Daily Market Outlook, September 22, 2022

Daily Market Outlook, September 22, 2022

Overnight Headlines

- Fed Raises Rates By 75 Basis Points Again; Sees Higher Terminal Rate

- Powell Signals Recession May Be Price To Pay For Crushing Inflation

- US Dollar Index Hits A Two-Decade High On Hawkish Fed Outlook

- US Equity Futures Fall As Fed Leaves Little Room For A Dovish Take

- EU Plans New Measures To Tame Energy Markets, Ease Gas Prices

- Putin Comments Spark EU Minister Talks On New Sanctions, Weapons

- Bank Of England Set For A Second 50 Basis Point Rate Rise In A Row

- BoE Rate Setters Expected To Take Hike Path Of Least Resistance

- UK Aims To End Stormont Row Before Planned Joe Biden Visit In 23

- Norwegian Central Bank May Keep To Half-Point Rate-Hike Pace

- Kuroda’s BoJ Holds Ground On Ultralow Rates, Pushing Yen To 145

- Yen Sinks Closer To 1998 Intervention Level With Traders On Edge

- Goldman Lifts Forecasts For Fed Hikes On Powell’s Hawkish Signal

- SNB Likely To Follow ECB With Hike To Exit Negative Rates

- Goldman Slashes China’s 2023 Growth Forecast As Covid Zero Stays

- Bitcoin, Ether Drop As Fed Warning Of Rate-Hike Pain Hits Crypto

The Day Ahead

- Asian equity markets extended declines following the US Fed’s decision last night to increase interest rates by 75bp to 3% to 3.25%, a 15-year high. Moreover, the Fed signalled further hikes to come and the rhetoric from Chair Powell was hawkish, with focus remaining on getting inflation down. In contrast, the Bank of Japan kept its interest rates unchanged as expected, resulting in a further weakening of the yen versus the US dollar.

- The Bank of England’s September policy update was originally planned for last Thursday but was delayed by a week because of the Queen’s funeral. Market expectations are centred on a second 50bp rate rise. The previous voting pattern on the MPC was not unanimous, and this time may again see a split. Speculation beforehand is that one Monetary Policy Committee member may again vote for a smaller 25bp rise, but that some others may favour a larger 75bp hike this time. Of key interest will be the BoE’s initial thoughts on the implications for monetary policy of the government’s announcement of measures to cushion the impact of rising energy prices. These will mean that inflation is likely to peak well below where the BoE’s envisaged at the time of its last update in August. However, the substantial fiscal stimulus will add to demand pressures at a time when domestic inflation is already very high. It seems likely that the BoE will opt not to take a strong position for now on whether this means that rates should rise by more or less than previously assumed. Instead, it may message that it is waiting for more detail on the fiscal outlook and that it will update its forecasts in time for its next update in November. In the meantime, it will probably retain previous guidance that rates are not on a pre-set course and that the path is ‘data dependent’.

- Both the central banks of Switzerland and Norway are also expected to raise interest rates this morning to 0.5% (+75bp) and 2.25% (+50bp), respectively, while the Turkish central bank is expected to leave its policy rate unchanged at 13%.

- Early Friday sees the release of the closely watched UK GfK consumer confidence survey. The headline index may see a small rebound in September from August’s record low reflecting a positive initial response to the energy package. Look for a rise to -41 from -44.

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9800 (1.76BLN), 0.9900 (2.09BLN), 0.9950-55 (1.08BLN)

- 0.9990-00 (5.55BLN), 1.0020-30 (1.08BLN) 1.0050 (1.17BLN), 1.0100 (893M)

- USD/JPY: 143.35-45 (836M), 144.50 (300M)

- USD/CHF: 0.9595-00 (300M), 0.9640-50 (463M). EUR/CHF: 0.9525 (311M)

- GBP/USD: 1.1400 (200M), 1.1490 (502M)

- AUD/USD: 0.6500 (357M), 0.6600-10 (375M)

- USD/CAD: 1.3420 (890M), 1.3450 (1.06BLN)

