Daily Market Outlook, September 20, 2022

Daily Market Outlook, September 20, 2022

Overnight Headlines

- US 10-Year Treasury Yield Rises To 3.5% For First Time Since 2011

- US Dollar Mixed As Markets Brace For Another Big Fed Rate Increase

- Bitcoin Touches 3-Month Low; Ether Extends Swoon Since ‘Merge’

- US Equity Futures Rise After Wall St Snaps Two Day Losing Streak

- Bank Of England Weighs Biggest Interest-Rate Rise In 33 Years

- Biden To Release 10 Million Barrels Of Oil Ahead Of EU-Russian Ban

- Biden Leaves No Doubt: ‘Strategic Ambiguity’ Toward Taiwan Is Dead

- No. 2 US Port Sees Consumer Demand Easing From Covid-Era Surge

- Germany Earmarks Billions For LNG To Sever Russian Gas Reliance

- Ukraine Marches Into Liberated Lands, Separatist Calls For Referendum

- Top EU Diplomat Borrell: No Chance Of Iran Deal Breakthrough At UN

- China Leaves Lending Benchmarks Unchanged As Widely Expected

- Japanese August Consumer Price Inflation Hits Near Eight-Year High

- Kuroda’s BoJ Set to Become World’s Last Negative Rate Holdout

- Australian Central Bank Warns Rate Hikes Could Slow At Some Point

The Day Ahead

- Equity markets across Asia have rallied overnight, following on from yesterday’s positive close on Wall Street. Overall, however, market risk sentiment remains relatively cautious ahead of a number of central bank decisions over the coming days, including those from the US Federal Reserve and the Bank of England. The release of the minutes from the Reserve Bank of Australia’s September 6th meeting showed that the board discussed the merits of a smaller hike of 25bp, rather than the 50bp increase it delivered. It was also noted that interest rates were getting closer to a ‘normal setting’.

- Monetary policy updates from the US Federal Reserve and the Bank of England are likely to be the key focus for markets in the coming days. Markets expect both to raise interest rates again although there is some uncertainty over how much. In the case of the Fed, speculation for much of the period since the last policy meeting in August has centred on whether it would opt for a third successive 75 basis point hike or a smaller 50bp increase. However, hawkish comments from Fed Chair Powell just before the central bank went into its blackout period and this week’s inflation data have convinced markets that a move of at least 75bp is a near certainty. Indeed, market pricing suggests there is a strong risk of a 100bp hike. Equally important will be what the Fed signals about its future policy intentions. Overall, the Fed’s message is likely to remain that getting inflation under control is the number one priority and so further rate hikes are likely.

- Similarly, financial markets expect the Bank of England to also hike rates at its meeting this week, with a second successive 50bp rate rise fully expected by money markets. The previous voting pattern on the MPC wasn’t unanimous, and this time may again see a split. Speculation beforehand is that one Monetary Policy Committee member may again vote for a smaller 25bp rise, but that others may favour a larger 75bp hike this time.

- Ahead of both of these, Sweden’s central bank is expected to announce a doubling of its policy rate this morning. At 08:30 BST, the Riksbank is forecast to lift interest rates from 0.75% to 1.50% according to the latest Bloomberg poll of economists, which would be its biggest hike in almost three decades, with some predicting a larger 100bp increase. Beyond this meeting, interest rate markets expect the Riksbank to take its policy rate above 2% by the end of the year in response to the sharp rise in both core and headline inflation in recent months.

- This afternoon, US housing data for August are expected to show further falls in housing starts and building permits issuance in response to the slowdown in housing sales amid higher borrowing rates.

