Dissecting the Markets: Breakout Ahead for the Dollar? The Charts Seem to Agree

The global currency and equity markets enter a critical phase this week, as several major central banks prepare to announce policy decisions. In early European trading on Tuesday, the US Dollar Index (DXY) edged slightly higher, hovering near 107 level against a basket of key counterparts. The measured upward drift indicates mounting pressure on the upper boundary of the bearish pullback channel, hinting that the currency may be positioning for a renewed rally if forthcoming US Retail Sales data and the FOMC meeting yield hawkish outcomes:

The central event on most market participants’ radar is the upcoming US Federal Reserve meeting. Expectations have solidified around another interest rate reduction, which would mark the Fed’s third cut at its December gathering. Consensus suggests a quarter-point trim, pulling the target range to 4.25%-4.50%. Interest rate futures assign a probability near 95.4% to such a move, a steep increase from around 78% just one week ago.

Beyond the pivotal Summary of Economic Projections and the "dot plot," which will form the foundation of the Fed's policy guidance for the upcoming year, investors will scrutinise Chair Jerome Powell’s press conference. If the rate cut is framed in a way that still emphasises inflation concerns, the dollar could find support.

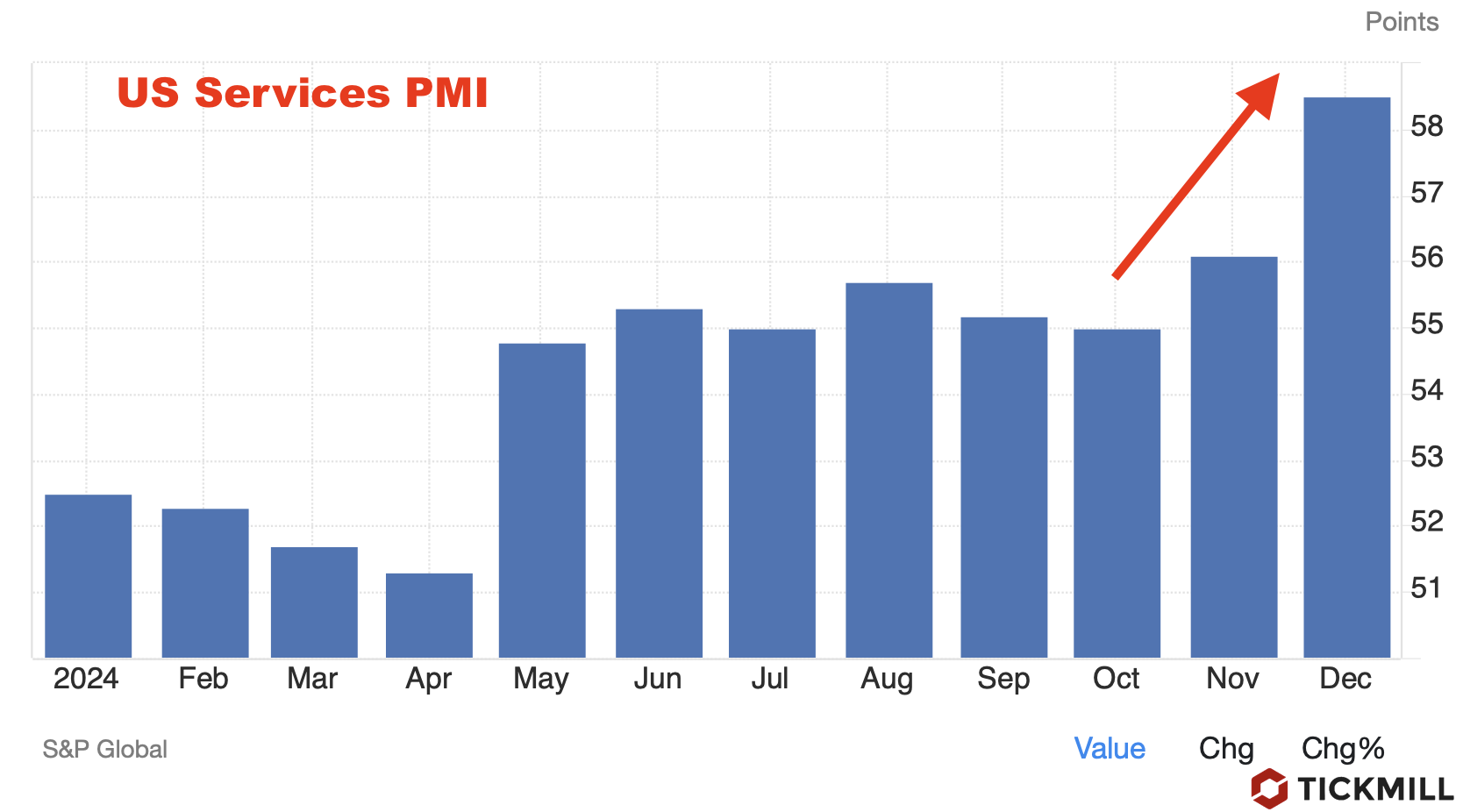

Monday’s preliminary S&P Global data reinforced positive US outlook. The December Composite PMI ticked up to 56.6 from 54.9, reaching its highest reading in nearly three years—an indication that, broadly speaking, American economic activity is holding up. Service sector strength stood out, with the Services PMI rising to 58.5, well above the forecast of 55.7:

This suggests that consumer-facing industries and related service firms remain buoyant. The Manufacturing PMI dipped to 48.3 from 49.7, missing expectations of 49.4 and sinking further into contraction territory.

