Dollar extends rally on the back of US economic surprises

The dollar index continued to rise on Thursday and broke through the 104 level. The dynamics of economic activity in the US continues to surprise this quarter, which allows the Fed to remain hawkish and keep short-term yields in the US unchanged. Today's data calendar is not particularly remarkable, but several speakers from the Fed and the ECB are scheduled to speak.

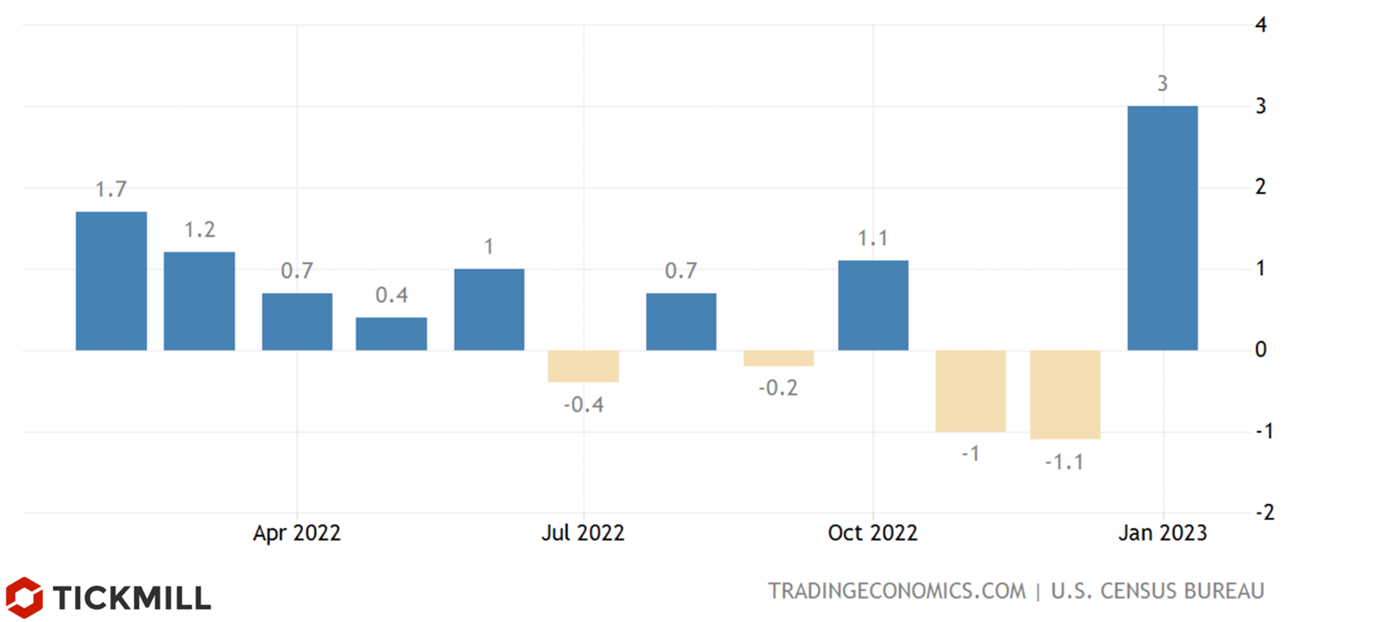

US Retail Sales released yesterday was a major hawkish surprise. Headline reading surprised on the upside as sales rose 3% YoY, while core sales increased 2.3% which is almost three times higher than the forecast (0.8%):

Although the warm weather made a significant contribution (through increased consumer mobility), the data caused a shift in expectations for the US economy, the Atlanta Fed's GDP Now forecast for the first quarter was revised from 2.2% to 2.4%. This data allows the Fed to remain in hawkish mode, and the market will continue to count on two or three more Fed rate hikes of 25 basis points by the summer.

A hawkish reassessment of the Fed's policy in February resulted in a 50-basis point rise in US short-term bond yields over the past two weeks and a return to some volatility in the Treasury and forex markets. The yield curve remains in deep inversion over the 2–10-year period, providing support for the dollar.

At the same time, the dollar's upward movement is capped by recovery in risk appetite. Equity markets have been holding up since the start of the year, and recent investor surveys show that cash holdings, although declining, are still at relatively high levels, which means that the supply of the dollar has room to grow. Fund surveys continue to point to insufficient positioning in the stock markets.

For now, US attention will be focused on the January PPI (the underlying is expected to fall to 4.0 from 4.6% YoY), initial jobless claims and the Philadelphia Fed's business outlook. We'll also hear from Fed hawks Loretta Mester and James Bullard. DXY should trade in a tight range of 103.50-104.00.

There is little data on the European economy today, perhaps the most interesting event will be the speech of ECB chief economist Philip Lane. Most likely, he will not want to resist the market's expectations too much that the ECB will tighten 115 bps in the summer, so EURUSD will continue to cautiously move towards support at 1.065 against the background of the general strengthening of the dollar:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.