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9800 (1.3BLN), 0.9900 (287M), 0.9920 (402M)

- 0.9975-80 (265M), 1.0000 (823M), 1.0040-50 (965M)

- 1.0100 (632M), 1.0125 (668M), 1.0200-10 (500M)

- USD/JPY: 141.00 (226M), 143.25 (260M)

- EUR/JPY: 141.00 (489M). USD/CHF: 0.9500 (400M)

- GBP/USD: 1.1425 (697M), 1.1525 (449M)

- AUD/USD: 0.6675 (406M), 0.6720 (400M), 0.6725-35 (408M)

- 0.6750 (313M),

- USD/CAD: 1.3100 (282M), 1.3130-40 (394M)

Technical & Trade Views

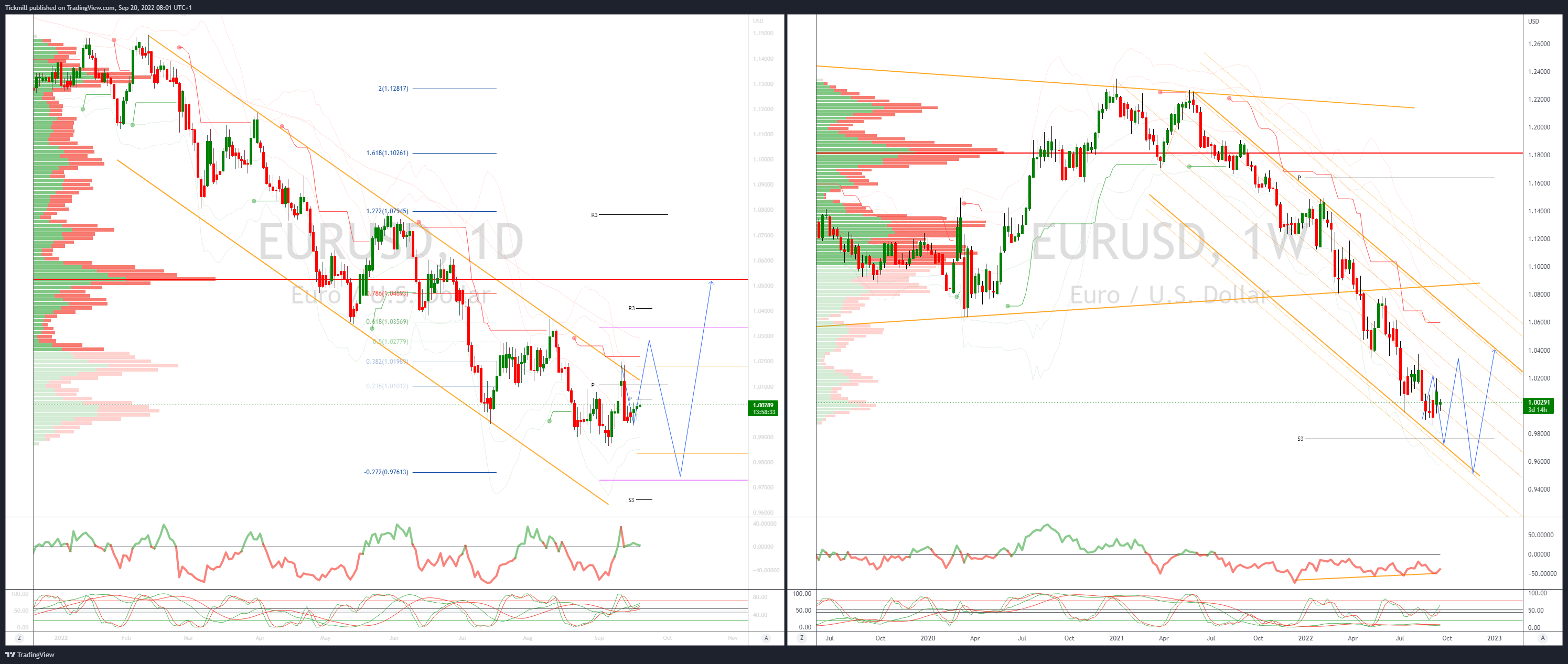

EURUSD Bias: Bearish below 1.0250