Technical & Trade Views

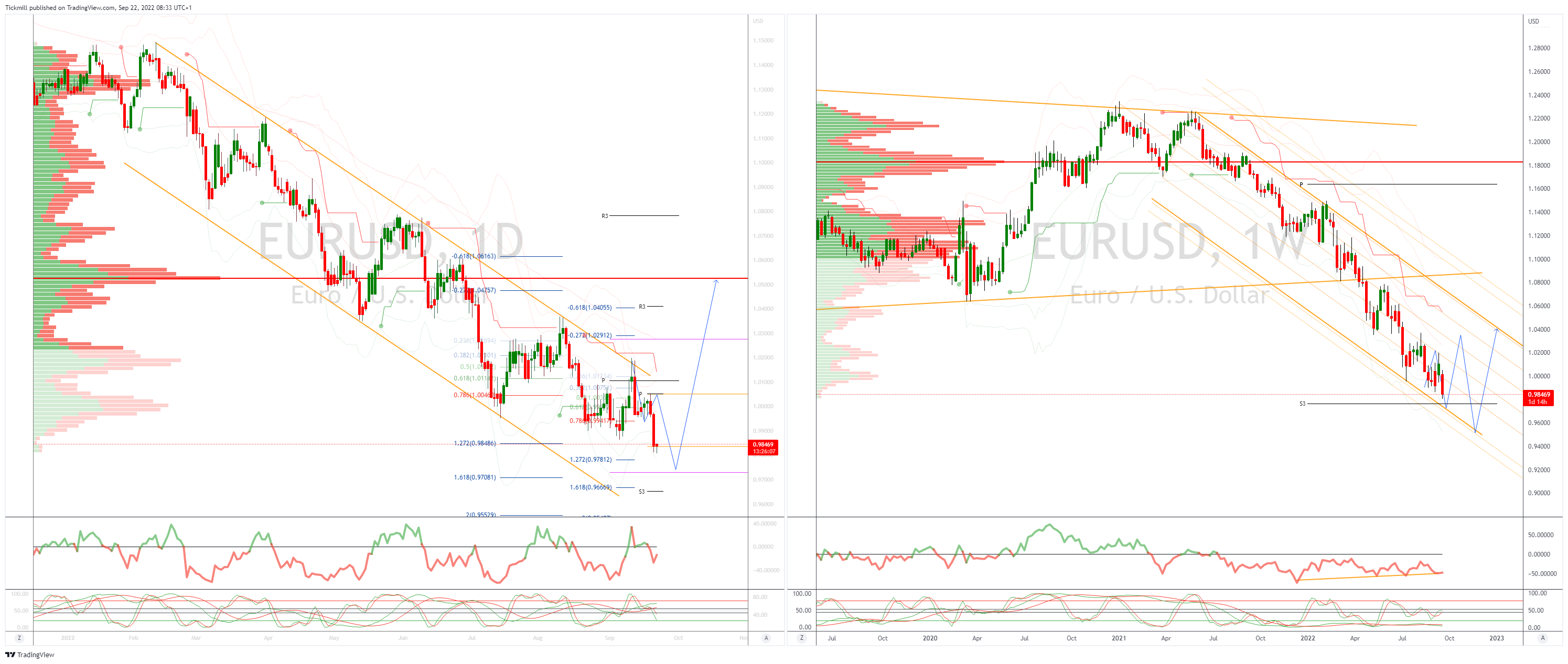

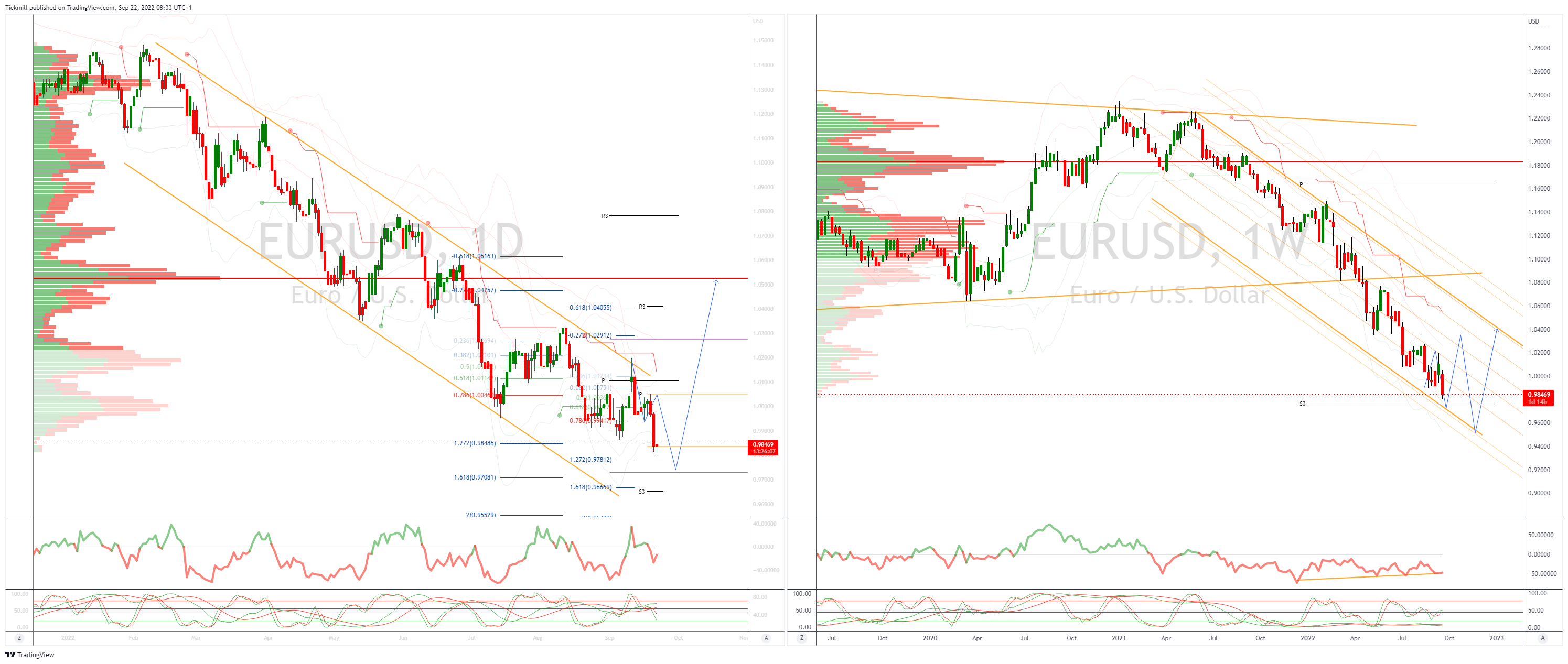

EURUSD Bias: Bearish below 1.0250

- EUR/USD Slumps as hawkish Fed encourages fresh USD buying

- EUR/USD opens -1.3% @ fresh trend low after hawkish Fed hike sent USD higher

- Fed managed to exceed hawkish Fed expectations with aggressive dot-plot

- Ukraine uncertainty also weighs as EUR fell against all major currencies

- Technicals and fundamentals make it difficult to justify long EUR/USD

- There isn't any support of note until monthly low at 0.9670

