Daily Market Outlook, October 23, 2020

Daily Market Outlook, October 22, 2020

Speaking last night, US House Speaker Pelosi said that she and Treasury Secretary Mnuchin were “just about there” on a US coronavirus relief package. Market sentiment, however, reflected some concern of the bill passing through the Senate amid opposition from the Republicans. Meanwhile, following a more constructive second US Presidential debate between Trump and Biden, a snap CNN poll showed 53% of respondents viewed Biden as the victor, versus 39% for Trump. This roughly mirrored the current position of both candidates in the polls.

The GfK’s measures of UK consumer confidence dropped by 6 points to -31 in October, reversing most of the improvement seen over the past few months. Much of the decline was led by concerns over the economic outlook. Notably, prospects for personal finances over the next 12 months remained remarkably steady, moving down only marginally to 0 from +1.

UK retail sales figures published at 7am showed an above expectations rise of 1.5% in September. This follows a run of strong reports in recent months and means that overall retail sales were up over 17% in the third quarter. Notwithstanding the better-than-expected UK retail sales numbers, concerns over the outlook continue to grow, both at home and abroad. This comes amid signs that the post-lockdown economic rebound is fading as rising Covid cases and increasing government restrictions will result in lower activity.

Today’s PMIs for the UK, Eurozone and US will provide a timely update on current economic conditions. In the UK, both the manufacturing and services PMIs slipped in September, albeit from very high levels in August. Expect further slippage in October, but for both measures to stay well above the key 50 level consistent with economic expansion. In the Eurozone, however, September saw a sharp fall in the services reading below 50, but a modest rise in manufacturing. Expect both to have fallen in October, taking the composite measure below 50 for the first time since June. Meanwhile, in the US, usually the PMIs do not get much attention, but we expect them to be relatively unchanged from their September levels, consistent with modest economic growth.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1750-55 (1.26BLN), 1.1800 (2.0BLN), 1.1830 (426M) 1.1840-50 (1.43BLN), 1.1975 (518M), 1.2000 (1.4BLN)

- USDJPY: 103.00 (1.26BLN), 104.00 (493M), 105.00 (751M) 105.40 (340M), 105.60 (780M), 105.80-85 (728M)

- AUDUSD: 0.7180 (827M)

- GBPUSD: 1.2650 (670M), 1.3090-00 (1.14BLN), 1.3200 (353M)