Softer-than-expected retail sales numbers could weigh on the US dollar as they may reinforce expectations of more accommodative Fed policies down the line.

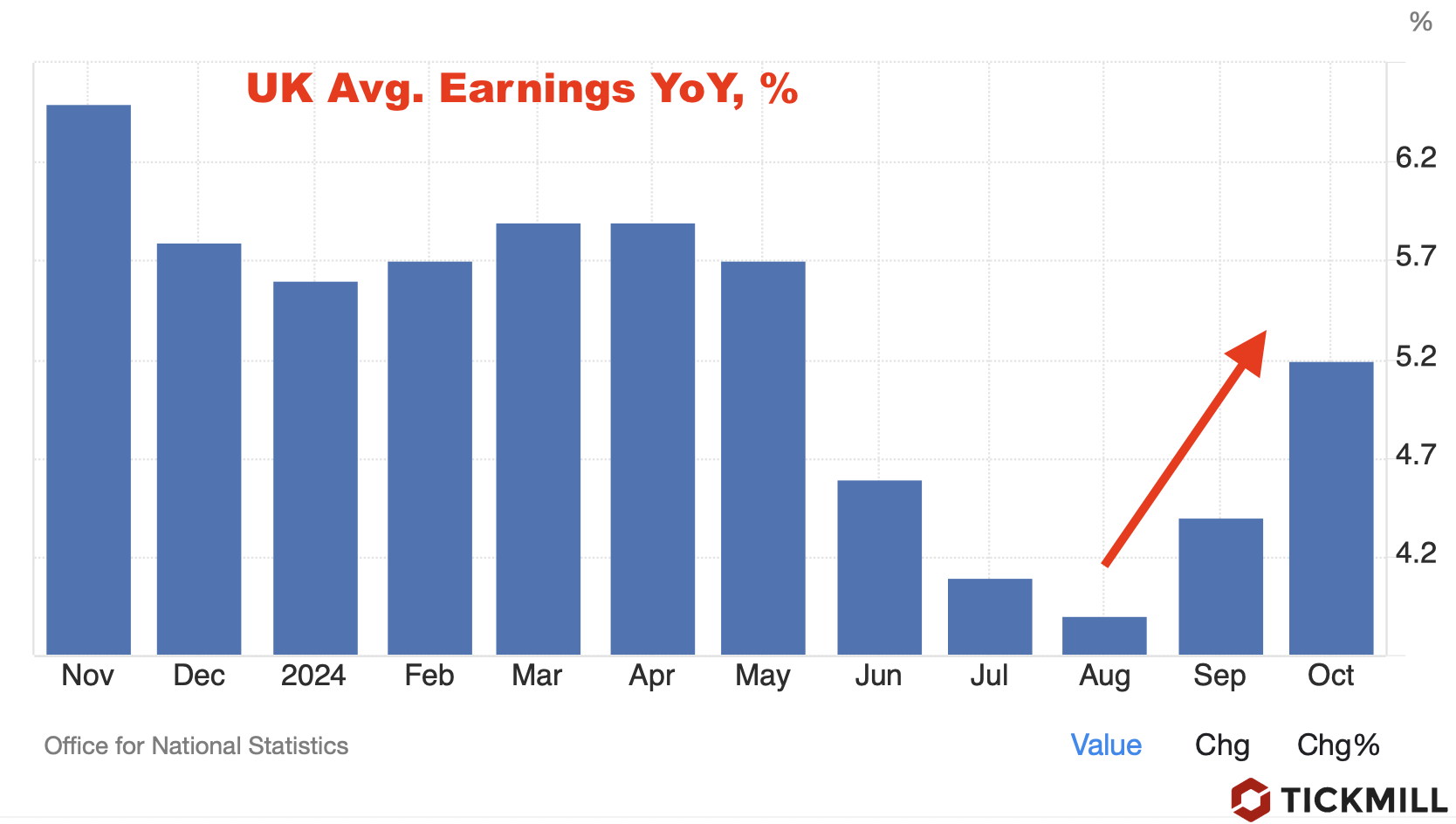

Turning to Europe, the UK labor market readings were broadly aligned with expectations but contained nuances worth noting. The ILO Unemployment Rate remained at 4.3% for the three months to October, meeting forecasts. While employment rose by 173K in October (down from 253K in September), wage metrics may influence the Bank of England’s decisions. Average Earnings excluding Bonus climbed 5.2% year-on-year in October, surpassing both September’s 4.9% and estimates of 5.0%:

Such strong wage growth could reignite inflationary pressures and might factor into how the BoE frames its next steps, especially given that the bank’s own policy announcement is due soon.

Elsewhere, Switzerland’s Producer and Import Price Index data revealed a 0.6% monthly decline in November, more pronounced than the 0.3% drop seen previously and well below the anticipated 0.2% increase. This soft price momentum might reinforce the traditional safe-haven appeal of the Swiss franc in times of global uncertainty, though it also signals that inflationary forces are subdued on the supply side in Switzerland.

Meanwhile, Middle Eastern geopolitical tensions continue to simmer. Turkey’s denunciation of Israel’s ambition to double settlements in the Golan Heights raises fresh questions about Israel’s posture in the region since Syria’s instability took hold with the fall of the Assad regime. Heightened uncertainty in geopolitically sensitive areas often encourages safe-haven flows, which could again prove supportive for currencies like the CHF.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.