- Bid on the softer U.S. dollar, signals turn positive

- Up 0.2%, as positive risk appetite weighs on the U.S. dollar in Asia

- Regional stocks are higher with Wall Street and E-mini S&P futures

- EUR likely driven by USD and or EUR/GBP flow amid Fed and BoE rate decisions

- 20 day VWAP bands climb - signals have moved from neutral to bullish

- Positive signals within the 0.9864-1.0198 broad September range

- Asian 1.0023 low and 1.0089 upper 20 day VWAP initial support, resistance

- 1.0030/40 512 mln and 1.0050 645 mln are the close strikes for Tuesday

- 20 Day VWAP bullish, 5 Day bullish

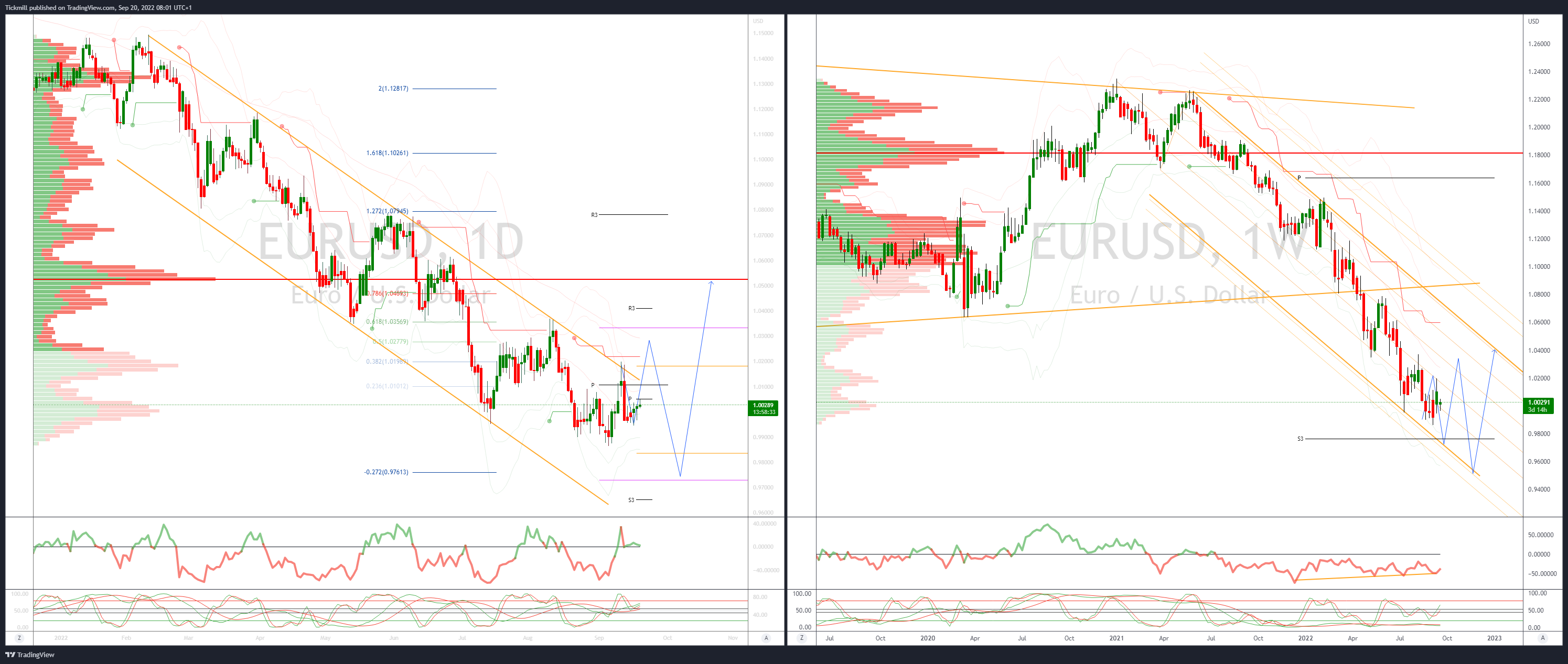

GBPUSD Bias: Bearish below 1.19

- Difference in BoE and Fed outlook key for sterling

- +0.05% after closing up 0.1% with an inside day, as 1.1350 proves resilient

- As the UK buried the Queen, focus on BoE and new government

- Truss gov't looking to cut taxes, which could fuel inflation

- BOEWATCH prices a 50pt hike to 2.25% at 57.36% and 75pts at 42.64%

- Differences in outlook between BoE and the Fed this week, key for sterling

- Close above 1.1589 would ease the bearish bias

