Daily Market Outlook, September 26, 2023

Daily Market Outlook, September 26, 2023

Munnelly’s Market Commentary…

Asian equity markets mostly traded lower, reflecting the mixed performance in the United States and concerns about rising yields. The Nikkei 225 declined by 1.0%, partly due to the acceleration in Services Producer Price Index (PPI) data and uncertainty surrounding potential foreign exchange (FX) intervention related to recent currency movements. Meanwhile, the Hang Seng and Shanghai Composite were both trading in minor negative tensions. Trade tensions added to the negative sentiment after the US imposed restrictions on additional Chinese and Russian companies involved in supplying components for drone production in Russia. However, mainland China's losses were partially offset by significant liquidity injections, coupled with hopes that the upcoming Mid-Autumn Festival and National Day Golden Week holidays would boost consumption and economic activity.

Investors are also concerned about the looming possibility of a US government shutdown on October 1st, as Moody's has issued a stern warning that could jeopardise the country's AAA credit rating. Additionally, investors are keeping an eye on an increase in Treasury supply, as a series of heavy Treasury auctions is set to begin with the sale of two-year notes on Tuesday, followed by three-year notes on Wednesday and seven-year paper on Thursday. This comes as the US budget deficit continues to widen due to higher spending and reduced tax receipts.

In the European session, the data calendar is relatively light, with the European Central Bank's Lane scheduled to speak at a conference at the Bank of France on monetary policy. In the US, the focus will be on the Consumer Confidence report, with a strong reading potentially exerting upward pressure on both US yields and the dollar, which could impact overall market sentiment.

FX Positioning & Sentiment

It's worth noting that current implied volatility prices are still significantly higher than the realised volatility measures. This discrepancy underscores the lack of actual volatility in the market and is expected to keep pressure on implied volatility. While FX options price action doesn't rule out the possibility of further gains for the US dollar (USD), it's likely to follow a gradual and less volatile upward trajectory. EUR/USD barrier and trigger options have been benefiting from this environment for some time and are expected to continue doing so. More barriers, triggers, and related defensive strategies are positioned around the 1.0500 level to provide support. In the case of GBP/USD, a substantial £1.4 billion 1.2200 strike expiry is set for 10 am New York/14 GMT on Thursday. This level could act as a magnet and limit GBP/USD movements in the lead-up to the expiration.

CFTC Data As Of 22-09-23

USD net spec short flips to long $4.567 in Sept 13-19 period; $IDX +0.51%

EUR$ -0.67% in Sep 13-19 period, specs -11,099 contract, now +101,981

Hawkish Fed posturing at Fed hold Wednesday pushed EUR lower in current period

$JPY +0.55%, specs -2,906 contract as pair hovers near 2023 highs

Dogfight b/w bulls & bears as longs profit, new longs eye US-JY yield diffs

GBP$ -0.87% in period, specs -12,491 contracts on less-hawkish BoE rate view

Weak BoE data, recent hold hints at further GBP weakness

AUD$ (+0.54%), $CAD (-0.9%) sold aggressively despite higher commodity prices

BTC +4.29% in period, specs -635 contracts; higher Fed rate musing stir long unwind (Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0520 (1.2BLN), 1.0575 (514M), 1.0600 (1.7BLN)

1.0645-55 (1.4BLN), 1.0700 (1.8BLN)

USD/CHF: 0.9010-15 (565M). EUR/CHF: 0.9650 (626M)

GBP/USD: 1.2170 (302M) - don't forget a mega 1.2200 strike on Thursday

EUR/SEK: 11.75 (670M)

AUD/USD: 0.6400 (648M), 0.6450-60 (1BLN). EUR/AUD: 1.6780 (425M)

USD/CAD: 1.3500 (1.3BLN). EUR/JPY: 159.50 (250M). USD/JPY: 148.50 (275M)

