Daily Market Outlook, November 30, 2020

Daily Market Outlook, November 30, 2020

Stock markets in Asia have started the week lower, along with US and European equity futures, as investors monitored Covid-19 developments. Nevertheless, global equities look set to have enjoyed a record month, as optimism remains high that a vaccine will start to be available relatively soon. Reports in recent weeks have pointed to early sign-offs by regulators and the possibility that the first inoculations would begin in December.

The overnight release of the Lloyds Business Barometer showed business confidence fall for a second month in November, dropping from -18% to -21%. Responses to the survey were collected between the 2nd and 16th of the month. However, later responses from the 9th November were more positive and showed confidence rising to -15%, likely reflecting the positive news around a potential vaccine.

Brexit talks are set to continue on a face-to-face basis as they enter what has been widely described again as a crucial week. Over the weekend, UK foreign secretary Dominic Raab suggested that a deal could be agreed this week, but added that this would require the EU to “understand the point of principle”, with respect to the UK’ regaining control of its waters. Some observers are saying that a deal must be done this week to allow time for votes in the UK and European parliaments before year-end. However, reports also suggest that preparations are being made for emergency voting sessions post-Christmas.

Data wise, ahead of tomorrow’s ‘flash’ Eurozone CPI reading for November, today’s regional numbers from Spain, Germany and Italy are expected to show another annual decline in prices, confirming the likelihood that further policy stimulus will be forthcoming soon. With next week’s ECB meeting fast approaching, President Lagarde and several of her colleagues are scheduled to speak. This will be their last opportunity before the ‘silent period’ to signal their intentions for the December policy meeting when they are expected to ease monetary policy.

In the UK, mortgage approvals are expected to have remained firm in October, reflecting a combination of pent-up demand and the impact from the Chancellor’s temporary stamp duty reduction. Look for an above-consensus rise of 90.5k, broadly similar to September’s data. However, with time running out for purchases to be completed, in order to take advantage of the reduction, the coming few months could see some slowdown in mortgage activity, particularly with unemployment set to rise further. Elsewhere, Bank of England policymaker, Silvana Tenreyro, will speak on the “Challenges facing monetary policy makers” at 14:30GMT.

Citi Month-end FX Rebalancing Estimates - USD sell signal GROWS - The final estimate of month-end FX hedge rebalancing flows points to an above-average need to sell USD today. Signal strength has slightly increased since the preliminary update and now stands above two historical standard deviations in most crosses. The signal to sell USD exceeds 2 standard deviations in all crosses except JPY where assumed lower hedge ratios dampen local JPY buying needs.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1900 (800M), 1.1950-65 (511M), 1.2000 (402M)

- USDJPY: 103.00 (882M), 104.00 (572M), 105.25 (576M)

- AUDUSD: : 0.7400 (777M)