- 20 Day VWAP is bearish, 5 Day bearish

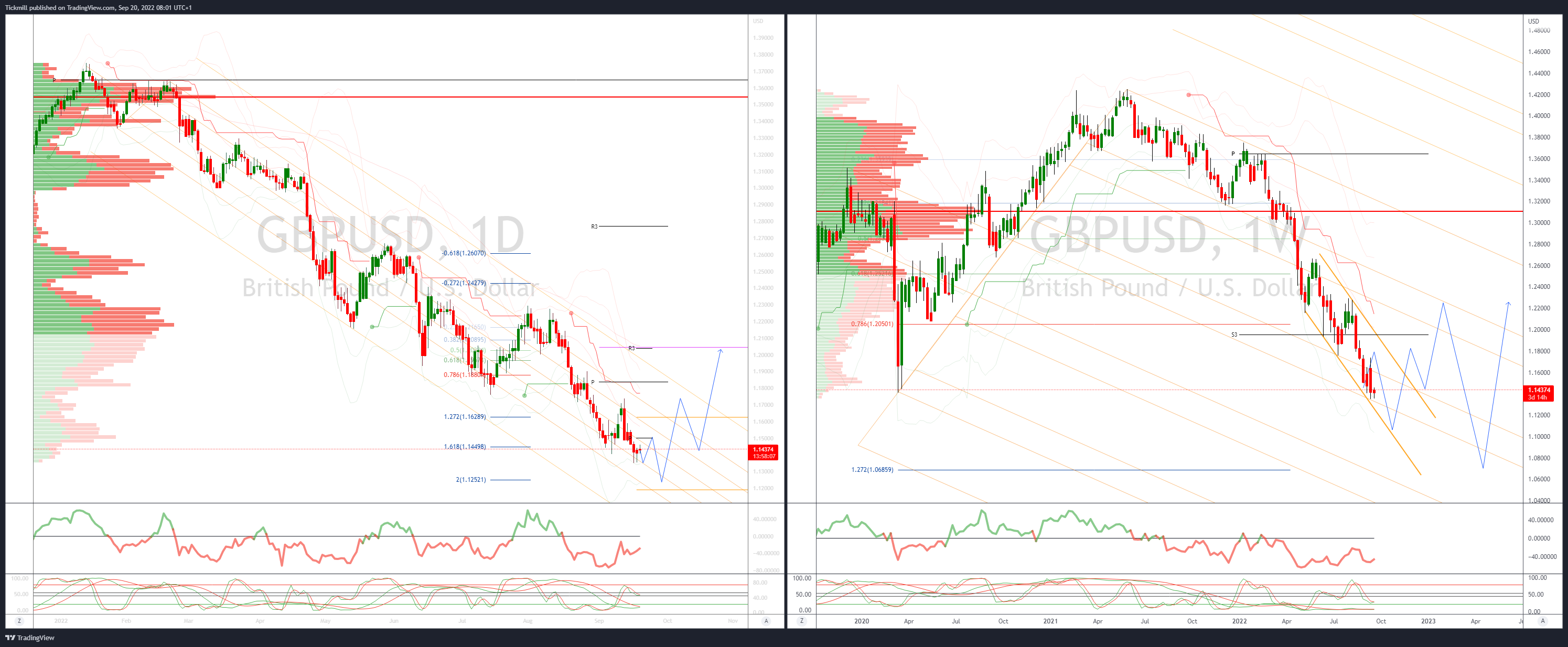

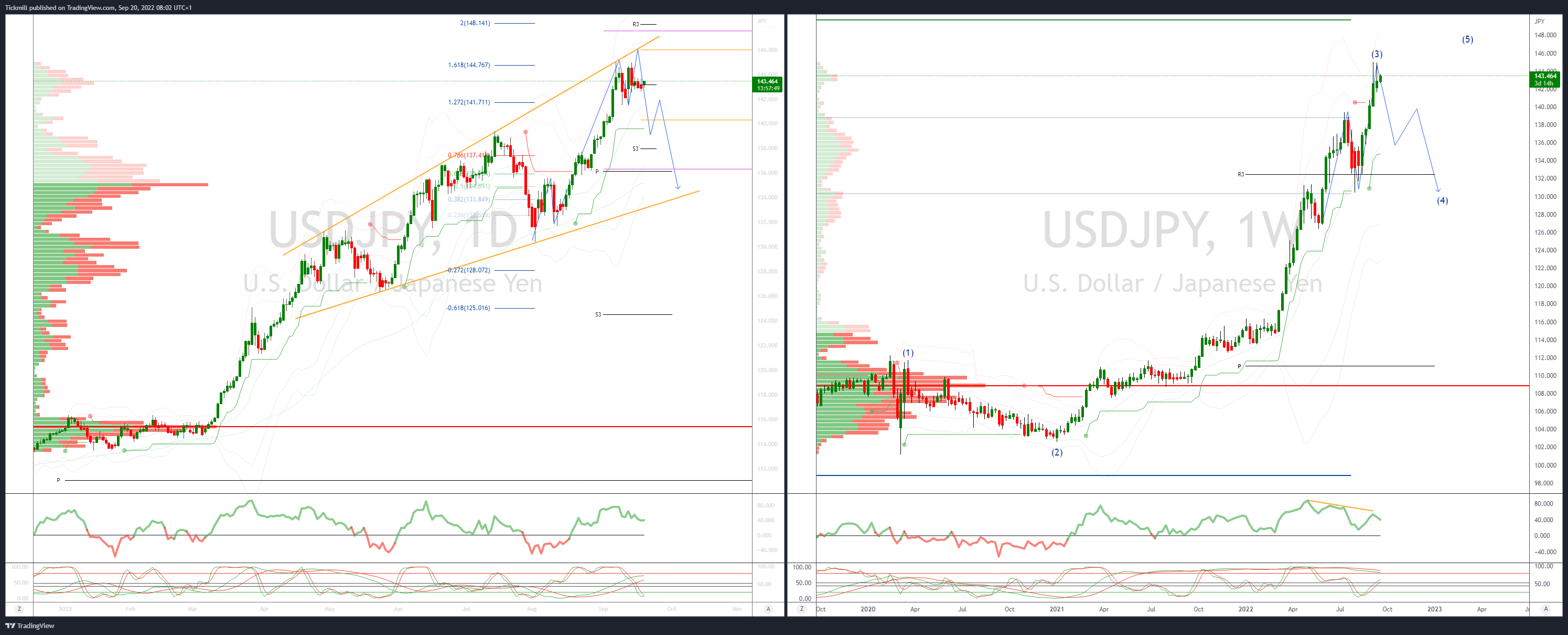

USDJPY Bias: Bullish above 139

- Touch firmer as inflationary pressures build

- +0.1% after closing up 0.2%, supported by strong shorter end UST yields

- Tokyo return from the long weekend - high core CPI, 2.8% vs 2.7% forecast

- CPI Nationwide Overall +3% - muted FX response, but inflation builds

- Close below 141.50 mid September range base would be a bearish signal

- Thursday's 143.80 high and Monday's 142.65 low initial support, resistance

