Daily Market Outlook, October 13,2020

Daily Market Outlook, October 13, 2020

US equity markets ended strongly last night, helped by technology stocks, but Asian markets were more mixed after reports of an unexpected illness resulting in a Covid vaccine trial being paused.

In the UK, the British Retail Consortium’s update on September retail sales showed a rise in like-for-like sales of 6.1%y/y, the strongest in more than a decade. The outlook, however, is clouded by resurgent coronavirus cases and higher unemployment. Earlier this morning, official labour market figures revealed a bigger-than-expected rise in the unemployment rate to 4.5% in the three months to August, up from 4.1% in the three months July. Employment also fell by 153k in the latest three months, which was a significantly larger decline than forecast. The official jobless rate is expected to rise further in the coming months, with the Coronavirus Job Retention Scheme closing at the end of this month, although increases may be partly offset by new schemes. Later today at 3pm, Bank of England Governor Andrew Bailey will provide evidence to the House of Lords Economic Affairs Committee on employment and Covid‑19. Meanwhile, MPs are due to vote on new local three-tier Covid restrictions for England, which are due to come into force tomorrow.

In the Eurozone, look for the German ZEW survey expectations index to pull back from last month’s 20-year high, to 71.0 from 77.4. The current situations index is forecast to improve further, but it will remain well in negative territory due to the impact of Covid‑19, suggesting that there is still a lot of ground to make up. We predict the current index to move up to ‑58.0 from ‑66.2. The survey is based on the opinions of financial professionals rather than businesses.

This afternoon’s US annual CPI inflation is forecast to be up modestly in September, but not by enough to suggest that inflation is back close to the Fed’s target. Expect a slight increase in the headline index to 1.4% from 1.3%.

The IMF is scheduled to publish an update of its world economic forecasts today. The Fund’s prior forecast in June for global GDP growth this year was revised lower to ‑4.9%, compared with its April prediction of ‑3.0%. With the latest consensus forecast for global GDP to fall about 4% this year, we may see slightly less dire numbers from the IMF. The narrative, however, will remain laden with downside risks to the central outlook owing mostly to uncertainties about the coronavirus and its effect on economic activity.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1775-80 (500M), 1.1800 (2.5BLN), 1.1845-50 (750M)

- USDJPY: 105.00-15 (657M), 106.10-15 (1BLN)

- AUDUSD: 0.7100 (1BLN), 0.7200 (690M), 07220 (404M)

