Daily Market Outlook, October 12th, 2021

.png)

Daily Market Outlook, October 12th, 2021

Overnight Headlines

- IMF Board Decides To Keep Georgieva Chief After Scandal

- China Start Inspection On Financial Regulators, State Banks

- Imminent Evergrande Payments Intensify Contagion Fears

- Japan Wholesale Inflation At 13-Year High, Profits Pressure

- Sydney Cases Ease Further, Focus Now To Revive Economy

- EU Study Joint Natural Gas Buy, Protect Against Price Surge

- UK Economy Scarred From Covid, Adding Strains On Budget

- UK Considering Aid For Companies Hit By Rising Energy Cost

- UK Shoppers, Hit By Fuel Crisis, Turn Cautious On Spending

- France Gets EU Countries’ Backing Warn UK In Fishing Row

- Oil Holds Above $80 As Power Shortage Boosting Demand

- Lufthansa Pays Back $1.7 Billion Of Germany’s Silent Stake

The Day Ahead

- UK labour market data, released earlier this morning, showed a 235k rise in employment in the three months to August and a fall in the unemployment over the same period to a 12-month low of 4.5%. Timelier HMRC payrolled employee data climbed by 207k in September and is above pre-pandemic levels. The level of vacancies, meanwhile, recorded a new record high of nearly 1.2 million in September. That all seems to point to reasons for concerns about a shortage of workers, with consequent upward pressure on wages. However, over a million workers may have re-entered the labour force at the end of September as the furlough scheme ended, and unemployment and inactivity is still some way above where is was pre-pandemic, so the demand/supply imbalance situation in labour market is particularly uncertain at present. The impact of the end of furlough may not be apparent in the official data until near the end of the year, just before the December MPC policy decision.

- Early tomorrow sees the release of UK August GDP data which are expected to show the economy continuing to grow, albeit at a weaker rate than in H1. The July estimate showed growth of just 0.1%, the slowest since January’s lockdown, primarily reflecting various supply constraints. It is possible that it underestimated the underlying pace of growth and so look for a bigger gain in August of 0.5%. However, output may fall in manufacturing which seems to be particularly plagued by supply issues. The expected August rise would leave GDP only around 1% below its pre-pandemic level. Whether it can move back above that before year end will partly depend on how ongoing supply issues continue to play out.

- In the Eurozone, the German ZEW survey last month showed the current situation index finally catch up with the expectations component. For today’s October release, look for slight declines for both to 30 (current situation) and 24 (expectations). A number of ECB speakers will speak today. Indications point to a more dovish or relaxed stance among most ECB policymakers, compared with (for example) the Bank of England, with reports last week that the Eurozone central bank is considering replacing the pandemic asset purchases with another bond-buying programme next year.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- USDJPY - 113.20 990m. 113.00 615m. 112.50 878m. 112.00 712m. 111.40/50 1.27bn (800m C).

- EURUSD - 1.1830/50 1.35bn (913m C). 1.1590/1.1610 1.94bn (1.35bn P). 1.1520/40 877m.

- GBPUSD - 1.3600 454m.

- AUDUSD - 0.7460/80 566m. 0.7390/0.7400 445m. 0.7330 584m. 0.7300 447m. 0.7220/30 727m.

- AUDNZD - 1.0310 720m.

- USDCAD - 1.2780 1.60bn (C). 1.2670/80 561m. 1.2610/20 1.07bn (762m P). 1.2480/1.2500 1.15bn (624m P).