- Resistance at former support at 0.9864 and 0.9975/80

- 20 Day VWAP bearish, 5 Day bearish

GBPUSD Bias: Bearish below 1.18

- GBP/USD at lowest in 37 years; BOE won't keep pace with Fed

- GBP/USD tumbles to 37-yr low 1.1237 in wake of FOMC; last 1.1254

- Fed hikes 75bps, sees further big rises ahead

- That means more pain for GBP, as 1.1000 barrier attracts

- Bearish chart signal affirmed; downtrend channel caps 1.1394

- BOE expected to hike 50bps today but may not keep pace with Fed

- UK inflation outlook could improve slightly

- The break of 1.1351 trend low, targets psychological 1.1000 level

- 20 Day VWAP is bearish, 5 Day bearish

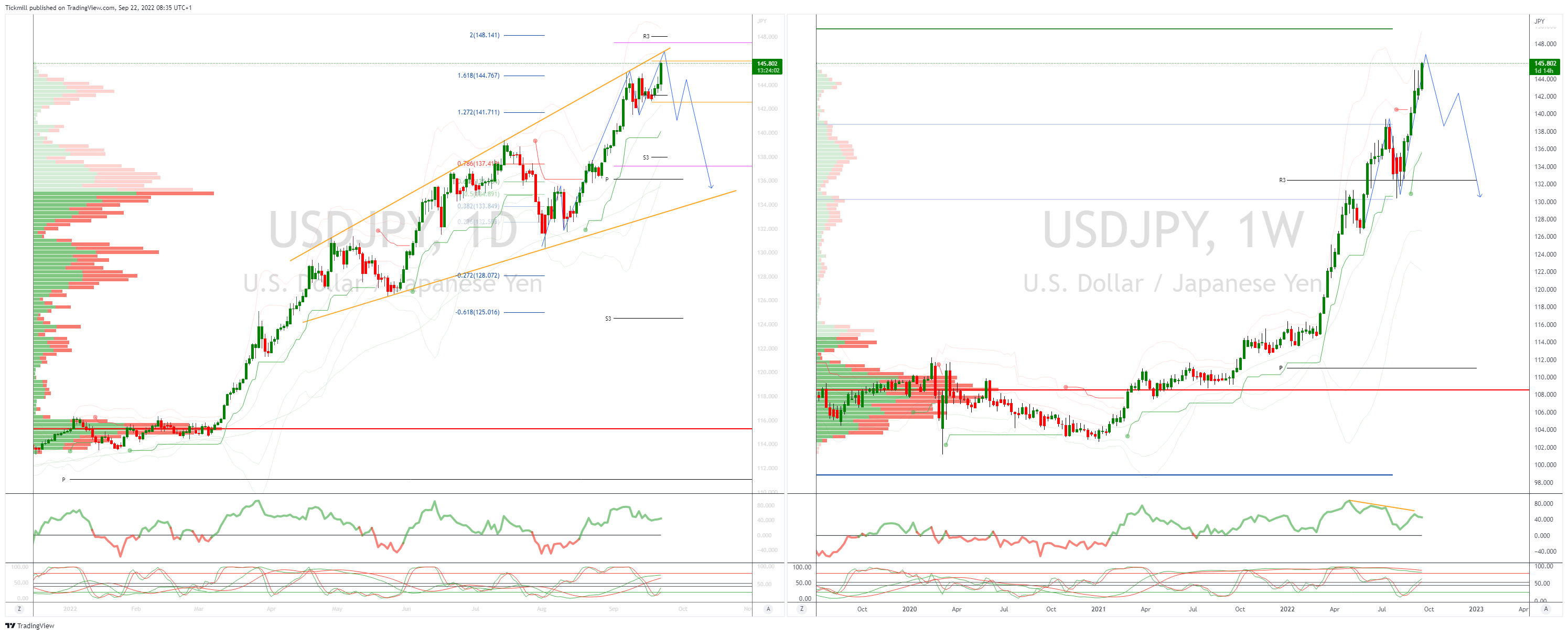

USDJPY Bias: Bullish above 139

- USD/JPY moves steadily higher, finds footing after sharp post-BOJ whipsaw

- C.bank maintains short-, long-term rate targets; no tweak to dovish guidance

- Remains global outlier with low rates despite weak yen

- Speculation of BOJ rate-checks in jittery market but no confirmation

- Dip buyers surface but rebound tops out at 144.95 as traders wary of BOJ

- BoJ Gov Kuroda does not see the need to change forward guidance for about 2-3 years

