.1185 July 2020

- Decisive break below 1.1180-90 double bottom bearish

- 1.1100 in spec sights, 1.1101 low June 2020, March 2020 nadir 1.0636

- Indecisive ECB, COVID spread in Europe among negatives overhanging EUR

- EUR/JPY 129.02 to 128.62 EBS on broad JPY strength with Asia risk-off

- Lowest since 128.57 Monday, spike low last Friday 127.99, bias still down

GBPUSD Bias: Bearish below 1.36 Bullish above.

- Cable heavy in Asia, off marginally from 1.3321 to 1.3299

- Both USD and JPY broadly bid with market risk-off, GBP/JPY 153.68 to 152.44

- GBP/USD lowest since December 2020, GBP/JPY down to ascending 200-DMA

- Market still holiday-thinned and moves may be somewhat exaggerated

- That said, UK negatives too including wishy-washy Johnson cabinet, BoE

- GBP/USD bracketed by option expiries - 1.3100 (611 mln), 1.3400-10 (1.3 bln)

- EUR/GBP steady, 0.8420-37, option expiries at 0.8400 (430 mln), 0.8515 (435)

USDJPY Bias: Bullish above 112.50 Bearish below

- USD/JPY off another leg US yields continue to slip

- USD/JPY off another leg to 114.45 in late Asia/early Europe trade

- High early in Asia 115.36 EBS, market turns very risk off

- Nikkei closed -2.5% at 28,751.62, E-Minis -1@ @4651.25

- Yield on US Treasury 10s from 1.602% early Asia to 1.541%

- New South African COVID strain, geo-political tensions cited

- USD/JPY moving down towards 114.00-50 support zone/base

- Extent, duration of current retracement dependent on US yields

AUDUSD Bias: Bearish below 0.75 Bullish above

- AUD/USD tanks, threatens 9 – mth low as virus fears escalate

- AUD/USD tanks to as low as 0.7139, down 0.7% vs Thurs close

- May slow near 0.7122 base of Bollinger downtrend channel

- 9-mth low of 0.7107 at risk; liquidity thin with US Thanksgiving

- New, highly-mutated COVID-19 variant triggers fear

- Risk-off escalates as Japan considers border curbs

- New variant in HK as Shanghai imposes travel limits

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!