Daily Market Outlook, November 4, 2020

Daily Market Outlook, November 4, 2020

The US Presidential election has proved to be very close and the result is still in doubt. President Trump has outperformed the national opinion polls that predicted a sizable win for the Democratic candidate Joe Biden. The result has been particularly close in some of the so called key battleground states with Trump importantly holding on to Florida, Ohio and Texas. Current projections give Biden 224 electoral college votes and Trump 213 (270 are needed). Among the states that are still undecided it appears that Michigan, Pennsylvania and Wisconsin may be decisive. Both sides are claiming victory but the outcome now seems unlikely to be known this morning and could even be decided in court. The Congressional vote also looks close. The Democrats appear to be on course to retain control of the lower Chamber. The outcome in the Senate, which the Republicans currently hold is still in doubt. However, with the Republicans holding a narrow lead of 47 to 46 seats (there are 100 in total) it looks as though Democrat hopes of a win there may not be realised. A split Congress may make it difficult for either party to pass their agenda including a fiscal stimulus bill.

The UK House of Parliament will vote on whether the second lockdown in England should go ahead from midnight. The government is expected to win the vote comfortably particularly as Labour Party leader Starmer has said that his MPs will support it but a number of Conservative MPs are expected to vote against the motion. The vote will take place shortly after PMs questions which is at 12.00. Today’s October PMI services data for the Eurozone and the UK are mainly final estimates that are not expected to be revised significantly from their initial readings. In the Eurozone the headline services index had slipped again and importantly was below the key 50 level that signals expansion or contraction, for the second consecutive month, suggesting that the largest part of the economy was weakening even before the latest rise in restrictions. In the UK, the services measure also fell for a second consecutive month although it stayed above 50.

In the US, the ISM services outturn for October will be new data. In September the index rose almost back to its July high and was well above 50 signalling strong growth in the sector. Its manufacturing equivalent surprised on the upside for October. That may not be a good predictor of the outlook for services given that social distancing measures are more of an issue for that sector but the Markit services PMI also surprised on the upside. On balance expect a modest fall in the ISM services index but for it to stay well above 50 and so continue to signal strong growth for now.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1600 (234M), 1.1725-35 (500M), 1.1750 (350M)

- USDJPY: 104.00 (350M), 104.50 (535M), 105.00 (1.4BLN), 105.25 (500M), 105.45-50 (500M)

- AUDUSD: 0.6930-40 (650M), 0.7030 (209M), 0.7130 (276M)

Technical & Trade Views

EURUSD Bias: Bullish above 1.1780 bearish below targeting 1.15

EURUSD From a technical and trading perspective, the failure to hold 1.1687 lows opens quick move to test 1.1610 as 1.1780 contains upside attempts look for a test of the pivotal 1.15

Flow reports suggest downside bids into the 1.1600 level with stops likely on a dip through the 1.1580 areas and technically weak through to the 1.1500 area and likely some stronger bids appear with limited congestion into the 1.1480 level vulnerable to further strong stops. Topside offers light through to the 1.1780 level with strong congestion then through to the 1.1820 areas before a mix of weak stops and congestion likely through to the 1.1850 and increasing offers on a push through to the 1.1900 level.

GBPUSD Bias: Bullish above 1.2861 targeting 1.3266

GBPUSD From a technical and trading perspective, while 1.2950 attracts sufficient bids look for a test of primary equality objective at 1.3264 UPDATE a failure to find sufficient bids ahead of 1.2850 opens a test of 1.27 next

Flow reports suggest topside offers now very light through to the 1.3150 level with stronger offers likely to continue through to the 1.3200 and strong stops on a push through the 1.3220 areas opening a move to the 1.3250 area before congestion moves in and the possibility of slowing the market, stronger offers then through into the 1.3300 level and weakness then appearing beyond. Downside bids light through to the 1.2900 level with weak stops limited through the level and likely increasing bids into the 1.2850 area to limit the downside through to the 1.2800 failing any surprises this late in the day, weak stops through the level opens a big drop and worries over Brexit at that point

