Daily Market Outlook, October 20th, 2021

Daily Market Outlook, October 20th, 2021

Overnight Headlines

- Biden Tells Democrats Package Of Up To $1.9T Should Be Target

- Progressives See Budget Deal Getting Close After Biden Meeting

- Fed's Waller: High Inflation May Need An 'Aggressive' Response

- US Closes In On Deal This Week To Halt Europe’s Digital Taxes

- UK Chancellor Resists Spending Pressure As BoE Set To Hike Rates

- China Sets Weaker-Than-Expected Yuan Fix, Boosts Cash Injection

- Japan's Export Growth Slows; Import Costs Weigh On Recovery

- Oil Slips From Seven-Year High As Report Signals Rising Stockpiles

- Yen Skids To Four-Year Low As Stocks Rally With Treasury Yields

- Netflix Posts Solid Beats On Earnings And New Subscribers

- Asian Equity Markets Rise Amid Rebound In China Tech Stocks

The Day Ahead

- Asian equity markets were mostly higher following yesterday’s positive close on Wall Street. The broadly constructive risk tone was supported by US corporate earnings reports and hopes for an easing of the regulatory crackdown in China which aided tech stocks. Yesterday evening, Fed Governor Waller said tapering should start next month, but rate rises were “still some time off”. In the UK, amid rising Covid cases, the government said there are no plans for further restrictions, but it is keeping a “very close eye” on the data.

- UK September CPI inflation edged down to 3.1%y/y from 3.2%y/y, compared with consensus forecasts for no change. It will be a temporary respite from the march up to and potentially beyond 4% in the coming months. The increase in the energy price cap will pull inflation higher in October, with a further significant rise likely next April as a result of soaring wholesale gas prices. That means that inflation seems set to remain around 4% into the second quarter of next year. It will present the MPC with a difficult policy trade-off between supporting the economy and tackling inflation.

- According to the earlier flash estimate, Eurozone CPI inflation increased to 3.4%y/y in September, well above the ECB’s new 2% symmetric inflation target. Today’s final release is expected to confirm that outturn. Headline CPI is the highest since 2008, with the rise in recent months reflecting higher energy prices, the broader impact of supply issues and base effects from Germany’s VAT changes. Inflation is expected to rise further in the near term before falling back next year, returning to 2% in the second half of 2022.

- Canada also releases September CPI today, seen rising to 4.3%y/y which would be the highest since 2003. The Bank of Canada is currently expected to keep interest rates on hold until around the middle of next year.

- There are a few Fed speakers today, including Vice Chair Quarles who will discuss the economic outlook. This evening’s Fed Beige Book survey may also warrant attention as it provides a summary of economic conditions based on anecdotal information. In particular, what the report says about labour market and broader supply conditions will be particularly interesting.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby (P) Puts (C) Calls )

- USDJPY - 113.70 490m. 112.10/30 483m.

- EURUSD - 1.1800/10 515m. 1.1770 975m. 1.1690 685m. 1.1610/20 472m. 1.1590/1.1600 970m.

- GBPUSD - 1.3700 464m. 1.3640/50 459m. 1.3570/80 695m. 1.3550 605m. 1.3520/30 513m.

- AUDUSD - 0.7300 506m. 0.7250/60 952m.

- AUDNZD - 1.0560 1.09bn (888m C). 1.0510 934m. 1.0450 755m. 1.0400 680m.

- USDCAD - 1.2700 500m. 1.2300 838m.

- EURGBP - 0.8420 440m.

- USDCHF - 0.9320 600m.

Technical & Trade Views

EURUSD Bias: Bearish below 1.17 Bullish above

- EUR/USD opened 0.2% higher at 1.1632 after topping out at 1.1670

- After trading at 1.1626 early Asia it moved up to 1.1647

- Heading into the afternoon it is settling around 1.1635/40

- Resistance is a the 38.2 of the 1.1909/1.1522 move at 1.1670

- A break of 1.1675 targets 1.1715 where the 55-day MA & 50% retrace converge

- Support is at the 21-day MA at 1.1616 and break would ease upward pressure

- The EUR/USD needs to break 1.1675 or risk more sideways consolidation

GBPUSD Bias: Bearish below 1.37 Bullish above.

