Daily Market Outlook, September 21st, 2021

.png)

Daily Market Outlook, September 21st, 2021

Overnight Headlines

- Democrats Dare GOP, Link Debt Limit To Vital Spending Bill

- Canada’s Trudeau To Secure Third Term, Without Majority

- Asian Equities Hit By Volatility On Evergrande Default Fears

- Evergrande Likely Default Without Direct Support, S&P Say

- Australia's Central Bank Wary In Case Delta Slows Recovery

- RBNZ Hawkesby Quashes October Aggressive Rate Hike Bet

- EU Borrell: No UN Ministers' Meeting On Iran Nuclear Deal

- EU Risks Running Out of Gas This Winter, US Official Warns

- UK PM Johnson: Biden Bigger Priorities Than UK Trade Deal

- UK Workers Find Lack Job Options Despite Labour Shortage

- ConocoPhillips To Buy Shell Permian Assets For $9.5 Billion

- Robinhood Beta App Test Crypto Wallet, Transfer Features

The Day Ahead

- The latest Lloyds Bank Recovery Tracker has been released this morning. It points to a slowdown in the pace of recovery in the UK and across much of the world. Supply constraints seem to be the principal cause, although demand may also have slowed. More positively there are signs of at least some inflationary pressures waning.

- Today’s September CBI industrial survey will provide a further update on the UK factory sector. While it typically gets less attention than the PMI report due Thursday, the CBI survey is long established. Recent results have painted a similar picture to the PMI. Domestic orders are elevated (but export orders less so) suggesting that demand for manufactured products is still robust. However, output growth has clearly slowed primarily because of supply constraints and inflationary pressures remain intense.

- Supply-side issues are also prominent in the US, which probably helps to explain this year’s surprising weakness of housing construction. Housing starts fell by 7% in August reflecting declines in both single units and a particularly large fall in multi units. Today’s data for September is expected to see a modest rebound in starts but that will still leave them well below their Spring peak.

- Today’s Swedish Riksbank monetary policy announcement is the first of several central bank updates this week. The Riksbank is not expected to make any policy change today, in contrast to the Norges Bank, which is predicted to hike rates on Thursday. The Riksbank remains concerned that a rise in rates well ahead of the European Central Bank runs the risk of pushing up the krona. Nevertheless, some economists think that the Riksbank will still point to a rate rise earlier than previously expected (late 2024). The Bank of Japan will report on policy early Wednesday and is also expected to leave its settings unchanged.

G10 FX Options Expiries for 10AM New York Cut

(Hedging effect can often draw spot toward strikes pre expiry if nearby)

- USDJPY - 110.90/111.00 603m. 109.80/90 645m. 109.50/60 1.37bn (932m C). 109.00 1.45bn (1.33bn P). 108.50/60 652m.

- EURUSD - 1.2100 415m. 1.1900/20 1.77bn (1.39bn C). 1.1860/70 457m. 1.1840/50 679m. 1.1800 674m. 1.1720/30 402m. 1.1700/10 561m. 1.1680/90 624m.

- AUDUSD - 0.7350 430m. 0.7310/20 606m. 0.7160/70 579m. 0.7100 576m.

- USDCAD - 1.2900 460m. 1.2800 1.59bn (1.10bn C). 1.2640 417m.

- EURJPY - 127.00 630m. 126.70 420m.

- EURNOK - 10.37 640m. 10.32 420m. 10.30 510m. 10.17 520m. 10.15 750m.

- USDSGD - 1.3550 410m.

- USDMXN - 20.12 430m. 19.80 1.17bn (P).

