Daily Market Outlook, November 30, 2021

Daily Market Outlook, November 30, 2021

Overnight Headlines

- Moderna Chief Predicts Existing Vaccines Will Struggle With Omicron Variant

- US President Biden Warns Against Omicron Panic, Pledges No New Lockdowns

- US Congress Aims For Quick Passage Of Bill Averting Government Shutdown

- Senator Manchin Holds Off On Committing To Moving Biden Agenda This Year

- Fed Chair Powell To Tell Senate Omicron Poses Downside Risk To Economy

- Yellen Warns Failure To Deal With Debt Limit Would 'Eviscerate' US Recovery

- French PM To Offer Boris Johnson EU Migration Deal After Channel Deaths

- Half Of UK Companies Plan To Raise Prices To Offset Higher Wages: LLoyds

- EU, Russia And Iran Upbeat As Nuclear Talks Resume Amid Scepticism

- Chinese Manufacturing Rebounds In November With Signs Inflation Easing

- Japanese Output Rises For First Time In 4 Months As Supply Constraints Ease

The Day Ahead

- Asian equity markets are down this morning as investors remain uncertain about the risks posed by the Omicron variant. In England, the government has announced an acceleration of its booster vaccine programme. Meanwhile in the US, President Biden said that no new restrictions were necessary at present.

- The November Lloyds Business Barometer, which was released overnight, edged lower for the second month in a row. However, the decline was a modest 3 points, leaving the headline reading still well above levels earlier this year and its long-run average. The survey showed that hiring intentions remained strong although they have eased a touch since the end of the furlough scheme. Meanwhile, wage pressures continued to build and the percentage of firms expecting to raise prices rose to a record high. BoE policymaker Mann is set to speak this afternoon. She voted with the majority to leave interest rates unchanged in November but also for an early end to the QE programme. Mann has indicated that she favours a modest rise in interest rates in the coming months, but it was unclear even before the recent news on the virus whether she would support a December hike. Markets will focus on any comments on the potential impact of the new variant on the outlook for monetary policy.

- US Federal Reserve Chair Powell will testify to Congress alongside Treasury Secretary Yellen later today. Powell is bound to be quizzed about the sharp rise in US inflation. Of most interest will be whether he offers any signals about the future policy response. Prior to last week’s news, markets were increasingly speculating that the Fed would accelerate the tapering of its asset purchase programme at its December meeting to open up an earlier than expected hike in interest rates. However, Powell’s pre-released opening comments yesterday pointed to the downside risks to economic growth and employment, which suggests that any further action may now be delayed.

- In the Eurozone, November CPI inflation is forecast to have risen further above the ECB’s target and to a record high. Yesterday’s rise in German inflation points to a risk that the rise may be larger than expected. However, it will have little impact on interest rate expectations as ECB policymakers continue to signal that they see the increase as temporary and that monetary policy will not be tightened in response.

CFTC Data

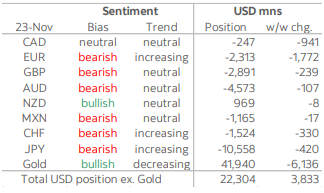

For the first week in seven, investors added to the aggregate USD long position with a large USD3.8bn increase over the Nov 17-23 week. The total bullish position on the greenback now sits at USD22.3bn, less than 5% off its early-October high of USD23.2bn. Over the week, the USD gained ground against all major currencies, with the MXN seeing the steepest decline at 2.2% while the JPY, CHF, and GBP outperformed with more modest losses of 0.3/4%.

Negative EUR sentiment worsened significantly this week as accounts added USD1.8bn to the shared currency’s short of now USD2.3bn. The EUR looked on track to test the 1.12 level in the days following the data cutoff (it has since traded briefly under the mark) amid ultra-dovish policy settings at the ECB and the risk of lockdowns in the currency zone due to surging contagions. The current EUR short is, however, still about USD1bn smaller than in early-October and interest in shorting the EUR may now be limited after already seeing a 10c drop since May.

Speculative adjustments in the high-beta/commodity currencies (CAD, MXN, AUD, NZD) accounted for a net USD1.1bn combined bet in favour of the dollar. The shift in CAD sentiment accounted for the bulk of this move, however, as positioning deteriorated from net long to net short at USD247mn on a USD941mn move against it over the period with USDCAD testing 1.27. The MXN short rose only slightly by USD17mn to USD1.2bn.