Technical & Trade Views

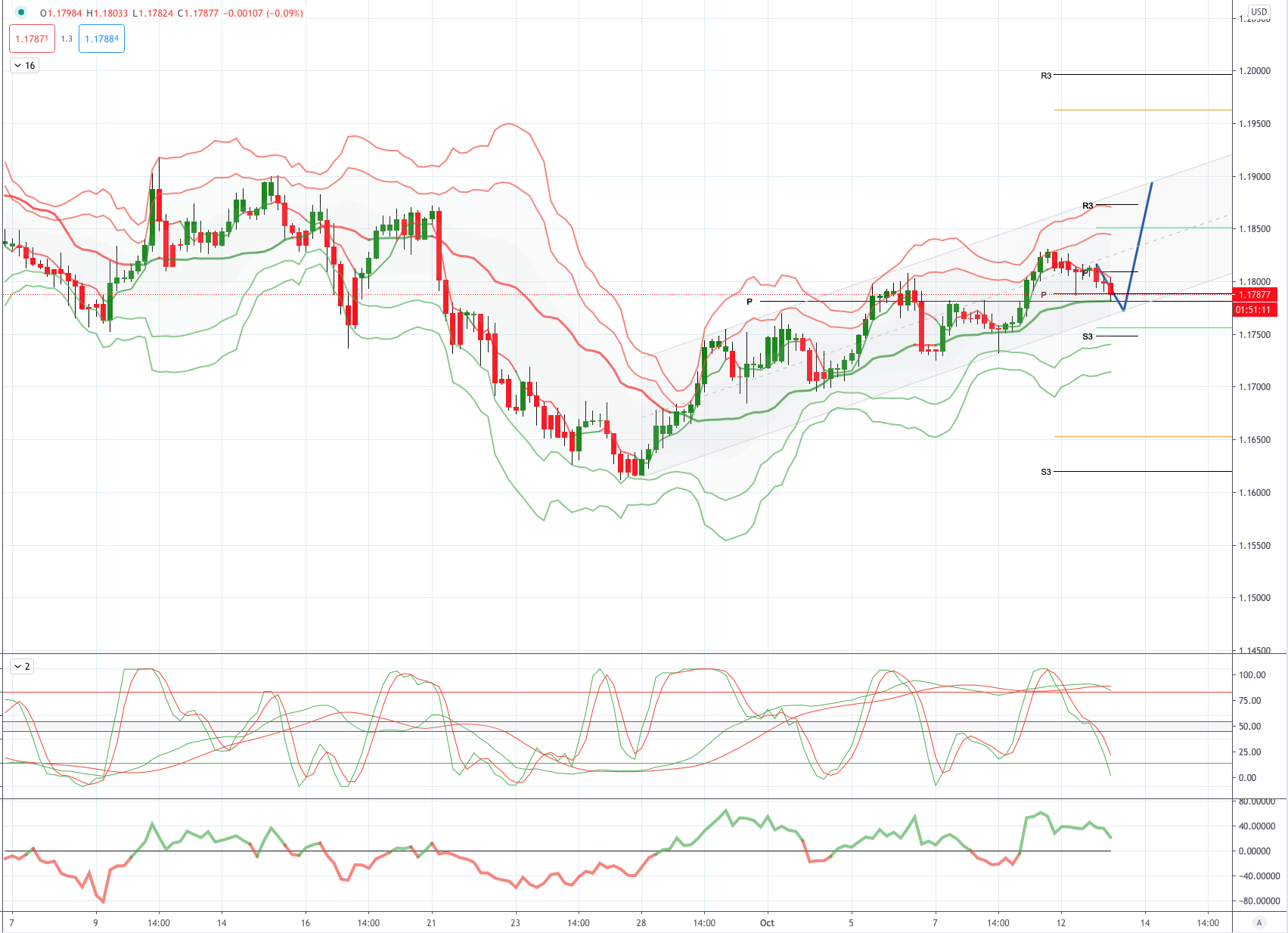

EURUSD Bias: Bullish above 1.1750 targeting 1.19

EURUSD From a technical and trading perspective, as ascending trendline support at 1.1750 is defended look for a test of projected trend channel resistance to 1.19.

Note - DTCC flagged Tuesday's massive 1.1800 strike EUR/USD option expiry last week It's grown to EUR 2.5-billion now, and set to dominate today. Option players try to neutralise any exposure by trading cash around strike Called delta hedging, it can often contain FX rate if nearby, like it is now. Another EUR 2.5-billion of 1.1800 strikes are spread between Thursday-Friday. Options price risk of more EUR gains, but potentially limited.

Flow reports suggest topside offers likely to be strong on any move through to the 1.1860 area with those offers increasing into the 1.1880 area in particular and continuing through the 1.1900, possibly weak stops appearing above the 1.1910 area however, the offers are likely to continue through to the 1.1950 area before buyers start to enthuse about the 1.2000 area, Downside bids likely to appear on a dip through the 1.1800 level with stronger bids continuing through to the 1.1780 area with weak stops likely in size on any dip through quickly testing through to the 1.1700-20 area.

GBPUSD Bias: Bullish above 1.29 targeting 1.3150

GBPUSD From a technical and trading perspective, as 1.2950 is defended intraday look for further upside extension to target projected trend channel and predicted daily range resistance to 1.3150

Flow reports suggest topside offers through the 1.3080 level and likely to continue weakly through to the 1.3150 area with increasing congestive offers from that point onwards through to the 1.3200-20 area, Downside bids light back through the 1.3000 level with weak stops likely close through the level with very little around the 1.2950 area and increasing into the 1.2900 level, stronger stops on a break here will then see stronger bids starting to appear through to the 1.2800 area.