Technical & Trade Views

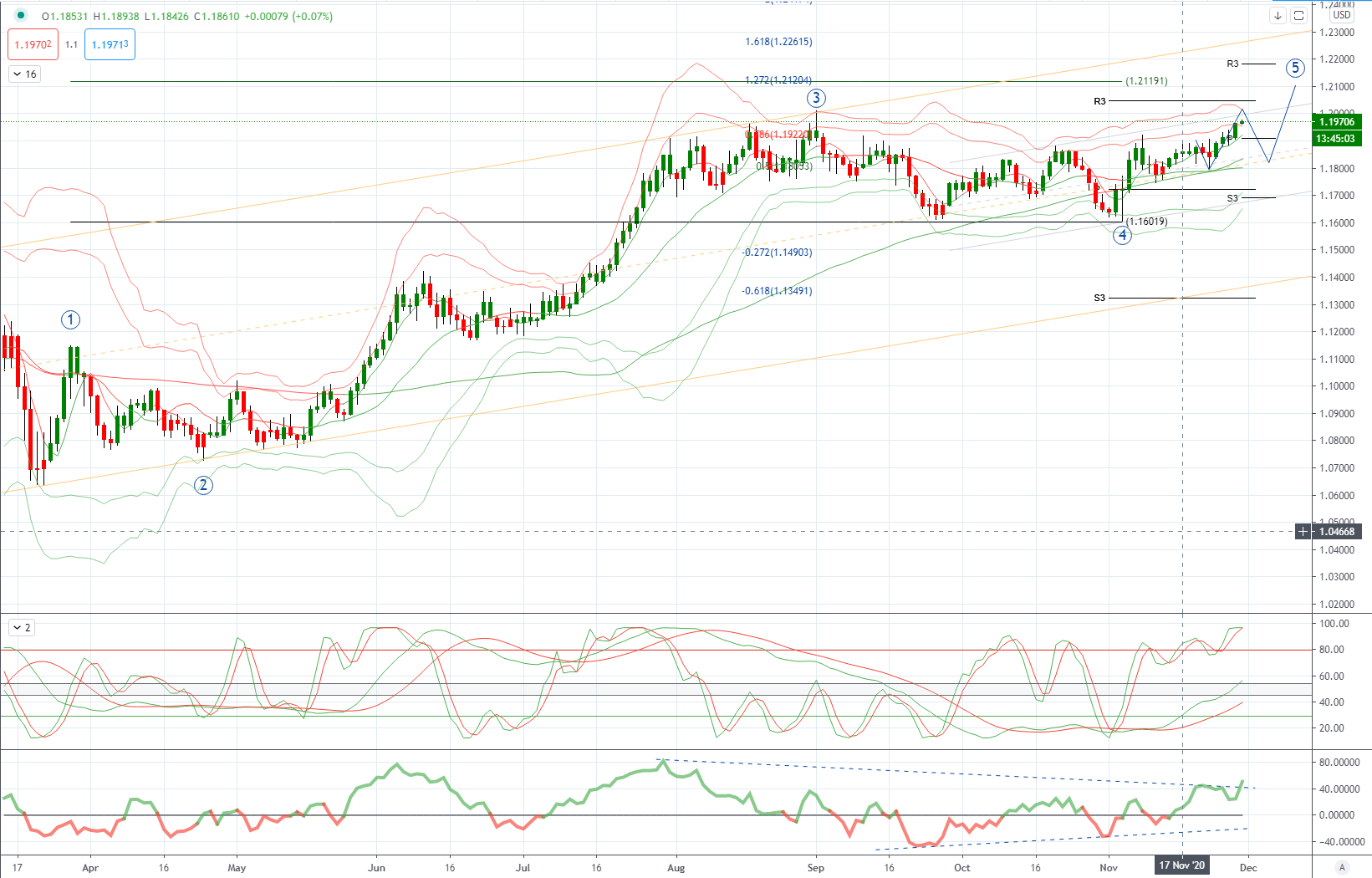

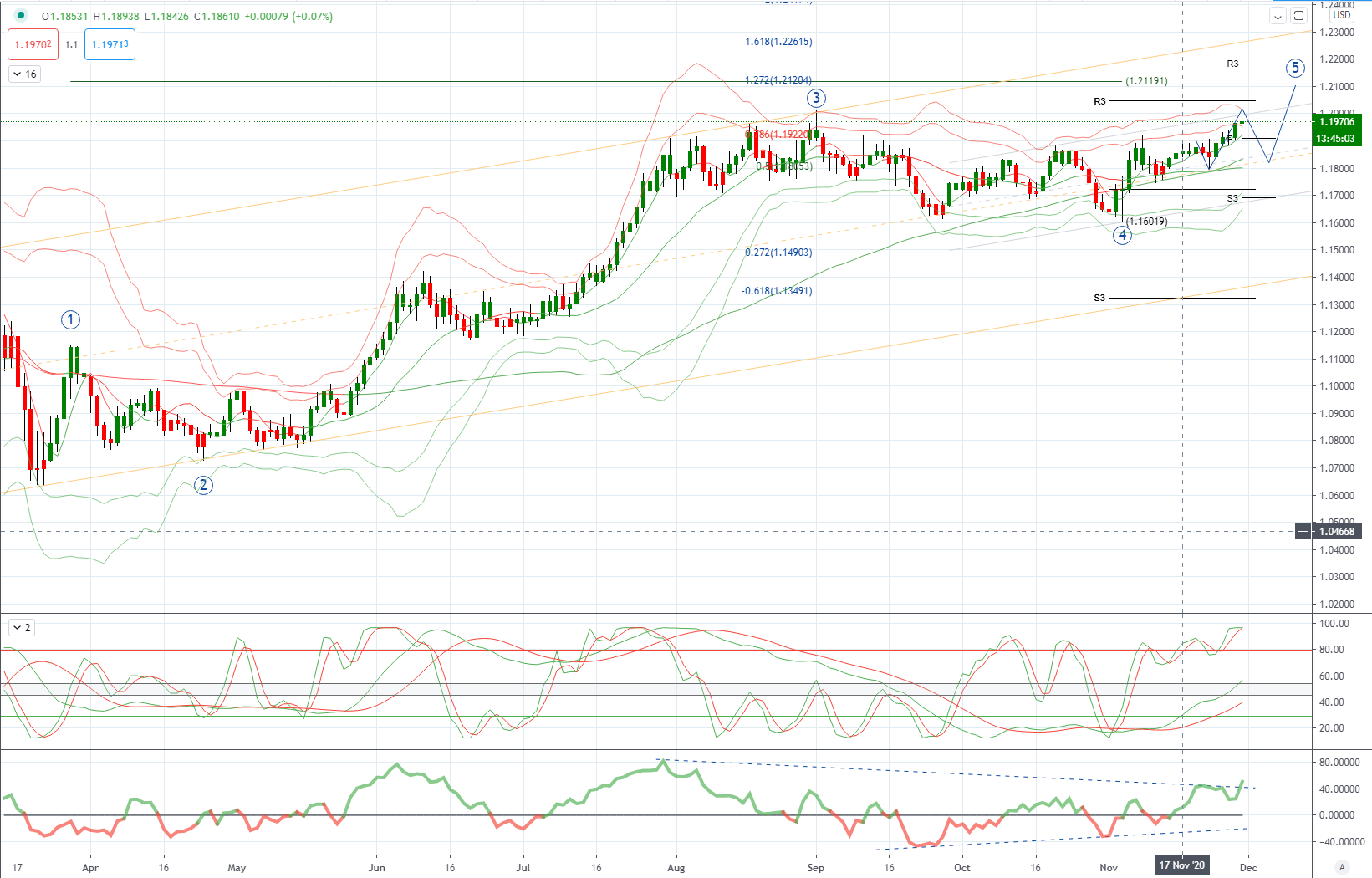

EURUSD Bias: Bullish above 1.1820 targeting 1.2120

EURUSD From a technical and trading perspective, as 1.1820 acts a support look for a retest of cycle highs at 1.20 anticipate a profit taking pullback on the initial test, while 1.1820 is defended then look for price to test the wave 5 upside objective at 1.2120

Flow reports suggest strong offers through the 1.1980 level and likely strong option interest in the area before weak stops and possible break out stops lining up above the figure level possibly around the 1.2020 area and opening the 1.2050 area depending on the balance of option interest, steady offers on the approach to the 1.2100 level with offers likely to continue through to the 1.2120 area but possibly limited stop interest. Downside bids light through the 1.1800 area with weak stops on a dip through the 1.1780 area and opening the market for a renewed challenge of the 1.1700 area with light support from there.

GBPUSD Bias: Bullish above 1.3150 targeting 1.3480

GBPUSD From a technical and trading perspective, as 1.3150 supports look for a test of prior cycle highs at 1.3480, from here expect a profit taking pullback as 1.31 supports then prices can extend higher to test wave 5 upside objectives to 1.3910/80 area

Flow reports suggest strong offers into the 1.3400 level with weak stops likely through the level before running into stronger offers from the 1.3440-50 area, a break here is likely to see stronger stops appearing and the market testing to the 1.3500 with stronger offers again reappearing however, a strong push through the level will allow the market over time to test to the 1.40-43 area, downside bids light through the 1.3300 area and weak stops likely to appear with limited congestion through to the 1.3200 level with again limited bids and stronger congestion on the move starting to appear to match off with any weak stops on a run to the 1.3150 and stronger bids.