- GBP/USD falls to intra – day low after UK CPI below forecast

- Cable drops to 1.3781 after UK Sept CPI comes in fractionally below forecast

- Up 3.1% YY vs 3.2% f/c 1.3788-1.3814 was Asia range (pre-CPI)

- 1.3781 is also the low water-mark since Tuesday's one-month high of 1.3834

- Tuesday rise to 1.3834 followed hawkish shift in BoE expectations on Bailey

- BoE rate hike expected on Nov 4

- 1.3765 (Monday's high) and 1.3750 (Sept 23 high) are GBP/USD support points

USDJPY Bias: Bullish above 112.50 Bearish below

- If USD/JPY is going to peak, this is the spot

- USD/JPY reached new 4-year high at 114.695 (EBS) in Asia Wednesday

- Huge option barriers and related defence make 115 hard to crack

- Previous spikes above 114 in late 2017 and late 2018 failed to break 115.00

- 114.73 was the peak in Nov 2017, not above 115.00 since March 2017

- However, options market remains wary - Implied volatility highs since March

- Limited option positions and short covering can fuel demand if 115 breaks

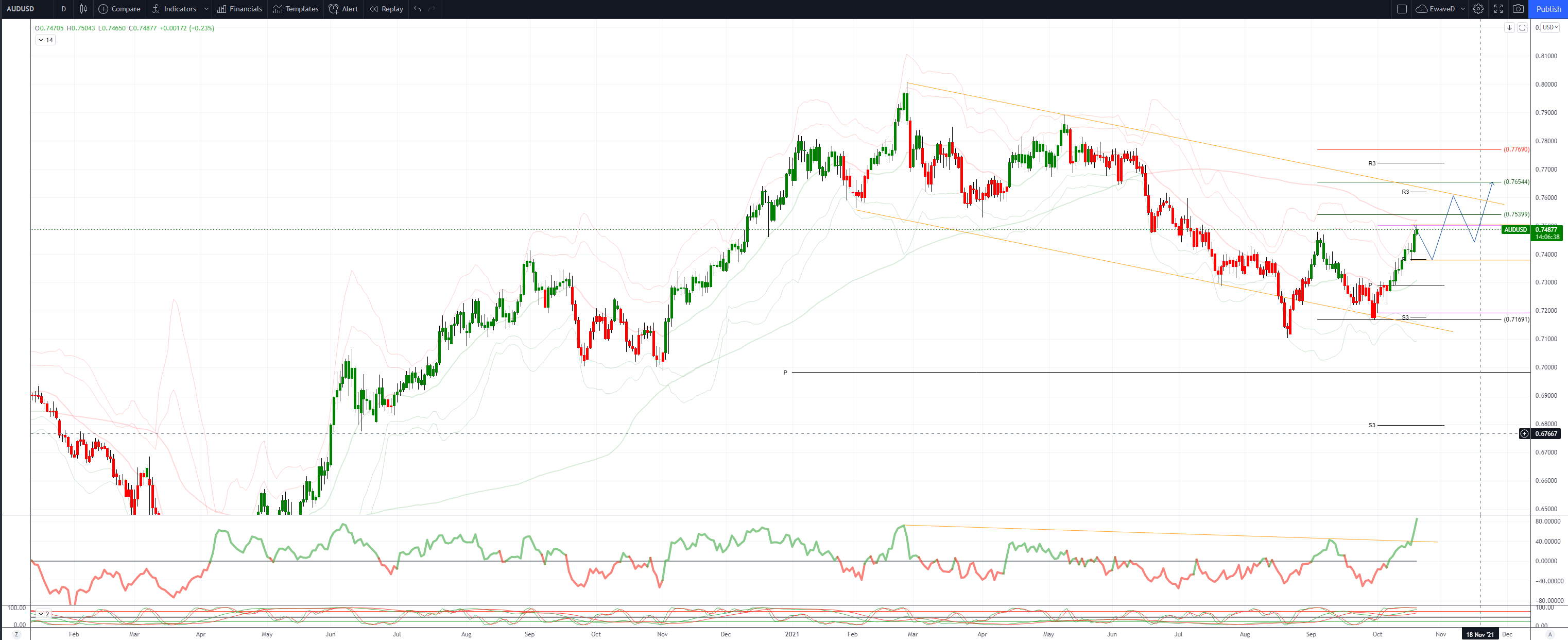

AUDUSD Bias: Bearish below 0.75 Bullish above

- Retains bid tone after making fresh 3 – month high

- AUD/USD opened 0.86% higher at 0.7476 after USD broadly eased

- After trading 0.7465 AUD/USD started to track higher

- It traded to fresh 3-month high at 0.7489 before settling around 0.7480

- Sellers are tipped ahead of 0.7500 to slow down upward momentum

- AUD getting support from higher Aus yields and 10-year yield hits 1.80%

- AUD/USD resistance is at 0.7555/65 where the 50% of 2021 move and 200-day MA converge

- Support is at yesterday's 07607 low and the 10-day MA at 0.7390

- AUD/USD trending higher and buying dips is favoured

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!