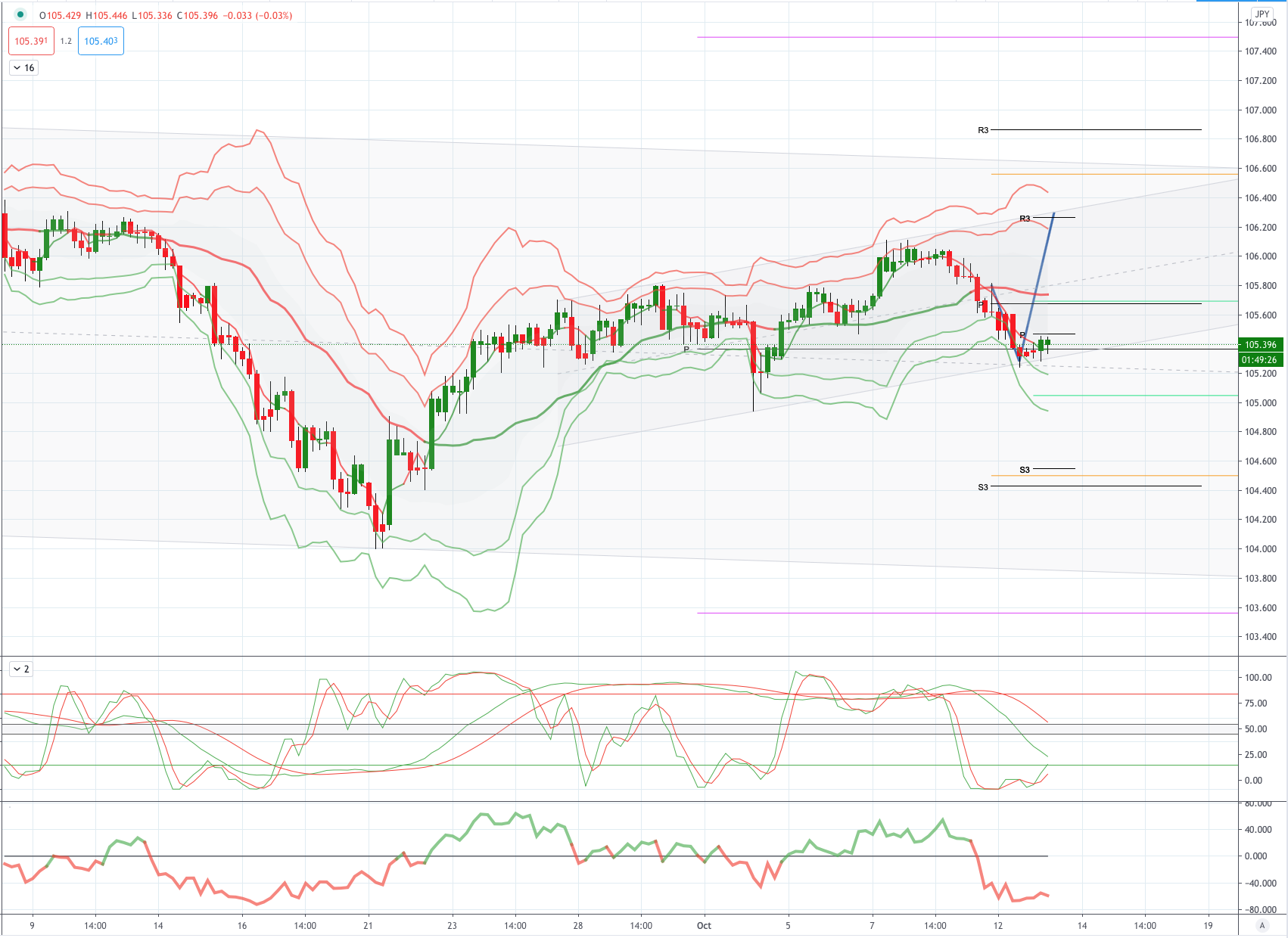

USDJPY Bias: Bullish above 105.20 targeting 106.30

USDJPY From a technical and trading perspective, as 105.20 supports look for a move to test offers and stops to 106.30