Technical & Trade Views

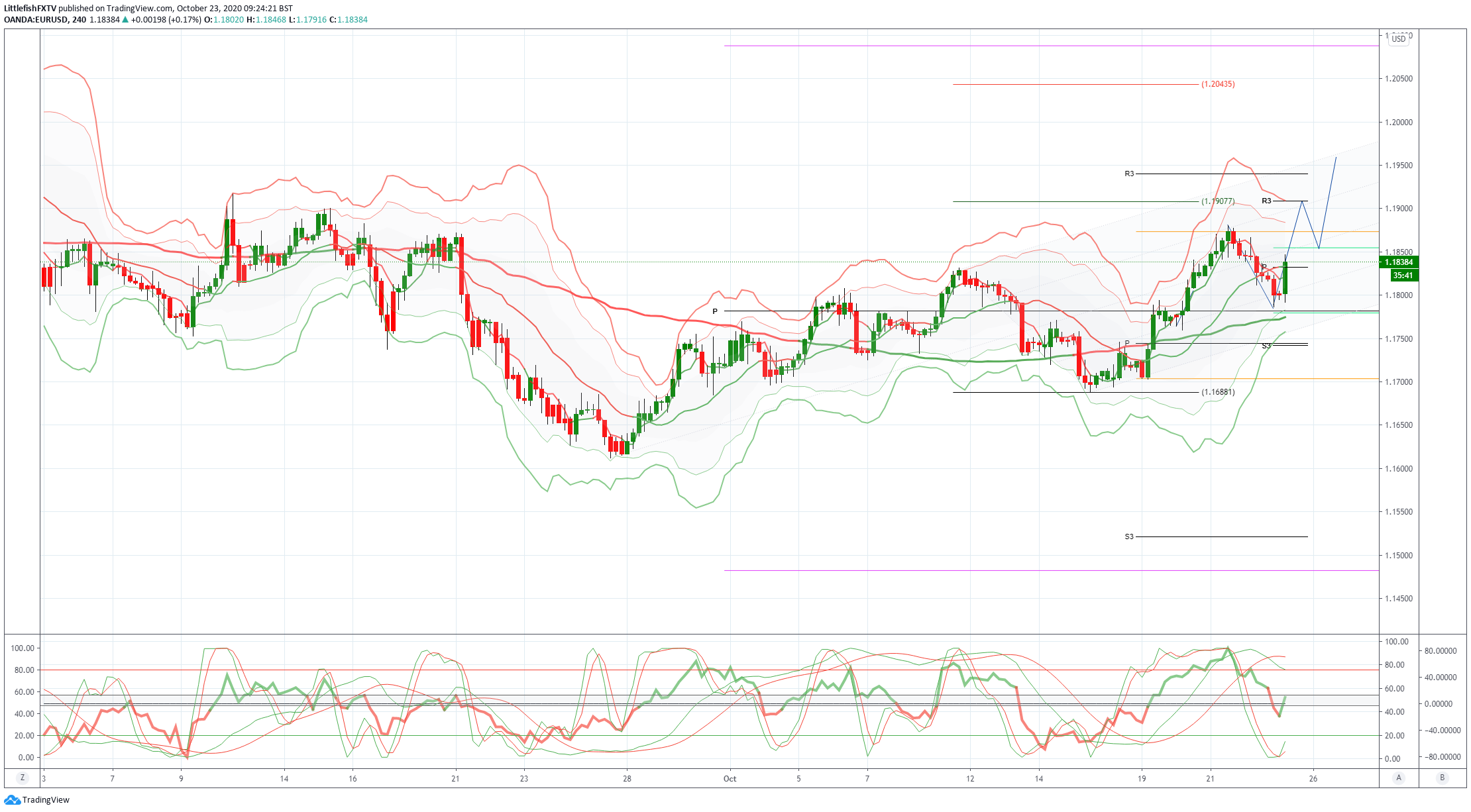

EURUSD Bias: Bullish above 1.1687 targeting 1.19

EURUSD From a technical and trading perspective, as 1.1750/60 now acts as resistance look for a test of 1.1650 next UPDATE 1.17/1.18 range for now, breach of 1.18 opens 1.1840, below 1.17 opens 1.1630 UPDATE the topside breach of 1.18 puts the equality objective at 1.19 firmly in site, intraday support at 1.18 UPDATE breach of 1.18 indicative of lack of conviction in current trade. A failure below 1.1750 will open a retest of the 1.1687 pivot.

Flow reports suggest topside offers increasing the closer the market gets to the 1.1900 level with strong offers into the area however, a break through the 1.1920 level will likely see the market gunning for the 1.2000 for the highs of the year however, option plays are likely to see good defences of the levels for the moment and any push through could be brief before dropping back again and any push for the top would have to have good timing. Downside bids light through to the 1.1780 with weak stops on a move through the level before running into congestion around the 1.1750-00 area before further stops appear and a weak downside on any break below 1.1650 area.

GBPUSD Bias: Bullish above 1.2861 targeting 1.3266

GBPUSD From a technical and trading perspective, broad range trade persists 1.3050/1.29, play range or wait for breach and retest UPDATE price contain within monthly weekly and daily pivots, as 1.2950 supports intraday look for a test of 1.3080 next

Flow reports suggest topside offers light through the 1.3100 level and increasing on any move through to the 1.3150 area and increasing again in size on any attempt at the 1.3200 level with weak stops likely on a breach of the level, downside bids through the 1.3050 area before stronger bids start to form through to the 1.3000 level with weak stops appearing and stronger bids having already moved higher the market could be vulnerable toa deeper move through to the 1.2950-30 areas.

USDJPY Bias: Bearish below 105.75 targeting 104.67

USDJPY From a technical and trading perspective, breach of ascending trend channel concerns bullish thesis as 105.50 caps upside look for a test of 104.90

Flow reports suggest downside bids strengthen into the 104.20-00 level with possibly bottom pickers appearing below the figure level however weak stops through the 103.80 area could see a quick stab lower through to the 102.00 level before bids start to reappear. Topside offers light on a push through the 105.00 level with limited offers into the 105.80-106.20 area and the possibility of congestion then continuing through to the 106.40-80 area. And stronger offers thereafter.

AUDUSD Bias: Bearish below .7243 targeting .6907

AUDUSD From a technical and trading perspective, .7050 test should see another move to retest .7120/30 as resistance, setting up another leg lower to test .7000 enroute to the equality objective at .6907

Flow reports suggest topside offers into the 0.7140-60 area before some light weakness appears however, 0.7180-0.7200 area sees stronger offers and 0.7220 level likely to see some congestion with stop losses through the level to open a quick move to stronger offers around the 0.7250 area. Downside bids light through to the 0.7060-40 area with stronger bids likely to appear on any move to test the 0.70000 areas, while there may be some weak stops on a move through the 0.6980 area the market is likely to see plenty of congestion into the 0.6950 area and increasing bids beyond.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!