- GBPJPY - 152.10 460m

Technical & Trade Views

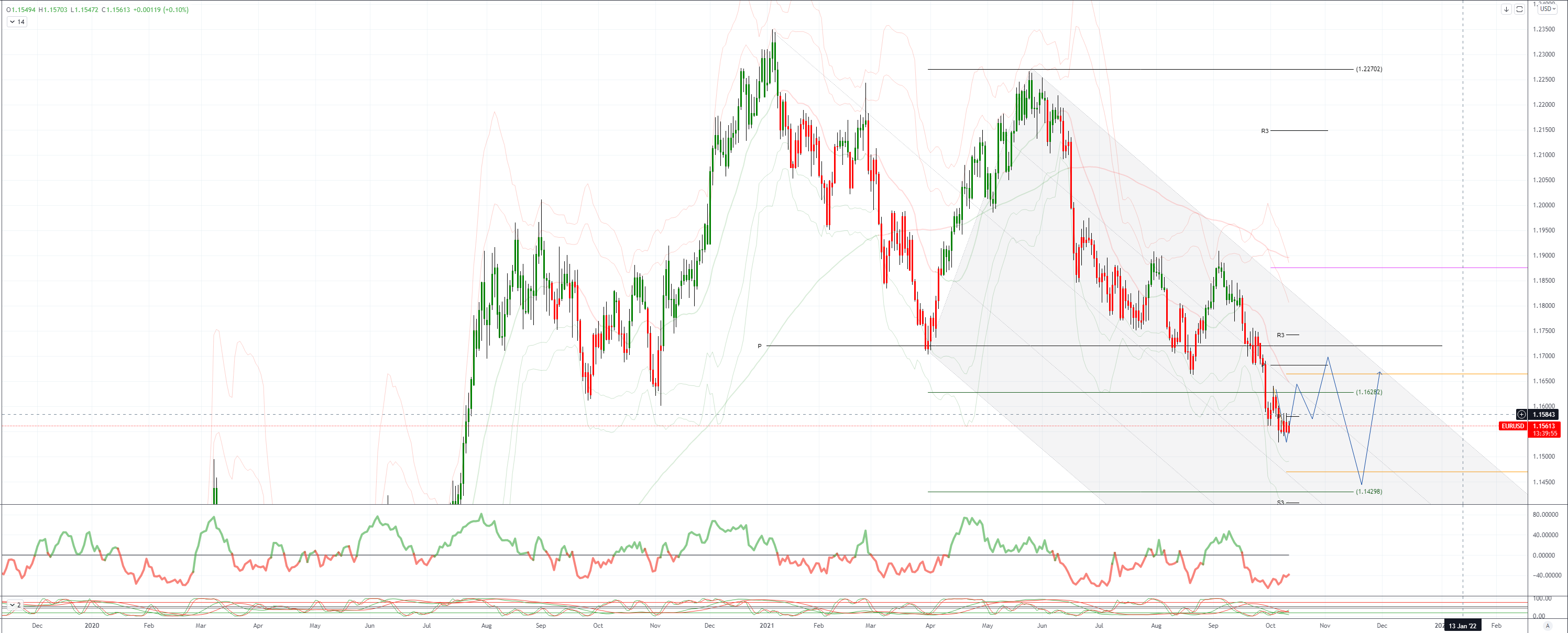

EURUSD Bias: Bearish below 1.17 Bullish above

- Holds around the 1.1550 level in quiet Asian trading

- EUR/USD opened -0.2% at 1.1553 and traded in a 1.1547/59 range

- It was around the session high heading into the afternoon session

- EUR/USD is in a slow motion trend lower, as price action lacks impulsiveness

- The 5, 10 and 21-day MAs are in a bearish alignment and are tilting lower

- A close above the 10-day MA at 1.1578 would ease downward pressure

- Support is at last week's 1.1529 low and break targets 1.1492

- The 50% retracement of 1.0636/1.2349 move is at 1.1492 with bids at 1.1500

GBPUSD Bias: Bearish below 1.37 Bullish above.

- GBP/USD within strike of 1.36 after UK jobs, earnings data

- Cable rises to 1.3611 (intra-day high) after UK employment and earnings data

- Employment +235k vs +243k f/c.... Jobless rate 4.5%, as expected

- ONS estimates underlying ex-bonus earnings growth rate between 4.1% and 5.6%

- 1.3582 was Asian session low (1.3584 was Monday's low)

- Big 1.3600 option expiry today, with more 1.3600 expiries Wednesday/Thursday

- UK's Frost to talk about NI protocol today

USDJPY Bias: Bullish above 111.50 Bearish below

- USD/JPY up about 1% after buy-stop-fest above 2019's 112.40 EBS peak

- Current 113.41 Monday high is by 161.8% off October's 110.82 base

- Bigger targets are the 76.4% Fibo of 2016-20 drop & 2018 high at 114.54-55

- Daily & weekly RSIs already overbought but no pullback signals yet

- Post-NFP Tsy yield rise on Fed tightening expectations is the main lift

- BOJ can't tighten and energy prices are USD/JPY bullish...

- Wednesday's U.S. CPI and Fed minutes are the next event risks

AUDUSD Bias: Bearish below 0.75 Bullish above

- AUD by far the best performing currency - rising almost 1.5% against the JPY

- AUD/USD opens nearly 0.5% higher despite broad USD strength and Wall Street fall

- Soaring copper and iron ore prices helping to underpin the AUD/USD

- AUD also getting support from huge rise in Aus 10-year bond yield

- The Aus 10-year yield is now more than 10 BPs higher than US 10-year yield

- AUD/USD resistance at 76.4 of 0.7477/0.7170 move at 0.7405

- Objective of move is a full retracement back to 0.7477

- Support is at the 10-day MA at 0.7284 and break eases upward pressure

- NAB business survey today, but shouldn't be a market m

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!