Daily Market Outlook, October 22, 2020

Daily Market Outlook, October 22, 2020

Equities remained under pressure during the Asian session, as investors await news of progress on a US fiscal stimulus package. House Speaker Pelosi and Treasury Secretary Mnuchin will speak again today, although it is not clear if an agreement will be found before the election. Reports of interference in the upcoming election by Russia and Iran are also weighing on risk sentiment.

EU-UK negotiations are set to resume in London this afternoon and will take place every day, with the aim of the intensified talks to reach an agreement, possibly by midNovember according to some reports. The UK warned that ‘significant gaps’ remain between the two sides. Bank of England Governor Andrew Bailey is due to speak today, although the topic appears not to be on monetary policy. Chief Economist Andy Haldane is also due to give remarks this morning at a Rebuilding Macroeconomics conference. Chancellor Rishi Sunak, meanwhile, will provide an economic update to the House of Commons, with markets on the lookout for more stimulus measures. The CBI will release its UK October industrial trends survey this morning, which will include extra quarterly questions. The survey’s expected output balance has improved markedly in recent months, but the total orders balance remains weak suggesting firms in the sector are facing headwinds.

This afternoon’s US weekly jobless claims will be closely watched as concerns grow that the labour market recovery is slowing. Last week’s initial claims jumped up unexpectedly to 898k. Look for a fall to 845k in today’s figures, although the consensus is for a smaller decline to 870k.

UK GfK consumer confidence, due overnight, is forecast to fall back to -27 in October from -25. September retail sales will also be released, at 7am tomorrow. Look for a monthly increase of 0.7%, but more attention will probably be reserved for the October flash PMIs later on Friday morning, which are expected to show a further moderation in the pace of growth.

The final US Presidential debate takes place this evening (Friday 2am UK time), with less than two weeks to the election. Democratic contender Biden remains a strong favourite to win, as nationwide polls and betting markets give him a substantial lead. However, his lead in the polls remains narrower in key ‘swing’ states, which suggests the result may still be close. Indeed, there remains a risk that markets may face a situation where the outcome is unclear on election night and for some days afterwards.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.18 (1.25BLN), 1.1845-50 (710M), 1.1875-80 (550M) 1.19 (660M)

- USDJPY: 104.00-10 (2.1BLN), 104.50-55 (2.9BLN), 104.65-75 (500M) 104.90-105.00 (1.6BLN), 105.23-25 (1.2BLN), 105.30-40 (850M), 105.50 (690M)

- AUDUSD: 0.6950 (853M), 0.70 (509M), 0.7050 (409M), 0.7075 (377M) 0.71 (282M), 0.7130-35 (300M), 0.7210 (288M)

- GBPUSD: 1.3040-45 (360M), 1.3200 (205M), 1.3300 (484M)