Technical & Trade Views

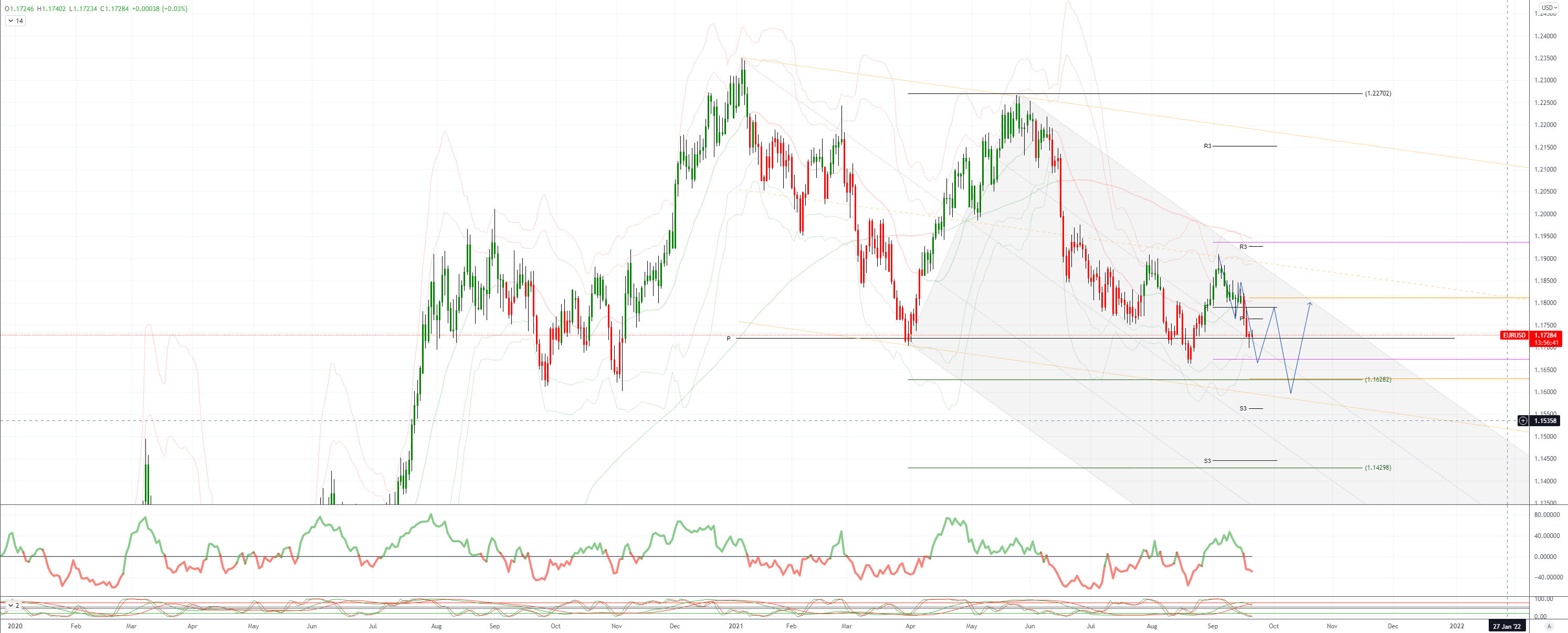

EURUSD Bias: Bearish below 1.19 Bullish above

- EUR/USD risk of short – covering but evidence suggests otherwise

- Wait for Fed's Sep 22 policy decision continues with traders short ahead

- Risk of profit taking (short-covering) but little sign of that so far

- Downside pressure continuing until 9GMT yesterday when pair traded 1.1700

- Seems traders willing to add the big growth in shorts

- Shorts doubled in wake of Jun Fed meeting

- Profit taking has trimmed just 12% of that larger bearish bet

- Over sold yesterday EUR/USD has drifted higher to 1.1740

- Neutral ground lies much higher at 1.1804

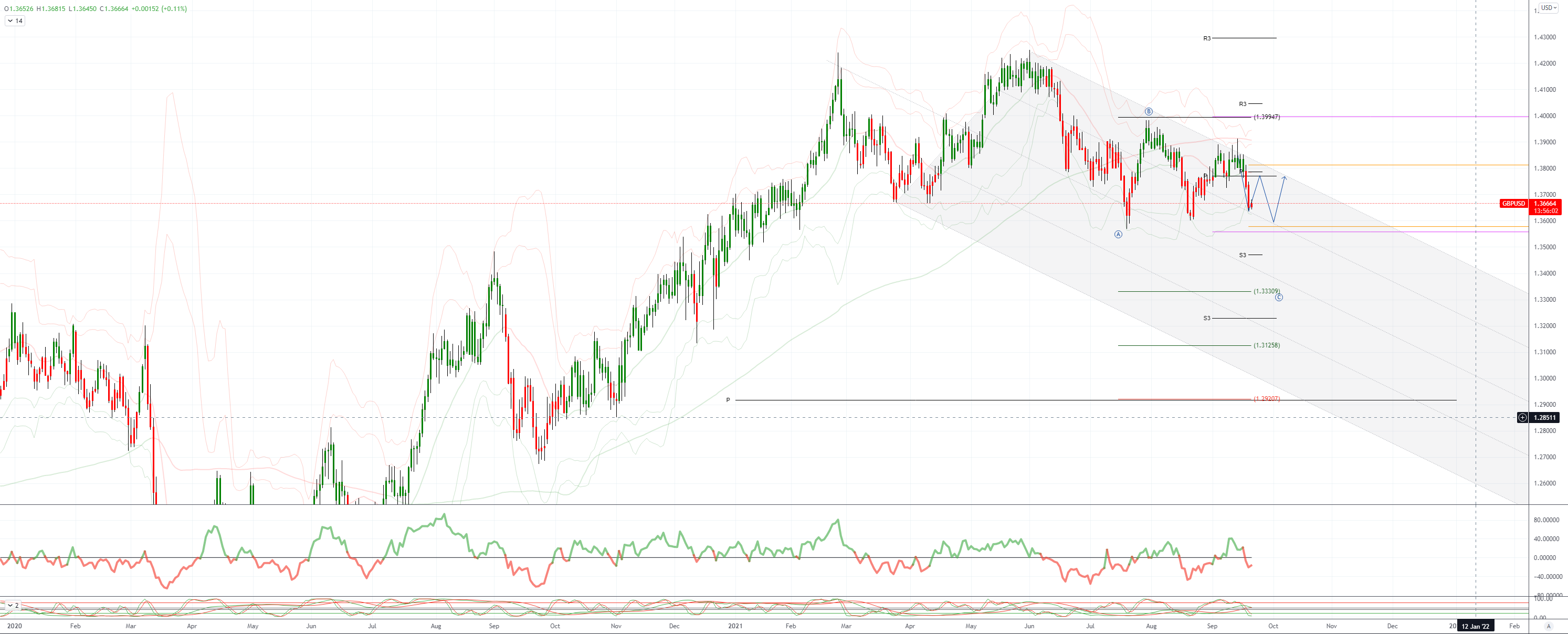

GBPUSD Bias: Bearish below 1.39 Bullish above.

- FX traders eye minimum correction off Monday low

- Sharp three-day decline checked at 1.3640 Monday low

- Minimum correction off recent 1.3913 to 1.3640 drop is at 1.3704

- Key Fibo of that move, 50%, at 1.3777: 38.2% is at 1.3744

- Sterling still in trouble while below Sept 8 1.3727 former range base

- Pivotal downside target remains 1.3602, Aug 20 low

- Break opens up major tipping point at 1.3573, Jul 20 low

USDJPY Bias: Bullish above 109 Bearish below

- USD/JPY – Bid as risk appetite stabilizes in Asia

