Daily Market Outlook, October 16, 2020

Daily Market Outlook, October 16, 2020

Risk tone was subdued, as investors continued to weigh prospects of more US fiscal stimulus and rising global coronavirus infections. In England, London, Essex and York are among areas moving to ‘tier two’ Covid measures from midnight (no households mixing indoors, including in pubs and restaurants), while Greater Manchester is pushing back against a move to ‘tier three’.

UK PM Johnson is expected to provide an update today on the state of play in negotiations with the EU on a future relationship. That followed yesterday’s communique from EU leaders in the first of a two-day summit, which asked the UK to make “the necessary moves” for an agreement. UK chief Brexit negotiator David Frost said he was “surprised” at the suggestion. Indications are that negotiations are likely to continue for more weeks. Fisheries remains one of the sticking points.

The final estimate of Eurozone September CPI inflation is expected to confirm its earlier ‘flash’ estimate, which showed a decline further into negative territory at -0.3%y/y from ‑0.2%y/y in August. Core inflation, excluding energy and food, fell to a record low of 0.2%y/y. Some of the slippage is likely to be temporary due in part to the German VAT cut. It raises concerns, however, that the effect of the pandemic on demand may also be having a more enduring negative impact on inflation.

In the US, the economy has continued to grow despite concerns through the summer of a possible negative impact from the rise in Covid-19 cases. Retail sales have been a key source of strength since lockdown restrictions were eased. Look for another rise of 0.6% in September, the same rate as in August. Industrial production is also predicted to be up again in September and we forecast a 0.8% increase, which would be a fifth consecutive monthly gain.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: .1650 (250M), 1.1690 (209M), 1.1700 (680M), 1.1715-20 (600M) 1.1750 (524M), 1.1800 (1.9BLN)

- USDJPY: 104.50 (1.8BLN), 104.75 (430M), 105.00-05 (3BLN) 105.35-40 (1.2BLN), 105.50 (268M), 105.60 (270M), 105.70 (360M)

- GBPUSD: 1.2945-50 (512M)

- AUDUSD: 0.7050-60 (570M), 0.7100-10 (400M), 0.7175 (800M).

Technical & Trade Views

EURUSD Bias: Bullish above 1.1750 bearish below

EURUSD From a technical and trading perspective, as ascending trendline support at 1.1750 is defended look for a test of projected trend channel resistance to 1.19. UPDATE a close through 1.1720 would negate the near term bullish thesis opening a broader correction to test bids back to 1.620 UPDATE as 1.1750/60 now acts as resistance look for a test of 1.1650 next

Flow reports suggest topside offers through the 1.1800 levels with weak stops on a push through the 1.1820 level with offers around the 1.1850 area with increasing offers through to the 1.1900 level, downside bids into the 1.1700 level with weak stops on a break through the 1.1680 level and limited bids through to the 1.1620 area where stronger bids seem to appear however, a break here opens a deeper move through to the 1.1500 area.

GBPUSD Bias: Bullish above 1.29 bearish below

GBPUSD From a technical and trading perspective, as 1.2950 is defended intraday look for further upside extension to target projected trend channel and predicted daily range resistance to 1.3150. UPDATE Breach of 1.29 invalidates near term bullish thesis focus shifts to pivotal 1.2850, failure here would open a quick test of 1.28 UPDATE 1.2850 probe saw sharp reversal, today look for 1.2950 support to stage a test of 1.31 UPDATE broad range trade persists 1.3050/1.29, play range or wait for breach and retest

Flow reports suggest topside offers light through to stronger offers around the 1.3000 area with strong stops through the level and the market then opening for further gains. Downside bids light through the 1.2800 area with weak stops on a move through likely to be light and quickly absorbed on any dip through to the congested 1.2750 areas with stronger bids into the 1.2700 level.