- BOJ-Fed policy divergence to underpin USD; intervention fears may cap gains

- Offers sited 146.60

- 20 Day VWAP is bullish, 5 Day bullish

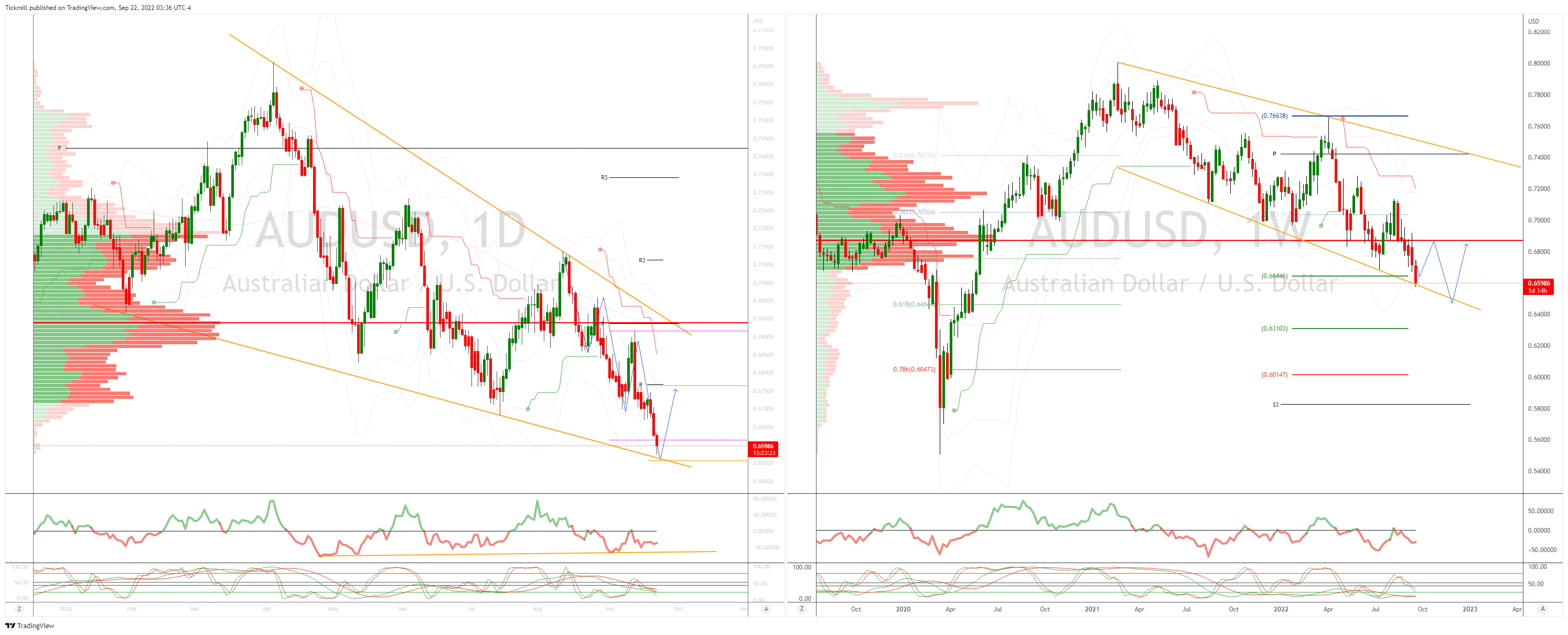

AUDUSD Bias: Bearish below .70

- Slumps below 0.6600 early Asia as buyers disappear

- AUD/USD hit hard in early Asia and is 0.55% lower at 0.6595

- Market reluctant to bottom pick as fundamentals and technicals decidedly negative

- There isn't any support ahead of the 61.8 of pandemic low/high at 0.643

- Hawkish Fed supports USD and undermines risk assets

- Investors fear global growth slump, which also weighs on AUD/USD

- 20 Day VWAP is bearish, 5 Day bearish

BTCUSD Bias: Bearish below 25.3K

- BTC bids ahead of 18K rebound of over 2%

- Puts it on track to test Dec 2020 low of 17,592

- If that bottom is breached, confidence will fade further

- A prolonged slide to psych barrier 15k may then ensue

- JPMorgan’s Dimon: Crypto Tokens Are ‘Decentralized Ponzi Schemes’ - BBG

- Crypto exchange Kraken CEO Powell to step down

- SocGen arm offers custodian services for crypto funds

- 20 Day VWAP is bearish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!