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

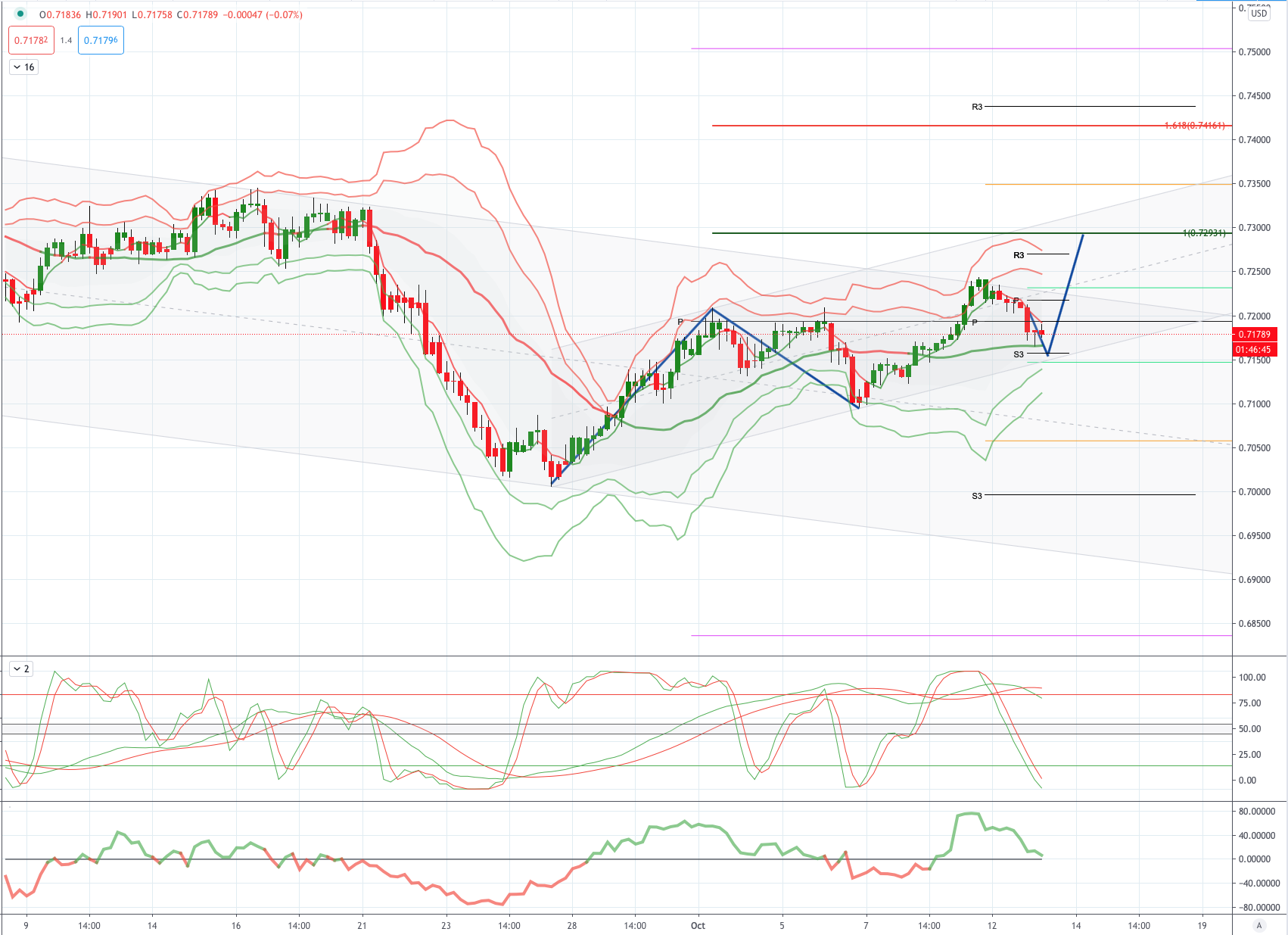

AUDUSD Bias: Bullish above .7150 targeting .7300

AUDUSD From a technical and trading perspective, as .7190/50 area continues to attract bids look for a grind higher to test ascending projected trend channel resistance and the equality objective at .7300.

Flow reports suggest topside offers increase through the 0.7250 area and likely to find congestion through to the 0.7340 area with minor stops likely to be absorbed easily, a push through the 0.7360 area though would likely see stronger tests appearing for a test of the stronger 74 cents level from the beginning of last month, downside bids cleared through to the congestion into the 0.7150 area and stronger bids into the 0.7100 area and stronger stops then opening a quick move through to the 70 cents levels and for today possibly a bit far.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!