- 20 Day VWAP is bullish, 5 Day bearish

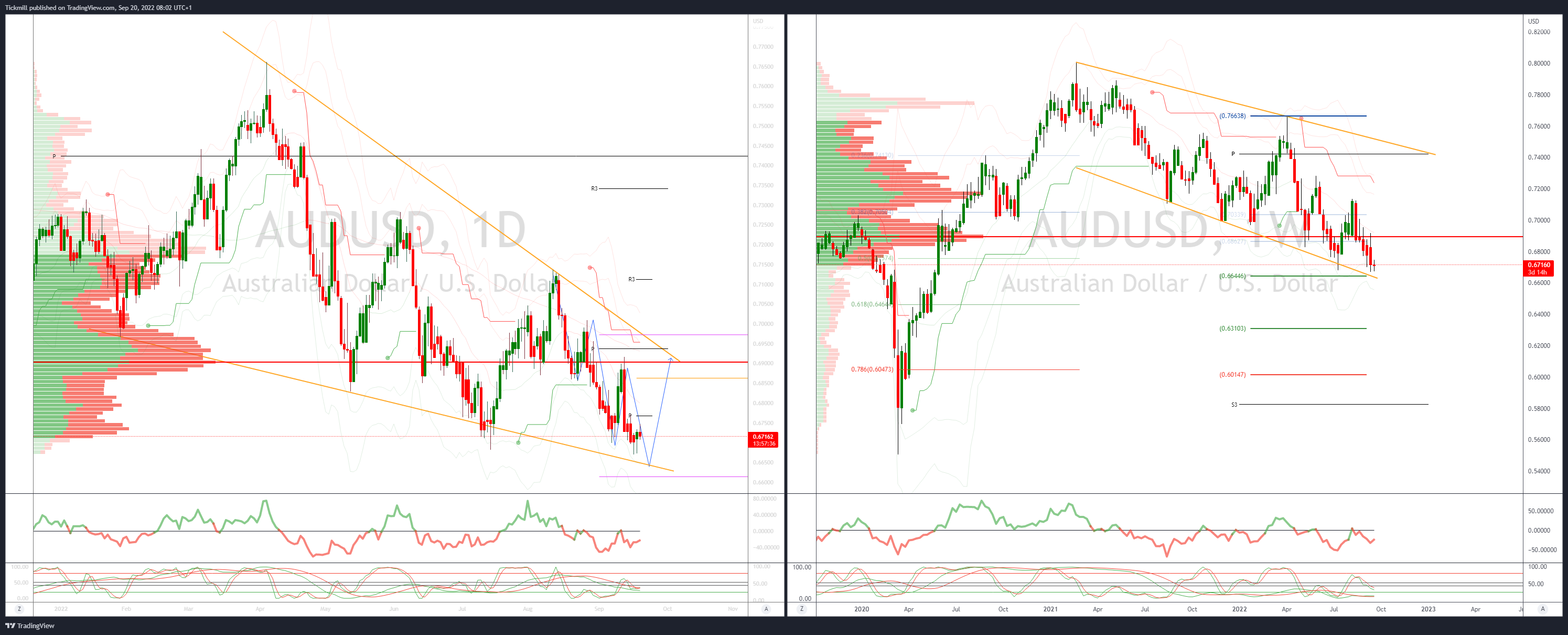

AUDUSD Bias: Bearish below .70

- AUD demand evaporates above the 0.6682 2022 base, USD to lead

- No major surprises from RBA Governor Lowe - remains data driven

- RBAWATCH split on Oct 2nd meeting - 25pt hike 52.15% chance, 50pts 47.85%

- 20 day VWAP bands and daily momentum studies edge south - bearish setup

- 0.6682 July and 2022 low held - break targets 0.6463 61.8% 2020/21 rise

- Asian 0.6685 low and New York 0.6749 high initial support, resistance