- +0.2% at the top of a 109.31-109.60 range, as risk appetite stabilized

- E-mini S&P +0.4%, Brent +0.85%, 10yr UST yields 1.324% +1bp

- Nikkei -2% catching up with 2 sessions of losses on Wall Street

- Japan fin min: meeting budget target may take more time

- BoJ Wednesday - no change expected with a cautious outlook

- Charts; falling 109.69 Tenkan line, horizontal 109.78 Kijun line resistance

- Last week's 109.11 low is first significant support then 108.72 August low

- Today's close strikes are 109.50 766 MLN and 109.65/70 830 MLN

AUDUSD Bias: Bearish below 0.75 Bullish above

- AUD/USD – Moves higher as Asian markets calm after the storm

- AUD/USD opened -0.14% after showing remarkable resilience during risk rout

- Market calmed in Asia with E-minis +0.35% and AXJ index only 0.18% down

- AUD/USD moved higher and is at session high around 0.7265/70 into the afternoon

- AUD/JPY buying helped as the cross gained around 0.40% since NY close

- AUD/USD resistance is at 10-day MA at 0.7319 and break would ease pressure

- Support is at 76.4 of 0.7106/0.7477 move @ 0.7194 with bids tipped at 0.7220

- If European markets and Wall Street calm, more short-covering likely

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!