Overnight Newswire Updates of Note

Dollar Rallies To 2023 High As Yields Keep Rising On Fed’s Path

Senate Nearing Bipartisan Measure To Avert A Government Shutdown

Fed’s Kashkari Says He Expects One More Rate Hike This Year

US Risks Its Top Credit Rating With Shutdown, Moody's Warns

China, Japan, South Korea Meet To Revive Trilateral Ties

China GDP Growth To Rise To 5.2% In Q4 - Securities Daily

EU Trade Chief Warns China’s Stance On Ukraine Is Hurting Trade

Global Trade Falls At Fastest Pace Since Pandemic

Treasury Yields Soar, Steepening Extends as 5s30s Turns Positive

Oil Slips As Strengthening Dollar Outweighs Supply Tightness

Asia Stocks Fall Tuesday As Treasury Yields, Dollar Higher

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

SP500 Bias: Bullish Above Bearish Below 4355

Above 4360 opens 4385

Primary resistance is 4465

Primary objective is 4266

20 Day VWAP bullish, 5 Day VWAP bearish

EURUSD Bias: Bullish Above Bearish Below 1.0650

Above 1.07 opens 1.0750

Primary resistance is 1.1066

Primary objective is 1.0550

20 Day VWAP bearish, 5 Day VWAP bearish

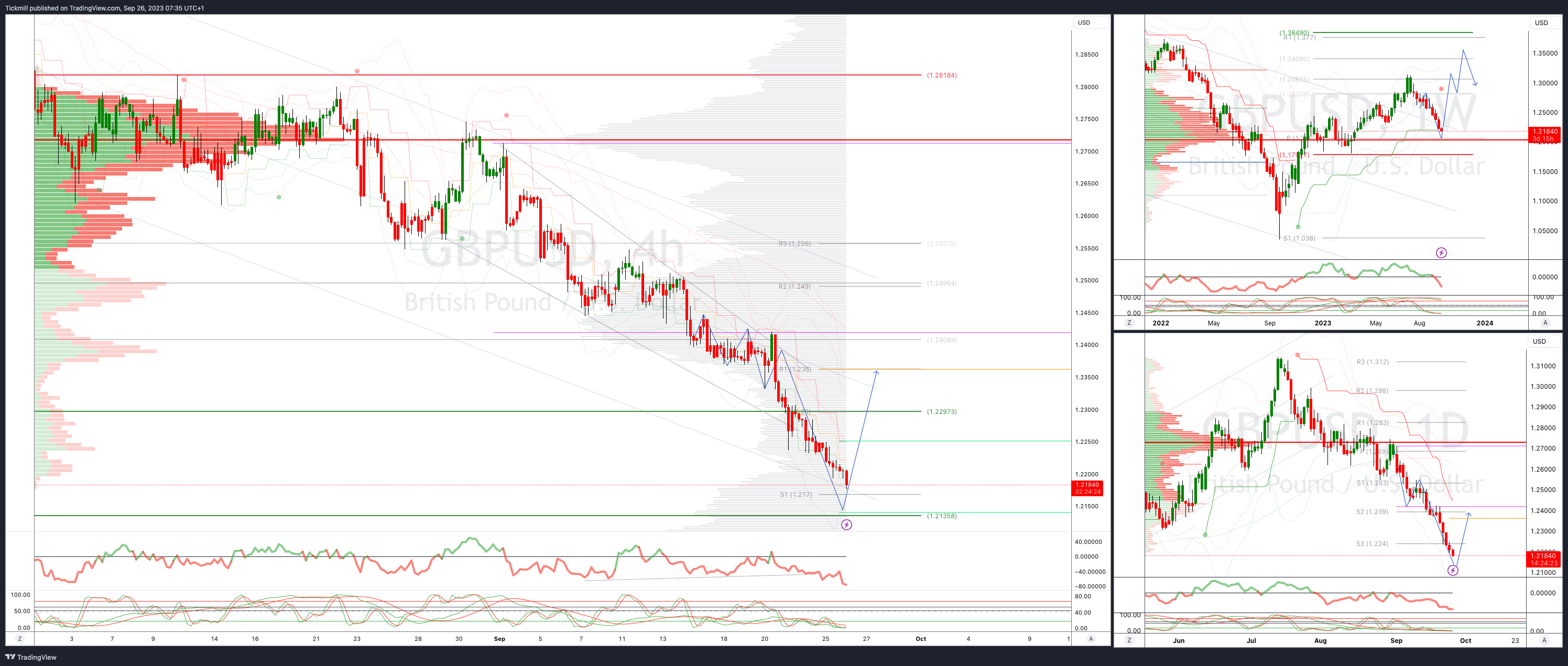

GBPUSD Bias: Bullish Above Bearish Below 1.2250

Above 1.2250 opens 1.2360

Primary resistance is 1.2750

Primary objective 1.2150

20 Day VWAP bearish, 5 Day VWAP bearish

USDJPY Bias: Bullish Above Bearish Below 148.50

Below 148 opens 147.50

Primary support 144.50

Primary objective is 150

20 Day VWAP bullish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish Below .6450

Above .6475 opens .6525

Primary resistance is .6620

Primary objective is .6320

20 Day VWAP bearish, 5 Day VWAP bullish

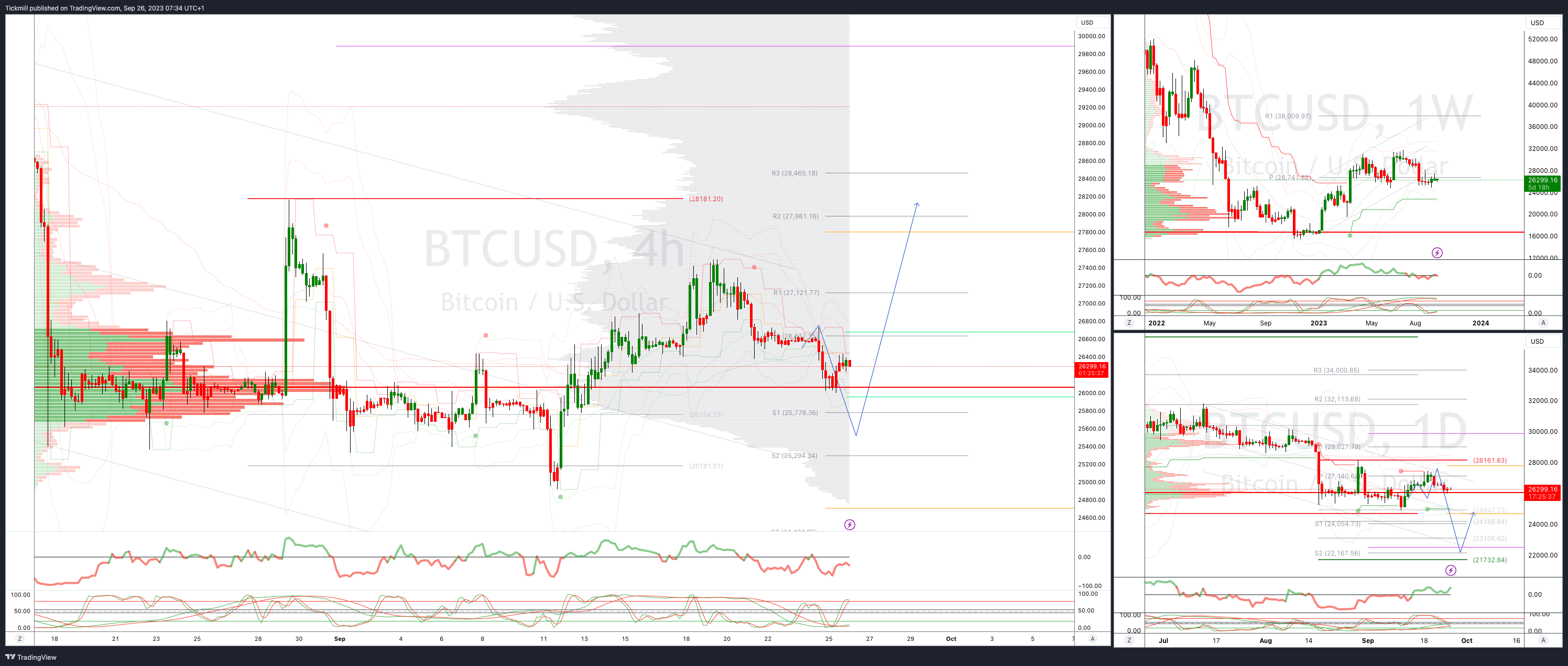

BTCUSD Bias: Bullish Above Bearish below 27500

Above 28200 opens 30000

Primary resistance is 28175

Primary objective is 23300

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!