USDJPY Bias: Bearish below 105 targeting 101.20

USDJPY From a technical and trading perspective,near term short covering to challenge offers to 105 descending trendline resistance, as this area contains upside attempts look for the next leg lower to target year to date lows at 101.20

Flow reports suggest congested through to the 104.80 level where offers are likely to be a little stronger with weak stops on a move through the 105.20 level before further offers into the 105.50 area and weakness through to the 106.00. downside Bids into the 103.50 level increasing on move through the 103.00 area with the stops likely to increase through 102.80, topside offers likely to increase through to the 106.00 area with weak stops through the 106.20 area and increasing congestion on a push above the 106.50 level and into the 107.00.

AUDUSD Bias: Bearish below .7230 bullish above targeting .7700

AUDUSD From a technical and trading perspective, as .7240/20 now acts as support look for a retest of offers and stops above .7400 from here anticipate a profit taking pullback towards .7200 again before price attempts to extend higher again to target wave 5 upside objective towards .7700

Flow reports suggest downside bids cleared through to the 0.7260 level yesterday but reforming with stronger bids likely through to the 0.7240 area, a move through the level is likely to see limited bids into the 0.7200 area with weak stops appearing on a move through the 0.7180 area opening a deeper move over several days to the 70 cents level. Topside offers through the 0.7350 area are likely to continue to be strong with increasing offers beyond the 0.7380 area through to the 0.7410-20 level before stops appear however, offers around the 0.7450 area are likely to increase beyond the level.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!