The sizeable AUD short rose for the first time since early-October ahead of its decline under 0.72 last week. Investors placed a net USD107mn wager against the Aussie last week, taking the overall AUD short to USD4.6bn about USD2bn short of its peak last month. As for the NZD long, bullish optimism is showing limited signs of waning despite the kiwi dropping under the 0.70 level in mid-month and today trading at a new low since last November. The NZD long position (still the largest in this report) was left practically unchanged close to USD1bn in data to Tuesday afternoon, i.e. just before the RBNZ’s cautious hike that evening.

The haven/yield-sensitive currencies, the JPY and CHF, saw an increase in their respective aggregate shorts after two consecutive weeks of reductions; market turmoil in recent days has possibly resulted in adjustments in their favour, however. Bearish positioning in the JPY rose to USD10.6bn on the back of a USD420mn negative bet after the previous week’s USD1.5bn bullish adjustment. As for the CHF, speculators increased their negative bets by USD330mn to USD1.5bn.

Finally, the GBP’s short rose for a fourth consecutive week, by USD239mn to USD2.9bn its highest level since summer 2020, as investors continue to adjust to BoE hike uncertainty that has taken the pound to its weakest level for the year in recent trading.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

EUR/USD: 1.1250-55 (1.3BLN), 1.1300 (553M), 1.1350 (549M)

1.1445-50 (1.5BLN). GBP/USD: 1.3485-1.3500 (427M)

AUD/USD: 0.7075 (230M), 0.7150 (249M)

AUD/NZD: 1.0470 (1BLN). NB: 1.2BLN will expire at 1.05 on Wednesday

USD/JPY: 113.80 (1.6BLN), 114.00 (615M), 114.50 (718M), 114.75 (471M)

115.00 (2.8BLN)

Technical & Trade Views

EURUSD Bias: Bearish below 1.15 Bullish above

- Edges higher in quiet Asia as asset markets remain steady

- EUR/USD opened 0.22% lower at 1.2290 after recovering from 1.1258

- It moved up to 1.1305 early Asia on EUR/JPY demand at Tokyo fix

- Heading into the afternoon it is settling around 1.1300

- Support at 10-day MA at 1.1279 and another close above would suggest bottom forming

- 5-day MA pointing up and about to cross 10-day MA also suggesting bottoming

- Resistance is at the 38.2 of 1.1692/1.1186 at 1.1379 & 21-day MA at 1.1397

GBPUSD Bias: Bearish below 1.36 Bullish above.

- GBP steady – buoyant in Asia, awaiting fresh catalysts

- GBP steady to buoyant in Asia, awaiting fresh catalysts

- Cable 1.3310-29, holding above 1.3288 low yesterday, 1.3278 low Friday

- Holding for now in area of 1.3319-52 hourly Ichi cloud, 1.3322 55-HMA

- Seen heavy above 1.3331 descending 100-HMA, recent moves above rejected

- GBP/JPY 151.07-62, above 150.65-67 double bottom yesterday, Friday

- Also mostly below 151.51 descending 55-HMA, 151.55 hourly Ichi cloud base

- BoE key going forward, seen more hawkish but weak economy may weigh

USDJPY Bias: Bullish above 112.50 Bearish below

- USD/JPY swoons with US yields, Nikkei on Moderna news

- News Moderna vaccine not as effective against Omicron

- Risk suddenly off in late Tokyo trading, USD/JPY, Nikkei, US yields off

- Nikkei currently -0.9% @28,033, yield on US Treasury 10s @1.466%

- USD/JPY as low as 113.03 before bouncing a bit, high earlier 113.90

- Looks like Omicron news to continue to impact thin month-end markets

AUDUSD Bias: Bearish below 0.75 Bullish above

- AUD/USD dives as Moderna sounds pessimistic on Omicron

- AUD/USD takes a dive, reversing modest gains, last 0.7112

- Close to breaking Aug base 0.7107; would be lowest in a year

- Ceiling of Bollinger downtrend channel moves lower to 0.7182

- Moderna chief predicts Omicron resistant to vaccines

- Sparks risk-off reaction in some FX, S&P futures -0.6%

- Uncertainty around new variant still causing volatility

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!