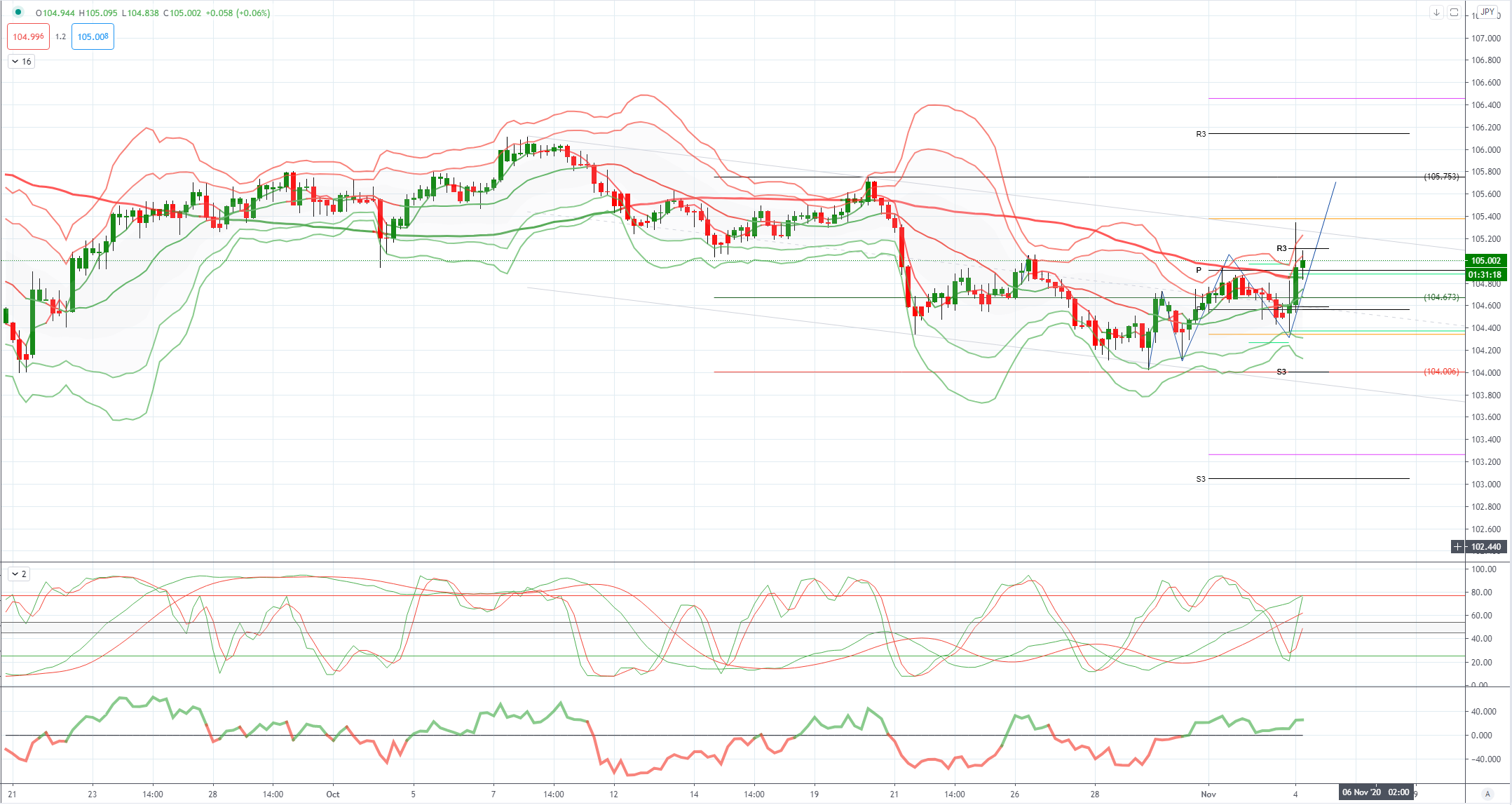

USDJPY Bias: Bearish below 104.30 bullish above

USDJPY From a technical and trading perspective, as 104.30 supports look for a test of descending trendline resistance at 105.50

Flow reports suggest topside offers through the 105.40-60 area with stronger offers likely to be building into the 105.80-106.00 areas with weak stops likely through the 106.20 area and opening the topside through to the 106.40 area before stronger offers appear, downside bids light through to the 104.50 with some support in the area and then increasing through to the 104.00 level and a concern for the BoJ on any dip through the level and weak stops on a move through the 103.80 area and stronger bids likely to appear into the 103.50 area.

AUDUSD Bias: Bearish below .7243 targeting .6907

AUDUSD From a technical and trading perspective, as .7243 caps upside attempts look for decline to resume to expose bids and stops towards .6900

Flow reports suggest downside bids into the 0.7000 level with weak stops on a dip through the 0.6980 area and increasing bids on any move through to the 0.6950 areas and likely continuing to increase on any test of the 69 cents level, Topside offers likely through the 0.7250 area with strong congestion through to the 73 cents with mixed stops and congestion continuing through the level to the 0.7350 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!