- 20 Day VWAP is bearish, 5 Day bullish

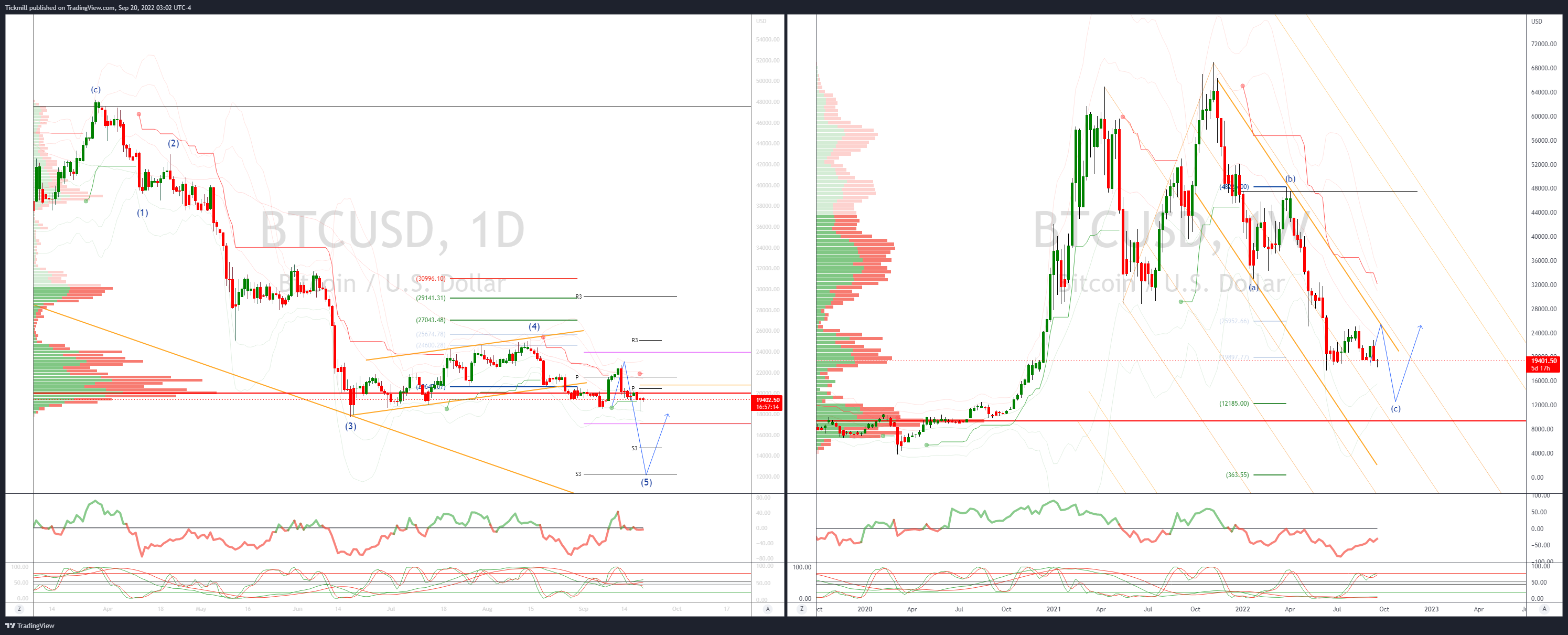

BTCUSD Bias: Bearish below 25.3K

- BTC back above 19k after testing demand below 18.5k

- Crypto firm fights SEC by claiming its investors have no rights

- ETH weakness returns, making test of $1,000 a possibility

- Weekend slump validated downtrend channel

- Ceiling of channel now caps intraday at $1,443.70

- Energy-saving 'Merge' fails to inspire investors

- Still a highly risky asset closely correlated to stocks

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!