USDJPY Bias: Bullish above 105.20 bearish below

USDJPY From a technical and trading perspective, as 105.20 supports look for a move to test offers and stops to 106.30 UPDATE breach of ascending trend channel concerns bullish thesis as 105.50 caps upside look for a test of 104.90

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

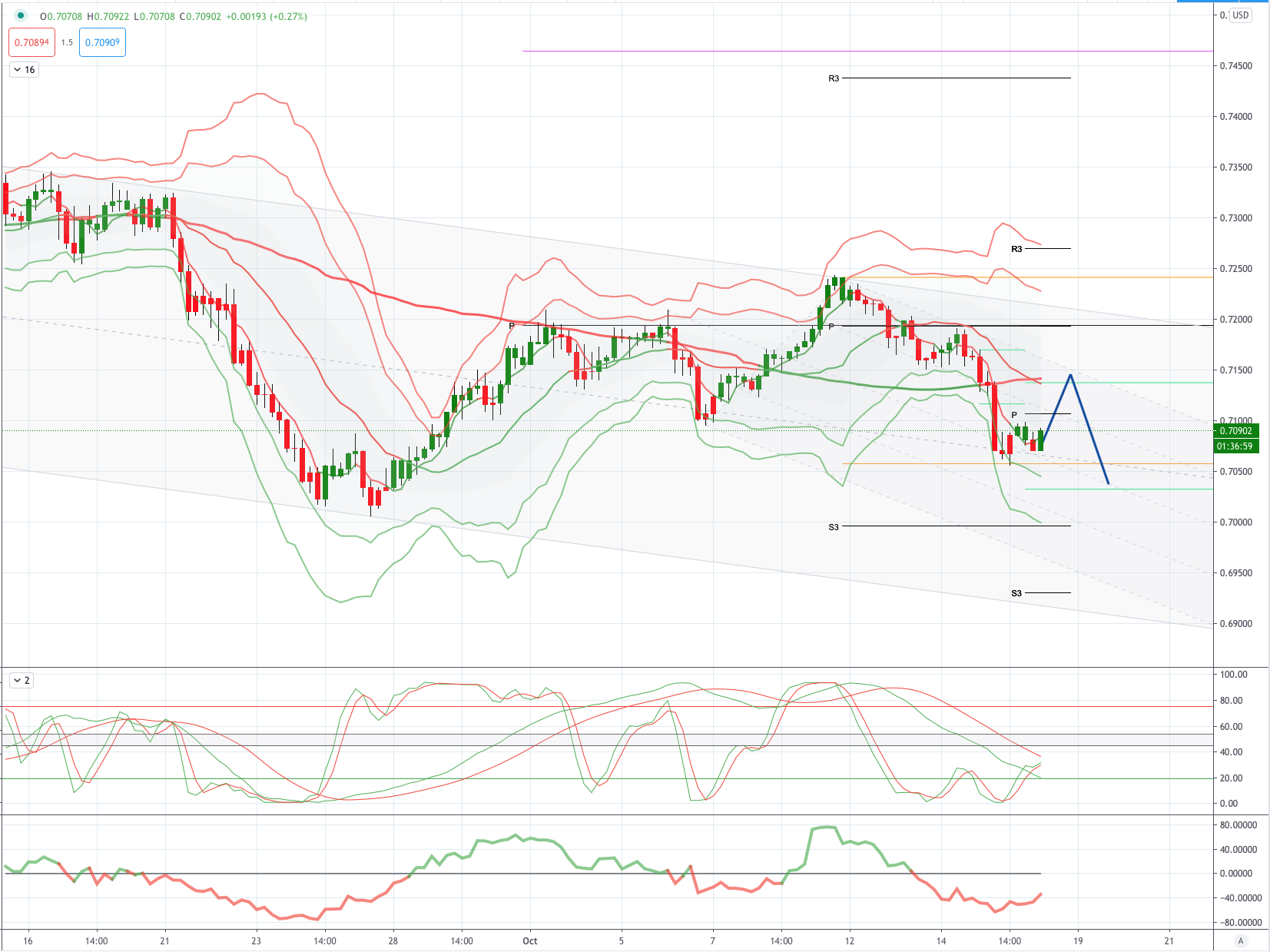

AUDUSD Bias: Bullish above .7150 bearish below

AUDUSD From a technical and trading perspective, as .7190/50 area continues to attract bids look for a grind higher to test ascending projected trend channel resistance and the equality objective at .7300. UPDATE failure through .7140 exposes .7100 bids and stops UPDATE as .7170 caps upside look for a test of .7050 next UPDATE .7050 test should see another move to retest .7030/50 as resistance, setting up another leg lower to test .7000

Flow reports suggest topside offers light through the 71 cent area with limited stops through the 0.7120 area, stronger offers likely on a move through to the 0.7150 area and likely to increase on a move through the 0.7180 area and into the 72 cents level before stronger stops appear above the 0.7220 area. Downside bids into the 0.7020-00 level with weak stops likely through the 0.6980 level with stronger support into the 0.6950 area and congestion thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!