Technical & Trade Views

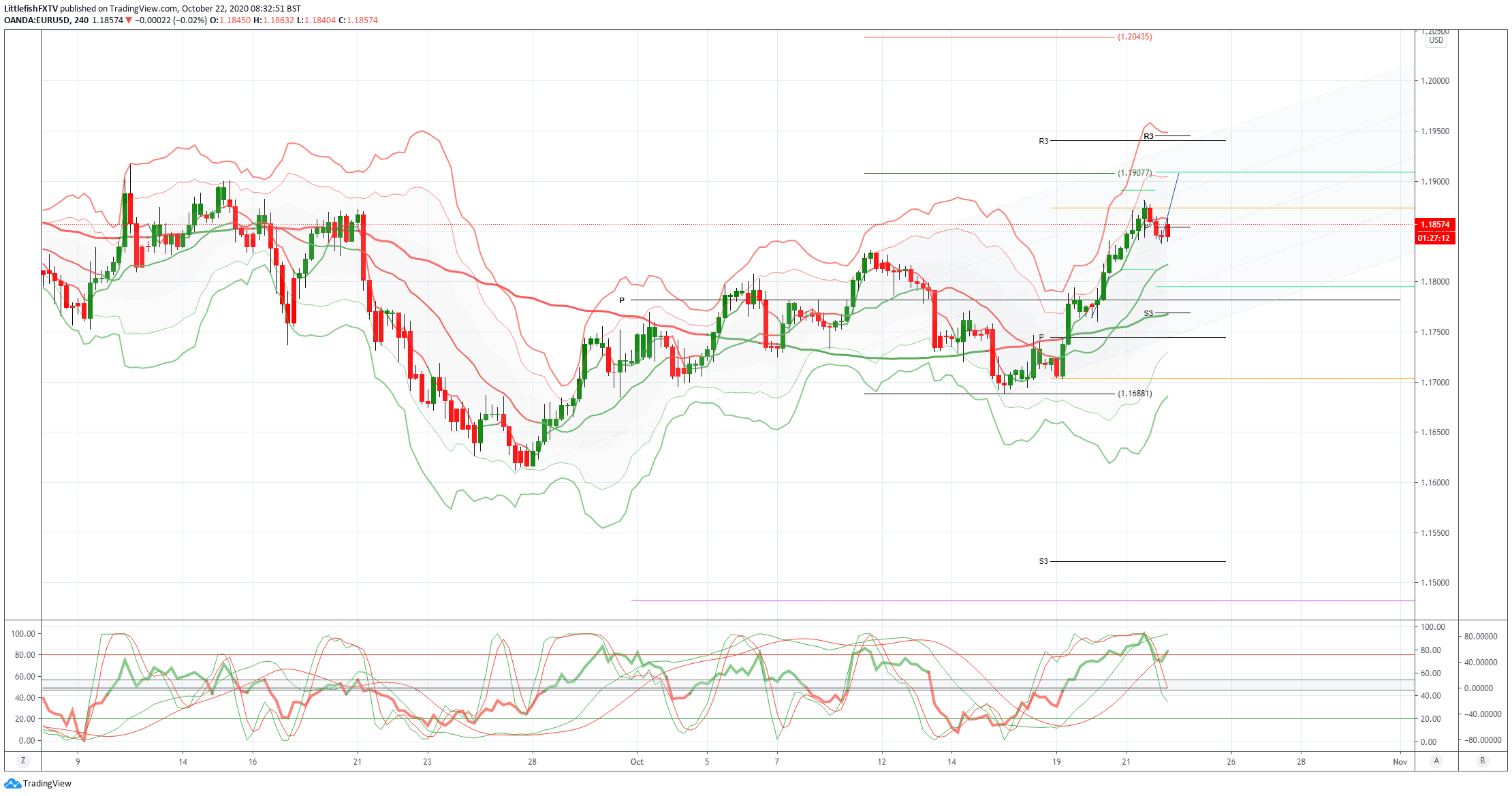

EURUSD Bias: Bullish above 1.1687 targeting 1.19

EURUSD From a technical and trading perspective, as 1.1750/60 now acts as resistance look for a test of 1.1650 next UPDATE 1.17/1.18 range for now, breach of 1.18 opens 1.1840, below 1.17 opens 1.1630 UPDATE the topside breach of 1.18 puts the equality objective at 1.19 firmly in site, intraday support at 1.18

Flow reports suggest topside offers around the 1.1850 area with increasing offers through to the 1.1900 level, downside bids into the 1.1800 level with weak stops on a break through the 1.1780 level and limited bids through to the 1.1720 area where stronger bids seem to appear however, a break here opens a deeper move through to the 1.1600 area.

GBPUSD Bias: Bullish above 1.2861 targeting 1.3266

GBPUSD From a technical and trading perspective, broad range trade persists 1.3050/1.29, play range or wait for breach and retest UPDATE price contain within monthly weekly and daily pivots, as 1.2950 supports intraday look for a test of 1.3080 next

Flow reports suggest topside offers light through to stronger offers around the 1.3050 area with strong stops through the level and the market then opening for further gains. Downside bids light through the 1.2860 area with weak stops on a move through likely to be light and quickly absorbed on any dip through to the congested 1.2750 areas with stronger bids into the 1.2700 level.

USDJPY Bias: Bearish below 105.75 targeting 104.67

USDJPY From a technical and trading perspective, breach of ascending trend channel concerns bullish thesis as 105.50 caps upside look for a test of 104.90 UPDATE as 104.70 now acts as resitacne lok for a test of bids to 104

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

AUDUSD Bias: Bearish below .7243 targeting .6907

AUDUSD From a technical and trading perspective, .7050 test should see another move to retest .7120/30 as resistance, setting up another leg lower to test .7000 enroute to the equality objective at .6907

Flow reports suggest topside offers light through the 71 cent area with limited stops through the 0.7120 area, stronger offers likely on a move through to the 0.7150 area and likely to increase on a move through the 0.7180 area and into the 72 cents level before stronger stops appear above the 0.7220 area. Downside bids into the 0.7020-00 level with weak stops likely through the 0.6980 level with stronger support into the 0.6950 area and congestion thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!